« National Accounts and Balance of Payments » : différence entre les versions

Aucun résumé des modifications |

|||

| (18 versions intermédiaires par le même utilisateur non affichées) | |||

| Ligne 37 : | Ligne 37 : | ||

{{Translations | {{Translations | ||

| fr = Comptes nationaux et balance des paiements | | fr = Comptes nationaux et balance des paiements | ||

| es = | | es = Cuentas nacionales y balanza de pagos | ||

}} | }} | ||

| Ligne 172 : | Ligne 172 : | ||

*Income from investments of the National Bank and the Confederation. | *Income from investments of the National Bank and the Confederation. | ||

== Balance | == Balance of current transfers == | ||

Debit: Non-counterparty payments made abroad | |||

Credit: Non-counterparty payments received from abroad | |||

[[File:économie internationale la balance des transferts courants 1.png|thumb|center|Source : BNS.]] | [[File:économie internationale la balance des transferts courants 1.png|thumb|center|Source : BNS.]] | ||

== | == Current transfers balance: details == | ||

Current transfers from the private sector: | |||

* | *transfers from Swiss emigrants; | ||

* | *Transfers from foreign insurance institutions; | ||

* | *Transfers from foreign immigrants. | ||

Current transfers from the public sector: | |||

* | *Social insurance contributions by Swiss abroad; | ||

* | *State revenue from withholding tax; | ||

* | *Social insurance benefits paid abroad; | ||

* | *contributions to international organisations. | ||

== Balance | == Balance of capital transactions == | ||

Debit: Payments related to the movement of capital from the country to abroad (purchase of a foreign security) | |||

Credit: Payments related to the movement of capital from abroad into the country (sale of a domestic security) | |||

Capital account (CK) = any asset transaction not listed in the CF | |||

Financial Account (FA) = private transactions, (FC) and official reserves (or "reserve assets", RES) | |||

== Balance of capital transactions == | |||

[[File:économie internationale la balance des en capital 1.png|thumb|center|Source : BNS.]] | [[File:économie internationale la balance des en capital 1.png|thumb|center|Source : BNS.]] | ||

== | == Capital account balance: detail == | ||

Capital account (CK) = any asset transactions not listed in the CF. | |||

* | *Capital transfers = transfer of ownership without consideration. Two types: (i) debt forgiveness (= cancellation) and (ii) other transfers (e.g. transfers of migrants' property). | ||

*Acquisitions/ | *Acquisitions/disposals of intangible assets such as patents, copyrights, trademarks, etc. | ||

Financial account (FC). Composed of five categories: | |||

* | *Direct investment = when the investor has a lasting interest and seeks to influence the management of the "invested" company (holding more than 10% of the voting rights or failing that of the share capital). | ||

* | *Portfolio investment = non-temporary transactions in marketable securities (shares, bonds). | ||

* | *Financial derivatives = transactions on options and futures markets. | ||

* | *Other investments = trade credits, loans and miscellaneous deposits. | ||

* | *Reserve assets = transactions in international reserves held by the Central Bank. | ||

== | == Net change in official reserves == | ||

Transactions on international reserves (foreign exchange, gold, Special Drawing Rights (SDRs), reserve position with the IMF) held by the Central Bank. | |||

Debit: An increase in reserves | |||

Credit: A decrease in reserves | |||

A surplus on the balance of accounts increases official gold and foreign exchange reserves; a deficit decreases them. | |||

[[File:économie internationale variation nette des réserves officielles 1.png|thumb|center|Source : BNS.]] | [[File:économie internationale variation nette des réserves officielles 1.png|thumb|center|Source : BNS.]] | ||

Algebraically adding the balance of the balance of accounts and the net change in official reserves gives the balance of the balance of payments equal to zero. | |||

== | == Residual item: Errors and omissions == | ||

All transactions are theoretically recorded on both the revenue and expenditure sides, so the two totals should be equal. In practice, this is not the case. | |||

The residual item is the difference between the total "revenue" and the total "expenditure". | |||

This difference is due to gaps and errors in the statistical records. | |||

[[File:économie internationale poste résiduel erreurs et omissions 1.png|thumb|center|Source : BNS.]] | [[File:économie internationale poste résiduel erreurs et omissions 1.png|thumb|center|Source : BNS.]] | ||

== | == Example: Euro zone == | ||

[[File:économie internationale comptes nationaux et balance des paiements exemple zone euro 1.png|thumb|center|Source : BCE.]] | [[File:économie internationale comptes nationaux et balance des paiements exemple zone euro 1.png|thumb|center|Source : BCE.]] | ||

== CC | == Current account and movement of capital == | ||

Any transaction in the current account (CC) is settled by a transaction in the capital movements balance (CF) = change in the country's stock of assets and liabilities vis-à-vis other countries. | |||

The reverse is not necessarily correct: a transaction originating in the capital account may have its counterpart in the capital account. In this case, it does not change the country's net financial debit or credit position vis-à-vis the ROW. | |||

Example: direct investment abroad financed by foreign currency borrowing. | |||

*Investment transaction = ↗ assets abroad (export of capital = debit) | |||

*Currency borrowing = ↗ liabilities to foreign countries (capital import = credit) | |||

== Remarks == | |||

Importance de la balance de base (BB, aussi appelée balance des règlements officiels ou encore balance des comptes): dans les régimes de change fixe, elle indique la capacité de la Banque Centrale à honorer ses engagements, puisqu’un déficit de la balance de base signifie une baisse des réserves officielles. | Importance de la balance de base (BB, aussi appelée balance des règlements officiels ou encore balance des comptes): dans les régimes de change fixe, elle indique la capacité de la Banque Centrale à honorer ses engagements, puisqu’un déficit de la balance de base signifie une baisse des réserves officielles. | ||

H ne peut pas accuser simultanément F "d'envahir son marché intérieur" (CC < 0) et "de capturer toute son épargne" (<math>CF < 0</math>). | |||

En principe : le solde agrégé de tous les CC sur le plan mondial devrait être égal à zéro. Or il est négatif! "Mystère du surplus manquant" | En principe : le solde agrégé de tous les CC sur le plan mondial devrait être égal à zéro. Or il est négatif! "Mystère du surplus manquant" | ||

| Ligne 267 : | Ligne 266 : | ||

Quel est le niveau optimal de CC? Un déficit important et permanent crée des problèmes de crédibilité (détériore la position extérieure nette du pays, cf. cas des USA, le plus grand pays débiteur mondial, KO encadré 13.2). Un surplus important et permanent crée des tensions avec les partenaires commerciaux qui se plaignent de leurs déficits. | Quel est le niveau optimal de CC? Un déficit important et permanent crée des problèmes de crédibilité (détériore la position extérieure nette du pays, cf. cas des USA, le plus grand pays débiteur mondial, KO encadré 13.2). Un surplus important et permanent crée des tensions avec les partenaires commerciaux qui se plaignent de leurs déficits. | ||

== | == To sum up == | ||

Wealth: | |||

:::::<math>total\ | :::::<math>total\ assets\ - total\ liabilities\ commitments</math> | ||

( | (amounts owned) - (amounts owing) | ||

* | *Every time a nation saves, i.e. has a surplus in its current account, its wealth increases. | ||

* | *Each time a nation borrows, i.e. runs a deficit in its current account, its wealth decreases. | ||

External wealth (or external position) : | |||

:::::<math>total\ | :::::<math>total\ foreign\ assets\ held - total\ domestic\ assets\ held\ by\ foreigners</math> | ||

* | *A positive international investment position means that the country is in credit. | ||

* | *A negative international investment position means that the country is in debit. | ||

== | == Overall deficits and surpluses == | ||

In recent years, there are countries with very large surpluses (emerging countries + oil exporting countries) and countries with very large deficits (led by the USA + a number of developed countries). | |||

[[File:économie internationale comptes nationaux et balance des paiements déficits et surplus globaux 1.png|thumb|center|Source: Feenstra and Taylor, 2008.]] | [[File:économie internationale comptes nationaux et balance des paiements déficits et surplus globaux 1.png|thumb|center|Source: Feenstra and Taylor, 2008.]] | ||

== | == Debtor and creditor countries == | ||

[[File:économie internationale comptes nationaux et balance des paiements pays débiteurs et pays créditeurs 1.png|thumb|right|Source: Feenstra and Taylor, 2008.]] | [[File:économie internationale comptes nationaux et balance des paiements pays débiteurs et pays créditeurs 1.png|thumb|right|Source: Feenstra and Taylor, 2008.]] | ||

The United States and other developed countries finance their current account deficits by selling securities that are purchased by countries that have | |||

trade surplus → change in ownership of securities → change in net holdings on the RDM | |||

Capital flows from emerging to developed countries: not in line with the theory of intertemporal trade (see trade course). | |||

The net position of a country also depends on changes in the value of assets. | |||

== | Default risk: since 1980, 14 countries have not paid their debts due to foreign exchange crises → country risk ↑ | ||

== The case of Argentina == | |||

[[File:économie internationale comptes nationaux et balance des paiements pays cas de l'Argentine 1.png|thumb|center|Source: Feenstra and Taylor, 2008.]] | [[File:économie internationale comptes nationaux et balance des paiements pays cas de l'Argentine 1.png|thumb|center|Source: Feenstra and Taylor, 2008.]] | ||

Consequences of default: the country becomes less attractive for foreign investment and the country will have to pay higher interest rates. | |||

Country risk: The additional interest rate that a country must pay to compensate investors for the risk of default. | |||

* | Example in June 2010, according to the Financial Times, compared to U.S. Treasury bills: | ||

* | *Countries with "good ratings": Poland (A-): +1.88%, Mexico (BBB): +1.36%. | ||

* | *Countries with junk-bond grades: Colombia (BB+): 2.16%, Turkey (BB+): +2.64%. | ||

*Countries still considered as "technically in default": Argentina (grade D): +33% | |||

== | == Partial correction? == | ||

Partial correction since 2009, Explanations? | |||

[[File:économie internationale comptes nationaux et balance des paiements correction partielle 1.png|thumb|center|Source: IMF, World Economic Outlook, 2011.]] | [[File:économie internationale comptes nationaux et balance des paiements correction partielle 1.png|thumb|center|Source: IMF, World Economic Outlook, 2011.]] | ||

= | = Summary = | ||

A country's international investment position is frequently measured by the current account balance (CC) or the basic balance (BB). | |||

In terms of macroeconomic aggregates, CC is equal to the difference between gross national income and domestic absorption (or expenditure). | |||

CC | CC is derived from the trade balance and the factor income balance. It reflects the external financing capacity (or need) of the country concerned. | ||

The various items in the capital account (CK) and financial account (FC) indicate the materialisation of this financing capacity in terms of changes in assets held. | |||

The balance of the BB indicates the capacity of the Central Bank to honour its commitments under a fixed exchange rate regime. | |||

External imbalances have increased sharply since 2001. | |||

= Annexes = | = Annexes = | ||

Version actuelle datée du 8 avril 2020 à 18:55

| Professeur(s) | |

|---|---|

| Cours | International Economy |

Lectures

- Ricardo's model: productivity differences as a determinant of trade

- The Heckscher-Ohlin model: differences in factor endowments as a determinant of trade

- Economies of scale as a determinant of trade: beyond comparative advantage

- Trade policy instruments

- Multilateral trade agreements

- Preferential Trade Agreements

- The Free Trade Challenge

- International Macroeconomics: Issues and Overview

- National Accounts and Balance of Payments

- Exchange rates and the foreign exchange market

- Short-term exchange rates: the asset-based approach

- Long-term exchange rates: the monetary approach

- Domestic product and short-term exchange rates

- Floating exchange rates

- Fixed exchange rates and intervention on the foreign exchange market

What is a country's external position?

How does it relate to GDP or national savings?

What are the different items in the balance of payments?

How can these different items be interpreted correctly?

National accounts reminders[modifier | modifier le wikicode]

GDP and NI[modifier | modifier le wikicode]

Gross domestic product GDP (territorial perspective) :

- [1]

Gross National Income (GNI) and National Income (NI) (residency perspective) :

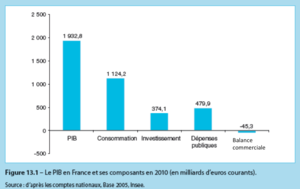

GDP and its components[modifier | modifier le wikicode]

GDP = sum of value added of all goods and services produced in the country.

GDP and GNI: an example[modifier | modifier le wikicode]

As we have just seen, GDP and GNI do not coincide. In particular, for a debtor country (net importer of capital or labour services) the → Example: Ireland

Absorption and current account balance[modifier | modifier le wikicode]

Simplification in the model: capital depreciation, taxes and subsidies assumed to be negligible --> "" is both national product and national income :

Condensed notation :

- [2]

where:

- : absorption (dépense intérieure)

- : solde balance courante (ou compte courant)

- (flux)

NB: if → current account deficit financed by net debt (↓)

where:

- (or rest of the world, RW) [3]

Savings, government deficit and current account[modifier | modifier le wikicode]

In an open economy, the current account is the difference between income and expenditure (or absorption) and reflects the change in net foreign assets over the period = the financing capacity of the economy.

Allocation of income:

- ( = private saving, = taxes) [4]

Combined with we get:

- [5]

In an open economy, savings lead either to an increase in the capital stock or to an increase in NEAs.

Or, as and :

- [5']

The surplus of private savings over I is used to finance the government deficit and the current account. Put differently, domestic investment can be financed by savings or by a current account deficit.

Current account deficit and net external debt[modifier | modifier le wikicode]

Implications of identities[modifier | modifier le wikicode]

An open economy can save either by developing its capital stock (as in a closed economy) or by acquiring external assets (example of intertemporal trade: the NZ building a new hydropower plant).

Equation [5] is a fundamental accounting identity, but not an economic model → beware of misinterpretation. Example: KO case study 13.1: the case of 'twin deficits'. USA early 1980s: expansive fiscal policy → public deficit → CC deficit. EU in the 1990s: the reduction of EU deficits - to meet the Maastricht criteria - did not result in a CC surplus. Why not? Because private savings decreased almost as much as the increase in public savings (possible explanation: Ricardian equivalence). → No automatism → Need for an economic model that EXPLAINS the links between the variables involved in identity.

The balance of payments[modifier | modifier le wikicode]

General principles[modifier | modifier le wikicode]

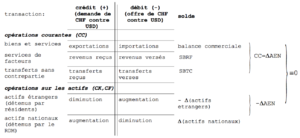

All international transactions are recorded in the balance of payments.

Any transaction that leads to foreign exchange earnings from abroad (exports of goods or assets) is recorded with a positive sign indicating a credit (+).

- → supply of foreign currency (or demand for domestic currency).

Any transaction that leads to a payment in foreign currency abroad (import of goods or import of assets) is accounted for with a negative sign indicating a debit (-)

- → demand for foreign currency (or supply of domestic currency).

- → If is Switzerland, any transaction leading to a demand (offer) of CHF is recorded as a credit (debit).

Types of transactions[modifier | modifier le wikicode]

Two kinds of transactions (but three accounts!) :

- Purchase or sale of goods and services. Transactions recorded in the current account (CC). An import purchase from a resident in gives rise to a debit of the CC of (and a credit of the CC of ), as payment in foreign currency in return.

- Purchase or sale of assets. Transactions recorded in the financial account (CF) or in the capital account (CK). For example, a resident of H buys shares in a company of (increase in foreign assets held by residents of ). The CF of is debited because there is demand for currency and credit in the CF of .

Balance of payments: simplified structure[modifier | modifier le wikicode]

Interpretation: CC indicates the net financing capacity of the economy relative to the RDM (e.g. a surplus of 100), and CK,CF indicate how this capacity materializes (e.g. a debt reduction of 20 = ↘ of domestic assets held by RDM and a debt increase of 80 = of foreign assets held by residents) => the balance of payments is always in equilibrium.

The principle of double writing[modifier | modifier le wikicode]

Each international transaction automatically enters the PB twice, once as a debit, once as a credit (again, the balance of payments is always in balance).

Ex. 1: The company PRECISA from Geneva sells watch cases to its French customer ARTHUS from Besançon. ARTHUS pays the customer:

- (i) by liquidating its cash voucher position at the BCG.

- (ii) by drawing a cheque on its Belfort CA account. PRECISA takes the opportunity to increase the French securities it already holds with the CA.

Ex. 2: Fiduciary BONCOMPTE of Geneva imports computer equipment produced by the company OLIVETTO of Turin. It does so:

- (i) by selling all its FIAT shares deposited in Banco M of Turin.

- (ii) by obtaining a loan from Banco M of Turin.

Balance of payments : Decomposition[modifier | modifier le wikicode]

Trade balance (labour and capital income)[modifier | modifier le wikicode]

Debit: Income from labour and capital paid abroad

Credit: Labour and capital income received from abroad

Factor income balance: details[modifier | modifier le wikicode]

Income from work:

- Payments to foreign cross-border commuters working in Switzerland;

- Salaries received by persons working for international organisations in Switzerland.

Income from capital:

- Income from securities (shares, bonds);

- Income from direct investments;

- Income from investments of the National Bank and the Confederation.

Balance of current transfers[modifier | modifier le wikicode]

Debit: Non-counterparty payments made abroad

Credit: Non-counterparty payments received from abroad

Current transfers balance: details[modifier | modifier le wikicode]

Current transfers from the private sector:

- transfers from Swiss emigrants;

- Transfers from foreign insurance institutions;

- Transfers from foreign immigrants.

Current transfers from the public sector:

- Social insurance contributions by Swiss abroad;

- State revenue from withholding tax;

- Social insurance benefits paid abroad;

- contributions to international organisations.

Balance of capital transactions[modifier | modifier le wikicode]

Debit: Payments related to the movement of capital from the country to abroad (purchase of a foreign security)

Credit: Payments related to the movement of capital from abroad into the country (sale of a domestic security)

Capital account (CK) = any asset transaction not listed in the CF

Financial Account (FA) = private transactions, (FC) and official reserves (or "reserve assets", RES)

Balance of capital transactions[modifier | modifier le wikicode]

Capital account balance: detail[modifier | modifier le wikicode]

Capital account (CK) = any asset transactions not listed in the CF.

- Capital transfers = transfer of ownership without consideration. Two types: (i) debt forgiveness (= cancellation) and (ii) other transfers (e.g. transfers of migrants' property).

- Acquisitions/disposals of intangible assets such as patents, copyrights, trademarks, etc.

Financial account (FC). Composed of five categories:

- Direct investment = when the investor has a lasting interest and seeks to influence the management of the "invested" company (holding more than 10% of the voting rights or failing that of the share capital).

- Portfolio investment = non-temporary transactions in marketable securities (shares, bonds).

- Financial derivatives = transactions on options and futures markets.

- Other investments = trade credits, loans and miscellaneous deposits.

- Reserve assets = transactions in international reserves held by the Central Bank.

Net change in official reserves[modifier | modifier le wikicode]

Transactions on international reserves (foreign exchange, gold, Special Drawing Rights (SDRs), reserve position with the IMF) held by the Central Bank.

Debit: An increase in reserves

Credit: A decrease in reserves

A surplus on the balance of accounts increases official gold and foreign exchange reserves; a deficit decreases them.

Algebraically adding the balance of the balance of accounts and the net change in official reserves gives the balance of the balance of payments equal to zero.

Residual item: Errors and omissions[modifier | modifier le wikicode]

All transactions are theoretically recorded on both the revenue and expenditure sides, so the two totals should be equal. In practice, this is not the case.

The residual item is the difference between the total "revenue" and the total "expenditure".

This difference is due to gaps and errors in the statistical records.

Example: Euro zone[modifier | modifier le wikicode]

Current account and movement of capital[modifier | modifier le wikicode]

Any transaction in the current account (CC) is settled by a transaction in the capital movements balance (CF) = change in the country's stock of assets and liabilities vis-à-vis other countries.

The reverse is not necessarily correct: a transaction originating in the capital account may have its counterpart in the capital account. In this case, it does not change the country's net financial debit or credit position vis-à-vis the ROW.

Example: direct investment abroad financed by foreign currency borrowing.

- Investment transaction = ↗ assets abroad (export of capital = debit)

- Currency borrowing = ↗ liabilities to foreign countries (capital import = credit)

Remarks[modifier | modifier le wikicode]

Importance de la balance de base (BB, aussi appelée balance des règlements officiels ou encore balance des comptes): dans les régimes de change fixe, elle indique la capacité de la Banque Centrale à honorer ses engagements, puisqu’un déficit de la balance de base signifie une baisse des réserves officielles.

H ne peut pas accuser simultanément F "d'envahir son marché intérieur" (CC < 0) et "de capturer toute son épargne" ().

En principe : le solde agrégé de tous les CC sur le plan mondial devrait être égal à zéro. Or il est négatif! "Mystère du surplus manquant"

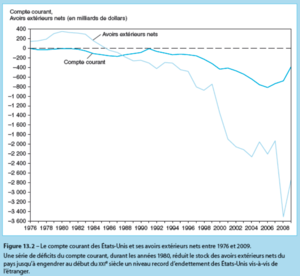

Quel est le niveau optimal de CC? Un déficit important et permanent crée des problèmes de crédibilité (détériore la position extérieure nette du pays, cf. cas des USA, le plus grand pays débiteur mondial, KO encadré 13.2). Un surplus important et permanent crée des tensions avec les partenaires commerciaux qui se plaignent de leurs déficits.

To sum up[modifier | modifier le wikicode]

Wealth:

(amounts owned) - (amounts owing)

- Every time a nation saves, i.e. has a surplus in its current account, its wealth increases.

- Each time a nation borrows, i.e. runs a deficit in its current account, its wealth decreases.

External wealth (or external position) :

- A positive international investment position means that the country is in credit.

- A negative international investment position means that the country is in debit.

Overall deficits and surpluses[modifier | modifier le wikicode]

In recent years, there are countries with very large surpluses (emerging countries + oil exporting countries) and countries with very large deficits (led by the USA + a number of developed countries).

Debtor and creditor countries[modifier | modifier le wikicode]

The United States and other developed countries finance their current account deficits by selling securities that are purchased by countries that have trade surplus → change in ownership of securities → change in net holdings on the RDM

Capital flows from emerging to developed countries: not in line with the theory of intertemporal trade (see trade course).

The net position of a country also depends on changes in the value of assets.

Default risk: since 1980, 14 countries have not paid their debts due to foreign exchange crises → country risk ↑

The case of Argentina[modifier | modifier le wikicode]

Consequences of default: the country becomes less attractive for foreign investment and the country will have to pay higher interest rates.

Country risk: The additional interest rate that a country must pay to compensate investors for the risk of default. Example in June 2010, according to the Financial Times, compared to U.S. Treasury bills:

- Countries with "good ratings": Poland (A-): +1.88%, Mexico (BBB): +1.36%.

- Countries with junk-bond grades: Colombia (BB+): 2.16%, Turkey (BB+): +2.64%.

- Countries still considered as "technically in default": Argentina (grade D): +33%

Partial correction?[modifier | modifier le wikicode]

Partial correction since 2009, Explanations?

Summary[modifier | modifier le wikicode]

A country's international investment position is frequently measured by the current account balance (CC) or the basic balance (BB).

In terms of macroeconomic aggregates, CC is equal to the difference between gross national income and domestic absorption (or expenditure).

CC is derived from the trade balance and the factor income balance. It reflects the external financing capacity (or need) of the country concerned.

The various items in the capital account (CK) and financial account (FC) indicate the materialisation of this financing capacity in terms of changes in assets held.

The balance of the BB indicates the capacity of the Central Bank to honour its commitments under a fixed exchange rate regime.

External imbalances have increased sharply since 2001.

Annexes[modifier | modifier le wikicode]

References[modifier | modifier le wikicode]

- ↑ Page personnelle de Federica Sbergami sur le site de l'Université de Genève

- ↑ Page personnelle de Federica Sbergami sur le site de l'Université de Neuchâtel

- ↑ Page personnelle de Federica Sbergami sur Research Gate

- ↑ Céline Carrère - Faculté d'économie et de management - UNIGE

- ↑ Céline Carrère - Google Scholar Citations

- ↑ Director Céline Carrère - Rectorat - UNIGE

- ↑ Céline Carrère | Sciences Po - Le Laboratoire Interdisciplinaire d'Evaluation des Politiques Publiques (LIEPP)

- ↑ Céline Carrere - EconPapers

- ↑ Céline Carrère's research works - ResearchGate