« Domestic product and short-term exchange rates » : différence entre les versions

Aucun résumé des modifications |

|||

| (14 versions intermédiaires par le même utilisateur non affichées) | |||

| Ligne 2 : | Ligne 2 : | ||

| image = | | image = | ||

| image_caption = | | image_caption = | ||

| cours = [[ | | cours = [[International Economy]] | ||

| faculté = | | faculté = | ||

| département = | | département = | ||

| Ligne 10 : | Ligne 10 : | ||

| enregistrement = | | enregistrement = | ||

| lectures = | | lectures = | ||

* [[ | * [[Ricardo's model: productivity differences as a determinant of trade]] | ||

* [[ | * [[The Heckscher-Ohlin model: differences in factor endowments as a determinant of trade]] | ||

* [[ | * [[Economies of scale as a determinant of trade: beyond comparative advantage]] | ||

* [[ | * [[Trade policy instruments]] | ||

* [[ | * [[Multilateral trade agreements]] | ||

* [[ | * [[Preferential Trade Agreements]] | ||

* [[ | * [[The Free Trade Challenge]] | ||

* [[ | * [[International Macroeconomics: Issues and Overview]] | ||

* [[ | * [[National Accounts and Balance of Payments]] | ||

* [[ | * [[Exchange rates and the foreign exchange market]] | ||

* [[ | * [[Short-term exchange rates: the asset-based approach]] | ||

* [[ | * [[Long-term exchange rates: the monetary approach]] | ||

* [[ | * [[Domestic product and short-term exchange rates]] | ||

* [[ | * [[Floating exchange rates]] | ||

* [[ | * [[Fixed exchange rates and intervention on the foreign exchange market]] | ||

}} | }} | ||

| Ligne 35 : | Ligne 35 : | ||

{{Translations | {{Translations | ||

| fr = Produit intérieur et taux de change à court terme | | fr = Produit intérieur et taux de change à court terme | ||

| es = | | es = Producto interno y tipos de cambio a corto plazo | ||

}} | }} | ||

| Ligne 77 : | Ligne 77 : | ||

As we shall see, the conclusions reached in terms of the consequences for the macroeconomic balance following either a monetary or a fiscal shock are qualitatively identical to those obtained in the DD-AA model. The main advantage of the DD-AA model compared to the [[The Keynesian approach and the IS-LM model|IS-LM model]] extended to the open economy is that it is better suited to analysing the long-term effects since the IS-LM model is a model based on the assumption of fixed prices. | As we shall see, the conclusions reached in terms of the consequences for the macroeconomic balance following either a monetary or a fiscal shock are qualitatively identical to those obtained in the DD-AA model. The main advantage of the DD-AA model compared to the [[The Keynesian approach and the IS-LM model|IS-LM model]] extended to the open economy is that it is better suited to analysing the long-term effects since the IS-LM model is a model based on the assumption of fixed prices. | ||

= | = The asset market: the AA curve = | ||

== | == The asset market: the AA curve == | ||

Definition: The AA curve is the set of pairs (<math>Y</math>, <math>E</math>) that simultaneously ensure equilibrium on the foreign exchange market (<math>PTI_{nc}</math> satisfied) and on the money market. | |||

Derivation of the AA curve | |||

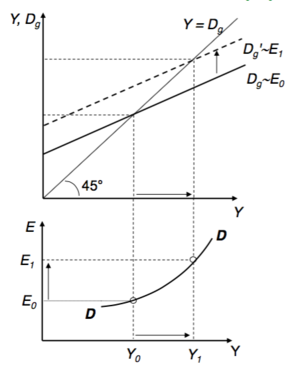

1) | 1) Graphic derivation : | ||

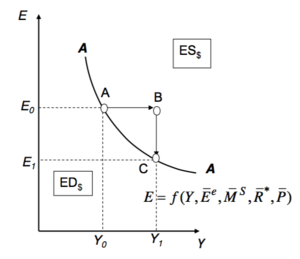

* | *Principle: we start from a situation of equilibrium (<math>1 - 1'</math>), we consider a ↑ of <math>Y</math> and we report the equilibrium combinations, (<math>Y_0</math>, <math>E_0</math>), (<math>Y_1</math>, <math>E_1</math>), in the diagram on the left. | ||

*Intuition : <math>Y</math>↑→ <math>L</math>↑ → <math>R</math>↑; | *Intuition: <math>Y</math>↑→ <math>L</math>↑ → <math>R</math>↑; to bring the asset market back to equilibrium this year ↑ of <math>R</math> must be offset by currency appreciation (<math>E</math>↓) | ||

==> AA a | ==> AA has a negative slope. | ||

[[File:économie internationale dérivation de la courbe AA 1.png|thumb|center|]] | [[File:économie internationale dérivation de la courbe AA 1.png|thumb|center|]] | ||

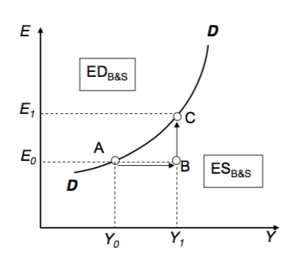

2) | 2) Synthetic Derivative : | ||

* | *point <math>A</math> : simultaneous equilibrium in the asset and currency market <math>E</math> | ||

*point <math>B</math> : <math>Y</math> ( | *point <math>B</math> : <math>Y</math> (income) ↑ => Currency ED => R↑ => ES currencies => <math>E</math>↓ | ||

*point <math>C</math> : nouvel équilibre simultané => AA a une pente négative. | *point <math>C</math> : nouvel équilibre simultané => AA a une pente négative. | ||

All points above (below) AA correspond to a currency ES (ED). | |||

[[File:économie internationale dérivation de la courbe AA 2.png|thumb|center|]] | [[File:économie internationale dérivation de la courbe AA 2.png|thumb|center|]] | ||

== | == Displacement of the AA curve == | ||

=== | === Example === | ||

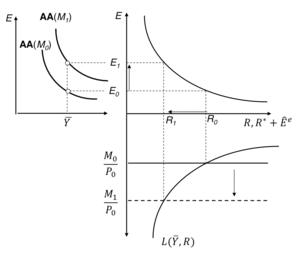

increase of <math>M</math> | |||

Reasoning at constant <math>Y</math> (<math>R</math>↓) => moving AA upwards | |||

[[File:économie internationale déplacement de la courbe AA 1.png|thumb|center|]] | [[File:économie internationale déplacement de la courbe AA 1.png|thumb|center|]] | ||

NB : | NB: One could also have reasoned at constant <math>E</math> (<math>E = \bar {E}_0</math> ⟺ <math>R = \bar {R}_0</math>); dn this case, to reabsorb the money ES at constant <math>R</math>, it is necessary that <math>Y</math>↗ = moving AA to the right. | ||

=== | === Generalisation === | ||

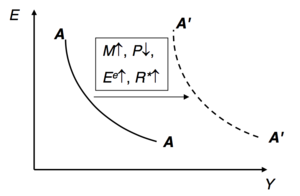

Any factor causing a currency ED (<math>M</math>↗, <math>P</math>↓, <math>E^e</math>↗, <math>R*</math>↗) causes AA to move to the right. | |||

[[File:économie internationale déplacement de la courbe AA 2.png|thumb|center|]] | [[File:économie internationale déplacement de la courbe AA 2.png|thumb|center|]] | ||

Conversely: Any factor causing a currency ES (<math>M</math>↓, <math>P</math>↗, <math>E^e</math>↓, <math>R^*</math>↓) moves the AA curve to the left. | |||

= | = The goods market: the DD curve = | ||

== | == Global demand: assumptions == | ||

*<math>C</math> = | *<math>C</math> = private consumption | ||

is positively dependent on disposable income (<math>Y_d \equiv Y - T</math>) ⇒ <math>C = C(Y_d)</math>, where <math>0 < \frac {\partial C}{\partial Y} \equiv c < 1</math> (marginal propensity to consume) | |||

*<math>I</math> = | *<math>I</math> = business investment | ||

assumed constant (exogenous) ⇒ <math>I = \bar {I}</math> | |||

*<math>G</math> = | *<math>G</math> = state spending and <math>T</math> = taxes. | ||

assumed constant (exogenous) ⇒ <math>G = \bar{G}</math> and <math>T = \bar{T}</math> | |||

*<math>CA</math> = " | *<math>CA</math> = "current account", to transfers on loan, i.e. <math>CA = EXP - IMP + SBRF</math>, where we assume <math>SBRF</math> constant and equal to <math>0</math> ⇒ the current balance coincides with the trade balance. | ||

The higher the <math>Y</math> is, the higher the <math>IMP</math> is, which deteriorates <math>CA</math> (one neglects <math>Y^*</math> which influences <math>EXP</math>). The higher the <math>q</math> is, the higher the relative price of foreign products, which improves <math>CA</math> (under a particular condition supposedly satisfied) ⇒ <math>CA = CA(Y,q)</math>, où <math>\frac {\partial CA}{\partial Y} < 0</math> and <math>\frac {\partial CA}{\partial q} > 0</math> | |||

== CA: Marshall-Lerner's Condition == | |||

Condition for <math>\frac {\partial CA}{\partial q} > 0</math> | |||

=> | Link CA - q: if <math>q</math>↗, what's going on? | ||

*quantity effect: if <math>q</math>↗ => <math>EXP</math>↗, <math>IMP</math>↘ => goes well in the direction of a ↗ of CA. | |||

*price effect: if <math>q</math>↗ => the value of imports is increasing (their relative price ↗) => tendency towards ↘ of CA. | |||

=> Ambiguous a priori effect. | |||

It can be shown that, following a real depreciation, the current account balance will improve if the following condition is satisfied : | |||

:::::<math>\eta + |\eta^*| > 1</math> | :::::<math>\eta + |\eta^*| > 1</math> | ||

where <math>\eta</math> and <math>\eta^*</math> indicate the elasticity of demand for exports and the elasticity of demand for imports of the domestic country, respectively. This condition is known as the Marshall-Lerner (M-L) condition. Unless otherwise indicated, it is assumed that this condition is satisfied and that, therefore, a real depreciation of the domestic economy is not necessary. (<math>q</math>↑) causes an improvement in CA. | |||

== Condition | == Condition of M-L: J-curve == | ||

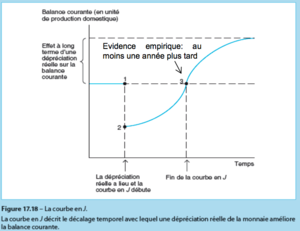

Empirical evidence shows that the initial effect of a depreciation on the current account is negative = the depreciation initially causes a deficit. | |||

Explanation: the quantities imported and exported by enterprises and households are fixed in contracts, which will only be gradually renegotiated = initially only the price effect is active (the value of IMP ↑ while the value of EXP does not change), the quantity effect only appears later = initial negative effect on the balance of turnover. | |||

[[File:économie internationale courbe en J 1.png|thumb|center|]] | [[File:économie internationale courbe en J 1.png|thumb|center|]] | ||

J-curve : | |||

* | *The price effect of a devaluation is immediate (more expensive imports, with unchanged import and export quantities). | ||

* | *The quantity effects (sum of the elasticities) are slower on the J curve of CA versus time. | ||

== | == M-L condition: empirical evidence == | ||

* | *"Short term" = < 6 months | ||

* | *"Medium term" = < 12 months | ||

* | *"Long term" = > 1 year | ||

Our hyp. for the rest: | |||

:::::<math>\frac {\partial CA}{\partial q} > 0</math> | :::::<math>\frac {\partial CA}{\partial q} > 0</math> | ||

[[File:économie internationale condition de M-L évidence empirique 1.png|thumb|center|Source: Krugman-Obstfeld]] | [[File:économie internationale condition de M-L évidence empirique 1.png|thumb|center|Source: Krugman-Obstfeld]] | ||

== | == Balance in the G&S market == | ||

Balance on the goods and services market: Supply = Aggregate demand, i.e. : | |||

:::::<math>Y = D_g (Y, E) = C(Y_{+d} + I + G + CA(Y_{-}, q_{+})</math> | :::::<math>Y = D_g (Y, E) = C(Y_{+d} + I + G + CA(Y_{-}, q_{+})</math> | ||

Definition: the DD curve is the set of couples (<math>Y</math>, <math>E</math>) which ensure the equilibrium on the B&S market. | |||

Assumptions: | |||

*<math>\frac {\partial C}{\partial Y_d} \equiv c</math>, | *<math>\frac {\partial C}{\partial Y_d} \equiv c</math>, marginal propensity to consume, <math>0 < c < 1</math> | ||

*<math>\frac {\partial CA}{\partial Y} \equiv -mi</math>, | *<math>\frac {\partial CA}{\partial Y} \equiv -mi</math>, marginal propensity to import, <math>0 < mi < c</math> | ||

*<math>\frac {\partial CA}{\partial_q} > 0</math>, | *<math>\frac {\partial CA}{\partial_q} > 0</math>, Marshall-Lerner's condition is met. | ||

=><math>D_g (Y_{+}, q_{+}</math> et <math>0 < \frac {\partial D_g}{\partial Y} = c - mi < 1</math> = | =><math>D_g (Y_{+}, q_{+}</math> et <math>0 < \frac {\partial D_g}{\partial Y} = c - mi < 1</math> = the overall demand is positively dependent on <math>Y</math> (but the induced increase of <math>D_g</math> is smaller than the increase of <math>Y</math>) and <math>q</math>. | ||

Equilibrium (short-term = fixed prices and variable <math>Y</math>) : <math>Y D_g(Y, \bar{E}, ...)</math> | |||

[[File:économie internationale Equilibre sur le marché des B&S 1.png|thumb|center|]] | [[File:économie internationale Equilibre sur le marché des B&S 1.png|thumb|center|]] | ||

== | == The G&S market: the DD curve == | ||

Derivation of the DD curve | |||

:1) | :1) Graphic derivation: | ||

Principe: we start from a situation of equilibrium, we consider a ↗ of <math>E</math> (=> <math>q</math>↗ => by M-L, <math>CA</math>↗ => <math>D_g</math> moves up and <math>Y</math> ↗ to bring the goods market back into equilibrium) and the equilibrium combinations, (<math>Y_0, E_0</math>),(<math>Y_1, E_1</math>), are plotted in the bottom diagram. | |||

=> DD has a positive slope. | |||

[[File:économie internationale marché des B&S dérivation de la courbe DD 1.png|thumb|center|]] | [[File:économie internationale marché des B&S dérivation de la courbe DD 1.png|thumb|center|]] | ||

2) | 2) Synthetic derivative: | ||

*point <math>A</math> : | *point <math>A</math>: initial equilibrium | ||

*point <math>B</math> : <math>Y</math> (production)↗ => ES | *point <math>B</math> : <math>Y</math> (production)↗ => ES of G&S => E must ↗ (=> CA↗) to redress the balance | ||

*point <math>C</math> : | *point <math>C</math> : new balance | ||

=> DD a | => DD has a positive slope. | ||

=> | => All points below (above) DD correspond to a G&S ES (ED). | ||

[[File:économie internationale marché des B&S dérivation de la courbe DD 2.png|thumb|center|]] | [[File:économie internationale marché des B&S dérivation de la courbe DD 2.png|thumb|center|]] | ||

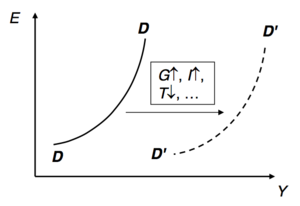

== | == Displacement of the DD curve == | ||

=== Example: increase in G === | |||

= | By reasoning at constant <math>E</math> (<math>Y</math>↑) => dDD shift to the right | ||

NB: one could also have reasoned at constant <math>Y</math> -> <math>G</math>↑ -> <math>D_g</math>↑ => to restore balance by playing <math>E</math> you need <math>E</math>↘ (⟺ <math>CA</math>↘) | |||

NB : | |||

=> | => moving DD down. | ||

[[File:économie internationale déplacement de la courbe DD 1.png|thumb|center|]] | [[File:économie internationale déplacement de la courbe DD 1.png|thumb|center|]] | ||

=== | === Generalisation === | ||

Any factor causing a G&S ED (<math>G</math>↑, <math>T</math>↘, <math>P</math>↘, <math>P^*</math>↑, <math>c</math>↑, <math>mi</math>↘) causes DD to move to the right. | |||

[[File:économie internationale déplacement de la courbe DD 2.png|thumb|center|]] | [[File:économie internationale déplacement de la courbe DD 2.png|thumb|center|]] | ||

Conversely: Any factor causing a G&S ES (<math>G</math>↘, <math>T</math>↑ , <math>P</math>↑ , <math>P^*</math>↘, <math>c</math>↘, <math>mi</math>↑ ) moves the DD curve to the left. | |||

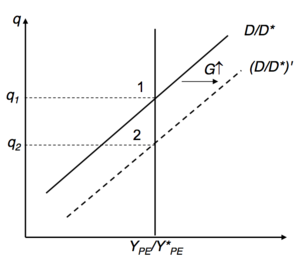

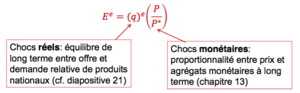

== | == Long-term balance == | ||

Alternative interpretation of [3] : <math>Y_{PE} = C(Y_{+PE} + I + G + CA(Y_{-PE} , q_{+})</math> [3’] | |||

<math>Y</math> | The condition [3'] determines the long term equilibrium level of <math>Y</math> has been replaced by its full employment level (<math>Y_{PE}</math>) => the condition [3'] determines the long term equilibrium level of <math>q</math> (see chapter 13) : | ||

[[File:économie internationale équilibre de long période 1.png|thumb|center|]] | [[File:économie internationale équilibre de long période 1.png|thumb|center|]] | ||

Example : <math>G</math>↑ => <math>\frac {D^*}{D}</math>↑ => <math>q</math>↘ | |||

Reminder: it is this value of <math>q</math> which | |||

is involved in the expectations of <math>E</math> : | |||

:::::<math>E^e = (q)^e )\frac {P}{P^*}</math> | :::::<math>E^e = (q)^e )\frac {P}{P^*}</math> | ||

NB: | NB: the relative demand function for domestic products becomes decreasing if it is defined as <math>\frac {1}{q}</math> or as <math>\frac {D^*}{D}</math>. | ||

= | = The complete model = | ||

== | == Equilibrium == | ||

The equilibrium values of <math>E</math>, <math>Y</math> and <math>R</math> are those that simultaneously satisfy the equilibrium on the asset market (AA curve) and on the G&S market (DD curve). | |||

[[File:économie internationale modèle complet équilibre 1.png|thumb|center|]] | [[File:économie internationale modèle complet équilibre 1.png|thumb|center|]] | ||

Adjustment is faster in the asset market. E.g. point <math>1</math> : <math>ES_$</math> and <math>ED_{B + S}</math> => it is the foreign exchange market that adjusts the fastest (<math>E</math>↘) => point <math>2</math>: equilibrium restored in the asset market but <math>EDB_{B + S}</math> remains => <math>Y</math>↗ gradually, but=> <math>L</math>↗ => <math>R</math>↗ => <math>E</math>↘ = we move along AA towards the simultaneous equilibrium of the three markets at the point <math>3</math>. | |||

== | == Full Diagram == | ||

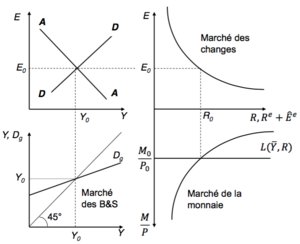

Determination of <math>Y</math>, <math>E</math>, <math>R</math> (endogenous variables): the above DD-AA diagram is a kind of "reduced form model" of a "structural model". | |||

Note : <math>Y_0 \le Y_{PE}</math> | Note: <math>Y_0 \le Y_{PE}</math> | ||

[[File:économie internationale modèle complet diagramme complet 1.png|thumb|center|]] | [[File:économie internationale modèle complet diagramme complet 1.png|thumb|center|]] | ||

== | == Anticipated exchange rate (<math>E^e</math>) == | ||

In the full model, expectations of <math>E</math>(<math>E^e</math>) are determined by the following expression : | |||

[[File:économie internationale taux de change anticipé Ee 1.png|thumb|center|]] | [[File:économie internationale taux de change anticipé Ee 1.png|thumb|center|]] | ||

In the following chapters, we will use the full model to analyze monetary and fiscal policies under floating and fixed exchange rate regimes. | |||

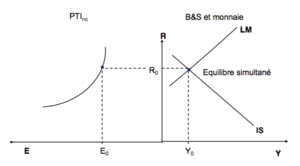

= | = The IS-LM model in an open economy = | ||

== | == IS-LM model == | ||

''' | '''Curve IS''' (balance in the G&S market): <math>Y = D_g = C(Y - T, R - \pi^e ) + I(R- \pi^e) + G + CA(\frac {EP^*}{P}, Y - T, R - \pi^e, Y^* - T^*)</math>, avec <math>G</math>, <math>T</math>, <math>Y^*</math> et <math>T^*</math> fixes | ||

''' | '''Curve LM''' (money market balance) : <math>\frac {M}{P} = L(R, Y)</math> | ||

The ''<math>PTI_{nc}</math>'' is checked in balance: <math>R = R^* + \frac{E^e - E}{E}</math> → <math>E = \frac {E^e}{(1+ R - R^*}</math> | |||

Our model therefore consists of three relationships = | |||

#<math>IS : Y = D_g (\frac {EP^*}{P}, Y - T, Y^* - T^*, R - \pi^e, G)</math> =>( | #<math>IS : Y = D_g (\frac {EP^*}{P}, Y - T, Y^* - T^*, R - \pi^e, G)</math> =>(negative slope in the space {<math>Y</math>; <math>R</math>}, because the higher the income level, the lower the interest rate level has to be to find a balance between demand and supply of G&S) | ||

#<math>LM : \frac {M}{P} = L(R, Y)</math> => ( | #<math>LM : \frac {M}{P} = L(R, Y)</math> => (positive slope in the space {<math>Y</math>; <math>R</math>} because the greater the <math>Y</math>, the greater the interest rate must be to ensure the balance between real cash demand and real money supply). | ||

#<math>PTI_{nc} : R = R^* + \frac {E^e - E}{E}</math> => (relation | #<math>PTI_{nc} : R = R^* + \frac {E^e - E}{E}</math> => (inverse relation between <math>R</math> and <math>E</math> which will allow us to see the impact of a monetary or fiscal policy on the exchange rate) | ||

== | == Displacement of the curves == | ||

*''' | *'''Curve IS''' : any exogenous factor that increases aggregate demand causes the IS curve to shift to the right (at interest rate parity, <math>Y</math> increases). | ||

*''' | *'''Curve LM''' : Any increase in the supply of money or reduction in demand (moving the money demand curve to the left) causes the LM curve to move to the right (the equilibrium interest rate falls for every <math>Y</math>). | ||

*'''<math>PTI_{nc}</math> : | *'''<math>PTI_{nc}</math>: see chapter 11. | ||

== | == Equilibrium == | ||

[[File:économie internationale modèle IS-LM en économie ouverte équilibre 1.png|thumb|center|]] | [[File:économie internationale modèle IS-LM en économie ouverte équilibre 1.png|thumb|center|]] | ||

= | = Summary = | ||

== | == Model DD-AA == | ||

Curve AA : | |||

* | *combinations (<math>E</math>,<math>Y</math>) ensuring equilibrium in the asset market. | ||

* | *negative slope because if <math>Y</math>↗ => Money market EDs => <math>R</math>↗ => ES of currency => appreciation of the national currency =<math>E</math>↘. | ||

* | *Any factor leading to a currency ED moves AA to the right. | ||

DD curve : | |||

* | *combinations (<math>E</math>,<math>Y</math>) ensuring equilibrium in the goods and services market. | ||

* | *positive slope because if <math>Y</math>↗ => ES on the G&S market actual depreciation required to restore equilibrium ⇔ <math>E</math> must ↗. | ||

* | *Any factor leading to a B&S ED moves DD to the right. | ||

== | == Model IS-LM == | ||

IS curve : | |||

* | *combinations (<math>Y</math>, <math>R</math>) ensuring equilibrium in the goods and services market. | ||

* | *negative slope because if <math>Y</math>↗ => ES in the G&S market => ↘<math>R</math> to restore the balance. | ||

* | * Any factor leading to a B&S ED moves IS to the right. | ||

LM curve : | |||

* | *combinations (<math>Y</math>, <math>R</math>) ensuring equilibrium in the money market. | ||

* | *positive slope because if <math>Y</math>↗ => ED in the G&S market => ↗<math>R</math> to restore the balance. | ||

* | *any factor leading to a currency ES moves LM to the right | ||

= Annexes = | = Annexes = | ||

Version actuelle datée du 22 avril 2020 à 10:45

| Professeur(s) | |

|---|---|

| Cours | International Economy |

Lectures

- Ricardo's model: productivity differences as a determinant of trade

- The Heckscher-Ohlin model: differences in factor endowments as a determinant of trade

- Economies of scale as a determinant of trade: beyond comparative advantage

- Trade policy instruments

- Multilateral trade agreements

- Preferential Trade Agreements

- The Free Trade Challenge

- International Macroeconomics: Issues and Overview

- National Accounts and Balance of Payments

- Exchange rates and the foreign exchange market

- Short-term exchange rates: the asset-based approach

- Long-term exchange rates: the monetary approach

- Domestic product and short-term exchange rates

- Floating exchange rates

- Fixed exchange rates and intervention on the foreign exchange market

What are the determinants of the exchange rate in the short term (i.e. when the general price level remains constant but the level of economic activity fluctuates)?

Under what conditions does a real depreciation lead to an improvement in the trade balance?

What are the combinations of output levels and exchange rates that simultaneously guarantee equilibrium in the foreign exchange market, the currency market and the market for goods and services?

Introduction[modifier | modifier le wikicode]

General principle: taking into account variations in national income () → equilibrium on the goods and services market (G&S).

Hypothesis: short-term equilibrium: , rigid and short-term (deviations from the level of full employment production are possible)

Until now we have kept the Gross Domestic Product (GDP) constant (or exogenous, i.e. determined outside our models). In the long term ( of full employment), this is justified by the fact that the level of economic activity is determined by the fundamentals of the economic system (capital endowments, labour, land and technology) and not by monetary variables, and that prices adjust perfectly and instantaneously.

In the short term it is possible that changes in the money market or in the exchange rate may affect the level of economic activity, when prices are assumed to be rigid and do not adjust immediately to shocks that the economy may experience (labour contracts and other "menu costs").

DD-AA approach[modifier | modifier le wikicode]

SD-PAA approach To study the relationship between exchange rates and GDP in the short term, we combine the monetary model of the exchange rate (to introduce the role of expectations) and the short-term model of the goods and services market with rigid prices.

DD-AA approach (KO)

System of 3 equations with 3 unknowns (, , ) :

- () [1]

- (monetary market) [2]

- (D global=Offer) [3]

Hypothesis: only intervenes in equations [1] and [2] = "asset market" and if we combine them, we come back to a model with 2 equations in 2 unknowns (Y,E) :

- [1] + [2] → → curve AA

- [3] → → curve DD

IS-LM approach[modifier | modifier le wikicode]

An alternative approach to study the relationship between and in the short term is to extend the classical IS-LM model to the open economy and integrate it with the principle of .

IS-LM approach (FT and all other manuals)

In the AA-DD model it is assumed that investment and consumption do not depend on the interest rate → very strong assumption. In general, investment decreases with the interest rate, as does consumption (and imports): the higher the , the higher the cost of borrowing. (=> ↓) and the higher the math, the more people are going to want to save (=> and ↓).

The IS-LM model does not make this assumption and gives us the simultaneous equilibrium conditions in the goods market (IS) and in the money market (LM) defined in the space {; }.

As we shall see, the conclusions reached in terms of the consequences for the macroeconomic balance following either a monetary or a fiscal shock are qualitatively identical to those obtained in the DD-AA model. The main advantage of the DD-AA model compared to the IS-LM model extended to the open economy is that it is better suited to analysing the long-term effects since the IS-LM model is a model based on the assumption of fixed prices.

The asset market: the AA curve[modifier | modifier le wikicode]

The asset market: the AA curve[modifier | modifier le wikicode]

Definition: The AA curve is the set of pairs (, ) that simultaneously ensure equilibrium on the foreign exchange market ( satisfied) and on the money market.

Derivation of the AA curve

1) Graphic derivation :

- Principle: we start from a situation of equilibrium (), we consider a ↑ of and we report the equilibrium combinations, (, ), (, ), in the diagram on the left.

- Intuition: ↑→ ↑ → ↑; to bring the asset market back to equilibrium this year ↑ of must be offset by currency appreciation (↓)

==> AA has a negative slope.

2) Synthetic Derivative :

- point : simultaneous equilibrium in the asset and currency market

- point : (income) ↑ => Currency ED => R↑ => ES currencies => ↓

- point : nouvel équilibre simultané => AA a une pente négative.

All points above (below) AA correspond to a currency ES (ED).

Displacement of the AA curve[modifier | modifier le wikicode]

Example[modifier | modifier le wikicode]

increase of

Reasoning at constant (↓) => moving AA upwards

NB: One could also have reasoned at constant ( ⟺ ); dn this case, to reabsorb the money ES at constant , it is necessary that ↗ = moving AA to the right.

Generalisation[modifier | modifier le wikicode]

Any factor causing a currency ED (↗, ↓, ↗, ↗) causes AA to move to the right.

Conversely: Any factor causing a currency ES (↓, ↗, ↓, ↓) moves the AA curve to the left.

The goods market: the DD curve[modifier | modifier le wikicode]

Global demand: assumptions[modifier | modifier le wikicode]

- = private consumption

is positively dependent on disposable income () ⇒ , where (marginal propensity to consume)

- = business investment

assumed constant (exogenous) ⇒

- = state spending and = taxes.

assumed constant (exogenous) ⇒ and

- = "current account", to transfers on loan, i.e. , where we assume constant and equal to ⇒ the current balance coincides with the trade balance.

The higher the is, the higher the is, which deteriorates (one neglects which influences ). The higher the is, the higher the relative price of foreign products, which improves (under a particular condition supposedly satisfied) ⇒ , où and

CA: Marshall-Lerner's Condition[modifier | modifier le wikicode]

Condition for

Link CA - q: if ↗, what's going on?

- quantity effect: if ↗ => ↗, ↘ => goes well in the direction of a ↗ of CA.

- price effect: if ↗ => the value of imports is increasing (their relative price ↗) => tendency towards ↘ of CA.

=> Ambiguous a priori effect.

It can be shown that, following a real depreciation, the current account balance will improve if the following condition is satisfied :

where and indicate the elasticity of demand for exports and the elasticity of demand for imports of the domestic country, respectively. This condition is known as the Marshall-Lerner (M-L) condition. Unless otherwise indicated, it is assumed that this condition is satisfied and that, therefore, a real depreciation of the domestic economy is not necessary. (↑) causes an improvement in CA.

Condition of M-L: J-curve[modifier | modifier le wikicode]

Empirical evidence shows that the initial effect of a depreciation on the current account is negative = the depreciation initially causes a deficit.

Explanation: the quantities imported and exported by enterprises and households are fixed in contracts, which will only be gradually renegotiated = initially only the price effect is active (the value of IMP ↑ while the value of EXP does not change), the quantity effect only appears later = initial negative effect on the balance of turnover.

J-curve :

- The price effect of a devaluation is immediate (more expensive imports, with unchanged import and export quantities).

- The quantity effects (sum of the elasticities) are slower on the J curve of CA versus time.

M-L condition: empirical evidence[modifier | modifier le wikicode]

- "Short term" = < 6 months

- "Medium term" = < 12 months

- "Long term" = > 1 year

Our hyp. for the rest:

Balance in the G&S market[modifier | modifier le wikicode]

Balance on the goods and services market: Supply = Aggregate demand, i.e. :

Definition: the DD curve is the set of couples (, ) which ensure the equilibrium on the B&S market.

Assumptions:

- , marginal propensity to consume,

- , marginal propensity to import,

- , Marshall-Lerner's condition is met.

=> et = the overall demand is positively dependent on (but the induced increase of is smaller than the increase of ) and .

Equilibrium (short-term = fixed prices and variable ) :

The G&S market: the DD curve[modifier | modifier le wikicode]

Derivation of the DD curve

- 1) Graphic derivation:

Principe: we start from a situation of equilibrium, we consider a ↗ of (=> ↗ => by M-L, ↗ => moves up and ↗ to bring the goods market back into equilibrium) and the equilibrium combinations, (),(), are plotted in the bottom diagram.

=> DD has a positive slope.

2) Synthetic derivative:

- point : initial equilibrium

- point : (production)↗ => ES of G&S => E must ↗ (=> CA↗) to redress the balance

- point : new balance

=> DD has a positive slope.

=> All points below (above) DD correspond to a G&S ES (ED).

Displacement of the DD curve[modifier | modifier le wikicode]

Example: increase in G[modifier | modifier le wikicode]

By reasoning at constant (↑) => dDD shift to the right

NB: one could also have reasoned at constant -> ↑ -> ↑ => to restore balance by playing you need ↘ (⟺ ↘)

=> moving DD down.

Generalisation[modifier | modifier le wikicode]

Any factor causing a G&S ED (↑, ↘, ↘, ↑, ↑, ↘) causes DD to move to the right.

Conversely: Any factor causing a G&S ES (↘, ↑ , ↑ , ↘, ↘, ↑ ) moves the DD curve to the left.

Long-term balance[modifier | modifier le wikicode]

Alternative interpretation of [3] : [3’]

The condition [3'] determines the long term equilibrium level of has been replaced by its full employment level () => the condition [3'] determines the long term equilibrium level of (see chapter 13) :

Example : ↑ => ↑ => ↘

Reminder: it is this value of which

is involved in the expectations of :

NB: the relative demand function for domestic products becomes decreasing if it is defined as or as .

The complete model[modifier | modifier le wikicode]

Equilibrium[modifier | modifier le wikicode]

The equilibrium values of , and are those that simultaneously satisfy the equilibrium on the asset market (AA curve) and on the G&S market (DD curve).

Adjustment is faster in the asset market. E.g. point : and => it is the foreign exchange market that adjusts the fastest (↘) => point : equilibrium restored in the asset market but remains => ↗ gradually, but=> ↗ => ↗ => ↘ = we move along AA towards the simultaneous equilibrium of the three markets at the point .

Full Diagram[modifier | modifier le wikicode]

Determination of , , (endogenous variables): the above DD-AA diagram is a kind of "reduced form model" of a "structural model".

Note:

Anticipated exchange rate ()[modifier | modifier le wikicode]

In the full model, expectations of () are determined by the following expression :

In the following chapters, we will use the full model to analyze monetary and fiscal policies under floating and fixed exchange rate regimes.

The IS-LM model in an open economy[modifier | modifier le wikicode]

IS-LM model[modifier | modifier le wikicode]

Curve IS (balance in the G&S market): , avec , , et fixes

Curve LM (money market balance) :

The is checked in balance: →

Our model therefore consists of three relationships =

- =>(negative slope in the space {; }, because the higher the income level, the lower the interest rate level has to be to find a balance between demand and supply of G&S)

- => (positive slope in the space {; } because the greater the , the greater the interest rate must be to ensure the balance between real cash demand and real money supply).

- => (inverse relation between and which will allow us to see the impact of a monetary or fiscal policy on the exchange rate)

Displacement of the curves[modifier | modifier le wikicode]

- Curve IS : any exogenous factor that increases aggregate demand causes the IS curve to shift to the right (at interest rate parity, increases).

- Curve LM : Any increase in the supply of money or reduction in demand (moving the money demand curve to the left) causes the LM curve to move to the right (the equilibrium interest rate falls for every ).

- : see chapter 11.

Equilibrium[modifier | modifier le wikicode]

Summary[modifier | modifier le wikicode]

Model DD-AA[modifier | modifier le wikicode]

Curve AA :

- combinations (,) ensuring equilibrium in the asset market.

- negative slope because if ↗ => Money market EDs => ↗ => ES of currency => appreciation of the national currency =↘.

- Any factor leading to a currency ED moves AA to the right.

DD curve :

- combinations (,) ensuring equilibrium in the goods and services market.

- positive slope because if ↗ => ES on the G&S market actual depreciation required to restore equilibrium ⇔ must ↗.

- Any factor leading to a B&S ED moves DD to the right.

Model IS-LM[modifier | modifier le wikicode]

IS curve :

- combinations (, ) ensuring equilibrium in the goods and services market.

- negative slope because if ↗ => ES in the G&S market => ↘ to restore the balance.

- Any factor leading to a B&S ED moves IS to the right.

LM curve :

- combinations (, ) ensuring equilibrium in the money market.

- positive slope because if ↗ => ED in the G&S market => ↗ to restore the balance.

- any factor leading to a currency ES moves LM to the right

Annexes[modifier | modifier le wikicode]

References[modifier | modifier le wikicode]

- ↑ Page personnelle de Federica Sbergami sur le site de l'Université de Genève

- ↑ Page personnelle de Federica Sbergami sur le site de l'Université de Neuchâtel

- ↑ Page personnelle de Federica Sbergami sur Research Gate

- ↑ Céline Carrère - Faculté d'économie et de management - UNIGE

- ↑ Céline Carrère - Google Scholar Citations

- ↑ Director Céline Carrère - Rectorat - UNIGE

- ↑ Céline Carrère | Sciences Po - Le Laboratoire Interdisciplinaire d'Evaluation des Politiques Publiques (LIEPP)

- ↑ Céline Carrere - EconPapers

- ↑ Céline Carrère's research works - ResearchGate