International Macroeconomics: Issues and Overview

| Professeur(s) | |

|---|---|

| Cours | International Economy |

Lectures

- Ricardo's model: productivity differences as a determinant of trade

- The Heckscher-Ohlin model: differences in factor endowments as a determinant of trade

- Economies of scale as a determinant of trade: beyond comparative advantage

- Trade policy instruments

- Multilateral trade agreements

- Preferential Trade Agreements

- The Free Trade Challenge

- International Macroeconomics: Issues and Overview

- National Accounts and Balance of Payments

- Exchange rates and the foreign exchange market

- Short-term exchange rates: the asset-based approach

- Long-term exchange rates: the monetary approach

- Domestic product and short-term exchange rates

- Floating exchange rates

- Fixed exchange rates and intervention on the foreign exchange market

What is the field of study of international macroeconomics?

How does the foreign exchange market work?

What determines exchange rate fluctuations?

What information is derived from a country's Balance of Payments?

Policy choice: fixed vs. floating exchange rates?

What are the benefits of financial openness?

Types of international transactions

Types of international transactions

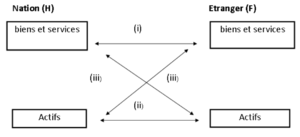

Types of transactions between (Home) and (Foreign) :

- (i) trade; e.g. exports watches, exports textiles.

- (ii) capital exchanges; e.g. acquires a title of , acquires a title of .

- (iii) inter-temporal trade; e.g., imports equipment from and incurs debt in relation to .

Basic motivation: arbitrage gains = exploitation of differences between countries.

The two approaches to exchanges

1) Real theory of trade (International Economy I)

- Subject: real trade in goods or factors between countries.

- Primarily micro-economic approach

- Examples of questions: Gains from trade, redistributive consequences, protectionism

- Examples of institutions: WTO, regional agreements (NAFTA, Single European Market...)

2) International payments (International Economy II)

- Subject: International payments and the role of currency (exchange rates).

- Primarily macro-economic approach (focuses on aggregate economic variables = countrywide)

- Sample questions: Fixed versus floating exchange rates? Should we join a monetary union? Causes and consequences of financial crises?

- Examples of institutions: ECB, IMF

Trade in goods: trade

A lot of trade within countries

35% of world trade is between developed countries

Growing importance of trade with Asia

Asset swaps: direct investment

FDI = foreign direct investment (multinationals)

Horizontal between rich countries (same sectors), vertical between rich countries and DCs

Essential FDI between developed countries (EU+USA = 55%), but growing Chinese FDI

Long-term development

Liberalization of capital flows

More liberalisation in the financial market and more financial transactions from the 1970s onwards, with some important differences between categories of countries.

Main topics covered

Two themes

Money/Currencies

There are many different currencies in use in the world today. The first part of our course is dedicated to understanding the implications of using different currencies and to understanding the mechanism of exchange rate determination. Obviously, in doing so we will not be able to ignore issues related to the international mobility of capital.

Economic policies

What is the role of governments today in an economic system characterized by strong integration? What room for manoeuvre is available to States in terms of economic policies? What choice of exchange rate regime? What decisions should be taken on the rules authorising or restricting the free movement of capital?

Exchange rates

- EXCHANGE RATE = price of a foreign currency

As goods, services and investments cross borders, the exchange rate has a significant impact on the relative prices of domestic and foreign goods (cars or textiles), services (insurance or tourism) and assets (stocks or bonds).

Exchange rates affect the economy through 2 channels:

- relative prices of goods (a shirt costs 45 EUR, a watch costs 75 CHF = 60 EUR at the exchange rate 1 EUR = 1.25 CHF => a watch is "worth" 1.33 shirts; if the exchange rate rises to 1.50 CHF per EUR, the relative shirt/watch price drops to 1.11 shirts per watch);

- relative prices of assets (the Eurozone countries had about $200 billion of US assets at the end of 2002, i.e. 200 billion € (1$ = 1€ at the end of 2002); 1 year later, at the end of 2003, these assets are worth only $160 billion because the dollar has depreciated / the euro has appreciated (1$ = 0.8€).

It is important to understand the exchange rate fluctuations.

Two exchange rate regimes

FREE FLOATING EXCHANGE PLAN: the price of currencies is freely determined by supply and demand on the foreign exchange market → frequent fluctuations on a daily basis. Euro zone, United States, United Kingdom, Japan

FIXED EXCHANGE REGIME: monetary authorities undertake to maintain their exchange rate at a publicly announced parity (the official value of the national currency in terms of another currency) so the exchange rate is relatively stable... except for occasional readjustments! Denmark, Latvia and Lithuania peg their currencies to the Euro; China has pegged its currency, the yuan, to the US dollar.

EXCHANGE CRISIS: A sudden and very large loss in the value of a country's currency relative to other currencies after a period of stable exchange rates. Very important economic consequences, all the more so if the country is heavily dependent on imports and foreign capital.

Currency Crises

WHEN THE EXCHANGE RATE FLUCTUATES "TOO" MUCH..: Relatively frequent crises (24 crises between 1997 and 2009).

An exchange rate crisis can put a country in default (the country cannot honour its debt repayments).

Can also be associated, in extreme cases, with political and social instability (Argentina crisis in 2002).

Financial Globalization

To understand the financial interactions between countries we need to use a framework comptable→ the PAYMENT BALANCE allows us to monitor how a country's indebtedness to the rest of the world evolves, the health of its industries subject to foreign competition, or to understand the links between foreign transactions and the supply of money (the very first part of our course).

Three notions:

- Income: the amount earned by the factors of production in an economy.

- Expenditure: how much is the economy spending on goods and services?

- Current account: difference between Income and Expenditure, either in surplus (Income > Expenditure) => savings lent abroad, or deficit (Income < Expenditure) => financed by foreign loans.

EXTERNAL POSITION: the current account balance and capital gains/losses will change the credit or debit position of the country vis-à-vis the rest of the world.

Economic policies

ECONOMIC POLICIES are defined to achieve macroeconomic objectives, such as keeping inflation low, stabilising interest rates, mitigating the effects of a recession.

Key decisions to be taken by the government:

- CHANGE SCHEME, which will influence the effectiveness of monetary and fiscal policies;

- FREE MOVEMENT OF CAPITAL RULES and regulation of international finance, which will influence the inflow and outflow of capital and the volume of international financial transactions.

Countries differ in the quality of their choice of economic policies and in the quality of the institutional context in which policies are implemented. To study international macroeconomic interactions, it is essential to understand how this context affects the effectiveness of policies.

Résumé

La macroéconomie internationale étudie les phénomènes qui ont trait à l’économie dans son ensemble (MACRO-économie), entre des économies interdépendantes (INTERNATIONALE).

Depuis les années 1970s → mouvement général vers plus de libéralisation financière (élimination progressive des restrictions aux mouvements de capitaux. Il en découle une augmentation du volume des transactions financières internationales.

Les fluctuations du taux de change influencent le système économiques via deux canaux: les prix relatifs des biens et les prix relatifs des actifs.

La balance des paiements est le document de comptabilité nationale qui permet de suivre l'évolution de la position extérieure du pays.

Les deux choix principales en termes de politique économique que le gouvernement doit prendre concernent le choix du régime de change (flottant versus fixe) et les règles sur la libre circulation des capitaux.

Annexes

References

- ↑ Page personnelle de Federica Sbergami sur le site de l'Université de Genève

- ↑ Page personnelle de Federica Sbergami sur le site de l'Université de Neuchâtel

- ↑ Page personnelle de Federica Sbergami sur Research Gate

- ↑ Céline Carrère - Faculté d'économie et de management - UNIGE

- ↑ Céline Carrère - Google Scholar Citations

- ↑ Director Céline Carrère - Rectorat - UNIGE

- ↑ Céline Carrère | Sciences Po - Le Laboratoire Interdisciplinaire d'Evaluation des Politiques Publiques (LIEPP)

- ↑ Céline Carrere - EconPapers

- ↑ Céline Carrère's research works - ResearchGate