Multilateral trade agreements

| Professeur(s) | |

|---|---|

| Cours | International Economy |

Lectures

- Ricardo's model: productivity differences as a determinant of trade

- The Heckscher-Ohlin model: differences in factor endowments as a determinant of trade

- Economies of scale as a determinant of trade: beyond comparative advantage

- Trade policy instruments

- Multilateral trade agreements

- Preferential Trade Agreements

- The Free Trade Challenge

- International Macroeconomics: Issues and Overview

- National Accounts and Balance of Payments

- Exchange rates and the foreign exchange market

- Short-term exchange rates: the asset-based approach

- Long-term exchange rates: the monetary approach

- Domestic product and short-term exchange rates

- Floating exchange rates

- Fixed exchange rates and intervention on the foreign exchange market

Economic justification for multilateral agreements

Large countries (those that can affect international prices when they change their demand or supply on international markets) can improve their welfare by introducing tariffs that reduce their demand and thus cause the international prices of the products they import to decline....

If all countries are big and do the same thing this can have negative effects on international markets: trade wars

In order to avoid this scenario, multilateral agreements regulate international trade and what is and is not allowed in trade policy.

Framework: the World Trade Organization and its predecessor: the GATT

- General Agreement on Tariffs and Trade

- General Agreement on Tariffs and Trade

Multilateral Agreements and the WTO

The creation of the GATT

The GATT (General Agreement on Tariffs and Trade) was signed in 1947 (23 countries) and came into force on 1/1/1948. It was a provisional agreement within the framework of the Bretton Woods agreements, pending ratification by the American Congress of the creation of the International Trade Organization (ITO). But this was never ratified.

GATT-WTO Basic Principles

Three main agreements

- GATT

- GATS

- TRIPS

The fundamental principles in these agreements

- Trade without discrimination:

- Most Favoured Nation (MFN) Clause (e.g. Article I of GATT, Article II of GATS, and Article 4 of TRIPS)

- National treatment (e.g. GATT Article III, GATS Article XIII and TRIPS Article 3).

- Trade liberalisation: gradual and by negotiation

- Predictability: consolidation and transparency (e.g. elimination of non-tariff barriers).

The different rounds of negotiations

The Uruguay Round: 1986 - 1994

The cycle with the greatest developments

Tariffs on industrial goods had fallen from 40% in 1948 to 7% during the Tokyo Round. The Uruguay Round reduced them to 4% in the DDs (40% reduction) and 12% in the LDCs (20% reduction + "binding" of previously unbound tariffs).

Introduction of products in which developing countries had an export trade interest such as textiles and clothing and agriculture into the GATT rules, but far from perfect ...

"Backloading" of the liberalisation of non-tariff measures on textiles and clothing (end of the Multifibre Arrangement in 2005)

Very small reductions in agriculture due to "dirty pricing" + Decrease in soft agricultural subsidies + safeguard clause.

Introduction of agreements corresponding to the commercial interests of developed countries:

- GATS (General Agreement on Trade in Services)

- TRIPS (Trade-Related Aspects of Intellectual Property Rights).

- TRIMS (Trade-Related Aspects of Investment Measures).

Creation of the WTO to regulate all this.

One of the important objectives of the Doha Round is to rebalance between developed and developing countries. The word "development" is found more than 60 times in the 11-page Doha Ministerial Declaration. http://www.wto.org/french/thewto_f/minist_f/min01_f/mindecl_f.pdf

The Doha Round: what is at stake?

Summary of negotiations

Ministerial conferences were held in

Doha in 2001

19 topics including Agriculture (cotton), Singapore issues, Intellectual Property Rights, market access for non-agricultural products, services, trade and environment, e-commerce, etc.[10]

Cancun in 2003

for stocktaking = members must agree on how to complete the negotiations. Agreements on "intellectual property rights and public health Failure due to disagreement on agriculture (cotton) + on the "Singapore Issues".

4 issues studied by a working group established by the 1996 Singapore Ministerial Conference = Trade and Investment, Competition Policy, Transparency in Government Procurement, Trade Facilitation

Geneva in 2004

« 2004 july package » = 3 of the 4 Singapore issues removed from the Doha Agenda = continuation of negotiations on agriculture + sectoral initiative on cotton + market access for non-agricultural products

Hong Kong in 2005

several issues have been partially or fully resolved.

= agreement on the elimination of export subsidies in agriculture by 2013 (but the Declaration makes it clear that the agreed date is conditional)

= for cotton, the phase-out is accelerated until the deadline of end 2006

= cotton exports from the least developed countries will be admitted to developed countries on a duty-free and quota-free basis from the beginning of the implementation period of the new Agreement on Agriculture.

= Developing country Members will also have the right to use a Special Safeguard Mechanism based on import quantity and price triggers, with specific arrangements to be further defined. »

Genève in 2006

G-6: Ministers from Australia, Brazil, the United States, India, Japan and the European Union

= Failure of discussions on agricultural issues, market access and domestic support. The six did not even address the third element - non-agricultural market access.

= Suspension of the Doha Geneva negotiations in 2008

"2004 july package" = convergence on a number of elements of the NAMA modalities emerged among the Ministers of the so-called G-7 Group (Australia, Brazil, China, European Communities, India, Japan, the United States and the European Communities).

= still deadlock on agricultural issues (safeguard)

The place of agriculture

Agriculture absent from the GATT until the Uruguay Round. Formation of the Cairns Group which lobbies for the inclusion of this sector in the GATT rules.

Negotiation of the AAUR (Agriculture Agreement of the Uruguay Round) which will have rules different from those of the trade in manufactures:

3 pillars: 1) Market access

- "Pricing" of quantitative restrictions

- Tariffs were subject to reductions of 36% for Developed Countries (24% for PeD and 0% for LDCs),

- But "dirty pricing"

- 2) Subsidy for prohibited exports except for

If notified. Then subject to reductions of 36% for Developed Countries, 24% for PeD and 0% for LDCs. Notified by 25 members.

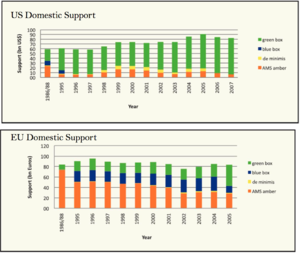

- 3) Domestic support (e.g. guaranteed price, guaranteed farmer's income, etc.) - 3 boxes

- Green

- Blue

- Amber

Reduction of internal supports...

... and especially those that cause great distortion...

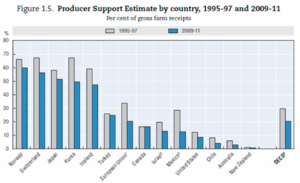

Subsidies vs. market access in the OECD?

Internal Support = not the main issue (and not necessarily distorting)

Or focus the negotiating effort for developing countries? What does theory tell us?

Subsidy is the least trade-distorting instrument because :

- Does not affect the consumer decision in the OECD. It only distorts the OECD production decision.

- And not necessarily if the subsidy is a green or blue box type.

- Snape (1986) had recommended at the beginning of the Uruguay Round to focus on market access. Subsidies will automatically adjust for government deficit reasons in the OECD. Once trade barriers fall, this becomes unsustainable from a fiscal point of view. Now the pressure of new countries entering the EU will end enough pressure on the domestic support system to be reduced.

So the negotiating effort of agricultural exporting countries should be on market access and not on agricultural subsidies, if one believes the economic reasoning and the data.

But why is it not?

The international campaign against agricultural subsidies in the OECD ($50 b. of aid and $300 b. of agricultural "subsidies") has been very successful (driven by NGOs, the World Bank, etc.), and this "shame game" increases the power of the PeD negotiations.

Images of the PeDs: "we are there and you have to count on us because we can block everything" => pushing the limits to know their negotiating power.

PeDs have almost no domestic support so by being aggressive in this sector, they have almost nothing to do as a reform, but some of them have significant border protection in agriculture (domestic support = lowest common denominator in a coalition that is probably too big).

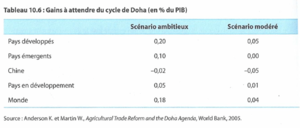

Doha gains for PeDs are relatively small in all estimates, so not much to lose

Earnings estimation and the role of "Aid for Trade"

Doha Round is not enough even for LDCs, even when trade negotiations are supposed to be very ambitious ...

Because loss for the importing countries ...

As we have just seen, in the Doha negotiations, one of the main demands of the PeDs concerns the agricultural policies of the developed countries that depress world prices and thus penalize foreign exporters.

The elimination of US and EU subsidies is expected to increase world agricultural prices, penalize net food-importing countries and raise security concerns in a number of countries.

cf. the "hunger riots" in 2008 in Egypt, Morocco, Indonesia, Philippines, Haiti, Nigeria, Cameroon, Ivory Coast, Mozambique, Mauritania, Senegal, Burkina Faso...

cf. the expected loss for China in simulations of the expected gains from the Doha Round (study by Anderson and Martin, 2005, WB)

... and low gains for exporting countries

Erosion of tariff preferences (GSP, Everything But Arms, AGOA, etc.). When MFN tariffs fall as a result of the negotiations, the tariff preference granted by the EU and the US to PeDs decreases .

Ex: LDCs = estimated loss around $350 million.

Sanitary, phytosanitary and other technical barriers are not considered and represent a significant barrier to exports of PeDs.

Complementary internal reforms and their financing in the LDCs are not part of the negotiation.

- No price transmission in remote areas

- Very little participation of LDC farmers in domestic (or obviously international) markets: 20-40% of production in Sub-Saharan Africa is subsistence.

- Lack of access to credit to reallocate production to more profitable sectors and therefore unable to benefit from the gains of trade.

« Aid for trade » pour financer

Services d’extension agricole pour faciliter l’ajustement et la productivité des agriculteurs:

- Incorporation des producteurs en subsistance aux marchés (accès au crédit, connaissance de fonctionnement de marché, etc.)

- « Know how » sur nouvelles graines, techniques de production, nouveaux produits (« découvertes » locales) etc...

- Capacité de satisfaire les standards de production domestiques et internationaux

Réduction des coûts de transports internes (routes, mais aussi concurrence sur les services de transport, et subventions temporaires pour aller dans des zones plus éloignées)

Aide à la transparence et transmission de information (radio,TV, association d’agriculteurs)

Résumé

Le Cycle de Doha naît en partie en réaction à ce qui était vu comme un déséquilibre du système multilatéral à la fin du Cycle de l’Uruguay entre les bénéfices pour les PVD (incorporation d’agriculture et textiles) et les bénéfices pour les PD (TRIPS, services, TRIMS...).

Le mot « Développement » apparaît 50 fois dans le texte de 10 pages de la Déclaration Ministérielle de Doha.

Mais il y en a énormément de problèmes qu’il faut résoudre avant que Doha arrive à livrer ses promesses de développement pour les pays moins avancés:

- Des négociations purement commerciales ne réussiront pas à rééquilibrer le système multilatéral

- Les négociations agricoles devront se focaliser sur l’accès au marché (et non pas sur le soutien interne dans l’OCDE) si l’objectif est l’intérêt des pays exportateurs de produits agricoles dans le monde en développement

- « Aid for trade » sera nécessaire pour faciliter l’ajustement dans les pays les plus pauvres et s’assurer que l’on maximise les gains potentiels offerts par le Cycle de Doha.

Du coté des pays développés : prolifération des accords bilatéraux pour obtenir des avancées sur les points évincés de Doha (cf. les question de Singapour, la protection des droits de propriété intellectuelle...).

Annexes

References

- ↑ Page personnelle de Federica Sbergami sur le site de l'Université de Genève

- ↑ Page personnelle de Federica Sbergami sur le site de l'Université de Neuchâtel

- ↑ Page personnelle de Federica Sbergami sur Research Gate

- ↑ Céline Carrère - Faculté d'économie et de management - UNIGE

- ↑ Céline Carrère - Google Scholar Citations

- ↑ Director Céline Carrère - Rectorat - UNIGE

- ↑ Céline Carrère | Sciences Po - Le Laboratoire Interdisciplinaire d'Evaluation des Politiques Publiques (LIEPP)

- ↑ Céline Carrere - EconPapers

- ↑ Céline Carrère's research works - ResearchGate

- ↑ http://www.wto.org/french/tratop_f/dda_f/dohasubjects_f.htm