« Economies of scale as a determinant of trade: beyond comparative advantage » : différence entre les versions

Aucun résumé des modifications |

|||

| (7 versions intermédiaires par le même utilisateur non affichées) | |||

| Ligne 45 : | Ligne 45 : | ||

{{Translations | {{Translations | ||

| en = Economies of scale as a determinant of trade: beyond comparative advantage | | en = Economies of scale as a determinant of trade: beyond comparative advantage | ||

| es = | | es = Las economías de escala como determinantes del comercio: más allá de la ventaja comparativa | ||

}} | }} | ||

| Ligne 126 : | Ligne 126 : | ||

[[File:économie internationale rappel monopole et concurrence monopolistique 1.png|thumb|center]] | [[File:économie internationale rappel monopole et concurrence monopolistique 1.png|thumb|center]] | ||

== | == Open for business == | ||

Merger of 2 identical markets of <math>n'</math> firms | |||

[[File:économie internationale rappel ouverture au commerce 1.png|thumb|center]] | [[File:économie internationale rappel ouverture au commerce 1.png|thumb|center]] | ||

== | == Gaining trade in monopolistic competition == | ||

going from <math>E^{'}</math> (Autarky) to <math>E^{'}</math> (Free Trade) | |||

Pro-competitive gain | |||

*markup decreases from math>\mu'</math> to math>\mu''</math> and therefore the price decreases from math>p'</math> to math>p''</math>. | |||

*Well-being gains for +C consumers | |||

Gain | Gain in economies of scale (or rationalization or selection) | ||

* | *Fewer firms operating on the total market (from <math>2n'</math> to <math>n''</math>) more production per firm (from <math>x'</math> to <math>x''</math>) | ||

* | *lower average cost | ||

Gain | Gain of varieties | ||

* | *Increase the number of varieties available to the consumer from <math>n'</math> to <math>n'</math>. | ||

*Equal gain for producers (more input varieties available => increases their productivity) | |||

Translated with www.DeepL.com/Translator (free version) | |||

== | == Remark == | ||

Firms disappear when trade is opened up. In this model, as all firms are identical, only chance determines which firms win. | |||

Model with heterogeneous firms: not all firms have the same productivity | |||

Once again, LE has winners and losers: large, highly productive companies win, smaller companies see their market share shrink and disappear. | |||

This type of model also explains why less than 20% of French and American manufacturing companies export, and an even smaller percentage invest abroad. | |||

== | == Empirical evidence? == | ||

A large part of the trade of OECD countries is intra-industrial (e.g. 40% for the EU). The trade model with economies of scale helps to explain this. | |||

[[File:économie internationale économie échelle interne évidences 1.png|thumb|center|Evolution | [[File:économie internationale économie échelle interne évidences 1.png|thumb|center|Evolution of the weight of intra-industry trade in world trade. (Source: Marius Brülhart, 2009).]] | ||

Effect of integration within NAFTA between the US, Canada and Mexico, cf. section 3 chapter 6 in FT (2012) . | |||

== | == Effect of trade integration within the EU-15 == | ||

* | *Elimination of tariff barriers (UD in 1968) and especially non-tariff barriers (single market - 1992), then single currency.... | ||

*defragmentation of the European market from 1992 onwards | |||

* | *Increased competition | ||

* | |||

We're getting the effects we expected... | |||

Effect of trade integration within the EU-15 (continued) | |||

Increased competition | |||

*Gain | *Gain in variety | ||

Mohler | Mohler and Seitz (2010): substantial gains between 1999-2008 for small countries (e.g. +0.75% of GDP for Denmark, +2.8% for Estonia), small for large countries. | ||

* | *Pro-competitive gain | ||

Allen et al | Allen et al (1999): The implementation of the Single Market reduced price-cost margins by about 4% on average. | ||

*Gain | * Gain in economies of scale or rationalisation | ||

* | *Increased competition | ||

** | **Pressure on profits | ||

** | **Economic restructuring | ||

= | = fewer firms, each of larger size and theoretically more efficient | ||

** | **European Competition Surveillance Policy | ||

** | **Change in the number of banks in the Euro Zone | ||

** | **Mainly due to M&A activity in the euro zone, 77% of which took place within the same country (especially for the largest countries). | ||

[[File:économie internationale membres de la zone euro illustration 1.png|thumb|center| | [[File:économie internationale membres de la zone euro illustration 1.png|thumb|center|Euro area members excluding Cyprus, Estonia, Malta, Slovakia and Slovenia (Sources: Baldwin and Wyplosz 2012).]] | ||

= | = External economies of scale (or historical accidents versus comparative advantage) = | ||

== | == External economies of scale == | ||

According to Marshall, there are 3 main reasons for corporate concentrations (i.e. 3 types of externalities): | |||

# | #Proximity to a large number of specialized suppliers / non-tradable intermediate goods; | ||

# | #Large pool of labor; | ||

# | #Knowledge externalities. | ||

Increasing returns to scale at sector level | |||

Each sector will have a decreasing supply curve: the greater its production, the lower the price at which it is prepared to sell. | |||

[[File:économie internationale économies d’échelle externes illustration 1.png|thumb|center]] | [[File:économie internationale économies d’échelle externes illustration 1.png|thumb|center]] | ||

Historical accidents can have important consequences on the comparative advantage of countries in the presence of external economies of scale, | |||

The presence of external economies of scale may justify ad hoc interventions over time. | |||

[[File:économie internationale économies d’échelle externes illustration 2.png|thumb|center]] | [[File:économie internationale économies d’échelle externes illustration 2.png|thumb|center]] | ||

More importantly. Once it produces at <math>P_2</math> the Thai economy can now satisfy the world economy at a <math>P_3</math> price. | |||

Trade restrictions become a means of promoting exports in these models. With gains to trade at the world level (with Swiss producers suffering losses). | |||

This justification for temporary protection of an industry is known as the infant industry argument. | |||

*important | *important in the debate on the role of trade policy in the development process, especially in the case of market failures (imperfection in the financial system, ownership problems - see Chapter 8). | ||

* | *It is difficult to identify concrete cases of successful industrialisation through import substitution, even though this strategy was widespread in the developing countries in the 1970s. | ||

* | *"Trade protection is not enough to develop a comparative advantage and a competitive industry (need to accumulate physical, human capital, etc.)" It is difficult to determine which sectors really need support. | ||

== Extension : | == Extension: The Geographic Economy == | ||

{{Article détaillé| | {{Article détaillé|Economic geography}} | ||

{{Article détaillé| | {{Article détaillé|Trade and geographical advantages}} | ||

Krugman (Nobel 2008) | Krugman (Nobel 2008) explains the processes of spatial agglomeration of the economy and the resulting economic exchanges. | ||

=== | === Agglomeration dynamics === | ||

If firms benefit from internal returns to scale and there are transport costs : | |||

* | *Interest in being close to a large market... | ||

* | *Setting up several companies in the same region | ||

* | *Creating external economies of scale" increases the size of the market (new producers attract new workers and therefore new consumers). | ||

* | *Attracting new producers ... Cumulative process of spatial agglomeration | ||

Cumulative process of spatial agglomeration resulting from the conjunction of internal and external economies of scale | |||

* | *Large regions specializing in industrial goods sectors with increasing returns | ||

* | *Peripheral regions specialize in constant-yield production | ||

* | *New trade flows | ||

In fact, not all activities with increasing returns are systematically concentrated in a single location because there are forces of dispersion (constraints on worker mobility, congestion effect on immobile factors, intensity of competition). | |||

Krugman (1991): | Krugman (1991): Starting from a situation where industrial sectors with increasing returns to scale are evenly distributed across regions/countries, the lowering of barriers to international trade increases the likelihood of a cumulative process of agglomeration. | ||

=== | === Example: European integration === | ||

[[File:économie internationale exemple intégration européenne 1.png|thumb|right]] | [[File:économie internationale exemple intégration européenne 1.png|thumb|right]] | ||

Countries/regions in the centre of Europe attract and specialise (1/7 of the surface area but 1⁄2 of the activity) + peripheral countries/regions less likely to develop dynamic industrial clusters. | |||

Growing inequalities between European regions. | |||

Ambitious regional policy Necessary to counterbalance the mechanisms of agglomeration. | |||

Trade-off between economic efficiency and spatial equity. | |||

= Résumé = | = Résumé = | ||

Version actuelle datée du 6 avril 2020 à 18:43

| Professeur(s) | |

|---|---|

| Cours | International Economy |

Lectures

- Ricardo's model: productivity differences as a determinant of trade

- The Heckscher-Ohlin model: differences in factor endowments as a determinant of trade

- Economies of scale as a determinant of trade: beyond comparative advantage

- Trade policy instruments

- Multilateral trade agreements

- Preferential Trade Agreements

- The Free Trade Challenge

- International Macroeconomics: Issues and Overview

- National Accounts and Balance of Payments

- Exchange rates and the foreign exchange market

- Short-term exchange rates: the asset-based approach

- Long-term exchange rates: the monetary approach

- Domestic product and short-term exchange rates

- Floating exchange rates

- Fixed exchange rates and intervention on the foreign exchange market

The idea is that the internal market of small countries is not sufficient to allow them to develop economies of scale. Trade with the rest of the world gives access to a larger market.

- Creating the European single market

- Canada's entry into NAFTA

But if we have, for example, increasing internal returns to scale:

- Large firms have an advantage over smaller firms and tend to dominate the market = > imperfect competition = >

- Products must be differentiated, otherwise in the long run there would simply be one firm in the market => product variety, and intra-industry trade (rather than inter-industry trade as in the Ricardo or HO models).

When economies of scale are present, the production of a good increases more than proportionally to the quantity of factors employed in that sector.

Internal economies of scale: where the unit cost of production depends on the size of each firm but not necessarily on the size of the sector. (e.g. fixed cost of a machine).

External economies of scale: where the unit cost of production (i.e. the average cost) depends on the size of the industry but not necessarily on the size of the individual firm. (e.g. labour pool, non-exchangeable service, etc.).

There are different implications for market structures.

Modèle de commerce avec économies d’échelle internes[modifier | modifier le wikicode]

Assumptions[modifier | modifier le wikicode]

One product, but a large number of varieties

Firms face internal economies of scale, but competition is monopolistic: firms continue to enter the market until profits are zero.

Heterogeneous consumers and each consumer has a preferred variety.

Two identical countries, but with a different history (therefore different varieties).

Gains from trade (beyond comparative advantage)[modifier | modifier le wikicode]

- Pro-competitive gains

- Economies of scale gains (or rationalization or selection)

- Gains in product variety

Theoretical reminders: Monopoly and monopolistic competition[modifier | modifier le wikicode]

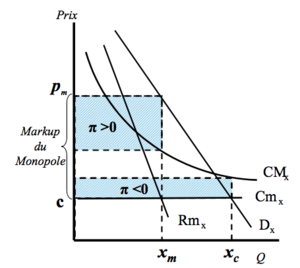

Internal economies of scale are assumed

Representation:

Fixed costs <and constant marginal cost and constant marginal cost.

- Total cost:

- Average cost:

- Marginal cost:

If then => negative profit

Internal economy of scale incompatible with pure competition

Theoretical reminders: Monopoly and monopolistic competition[modifier | modifier le wikicode]

Monopoly[modifier | modifier le wikicode]

One possibility = monopoly

Profit maximization rule: Rmx=Cmx price=pm; quantity=xm, positive profit

Monopolistic competition[modifier | modifier le wikicode]

Another possibility: free entry until D is tangent to CM (i.e. until px=CMx) n1 firms and always px>Cmx

Gaining trade in monopolistic competition[modifier | modifier le wikicode]

Monopolistic competition models are based on two central assumptions :

- Goods are assumed to be differentiated so each firm has a monopoly on its variety.

- Each firm considers the prices of its competitors as given.

Gaining trade in monopolistic competition[modifier | modifier le wikicode]

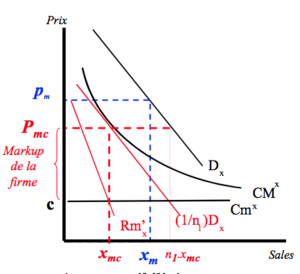

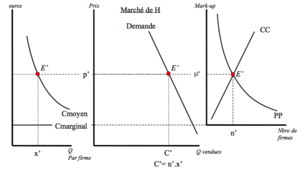

Relationship between price (markup) and number of firms?

- Symmetrical firms (same cost and demand functions) so they choose the same price, the same quantity produced and represent a 1/n fraction of the total production of the sector.

- the size of the market is given, so an increase in the number of firms reduces the output of each firm and thus increases its average cost (CC curve)

- the more firms there are in the sector, the more competition there is and the greater the incentive for firms to reduce their prices (falling markup = PP curve)

Situation initiale[modifier | modifier le wikicode]

Initial situation: Market in autarky with at equilibrium () firms (and therefore varieties) and a price .

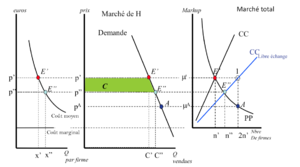

Open for business[modifier | modifier le wikicode]

Merger of 2 identical markets of firms

Gaining trade in monopolistic competition[modifier | modifier le wikicode]

going from (Autarky) to (Free Trade)

Pro-competitive gain

- markup decreases from math>\mu'</math> to math>\mu</math> and therefore the price decreases from math>p'</math> to math>p</math>.

- Well-being gains for +C consumers

Gain in economies of scale (or rationalization or selection)

- Fewer firms operating on the total market (from to ) more production per firm (from to )

- lower average cost

Gain of varieties

- Increase the number of varieties available to the consumer from to .

- Equal gain for producers (more input varieties available => increases their productivity)

Translated with www.DeepL.com/Translator (free version)

Remark[modifier | modifier le wikicode]

Firms disappear when trade is opened up. In this model, as all firms are identical, only chance determines which firms win.

Model with heterogeneous firms: not all firms have the same productivity

Once again, LE has winners and losers: large, highly productive companies win, smaller companies see their market share shrink and disappear.

This type of model also explains why less than 20% of French and American manufacturing companies export, and an even smaller percentage invest abroad.

Empirical evidence?[modifier | modifier le wikicode]

A large part of the trade of OECD countries is intra-industrial (e.g. 40% for the EU). The trade model with economies of scale helps to explain this.

Effect of integration within NAFTA between the US, Canada and Mexico, cf. section 3 chapter 6 in FT (2012) .

Effect of trade integration within the EU-15[modifier | modifier le wikicode]

- Elimination of tariff barriers (UD in 1968) and especially non-tariff barriers (single market - 1992), then single currency....

- defragmentation of the European market from 1992 onwards

- Increased competition

We're getting the effects we expected...

Effect of trade integration within the EU-15 (continued)

Increased competition

- Gain in variety

Mohler and Seitz (2010): substantial gains between 1999-2008 for small countries (e.g. +0.75% of GDP for Denmark, +2.8% for Estonia), small for large countries.

- Pro-competitive gain

Allen et al (1999): The implementation of the Single Market reduced price-cost margins by about 4% on average.

- Gain in economies of scale or rationalisation

- Increased competition

- Pressure on profits

- Economic restructuring

= fewer firms, each of larger size and theoretically more efficient

- European Competition Surveillance Policy

- Change in the number of banks in the Euro Zone

- Mainly due to M&A activity in the euro zone, 77% of which took place within the same country (especially for the largest countries).

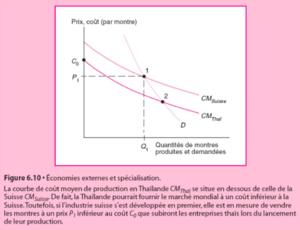

External economies of scale (or historical accidents versus comparative advantage)[modifier | modifier le wikicode]

External economies of scale[modifier | modifier le wikicode]

According to Marshall, there are 3 main reasons for corporate concentrations (i.e. 3 types of externalities):

- Proximity to a large number of specialized suppliers / non-tradable intermediate goods;

- Large pool of labor;

- Knowledge externalities.

Increasing returns to scale at sector level

Each sector will have a decreasing supply curve: the greater its production, the lower the price at which it is prepared to sell.

Historical accidents can have important consequences on the comparative advantage of countries in the presence of external economies of scale,

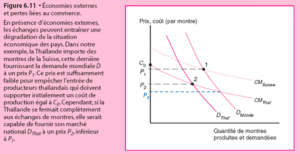

The presence of external economies of scale may justify ad hoc interventions over time.

More importantly. Once it produces at the Thai economy can now satisfy the world economy at a price.

Trade restrictions become a means of promoting exports in these models. With gains to trade at the world level (with Swiss producers suffering losses).

This justification for temporary protection of an industry is known as the infant industry argument.

- important in the debate on the role of trade policy in the development process, especially in the case of market failures (imperfection in the financial system, ownership problems - see Chapter 8).

- It is difficult to identify concrete cases of successful industrialisation through import substitution, even though this strategy was widespread in the developing countries in the 1970s.

- "Trade protection is not enough to develop a comparative advantage and a competitive industry (need to accumulate physical, human capital, etc.)" It is difficult to determine which sectors really need support.

Extension: The Geographic Economy[modifier | modifier le wikicode]

Krugman (Nobel 2008) explains the processes of spatial agglomeration of the economy and the resulting economic exchanges.

Agglomeration dynamics[modifier | modifier le wikicode]

If firms benefit from internal returns to scale and there are transport costs :

- Interest in being close to a large market...

- Setting up several companies in the same region

- Creating external economies of scale" increases the size of the market (new producers attract new workers and therefore new consumers).

- Attracting new producers ... Cumulative process of spatial agglomeration

Cumulative process of spatial agglomeration resulting from the conjunction of internal and external economies of scale

- Large regions specializing in industrial goods sectors with increasing returns

- Peripheral regions specialize in constant-yield production

- New trade flows

In fact, not all activities with increasing returns are systematically concentrated in a single location because there are forces of dispersion (constraints on worker mobility, congestion effect on immobile factors, intensity of competition).

Krugman (1991): Starting from a situation where industrial sectors with increasing returns to scale are evenly distributed across regions/countries, the lowering of barriers to international trade increases the likelihood of a cumulative process of agglomeration.

Example: European integration[modifier | modifier le wikicode]

Countries/regions in the centre of Europe attract and specialise (1/7 of the surface area but 1⁄2 of the activity) + peripheral countries/regions less likely to develop dynamic industrial clusters.

Growing inequalities between European regions.

Ambitious regional policy Necessary to counterbalance the mechanisms of agglomeration.

Trade-off between economic efficiency and spatial equity.

Résumé[modifier | modifier le wikicode]

En présence d’économies d’échelle internes, on aura des produits différenciés et donc de la concurrence imparfaite (on a supposé de la concurrence monopolistique).

Nouveaux gains du commerce:

- Du coté des consommateurs : le commerce international offre simultanément une plus grande variété de biens à des prix plus faibles

- Du coté des producteurs: moins de firmes sur le marché qui produisent chacune une plus grande quantité de bien à coût moyen plus faible

Si les économies d’échelle sont externes à la firme (elles ne peuvent pas être internalisées par la firme), l’avantage comparatif peut refléter des accidents historiques. Ceci peut justifier des interventions de politiques ponctuelles.

L’évidence empirique suggère des gains importants de rationalisation ou sélection ainsi que des gains pro-compétitifs sur des marchés qui s’intègrent (exemple de l’UE) .

Annexes[modifier | modifier le wikicode]

References[modifier | modifier le wikicode]

- ↑ Page personnelle de Federica Sbergami sur le site de l'Université de Genève

- ↑ Page personnelle de Federica Sbergami sur le site de l'Université de Neuchâtel

- ↑ Page personnelle de Federica Sbergami sur Research Gate

- ↑ Céline Carrère - Faculté d'économie et de management - UNIGE

- ↑ Céline Carrère - Google Scholar Citations

- ↑ Director Céline Carrère - Rectorat - UNIGE

- ↑ Céline Carrère | Sciences Po - Le Laboratoire Interdisciplinaire d'Evaluation des Politiques Publiques (LIEPP)

- ↑ Céline Carrere - EconPapers

- ↑ Céline Carrère's research works - ResearchGate