The Free Trade Challenge

| Professeur(s) | |

|---|---|

| Cours | International Economy |

Lectures

- Ricardo's model: productivity differences as a determinant of trade

- The Heckscher-Ohlin model: differences in factor endowments as a determinant of trade

- Economies of scale as a determinant of trade: beyond comparative advantage

- Trade policy instruments

- Multilateral trade agreements

- Preferential Trade Agreements

- The Free Trade Challenge

- International Macroeconomics: Issues and Overview

- National Accounts and Balance of Payments

- Exchange rates and the foreign exchange market

- Short-term exchange rates: the asset-based approach

- Long-term exchange rates: the monetary approach

- Domestic product and short-term exchange rates

- Floating exchange rates

- Fixed exchange rates and intervention on the foreign exchange market

Theoretical Arguments for an Interventionist Trade Policy

The terms of trade argument

Case of a large country (influences world prices for the good in question)

- Introduction of a tariff reduces the world price of imports Improves the terms of trade (see Chapter 5)

- This benefit may outweigh the costs associated with the distortions created by the tax Exists an optimal welfare-maximizing tariff

- Higher national welfare with this optimal rate than with free trade *

- Symmetrical reasoning for exports

- Exists an optimal tax on exports that maximizes the national welfare of a large country - e.g. oil exports.

Limit of the argument:

- Valid only for large countries (US, EU, some countries in a given sector) at the expense of foreign economies.

- Predatory behaviour that interferes with trading partner relationships

- Risk of retaliation

The market failure argument

Ex : Production externalities

- Firms cannot appropriate the benefit of a positive externality (R&D investment) or do not take into account the cost of a negative externality (pollution);

- social cost different from private cost (see Chapter 5).

- National authorities intervene to stimulate production if positive externality (tax on imports) or restrict production if negative externality (tax on exports).

- This social gain may exceed the costs associated with the usual distortions Again, there is an interventionist trade policy that maximizes the welfare of the economy.

- Special case of the second-order optimum = an interventionist policy may be desirable (welfare-enhancing) in the event of market failure.

Limitation of the argument :

- Trade policy is not necessarily the best instrument, better to deal directly with market failures (e.g. subsidy or production tax).

- Difficult to identify market failures and therefore an interventionist policy may aggravate the problem instead of offsetting it.

The tariff makes it possible to reach the social optimum of production at point B, but it introduces a consumer loss. A production subsidy would have allowed to wait for B, and the gain of positive externality for the other producers without introducing a consumer loss. The subsidy is the optimal policy, and the tariff is only a "second best" (second best policy).

But subsidies are politically and administratively costly.

The argument of external economies of scale

Emerging Industry Argument (see Chapter 4)

a PvD with a potential advantage in a manufacturing sector may not be able to compete with older, better-established industries countries, from developed countries

Need for temporary trade protection of the industry concerned until it is productive enough to compete internationally

Historically, most developed countries began their industrialization without customs barriers.

This argument is all the more relevant if there are market failures (imperfection of the financial system, appropriateness problem).

Limit of the argument:

- Requires an initial stock of physical and human capital...

- Be sure there are strong enough economies of scale

Otherwise trade protection will not improve the competitiveness of the industry.

Imperfect Competition and Strategic Trade Policies

The Trade Policy Argument Strategic

Small number of competing firms with market power International competition among these firms to capture as much rent as possible

A government can intervene to change the rules of the game and transfer part of the annuities held by foreign companies to domestic companies (e.g. subsidy).

Example from Boeing and Airbus, Krugman and Obstfeld 2009, pages 275-278

Limit of the argument:

- "Such a policy requires very detailed information, difficult to gather...

- Risk of retaliation, trade war

Globalization in the face of social challenges

Effects of free trade on wages and working conditions

Refers to the principles of comparative advantage (see chapters 2 and 3)

Example of maquiladoras = factories located in Mexico close to the US border following the signing of NAFTA - K&O 2009, pages 282-284

Problem: if wages are low, refers to differences in productivity and if working conditions are poor, is this a deterioration?

Introduction of Social Clauses / Fair Trade

Consumers willing to pay more if they know that the good has been produced in decent conditions / Certification system, e.g. Max Havelaar

Alternative: Explicit inclusion of social clauses in international trade agreements (especially since there is a fear of social dumping)?

Opposition from the developing countries who see this inclusion as a protective instrument for developed countries.[10]

Cultural Diversity

Cultural homogenization

Argument of market failures invoked to justify policies aimed at protéger national cultural specificities (France during UR, 1994)

Commerce et environnement

Toute activité économique, production comme consommation, est souvent source de pollution

Croissance économique, en multipliant les volumes produits et consommés, devrait donc toujours conduire a plus de dommages environnementaux

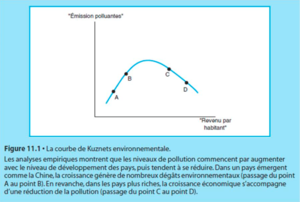

Relation Croissance économique / émissions polluantes pas linéaire

Courbe de Kuznets environnementale

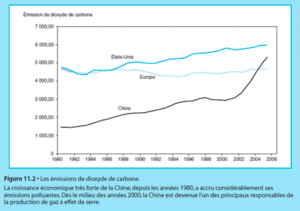

La Chine rattrape les US et l’UE ....

Lien commerce mondial / environnement ?

Coûts de transport (multipliés par la verticalisation du commerce)

Redistribution géographique de l’industrie mondiale

- Havre de pollution: localisation des industries les plus polluantes dans les pays les plus laxistes en termes de normes environnementales - Ex: Alang en Inde

- Quelques exemples existent mais difficile d’établir une généralisation

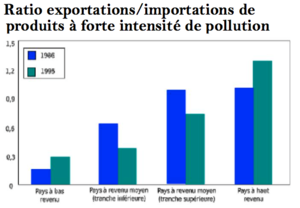

Ex: étude de la Banque mondiale de 1998

Cette étude établit qu’en 1986 les PvD étaient déjà importateurs nets de biens à production polluante, et les pays les plus pauvres étaient relativement les plus faibles exportateurs de produits polluants.

En 1995, cette tendance s'est accentuée : loin d'un dumping environnemental, on constate une concentration supérieure de productions polluantes destinées à l'exportation chez les pays les plus riches.

Redistribution géographique de l’industrie mondiale ?

Conclusions confirmée par d’autres chercheurs tels que Frankel and Rose (2003) ou Antweiler, Copeland and Taylor (2001)

- les pays riches ont des ratios capital/travail élevés, et les industries intensives en capital sont souvent polluantes

- « this factor-based pollution-haven effect dominates the income-based pollution-haven effect”

Cependant pour certains groupe de pays et quelques secteurs particuliers, on peut observer que les nations les plus riches tendent à importer d’avantage et exporter moins de biens dont la production génère beaucoup de pollution (voir survey dans Frankel 2009)

mais phénomène reste limité et différences de normes environnementales n’ont qu’un effet secondaire sur les spécialisation et le commerce

Annexes

References

- ↑ Page personnelle de Federica Sbergami sur le site de l'Université de Genève

- ↑ Page personnelle de Federica Sbergami sur le site de l'Université de Neuchâtel

- ↑ Page personnelle de Federica Sbergami sur Research Gate

- ↑ Céline Carrère - Faculté d'économie et de management - UNIGE

- ↑ Céline Carrère - Google Scholar Citations

- ↑ Director Céline Carrère - Rectorat - UNIGE

- ↑ Céline Carrère | Sciences Po - Le Laboratoire Interdisciplinaire d'Evaluation des Politiques Publiques (LIEPP)

- ↑ Céline Carrere - EconPapers

- ↑ Céline Carrère's research works - ResearchGate

- ↑ http://www.voxeu.org/article/social-dumping-misconceptions