Floating exchange rates

| Professeur(s) | |

|---|---|

| Cours | Economie Internationale |

Lectures

- Le modèle de Ricardo : différences de productivité comme déterminant du commerce

- Le modèle Heckscher-Ohlin : différences de dotations en facteurs de production comme déterminant du commerce

- Les économies d’échelle comme déterminant du commerce : au-delà de l’avantage comparatif

- Instruments de politique commerciale

- Les accords multilatéraux

- Les Accords de commerce préférentiel

- La Contestation du libre-échange

- Macroéconomie Internationale : enjeux et tour d'horizon

- Comptes nationaux et balance des paiements

- Les taux de change et le marché des changes

- Taux de change à court terme : l’approche par les actifs

- Taux de change à long-terme : l’approche monétaire

- Produit intérieur et taux de change à court terme

- Taux de change flottants

- Taux de change fixes et interventions sur le marché des changes

What is the impact of macroeconomic policies (↑ or ↑) under a floating exchange rate regime?

Does a temporary shock () have the same effect on the exchange rate as a permanent shock ()?

Can the evolution of the US current account be explained on the basis of the full model (DD-AA)?

Application of the DD-AA model to analyse the effects of fiscal and monetary policies.

Two possible situations :

- Floating exchange rates (this chapter)

- Fixed exchange rates (next chapter)

We start from a long-term situation where , .

We consider an expansionary shock (↑ of or ). Distinction between:

Temporary shock doesn't change currency expectations (\Delta E^e = 0</math>).

Permanent shock modifies exchange rate expectations (); in this case we also distinguish short-term effects () from long-term effects ().

Floating exchange rates

Most developed countries adopt a floating exchange rate regime = the government does not systematically intervene to try to maintain a parity against a base currency → continuous fluctuations.

Case Swiss franc (CHF) - euro (EUR)

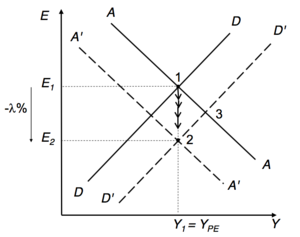

Model DD-AA: Temporary shocks

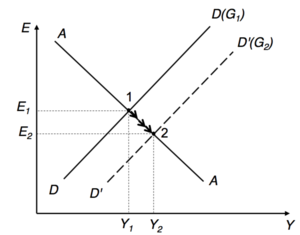

Politique budgétaire expansive

Temporary shocks =>

↗ => DD to the right => given, ED of goods and services => ↗ =>Currency ED => ↗ => ED of national currency => ↘ (ds movement along AA). This until equilibrium is restored in all markets at the point (but with a CA↘ through an appreciation of the national currency).

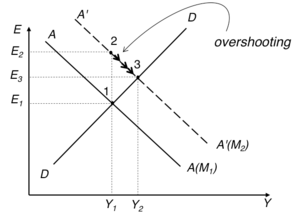

Expansionary monetary policy

Chocs temporaires =>

↗ => AA to the right => to , -> ↘ => -> ↗ = feedback on A’A’ (immediate adaptation), but with CA higher than initially => => ↗ => gradual transition from the point to the point (= partial compensation for the initial depreciation of the national currency).

Finally, at the point the AC improved through the depreciation of the national currency.

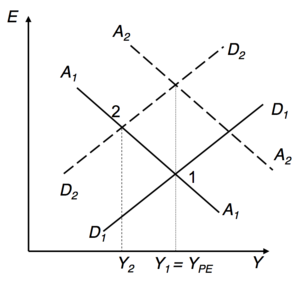

Policy of maintaining full employment

Initially

Temporary negative shock : ⟶ => 1 ⟶ 2 et

How to restore ? Either by:

- Monetary expansion ( ⟶ )

- Fiscal expansion ( ⟶ )

Or: combining monetary and fiscal policy

NB1: Even if the effect of these two interventions on output is identical, monetary policy and fiscal policy are not equivalent in their impact on the exchange rate.

NB2: What interventions can be imagined to counteract the recessionary effect of a temporary increase in the demand for money?

Remarks on stabilization policies

The short-term impact of macroeconomic policies may not occur at the desired time (the problem of timing, which affects fiscal policy more strongly).

Increasing government deficit as a result of an expansive fiscal policy weighs on future generations.

Risk that macroeconomic policy may be recuperated for political purposes (expansive policy just before an election): the anticipation of such behaviour may lead to wage demands and price increases = inflationary bias (self-fulfilling expectations) which led to the independence of many central banks in the 1980s.

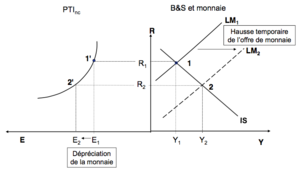

Model DD-AA: permanent shocks

Expansionary fiscal policy

The change in the expected exchange rate is based on the relationship :

As the level of has increased, agents anticipate, in the long term, a real appreciation of % necessary to restore equilibrium in the goods and services market.

Anticipated nominal exchange rate appreciates (same proportion): and the rise in domestic demand (due to ↑) is compensated by a ↓ pf CA.

AA moves downwards by a proportion vertically to full employment income ( by hypothesis): role of anticipations.

Simultaneous changes => one passes immediately from the point to the point .

Nominal appreciation of % (greater than in the case of a temporary expansion: point which maintains the economy at its full employment level.

No impact on national income (not even in the short term). N.B.: Here ( only with monetary shock).

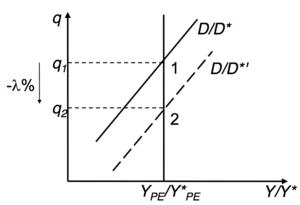

Pexpansive monetary policy

Agents anticipate that, in the long term, an increase in the money supply of % will be reflected in the same proportion on and on : role of expectations.

In the short term:

- ↑ de %, which moves AA upward in the same proportion (vertical to full employment income) -> ( -> ).

- Also, like ↑ => further movement of AA to the right -> ( -> ).

- In : -> ↓ => ↓ ( -> ).

=> impact on (↑) even more pronounced than if the shock is temporary (point ).

Gradual price adjustment

As and has risen, prices gradually increase until the economy returns to full employment () or ().

= DD and AA curves move left until they intersect vertically from (full employment) to the point .

=> No real long-term consequences ( , and all increase in the same proportion):

Exchange rate overshooting

Summary: Floating exchange rates

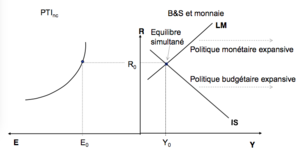

Modèle IS-LM avec changes flottants

Equilibre

NB.: le modèle IS-LM est un modèle de court terme qui n'est pas adapté à capturer les effets de long période d'une politique économique => dans la suite nous allons analyser les seuls impacts de politiques temporaires (cf. FT, ch7).

Choc budgétaire monétaire

Choc budgétaire temporaire

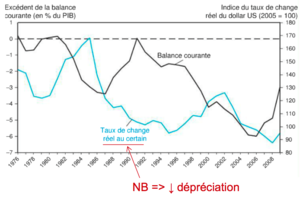

Etude de cas: le compte courant des États-Unis

Compte courant des EU 1976-2004

Sur l'ensemble de la période, on constate que le taux de change réel et le solde de la balance courante US semblent suivre une évolution cyclique = le dollar s'apprécie réellement avant 1985 et avant 2002 (NB: dans ce graphique une hausse du taux de change réel indique une appréciation réelle du dollar), alors que CA suit l'évolution inverse.

Est-ce que le modèle DD-AA (KO, ch.17) peut expliquer ces évolutions ?

Explanation

DD-AA model and expansive fiscal policy: as just seen above, under the DD-AA model an expansive fiscal policy leads to a real appreciation of the national currency and a current account deficit. This works well with the early 1980s and early 2000s: the two governments involved (Reagan or Bush junior) both reduced taxes and increased military spending.

What causes the pendulum to swing back?

Suggested KO: wealth effect (not formally incorporated in the DD-AA model) = as the current account deficit widens, the wealth of residents falls relative to that of non-residents (see chapter 10). Since there is a national preference, this should lead to a decline in the relative demand for domestic products, and thus to a real depreciation of the national currency. If the latter is correctly anticipated by agents, this immediately generates a depreciation of the national currency, which gradually corrects the current account deficit.

Puzzles

1. As soon as it noticed a fall in industrial production following the crisis caused by the 2000-2001 financial bubble (new technologies), the FED lowered interest rates to mitigate the effects of the recession = expansive monetary policy, which should have led, according to our DD-AA approach, to a depreciation of the dollar. However, the USD continued to appreciate until 2002. Why did it do so? Possible explanation: anticipation of future appreciation of the US currency based on two elements:

- Bush, narrowly elected, announces tax cuts = expansive fiscal policy.

- The 9/11 attacks would certainly call for an expansive fiscal policy.

2. From 2002 onwards the US dollar started to depreciate considerably. In spite of this, the trade balance continues to remain heavily in deficit and there is no evidence of improvement. Why?

Possible explanation: US domestic consumption too high and savings too low in relation to investments → strong international imbalances (see end of chapter 10).

Conclusion: One must remain cautious in the analysis. There are enough exogenous variables in the model to make it consistent with virtually all macroeconomic developments!

Annexes

References

- ↑ Page personnelle de Federica Sbergami sur le site de l'Université de Genève

- ↑ Page personnelle de Federica Sbergami sur le site de l'Université de Neuchâtel

- ↑ Page personnelle de Federica Sbergami sur Research Gate

- ↑ Céline Carrère - Faculté d'économie et de management - UNIGE

- ↑ Céline Carrère - Google Scholar Citations

- ↑ Director Céline Carrère - Rectorat - UNIGE

- ↑ Céline Carrère | Sciences Po - Le Laboratoire Interdisciplinaire d'Evaluation des Politiques Publiques (LIEPP)

- ↑ Céline Carrere - EconPapers

- ↑ Céline Carrère's research works - ResearchGate

- ↑ http://fx.sauder.ubc.ca/data.html