Consumer Price Index (CPI)

| Professeur(s) | |

|---|---|

| Cours | Introduction à la macroéconomie |

Lectures

- Aspects introductifs de la macroéconomie

- Le Produit Intérieur Brut (PIB)

- L'indice des prix à la consommation (IPC)

- Production et croissance économique

- Chômage

- Marché financier

- Le système monétaire

- Croissance monétaire et inflation

- La macroéconomie ouverte : concepts de base

- La macroéconomie ouverte: le taux de change

- Equilibre en économie ouverte

- L'approche keynésienne et le modèle IS-LM

- Demande et offre agrégée

- L'impact des politiques monétaires et fiscales

- Trade-off entre inflation et chômage

- La réaction à la crise financière de 2008 et la coopération internationale

In this chapter we focus on how to measure the cost of living, and its evolution. This will be useful to compare the purchasing power of different incomes at different points in time. For example, a salary of 200 can buy more than a salary of 2000 if the cost of living in the first case is more than 10 times lower than in the second case.

The consumer price index allows us to measure changes in the cost of living. It is a measure of the evolution of the general price level faced by the consumer, and therefore of inflation, i.e. the percentage change in the price level from one period to the next).

Construction and CPI issues

Definition and construction of the CPI

The CPI is the measure of the cost of the basket of goods and services purchased by the 'typical consumer'. It tells us the evolution of its cost of living. If the CPI increases, the typical consumer will have to spend more money to consume the same basket of goods and services, and therefore his cost of living will have increased.

Construction of the CPI and the inflation rate :

- the basket of the typical consumer is defined and fixed by conducting consumption surveys to determine the weight given to each good in the total expenditure ;

- price surveys are conducted at regular intervals;

- the value of the basket is calculated at different points in time based on the prices collected;

- a base year is chosen and the value of the index is calculated in each year by taking the ratio of the cost of the basket to the base year and multiplying it by 100;

- the percentage inflation rate is given by the annual change in the CPI: .

Construction of the CPI: example

1. We define the basket of goods purchased by a typical consumer:

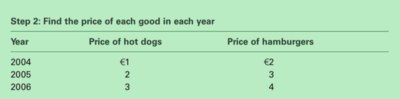

2. We do price surveys every year:

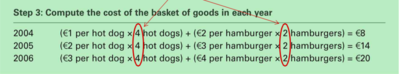

3. The cost of the (fixed) basket is calculated each year :

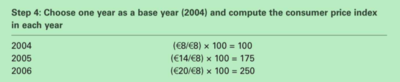

4. A base year is chosen for the index and the CPI is calculated:

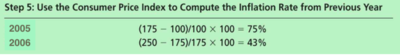

5. The CPI is used to calculate the annual inflation rate :

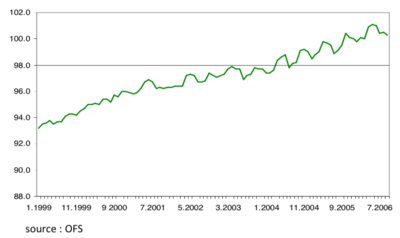

Development of the Swiss CPI

Problems with the CPI

The CPI is not a perfect measure of the cost of living. There are several reasons for this:

- substitution bias: price changes will affect the composition of the typical consumer's basket. The index overestimates the increase in the cost of living by not taking into account the ability of consumers to substitute goods.

- introduction of new goods: this gives more choice to consumers who can substitute the consumption of certain goods with new goods, thus reducing their cost of living (downloading films from the internet is not part of the CPI, but the cinema ticket is). The increase in the cost of living is again overestimated.

- Improved quality of goods: for the same price, the consumer can buy goods that give him greater satisfaction or that perform better. The CPI overestimates the increase in the cost of living by ignoring quality.

- It is not a "true" cost-of-living index: it does not take into account health insurance premiums, taxes, social security contributions, etc. It is not a "real" cost-of-living index. It does not take into account health insurance premiums, taxes, social security contributions, etc. (only consumer goods and services are considered).

- Heterogeneity of consumption baskets: young versus old, poor versus rich, etc. The average consumption basket does not really exist → limits of the average basket if the composition of society changes or the prices of the goods consumed by each group do not evolve in the same way → comparisons between difficult people (and even more so between countries!).

CPI versus GDP deflator

The GDP deflator was given by : GDP deflator =

Differences from the CPI

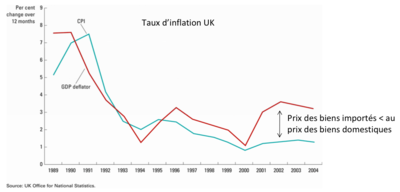

- The CPI focuses on the price evolution of goods consumed in the economy, while the GDP deflator focuses on the price evolution of goods produced in the domestic economy: the price of imported goods is included in the former but not in the latter.

- The CPI compares the evolution of the cost of a basket of goods that is fixed, while the GDP deflator looks at the evolution of the price of commonly produced goods in relation to the price of goods produced the previous year. (Paasche index versus Laspeyres index)

Indice de Paasche et Laspeyres

The GDP deflator is a "Paasche index":

- GDP deflator =

in the case of hot dogs and hamburgers =

The consumer price index is a "'Laspeyres index'":

in the case of hot dogs and hamburgers =

CPI versus GDP deflator

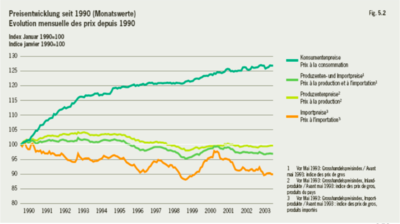

Two other alternative measures of price changes are the Producer Price Index (PPI), which measures changes in the cost of a (fixed) basket of goods and services purchased by producers (this is used to predict changes in the CPI), and the Import Price Index (IPI).

Changes in the main price indices since 1990

Correction of macroeconomic variables for inflation

Inflation correction

To be able to compare the purchasing power of a certain income in different years, the (nominal) value of this income must be corrected by the evolution of the cost of living. Ex: .

Example 1 :

- George Washington's income in 1789 was USD 25,000.

- George Bush's income in 2007 was USD 450'000.

- The consumer price index with base 100 in 1789 is 2000 in 2007.

Which of the two George's has a higher real income (higher purchasing power)? .

Eexample 2 :

- LeBron James' salary in 2003 (his first year in the NBA) is $4 million.

- Michael Jordan's salary in 1984 (his first year in the NBA) is $550,000.

- CPI in 2003 with base 100 in 1984 is $200.

James has a real salary almost 4 times higher than Jordan's in his first year of the NBA.

The base year

Price indices are generally set arbitrarily at 100 for a reference period: beware of comparisons!

If one index is 174 and another is 130, it is necessary to have the same base year (or index year or "year 100") in order to know which one has moved the fastest.

For example:

- and (1993 = 100)

Inflation rate (between 1995 and 1997) = Or more simply, by approximation:

- Inflation rate (between 1995 and 1997) =

(approximation valid only for small variations, i.e. < 10%)

Inflation and deflation

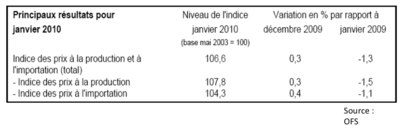

It can be seen that inflation is low between January 2010 and December 2009 and that there is deflation between January 2009 and January 2010.

Importance de mesurer correctement l’IPC

L'IPC est utilisé continuellement dans la vie politique et économique des pays et les autorités de politique économique ainsi que les individus se basent sur l'observation de l'ICP pour prendre leur décisions.

En « révisant » l’IPC a la baisse (cf. les biais qu’on a vu plus tôt), le gouvernement peut montrer une augmentation du salaire réel plus importante que l’augmentation effective et justifier les politiques économiques existantes. La politique monétaire adoptée par la Banque Centrale est choisie, entre outre, sur la base de l'évolution de l'IPC.

L’IPC est utilisé pour indexer certains contrats, comme les retraites, les salaires, la régulation des prix de l’électricité, etc.

Pour évaluer la rentabilité d’un investissement il nous faut une mesure de l’évolution du coût de la vie :

- Taux d’intérêt réel = taux d’intérêt nominal – taux d’inflation

Taux d’intérêt nominal et réel

Résumé

L’IPC montre le coût d’un panier de bien et services dans une année donnée par rapport au coût du même panier dans une année de base. Le changement en pourcentage de l’IPC nous donne le taux d’inflation.

L’IPC est une mesure imparfaite du cout de la vie pour quatre raisons :

- biais de substitution ;

- l’importance de nouveaux biens ;

- les changements pas mesurable de la qualité des biens ;

- hétérogénéité des paniers de consommation des différents individus.

Le déflateur du PIB diffère du IPC sur deux aspects :

- L’IPC se concentre sur un panier de consommation type et le déflateur sur les biens produits dans l’économie ;

- L’IPC utilise un panier fixe de biens et services alors que le déflateur du PIB ajuste la composition du panier de façon à refléter la structure de production chaque année.

Des variables monétaires mesurées dans différents moments dans le temps doivent être ajustées par leur pouvoir d’achat (IPC) afin d’être comparées. Pour pouvoir dire quelque chose sur l’évolution du pouvoir d’achat des individus dans le temps il faut mesurer correctement l’IPC.

L’IPC est utilisé pour fixer des salaires, des retraites, le prix de certain bien sous régulation publique.

Le taux d’intérêt réel est ce qui détermine la décision d’investir et il est donné par le taux d’intérêt nominal moins le taux d’inflation.

Annexes

- Insee: Qu'est ce que l’indice des prix à la consommation ?

- Insee: Indices pour les revalorisations de pensions alimentaires (Série France entière - hors tabac)

- Insee: Indice des prix à la consommation y compris tabac (Série France entière)

- Insee: Simuler un indice des prix personnalisé

- Diewert, 1993. "The early history of price index research". Chapter 2 of Essays in Index Number Theory, Volume I, W. E. Diewert and A. O. Nakamura, editors. Elsevier Science Publishers, B.V. doi:10.3386/w2713

- "CONSUMER PRICE INDEX". OECD.

- "Prices & Inflation". U.S. Bureau of Economic Analysis (BEA).

- "Consumer Price Index". U.S. Bureau of Labor Statistics.

- "The Consumer Price Index" (PDF). U.S. Bureau of Labor Statistics.

- "Consumer Price Index Frequently Asked Questions". U.S. Bureau of Labor Statistics.

- "Inflation (Consumer Price Index)". OECD.

- "Frequently Asked Questions about the Chained Consumer Price Index for All Urban Consumers (C-CPI-U)". Consumer Price Index. Bureau of Labor Statistics.

- Robert, Reich (April 4, 2013). "What's the 'Chained CPI,' Why It's Bad for Social Security and Why the White House Shouldn't Be Touting It (VIDEO)".

- "Consumer Price Index Data from 1913 to 2019". Consumer Price Index (CPI) Databases. United States Department of Labor.

- Losey, Stephen (31 December 2012). "Chained CPI proposal off table for now, lawmakers say". Federal Times.

- "The Fed - What is inflation and how does the Federal Reserve evaluate changes in the rate of inflation?".

- | Consumer Price Index Data

- Issues of the Consumer Price Index report from the BLS for 1953–present

- ILO CPI manual – This large manual produced co-operatively by a number of international organizations is the standard work on the methods of compiling consumer price indices and on the underlying economic and statistical theory.

- BLS rebuttal to SGS CPI calculation criticisms

- Boskin, Michael J., Ellen L. Dulberger, Robert J. Gordon, Zvi Griliches, and Dale W. Jorgenson. 1998. "Consumer Prices, the Consumer Price Index, and the Cost of Living." Journal of Economic Perspectives, 12 (1): 3-26.

- Economic Review of the Federal Reserve, Bank of Cleveland, vol. 29, no. 4 1993, Quarter 4, p. 15-24

- Matthew D. Shapiro and David W. Wilcox, "Mismeasurement in the Consumer Price Index: An Evaluation," NBER Macroeconomics Annual 11 (1996): 93-142.

- Hausman, Jerry. 2003. "Sources of Bias and Solutions to Bias in the Consumer Price Index ." Journal of Economic Perspectives, 17 (1): 23-44.

- Moulton, Brent R. 1996. "Bias in the Consumer Price Index: What Is the Evidence?" Journal of Economic Perspectives, 10 (4): 159-177.

- Lebow, David, E., and Jeremy B. Rudd. 2003. "Measurement Error in the Consumer Price Index: Where Do We Stand? ." Journal of Economic Literature, 41 (1): 159-201.

- Abraham, Katharine G., John S. Greenlees, and Brent R. Moulton. 1998. "Working to Improve the Consumer Price Index." Journal of Economic Perspectives, 12 (1): 27-36.

- Moulton, Brent R., et al. “Addressing the Quality Change Issue in the Consumer Price Index.” Brookings Papers on Economic Activity, vol. 1997, no. 1, 1997, pp. 305–366. JSTOR, https://www.jstor.org/stable/2534705.

References

- ↑ Page personnelle de Federica Sbergami sur le site de l'Université de Genève

- ↑ Page personnelle de Federica Sbergami sur le site de l'Université de Neuchâtel

- ↑ Page personnelle de Federica Sbergami sur Research Gate

- ↑ Researchgate.net - Nicolas Maystre

- ↑ Google Scholar - Nicolas Maystre

- ↑ VOX, CEPR Policy Portal - Nicolas Maystre

- ↑ Nicolas Maystre's webpage

- ↑ Cairn.ingo - Nicolas Maystre

- ↑ Linkedin - Nicolas Maystre

- ↑ Academia.edu - Nicolas Maystre