« Trade and the World Economy: 1974 - 2000 » : différence entre les versions

(Page créée avec « = Crise actuelle = La crise actuelle de l’euro aurait-elle de fortes ressemblances avec la crise des années 1920 et 1930 ? Si on regarde l’histoire, on voit des dange... ») |

Aucun résumé des modifications |

||

| (6 versions intermédiaires par le même utilisateur non affichées) | |||

| Ligne 1 : | Ligne 1 : | ||

= | {{Infobox Lecture | ||

|image= | |||

|image_caption= | |||

| cours = [[International Economic History]] | |||

| faculté = | |||

| département = | |||

| professeurs = [[Mary O'Sullivan]]<ref>https://www.unige.ch/sciences-societe/dehes/membres/mary-osullivan/</ref><ref>https://www.researchgate.net/profile/Mary_Osullivan14</ref><ref>http://www.levyinstitute.org/scholars/mary-osullivan</ref> | |||

| enregistrement = | |||

| lectures = | |||

*[[Introductory aspects of the International Economic History Course]] | |||

*[[Introduction to the International Economic History Course]] | |||

*[[Between Free Trade and Protectionism: 1846 - 1914]] | |||

*[[International triumph of the gold standard: 1871 - 1914]] | |||

*[[International Finance and Investment: 1860 - 1914]] | |||

*[[New Challenges in International Trade: 1914 - 1929]] | |||

*[[New monetary and financial order: 1914 - 1929]] | |||

*[[Dark history for the world economy: 1930 - 1945]] | |||

*[[Crises and regulations: 1930 - 1945]] | |||

*[[Divided trade policies: 1946 - 1973]] | |||

*[[Bretton Woods System: 1944 - 1973]] | |||

*[[Money, Finance and the World Economy: 1974 - 2000]] | |||

*[[Trade and the World Economy: 1974 - 2000]] | |||

}} | |||

{{Translations | |||

| fr = Commerce et l'économie mondiale : 1974 – 2000 | |||

| es = El comercio y la economía mundial: 1974 - 2000 | |||

| it = Commercio ed economia mondiale: 1974 - 2000 | |||

}} | |||

<gallery mode=packed heights=200px> | = Current crisis = | ||

Is the current euro crisis very similar to the crisis of the 1920s and 1930s? If we look at history, we see dangers in the decisions currently being taken within the eurozone. Long before the current crisis, a change in the possibility of major crises in the global economy is beginning to be detected. This is a trend related to the systemic independence of the world's financial systems. When financial and monetary crises are in developing countries, proponents of global financial integration interpret these crises as localized problems that can be solved with local solutions imposed by the IMF with the support of creditor countries. | |||

The current crisis is different because when we look at this crisis, we are not talking about a peripheral crisis. The origins of the current crisis lie at the centre of the global economy in developed countries, including the United States. It is a crisis that begins with the problem of subprime markets in the United States in the summer of 2007 that turns into a banking crisis and a general financial crisis with the bankruptcy of Lehman Brother in late 2008. The crisis is spreading to other developed countries, particularly in Europe. We see huge rescue plans in several countries to stop the financial crisis, as in the United Kingdom and Ireland, with serious consequences for the government's budget and debt levels. In 2009, the crisis turned into a phenomenal debt crisis with Greece, but also Portugal, Spain, Ireland and Italy. Demordais, we can talk about a real crisis in the euro zone. It is a deep crisis and the deepest since the Great Depression causing the fall of the world country. This is why specialists tend to compare the current crisis to the crisis of the 1930s.<gallery mode="packed" heights="200px"> | |||

Fichier:Figure 1. World industrial production, now vs then.png|Figure 1. World industrial production, now vs then. | Fichier:Figure 1. World industrial production, now vs then.png|Figure 1. World industrial production, now vs then. | ||

Fichier:Figure 2. Volume of world trade, now vs then.png|Figure 2. Volume of world trade, now vs then. | Fichier:Figure 2. Volume of world trade, now vs then.png|Figure 2. Volume of world trade, now vs then. | ||

</gallery> | </gallery> | ||

At the beginning of the crisis, in terms of the brutality of the fall, there are resonances, we see a significant drop in international trade, but then we see a very important difference. Global economic recovery today is much faster than in the 1930s. That is why we are talking about the Great Recession versus the Great Depression. At first, it sounds like such a deep crisis, but we are seeing an economic recovery that we did not see during the 1930s. Yet this is sufficient as a crisis to provoke strong criticism because proponents of globalization who have always extolled the benefits of global financial integration for a better allocation of capital. | |||

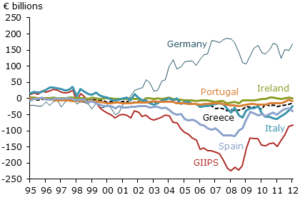

[[Image:Soldes courants pays de la zone €.png|thumb|300px| | Today, it is difficult to deny that there are only benefits, but that there are costs as well. Financial interdependence creates greater vulnerability to financial crises. Paul Walker questions the benefits of financial globalization. There is a strong debate about the advantages and disadvantages of global financial integration. Economists note that capital flows have financed productive investments in order to promote economic growth, but also to fuel financial speculation and especially real estate speculation in some countries. Some specialists note that it is because of globalization that there are huge imbalances between countries that are at the origin of the current crisis.[[Image:Soldes courants pays de la zone €.png|thumb|300px|Current country balances of the zone €.]] | ||

In the euro zone, international capital flows have allowed Ireland, Spain and Greece to live beyond their means. There are differences in external positions between countries. There are current account deficits in the GIIPS balance of payments that are extraordinary and financed by something. The financing comes from Germany with a large surplus on the current account so that Germany can finance the GIIPS deficits. | |||

[[Image:Soldes du compte financier pays de la zone €.png|thumb|300px|left| | [[Image:Soldes du compte financier pays de la zone €.png|thumb|300px|left|Financial account balances for countries in the € zone.]] | ||

For the GIIPS countries, we see an increase in external debt making them unable to pay deficits on current accounts. | |||

[[Image:Global Current Account imbalances, 1990 - 2012.png|thumb|300px| ]] | [[Image:Global Current Account imbalances, 1990 - 2012.png|thumb|300px| ]] | ||

At the global level, we see the same phenomenon. The United States and Great Britain are in opposition to Asian countries. This time, it is the United States that is able to spend beyond its means thanks to the possibility of borrowing abroad, particularly in China. Proponents of financial globalization still extol the benefits of the financial globalization process for the allocation of capital from rich countries that are supposed to have an excess of financial resources to developing countries with a strong need for these resources to finance their productive capital. The global financial system has facilitated the transfer of huge flows from developing countries like China to developed countries like the United States. It is questionable whether financial integration has destabilized the global economy, explaining the current crisis trend. | |||

<gallery mode=packed heights=100px> | <gallery mode="packed" heights="100px"> | ||

Fichier:Balance des paiements des | Fichier:Balance des paiements des Etats-Unis 2007, mia USD.png|US balance of payments 2007, USD bn. | ||

Fichier:Balance des paiements des | Fichier:Balance des paiements des Etats-Unis 2007, mia USD v2.png|US balance of payments 2007, USD bn. | ||

</gallery> | </gallery> | ||

There is a current account deficit offset by capital flows from smaller countries. The current account balance is negative more important than they export. This reflects a significant evolution in world trade since the 1970s. It is possible to see a second globalization that began during the 1980s and 1990s, encompassing not only the rich countries, but also the developing countries. Until 1973, there were very few developing countries that were permanently opening up to the world economy. | |||

= A real return to globalisation = | |||

[[Image:Tarifs_douaniers-_produits_manufacturés.png|thumb|300px|Tariffs: manufactured goods.]] | |||

[ | For rich countries, the trend continues with a decline in tariffs until recently contributing to the argument proposed byFindlay et O’Rourke {{citation|Thirty-five years after the end of World War II, the overall picture as regards world trade liberalization was disappointing. According to Sachs and Warner (1995), only around a quarter of the world's population lived in open economies... It was only in the 1980s, and especially the 1990s, that [...] reglobalization ...would really begin }}. It was during the 1980s and 1990s that globalization returned, not only because it involved rich countries, but also developing countries. There was a strengthening of European integration with the Single European Act in 1986 in order to reduce the obstacles to the integration of their market. | ||

[[Image:Exportations de marchandises % de PIB.png|thumb|300px|left|Merchandise exports % of GDP.]] | |||

There is a very important role for negotiations that includes a very large number of countries in the GATT negotiations. With the opening of the communist group countries, there is a possibility of extending these agreements to the new countries, but there are also demands from the IMF and the World Bank for the developing economies to be opened up. Under the GATT, we see a series of negotiations starting with the Kennedy Round in 1964 and 1967, then the Tokyo Round between 1973 and 1979 and finally the Uruguay Round between 186 and 1994. The number of countries concerned is also increasing. In the Uruguay Round, there are 125 participants. | |||

There is an effort to include agriculture in these negotiations, but it is a difficult subject because for rich countries it is often a very protected sector, as in Japan, Switzerland or the European Union, or even in the United States because it is considered to be a different sector, but above all part of a country's sovereignty. There are obstacles to liberalizing these sectors, but often, for developing countries, this is the main sector of their economy. For developing countries, it is a test of their international openness. Developing countries expect something from GATT to show their will. We see some progress up to the Uruguay round of negotiations and we also see the creation in 1995 of the World Trade Organization, which replaced the GATT. There is an international organization that takes responsibility for international negotiations around international trade. | |||

[[Image:Pavia, 2005, Assessing Protectionism and Subsidies in Agriculture.png|thumb|300px|Source: Pavia, 2005, Assessing Protectionism and Subsidies in Agriculture]] | Despite certain problems, the ambition to go further appears to be limits to globalisation and liberalisation. When we look at the average tariffs, they remain higher in 2000 than during the Second World War. Despite efforts to negotiate reductions in protection for the agricultural sector, this remains a very difficult point to negotiate. The agricultural sector is not sufficiently integrated into international agreements. In fact, the goal of the Doha Round, which began in 2001 but failed in 2006, was to open developing countries' access to the developed countries' markets. There is a blockage on several points where agriculture is the most important. The Bali package is an effort to relaunch negotiations with the will of the important countries to relaunch discussions on agriculture and its protection. This is the first international agreement negotiated since the creation of the WTO. The Bali package is above all a declaration to get involved in development.[[Image:Pavia, 2005, Assessing Protectionism and Subsidies in Agriculture.png|thumb|300px|Source: Pavia, 2005, Assessing Protectionism and Subsidies in Agriculture]] | ||

This reflects the fact that there are significant barriers to international trade in agriculture, for example in the industrial sector. There are still other trade barriers other than tariffs such as quotas or rules. | |||

= | = End of the great divergence = | ||

The question is whether we see the end of the great divergence. If we look at the long-term figures, we see that the share of developing countries in industrial production increased between 20% and 30% in the 1980s. So far, there is a tendency to say that developing countries export raw materials, agriculture, but not industrialization and industrial exports. This is the idea of a great divergence creating a place for developing countries and another place for industrialized countries. This tendency leads us to wonder whether this divergence is coming to an end and whether it is now impossible for developing countries to compete even at world level. | |||

[[Image:Part des pays en voie de développement dans la production industrielle mondiale.png|thumb|300px| | [[Image:Part des pays en voie de développement dans la production industrielle mondiale.png|thumb|300px|Share of developing countries in world industrial production.]] | ||

There is no general trend for developing countries. For example, for Latin America, there is no change, but for Asia and China, there is a change, just as for Brazil to a lesser extent. There is an insertion of developing countries that is new explaining their possibility of having a very large current account balance on their balance of payments. China plays the role of a banker for the United States, but we must not exaggerate the consequences of recent decades in terms of liberalizing international trade, because if we do not see any change for most countries in Africa and for developing countries. | |||

We cannot see a radical change, but there are some developing countries competing in global markets. China and other Asian countries are important enough to change the screwing of the global economy. This explains the possibility of global imbalances.[[Image:Global Current Account imbalances, 1990 - 2012.png|thumb|300px| ]] | |||

The two trends are the possibility of having a current account deficit for the United States and the possibility of having a surplus on China's current account. When we look at the balance of payments of the United States, there is the deficit on the current account, but there is also the counterpart. | |||

[[Image:Balance des paiements des Etats-Unis 2007, mia USD v3.png|thumb|300px|left|US balance of payments 2007, USD bn.]] | |||

We see that any current account deficit must be matched by a net inflow of capital, which is financial flows. It is necessary to be able to compensate the deficit on the current account with the sale of assets to foreigners. Other countries in the world must be convinced to finance the current account deficit. The rest of the world is financing the growing deficits of the United States creating a certain irony within globalization because normally we expect flows that go in another direction, but we see the opposite here. There is an exorbitant privilege that lasts for the United States. | |||

The question is, whose fault is it? Americans are not able to control themselves, but we can also wonder if the Chinese consume too little? That is, the fact that there is no policy in China that tries to promote domestic consumption and makes the Chinese economy too dependent on the outside world to sell its products. It is not clear that either argument is entirely valid. This raises the old Keynes question of who is responsible for global imbalances.[[Image:share of global foreign-exchange transactions involving the dollar.jpg|thumb|300px| ]] | |||

In the Bretton Woods agreements, privileges were enshrined in the texts, but now there is a flexible exchange rate at world level. There is something paradoxical about this because it is not what we expect. The value of the dollar remains high. So, normally, what is expected is a country with a current account deficit that has grown leading to a devaluation of its currency highlighting that this is not sustainable. We should see a devaluation against this trend in the real economy, but we do not see this trend for the dollar. Over the long term, the dollar holds its value, but it continues to play a very important role as an official reserve. It is not only to keep its value, but also to keep its role within the international monetary system. It is this role that supports the value of the dollar because there is always a demand from the dollar to play this role. That is why China is ready to keep the dollar, but given the international system's dependence on the dollar, it is starting to frighten people and especially the Chinese. However, there are constraints because we can ask whether we can expect the end of the dollar's reign. | |||

{{citation bloc|The dollar is about to have real rivals in the international sphere for the first time in 50 years... Americans especially tend to discount the staying power of the euro, but it isn't going anywhere. Contrary to some predictions, European governments have not abandoned it. Nor will they. They will proceed with long-term deficit reduction, something about which they have shown more resolve than the U.S. And they will issue “e-bonds”—bonds backed by the full faith and credit of euro-area governments as a group—as a step in solving their crisis. This will lay the groundwork for the kind of integrated European bond market needed to create an alternative to U.S. Treasurys as a form in which to hold central-bank reserves ».|Barry Eichengreen, "Why the Dollar's Reign is Near an End," Wall Street Journal, March 1, 2011.}} | {{citation bloc|The dollar is about to have real rivals in the international sphere for the first time in 50 years... Americans especially tend to discount the staying power of the euro, but it isn't going anywhere. Contrary to some predictions, European governments have not abandoned it. Nor will they. They will proceed with long-term deficit reduction, something about which they have shown more resolve than the U.S. And they will issue “e-bonds”—bonds backed by the full faith and credit of euro-area governments as a group—as a step in solving their crisis. This will lay the groundwork for the kind of integrated European bond market needed to create an alternative to U.S. Treasurys as a form in which to hold central-bank reserves ».|Barry Eichengreen, "Why the Dollar's Reign is Near an End," Wall Street Journal, March 1, 2011.}} | ||

Alternatives must be found to replace the dollar as the official reserve currency. Nevertheless, one may wonder which replacement to find. It is not clear that the time has come for the euro to take on the task of being the world's main official reserve currency. There is a very strong dependence on the dollar, but there is no very obvious alternative. As for the Chinese currency, there are too many important restrictions to play the role of a reserve value. | |||

Normally, in a flexible exchange rate system, flexibility is sought to address structural imbalances in the balance of payments. Prices change, do not adjust sufficiently to solve the problem of imbalances. The exchange rate is not flexible enough. We arrive at about the same problem as for the fixed exchange rate system, which are major structural imbalances. | |||

[[Image:Dette gouvernmentale (% PIB).png|thumb|300px|left| | If one asks about the relationship to recent experience with fixed exchange rates, there is no obvious answer. The euro is a completely fixed exchange rate system with no possibility of adjustment. The current eurozone problem shows that the fixed exchange rate regime is not a panacea either. Miller and Skidelsky talk about the "golden handcuffs" of the euro. With the euro system, we have gone further than the Bretton Woods system with the possibility of currency adjustments. These authors highlight the fact that we risk making the same mistakes made with the gold standard. We are once again creating "golden handcuffs" that we have already had. The "golden handcuffs" lead to deflation as a tool to solve the problems of the euro area. This was the orthodoxy of the late 1920s and early 1930s to emerge from the public spending crisis in Europe. The prescription is to reduce public spending to get out of the crisis, claiming that the problem is basically a budget problem, and we must reduce public spending to solve the crisis. That is the only thing that can be done in a system like the euro because there is no possibility of devaluation.[[Image:Dette gouvernmentale (% PIB).png|thumb|300px|left|Government debt (% GDP).]] | ||

Greece stands out for its high level of deficit and consequently its public debt where public spending is not under control. Ireland until 2007 had much lower sovereign debt than Germany. The change, the net increase and the explosion of Irish debt is explained by the government's commitment to relieve Irish banks of toxic products. It is not clear that the correct answer is to reduce Ireland's public spending. The question is who should take responsibility for the adjustment that needs to be made within the euro area. This must be Ireland by reducing public spending or Germany by reducing its debt level. The old question of who is responsible for structural imbalances appears. | |||

[[Image:Soldes courants pays de la zone €.png|thumb|300px| ]] | [[Image:Soldes courants pays de la zone €.png|thumb|300px| ]] | ||

There is an aspect closely linked to the Keynes question that arises, both for the current flexible exchange rate system at world level and for the fixed exchange rate system of the euro area. | |||

= Annexes = | = Annexes = | ||

= References = | = References = | ||

<references/> | <references /> | ||

[[Category:Mary O'Sullivan]] | [[Category:Mary O'Sullivan]] | ||

Version actuelle datée du 13 février 2021 à 23:21

| Professeur(s) | Mary O'Sullivan[1][2][3] |

|---|---|

| Cours | International Economic History |

Lectures

- Introductory aspects of the International Economic History Course

- Introduction to the International Economic History Course

- Between Free Trade and Protectionism: 1846 - 1914

- International triumph of the gold standard: 1871 - 1914

- International Finance and Investment: 1860 - 1914

- New Challenges in International Trade: 1914 - 1929

- New monetary and financial order: 1914 - 1929

- Dark history for the world economy: 1930 - 1945

- Crises and regulations: 1930 - 1945

- Divided trade policies: 1946 - 1973

- Bretton Woods System: 1944 - 1973

- Money, Finance and the World Economy: 1974 - 2000

- Trade and the World Economy: 1974 - 2000

Current crisis[modifier | modifier le wikicode]

Is the current euro crisis very similar to the crisis of the 1920s and 1930s? If we look at history, we see dangers in the decisions currently being taken within the eurozone. Long before the current crisis, a change in the possibility of major crises in the global economy is beginning to be detected. This is a trend related to the systemic independence of the world's financial systems. When financial and monetary crises are in developing countries, proponents of global financial integration interpret these crises as localized problems that can be solved with local solutions imposed by the IMF with the support of creditor countries.

The current crisis is different because when we look at this crisis, we are not talking about a peripheral crisis. The origins of the current crisis lie at the centre of the global economy in developed countries, including the United States. It is a crisis that begins with the problem of subprime markets in the United States in the summer of 2007 that turns into a banking crisis and a general financial crisis with the bankruptcy of Lehman Brother in late 2008. The crisis is spreading to other developed countries, particularly in Europe. We see huge rescue plans in several countries to stop the financial crisis, as in the United Kingdom and Ireland, with serious consequences for the government's budget and debt levels. In 2009, the crisis turned into a phenomenal debt crisis with Greece, but also Portugal, Spain, Ireland and Italy. Demordais, we can talk about a real crisis in the euro zone. It is a deep crisis and the deepest since the Great Depression causing the fall of the world country. This is why specialists tend to compare the current crisis to the crisis of the 1930s.

At the beginning of the crisis, in terms of the brutality of the fall, there are resonances, we see a significant drop in international trade, but then we see a very important difference. Global economic recovery today is much faster than in the 1930s. That is why we are talking about the Great Recession versus the Great Depression. At first, it sounds like such a deep crisis, but we are seeing an economic recovery that we did not see during the 1930s. Yet this is sufficient as a crisis to provoke strong criticism because proponents of globalization who have always extolled the benefits of global financial integration for a better allocation of capital.

Today, it is difficult to deny that there are only benefits, but that there are costs as well. Financial interdependence creates greater vulnerability to financial crises. Paul Walker questions the benefits of financial globalization. There is a strong debate about the advantages and disadvantages of global financial integration. Economists note that capital flows have financed productive investments in order to promote economic growth, but also to fuel financial speculation and especially real estate speculation in some countries. Some specialists note that it is because of globalization that there are huge imbalances between countries that are at the origin of the current crisis.

In the euro zone, international capital flows have allowed Ireland, Spain and Greece to live beyond their means. There are differences in external positions between countries. There are current account deficits in the GIIPS balance of payments that are extraordinary and financed by something. The financing comes from Germany with a large surplus on the current account so that Germany can finance the GIIPS deficits.

For the GIIPS countries, we see an increase in external debt making them unable to pay deficits on current accounts.

At the global level, we see the same phenomenon. The United States and Great Britain are in opposition to Asian countries. This time, it is the United States that is able to spend beyond its means thanks to the possibility of borrowing abroad, particularly in China. Proponents of financial globalization still extol the benefits of the financial globalization process for the allocation of capital from rich countries that are supposed to have an excess of financial resources to developing countries with a strong need for these resources to finance their productive capital. The global financial system has facilitated the transfer of huge flows from developing countries like China to developed countries like the United States. It is questionable whether financial integration has destabilized the global economy, explaining the current crisis trend.

There is a current account deficit offset by capital flows from smaller countries. The current account balance is negative more important than they export. This reflects a significant evolution in world trade since the 1970s. It is possible to see a second globalization that began during the 1980s and 1990s, encompassing not only the rich countries, but also the developing countries. Until 1973, there were very few developing countries that were permanently opening up to the world economy.

A real return to globalisation[modifier | modifier le wikicode]

For rich countries, the trend continues with a decline in tariffs until recently contributing to the argument proposed byFindlay et O’Rourke « Thirty-five years after the end of World War II, the overall picture as regards world trade liberalization was disappointing. According to Sachs and Warner (1995), only around a quarter of the world's population lived in open economies... It was only in the 1980s, and especially the 1990s, that [...] reglobalization ...would really begin ». It was during the 1980s and 1990s that globalization returned, not only because it involved rich countries, but also developing countries. There was a strengthening of European integration with the Single European Act in 1986 in order to reduce the obstacles to the integration of their market.

There is a very important role for negotiations that includes a very large number of countries in the GATT negotiations. With the opening of the communist group countries, there is a possibility of extending these agreements to the new countries, but there are also demands from the IMF and the World Bank for the developing economies to be opened up. Under the GATT, we see a series of negotiations starting with the Kennedy Round in 1964 and 1967, then the Tokyo Round between 1973 and 1979 and finally the Uruguay Round between 186 and 1994. The number of countries concerned is also increasing. In the Uruguay Round, there are 125 participants.

There is an effort to include agriculture in these negotiations, but it is a difficult subject because for rich countries it is often a very protected sector, as in Japan, Switzerland or the European Union, or even in the United States because it is considered to be a different sector, but above all part of a country's sovereignty. There are obstacles to liberalizing these sectors, but often, for developing countries, this is the main sector of their economy. For developing countries, it is a test of their international openness. Developing countries expect something from GATT to show their will. We see some progress up to the Uruguay round of negotiations and we also see the creation in 1995 of the World Trade Organization, which replaced the GATT. There is an international organization that takes responsibility for international negotiations around international trade.

Despite certain problems, the ambition to go further appears to be limits to globalisation and liberalisation. When we look at the average tariffs, they remain higher in 2000 than during the Second World War. Despite efforts to negotiate reductions in protection for the agricultural sector, this remains a very difficult point to negotiate. The agricultural sector is not sufficiently integrated into international agreements. In fact, the goal of the Doha Round, which began in 2001 but failed in 2006, was to open developing countries' access to the developed countries' markets. There is a blockage on several points where agriculture is the most important. The Bali package is an effort to relaunch negotiations with the will of the important countries to relaunch discussions on agriculture and its protection. This is the first international agreement negotiated since the creation of the WTO. The Bali package is above all a declaration to get involved in development.

This reflects the fact that there are significant barriers to international trade in agriculture, for example in the industrial sector. There are still other trade barriers other than tariffs such as quotas or rules.

End of the great divergence[modifier | modifier le wikicode]

The question is whether we see the end of the great divergence. If we look at the long-term figures, we see that the share of developing countries in industrial production increased between 20% and 30% in the 1980s. So far, there is a tendency to say that developing countries export raw materials, agriculture, but not industrialization and industrial exports. This is the idea of a great divergence creating a place for developing countries and another place for industrialized countries. This tendency leads us to wonder whether this divergence is coming to an end and whether it is now impossible for developing countries to compete even at world level.

There is no general trend for developing countries. For example, for Latin America, there is no change, but for Asia and China, there is a change, just as for Brazil to a lesser extent. There is an insertion of developing countries that is new explaining their possibility of having a very large current account balance on their balance of payments. China plays the role of a banker for the United States, but we must not exaggerate the consequences of recent decades in terms of liberalizing international trade, because if we do not see any change for most countries in Africa and for developing countries.

We cannot see a radical change, but there are some developing countries competing in global markets. China and other Asian countries are important enough to change the screwing of the global economy. This explains the possibility of global imbalances.

The two trends are the possibility of having a current account deficit for the United States and the possibility of having a surplus on China's current account. When we look at the balance of payments of the United States, there is the deficit on the current account, but there is also the counterpart.

We see that any current account deficit must be matched by a net inflow of capital, which is financial flows. It is necessary to be able to compensate the deficit on the current account with the sale of assets to foreigners. Other countries in the world must be convinced to finance the current account deficit. The rest of the world is financing the growing deficits of the United States creating a certain irony within globalization because normally we expect flows that go in another direction, but we see the opposite here. There is an exorbitant privilege that lasts for the United States.

The question is, whose fault is it? Americans are not able to control themselves, but we can also wonder if the Chinese consume too little? That is, the fact that there is no policy in China that tries to promote domestic consumption and makes the Chinese economy too dependent on the outside world to sell its products. It is not clear that either argument is entirely valid. This raises the old Keynes question of who is responsible for global imbalances.

In the Bretton Woods agreements, privileges were enshrined in the texts, but now there is a flexible exchange rate at world level. There is something paradoxical about this because it is not what we expect. The value of the dollar remains high. So, normally, what is expected is a country with a current account deficit that has grown leading to a devaluation of its currency highlighting that this is not sustainable. We should see a devaluation against this trend in the real economy, but we do not see this trend for the dollar. Over the long term, the dollar holds its value, but it continues to play a very important role as an official reserve. It is not only to keep its value, but also to keep its role within the international monetary system. It is this role that supports the value of the dollar because there is always a demand from the dollar to play this role. That is why China is ready to keep the dollar, but given the international system's dependence on the dollar, it is starting to frighten people and especially the Chinese. However, there are constraints because we can ask whether we can expect the end of the dollar's reign.

« The dollar is about to have real rivals in the international sphere for the first time in 50 years... Americans especially tend to discount the staying power of the euro, but it isn't going anywhere. Contrary to some predictions, European governments have not abandoned it. Nor will they. They will proceed with long-term deficit reduction, something about which they have shown more resolve than the U.S. And they will issue “e-bonds”—bonds backed by the full faith and credit of euro-area governments as a group—as a step in solving their crisis. This will lay the groundwork for the kind of integrated European bond market needed to create an alternative to U.S. Treasurys as a form in which to hold central-bank reserves ». »

— Barry Eichengreen, "Why the Dollar's Reign is Near an End," Wall Street Journal, March 1, 2011.

Alternatives must be found to replace the dollar as the official reserve currency. Nevertheless, one may wonder which replacement to find. It is not clear that the time has come for the euro to take on the task of being the world's main official reserve currency. There is a very strong dependence on the dollar, but there is no very obvious alternative. As for the Chinese currency, there are too many important restrictions to play the role of a reserve value.

Normally, in a flexible exchange rate system, flexibility is sought to address structural imbalances in the balance of payments. Prices change, do not adjust sufficiently to solve the problem of imbalances. The exchange rate is not flexible enough. We arrive at about the same problem as for the fixed exchange rate system, which are major structural imbalances.

If one asks about the relationship to recent experience with fixed exchange rates, there is no obvious answer. The euro is a completely fixed exchange rate system with no possibility of adjustment. The current eurozone problem shows that the fixed exchange rate regime is not a panacea either. Miller and Skidelsky talk about the "golden handcuffs" of the euro. With the euro system, we have gone further than the Bretton Woods system with the possibility of currency adjustments. These authors highlight the fact that we risk making the same mistakes made with the gold standard. We are once again creating "golden handcuffs" that we have already had. The "golden handcuffs" lead to deflation as a tool to solve the problems of the euro area. This was the orthodoxy of the late 1920s and early 1930s to emerge from the public spending crisis in Europe. The prescription is to reduce public spending to get out of the crisis, claiming that the problem is basically a budget problem, and we must reduce public spending to solve the crisis. That is the only thing that can be done in a system like the euro because there is no possibility of devaluation.

Greece stands out for its high level of deficit and consequently its public debt where public spending is not under control. Ireland until 2007 had much lower sovereign debt than Germany. The change, the net increase and the explosion of Irish debt is explained by the government's commitment to relieve Irish banks of toxic products. It is not clear that the correct answer is to reduce Ireland's public spending. The question is who should take responsibility for the adjustment that needs to be made within the euro area. This must be Ireland by reducing public spending or Germany by reducing its debt level. The old question of who is responsible for structural imbalances appears.

There is an aspect closely linked to the Keynes question that arises, both for the current flexible exchange rate system at world level and for the fixed exchange rate system of the euro area.