Bretton Woods System: 1944 - 1973

| Professeur(s) | Mary O'Sullivan[1][2][3] |

|---|---|

| Cours | International Economic History |

Lectures

- Introductory aspects of the International Economic History Course

- Introduction to the International Economic History Course

- Between Free Trade and Protectionism: 1846 - 1914

- International triumph of the gold standard: 1871 - 1914

- International Finance and Investment: 1860 - 1914

- New Challenges in International Trade: 1914 - 1929

- New monetary and financial order: 1914 - 1929

- Dark history for the world economy: 1930 - 1945

- Crises and regulations: 1930 - 1945

- Divided trade policies: 1946 - 1973

- Bretton Woods System: 1944 - 1973

- Money, Finance and the World Economy: 1974 - 2000

- Trade and the World Economy: 1974 - 2000

We will try to understand governance for monetary and financial aspects for post-war economies. The planning of the post-war international financial and monetary system began very early. Allies wonder what form future international monetary and financial relations will take before the fall of the Nazi regime. We need to look at the context in which these discussions are taking place in relation to the legacy of the past from the 1920s and 1930s, but also from the Second World War.

The debate on the new order[modifier | modifier le wikicode]

The memories of the 1920s and 1930s are vivid. The willingness of politicians to find solutions leads to better management following a learning process that greatly helps the task of rebuilding the world economy after the war. Despite the fact that during the Second World War we saw the same financial dependence as during the First World War, the financial consequences were different. This is due to a program instituted by Roosevelt which is the Loan-Lease program which is an armament program set up by the United States to provide allies with war material. This Act authorizes the President of the United States to sell, lease, or provide by any means a defence program to any government whose defence the President considers vital to the defence of the United States. This opens the possibility for the United States to almost give equipment to allied countries changing everything to financial consequences after World War II.

The main beneficiaries of the Lease-Loans were Great Britain, which benefited from 30 billion dollars, and the Soviet Union, which benefited from 11 billion dollars. The United States is counting on the return of these assets after the war.

«

- "What do I do in such a crisis?" the president asked at a press conference.

- "I don't say... 'Neighbor, my garden hose cost me $15; you have to pay me $15 for it' …

- 'I don't want $15 — I want my garden hose back after the fire is over." »

— Presidential Press Conference, December 17, 1940

The idea is to lend help to the allies to put an end to the fire according to Roosevelt's analogy. There is a different attitude in the United States towards the trade made necessary by the Second World War. In addition, Allied countries can keep these goods for a payment of only 10% of the value. There is a spirit of subsidy. The Loans-Leasing program plays a role in helping the Allies to continue the war, but also to avoid excessive debt as seen after the First World War. We see with certain bilateral agreements and especially between Great Britain and the United States in December 1945 that the United States decided to cancel almost all of the British debt. The existence of the Loan-Lease program does not mean that belligerent countries do not incur significant debts to finance the Second World War.

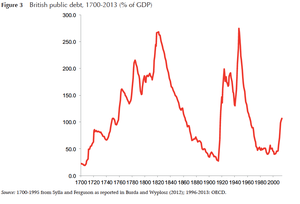

We see that wars are always expensive. The Loan-Lease programme cannot help the British avoid all the financial consequences of war. The exchange rate during the Second World War was more moderate than the First World War while the Second World War was more expensive than the First World War. This burden would have been much heavier without the U.S. loan and lease policy. We see better management of the war economy by allied countries.

We must also look at the reparations imposed on defeated countries after the Second World War. At the end of 1945, there were reparations discussions even before the end of the war, trying to specify the amount of reparations imposed on Germany. But we see a significant reluctance on the part of the United States because at the beginning it is the three great powers that are concerned, namely the United States, Great Britain and the Soviet Union. Only one country is pushing for major repairs, the Soviet Union. The Soviet Union plays the role of victim among the victorious countries suffering the most from the war in terms of human losses, but also in terms of material losses. The fact that the Soviet Union is demanding reparations is not surprising. However, the United States and Great Britain were reluctant to put a financial burden on a country that was much more devastated after the Second World War than after the First World War. There is a fear that having reparations imposed on some countries may have wider consequences than in the late 1930s. In the end, the amount imposed was not so large as after the First World War and reparations were imposed in kind. There is talk of the immediate confiscation of certain industrial assets with the sale of German industries exported to the Soviet Union. It is through the confiscation of property that already exists that we see the amount of reparations. The United States wants to limit reparations in kind by insisting that the Soviet Union take these reparations in kind from its own areas of Germany. The United States wants to limit the Soviet Union's ability to take reparations from other areas of Germany. There is a desire on the part of the major powers to control the financial implications of repairs. In the 1950s, further reparations were negotiated between the Federal Republic of Germany and other countries, but especially with Israel.

The issue of reparations is not new. The estimates for Germany do not include immediate material confiscations, but are much lower than for the First World War. Following the Second World War, there was a different policy on the part of the Allied countries. Other countries are concerned, such as Italy and Japan. Most experts believe that the Allies learned of the economic consequences of the post-First World War.

The complication of World War II and the fact that there was a First World War before. There is a possible interaction between the financial consequences of the First World War and the financial consequences of the Second World War. For the First World War, agreements ended financial reparations in the 1930s in the case of a moratorium initiated by Hoover in 1931 to freeze debts for one year. The Lausanne conference of 1932 put an end to the repairs. The debts contracted by Germany throughout the 1920s are contracted in order to pay for repairs with a close interaction between payment of repairs and increase in debts. The Dawes Plan and the Young Plan allowed the Germans to pay for the repairs. Other loans are contracted by firms or cities. Thus, we see a significant level of international debt for Germany.

In the 1930s, the Nazis tried to repudiate debts. We see a possible repudiation of these debts by the Nazis in the 1920s. At the end of the Second World War, the question arose as to whether the Germans were responsible for paying off the pre-war debts and the new loans added for reconstruction after the Second World War. There is the question of these pre-war and post-war debts. As far as the pre-war debt is concerned, we are talking about 13.5 billion marks. As far as the debts contracted immediately after the war are concerned, the debt is 16.2 billion marks. Between the two, we are talking about nearly 30 billion marks which remain to be determined for the amount of the debts. In 1951, Eisenhower accepted the responsibility of the Federal Republic of Germany to pay these debts. The Allies occupy West Germany, and he insists on the fact that German international trade must be revived leading to an agreement in 1953 that reduces the amount of debts of the Federal Republic of Germany by 50%. We are talking about a burden for an economy in full reconstruction in 1953, but which makes it possible to launch a certain expansion.

We can say that there is an important learning process among Allied countries following the experience of the First World War with a desire to limit the financial consequences after the Second World War, which does not mean that there are important problems to be solved after the Second World War in order to create a new international financial and monetary system. Allies are especially afraid of the collapse of the global trading system and the global economy. The idea is to create a global economic system that gives new impetus to international trade, but everyone quickly understands that in order to start international trade, international payment problems must first and foremost be solved.

Characteristics of the Bretton Woods system[modifier | modifier le wikicode]

The importance of the debate on the new monetary and financial order may seem strange, because we are talking about a technical and even obscure challenge, but there is a real obsession with the form of this new international monetary system after the end of the war and afterwards. It is considered the most important mechanism to revive international trade in the post-war period. The reconstruction of the new international monetary system is mainly the responsibility of the Americans and the British. On the one hand, the British are led to think about it by the Americans in the context of the principle of imperial preference. The United States claims Britain's involvement under the preferential agreements it has with its empire. Britain is very resistant because, given its large trade deficit, it is afraid of the consequences of the free trade system on its external economy. The British must find an answer other than resistance.

The most important figure working on this issue in Britain is Keynes who is the adviser to the British Foreign Secretary. In order to revive the international system, we need a system without punishing countries in deficit on the trade balance. In The General Theory of Employment, Interest and Money, he criticizes the orthodox policy of deflation to rebalance the economy. He noted as early as 1936 that the State had an important role to play in rebalancing the economy. In creating an international system, it is important to support the policy it wants to see within economies in order to create the opportunity outside deflation to rebalance the balance of payments. It has two objectives, to create an international payments system and to create other opportunities for countries that are in deficit. At the same time, Americans begin to talk about the same challenge through the person through White.

The initiatives of these two men advance separately, but once contact is established, it is clear that their vision of the international order of the world is different. In the possible Breton Woods agreement, we find a compromise between their two visions of the international monetary system. The two new systems reflect the different experiences of their own countries during the 1920s and 1930s. Keynes and White learn something from history, but from different things in history. For Keynes the lessons of history were rather sad, for Britain lost its place as hegemony of the world economy, the war increased its external dependence and Britain predicted a difficult post-war period following the problems it saw from the end of World War II. Britain is not an optimistic country for the post-World War II period. Moreover, following the experiment of the 1920s concerning the gold standard, the British are more and more negative compared to this experiment. During the 1920s, Britain had great difficulty keeping the pound parity against the dollar. The British have an overvalued pound, but they also consider that it was the fault of the other central banks that it was difficult to maintain parity with the dollar. They consider that the gold standard is not the best system to keep. They are concerned about the possibility of deflation-related punishment because they were punished in the 1920s.

One may wonder who is responsible for balanced and unbalanced international trade. If we have one country with permanent surpluses and another with permanent deficits, who is responsible? Some accuse deficit countries of spending more than they can afford. This was the shared idea, but not by Keynes who considered that the burden was shared. The countries that are in excess, for Keynes, do not respect the rules of the world economy. They should have stimulated their domestic economies to control their surpluses. Keynes finds that countries that are often in excess exploit demand from other countries. This is a very lively debate. When we talk about Germany and Greece today or the United States and China today, we have the same debate. At the end of the Second World War, the British were in deficit and the United States in surplus. Keynes, insists that international discipline is needed to regulate the global economy.

For the American economy, the consequences of the Second World War are rather happy with a strong external position and a strong external balance. It is a country which took advantage of the First World War to advance its positions and which foresaw an even more flourishing post-war period after the Second World War. Regarding the gold standard, the United States became increasingly enthusiastic about such a system, for White understood the consequences of war differently than Keynes. In Britain, politicians should have had more budgetary rigour and disciplined trade unions rather than pursued a monetary deficit policy. For White, the global economy must be based on competitiveness by taking measures that weigh on wages and prices in general. It is no coincidence that the United States and Great Britain had difficulty getting along in the interwar period. In the possible Breton Woods agreement, we find a compromise with their different visions of the international system.

A financial world under pressure[modifier | modifier le wikicode]

- The Breton Woods system has three features:

- fixed but adjustable exchange rate;

- currency convertibility, but capital flow controls ;

- new organizations: IMF and World Bank.

Fixed but adjustable exchange rate[modifier | modifier le wikicode]

The monetary authorities of each country undertake to maintain their currency at a parity being obliged to maintain their currency at a value of 20% around the parity value. The parities are adjustable under certain conditions. The chosen parity can be modified by a member country to correct a fundamental imbalance in the value of payments. For a change of up to 20% of the nominal value of the currency, the country must consult the IMF without necessarily having its approval. The decision remains national. For a larger change, IMF approval by qualified majority is required. The Americans take advantage of the Breton Woods agreements to place their currency at the heart of the system by declaring their currency in relation to gold. The other countries are not able to do to them after the war, because their economies are too weak to restore a balance, that is why they declare their currency against the dollar. If we look at the Breton Woods system, the key currency is the dollar, which plays an important role as an anchor in this system. Keynes proposed a new global currency called the bancor. The Americans and White did not want the birth of the bancor because they feared a loss of discipline in the creation of this currency. It was important to keep the dollar as the key to the system that succeeded in imposing the dollar as a solution. The fact that there is a possibility of adjustment means that there is another possibility of solving the problems of imbalance than deflation. It is an international monetary system that tries to integrate the solutions to devaluation into the international system itself.

Currency convertibility, but capital flow controls[modifier | modifier le wikicode]

When we talk about the convertibility of a currency, we are talking about the possibility of a national currency being exchanged for another currency or being converted into a foreign currency. Convertibility is divided between convertibility between current transactions and convertibility on capital transactions means that the domestic currency can be exchanged into foreign currency to ensure investment in the foreign country. White wants to have a general convertibility insisting on the control of both trade and international flows. The British and Keynes insist on the control of capital transactions. With the Breton Woods system, we only have convertibility control on current operations. The principle is that one cannot depend on free and general convertibility for any transaction.

New organizations: IMF and World Bank[modifier | modifier le wikicode]

There is the creation of institutions with the IMF and the IBRD, which eventually becomes the World Bank. The IMF is particularly important in the international system with the role of regulating international economies from a national perspective and financing the balance of payments of countries at risk. As a solidarity fund, each Member State must make a deposit, the amount of which depends on the predicted GDP of the Member States and if a country has problems balancing its balance of payments, it can call on aid which is automatic, but also conditional. Keynes wants a large amount of this envelope in order to be able to manage even serious imbalances. Yet White and the Americans are against this idea because the United States is not prepared to sign "blank cheques". Keynes loses and White wins. When we look at the characteristics of the Breton Woods system, we can see a compromise reflecting the negotiations between the United States and the British. Already during the debates around the form of the international monetary system. The United States dominates the Breton Woods negotiations.

« In Washington Lord Halifax; Once whispered to Lord Keynes: "It's true they have the money bags But we have all the brains." »

— "Source: "found on a yellowing piece of paper salvaged from the first Anglo-American discussions... about postwar economic arrangements" - Gardner, 1980, p. xiii

This agreement can also be understood as a response to a historical logic behind these characteristics because they are supposed to provide solutions to problems. The system meets the constraints of deflation imposed under the old gold standard system or the only way to rebalance is to impose deflation. The use of deflation is even more important after the Second World War since deflationary policies are even more important on the populations, because the power of the workers is even more important than before the Second World War under the impulse of the left parties. This first characteristic meets the need for an alternative to deflation.

Behind currency convertibility and capital flow control, there is the idea of solving the convertibility problem of the 1920s. The idea is to limit the role of financial speculation and its effect on countries.

The creation of a new international organization, especially the IMF, is intended to sanction governments that pursue policies that destabilize the international economy and to help countries with deficits. The idea is to create a place and an organization that takes responsibility for trying to solve these problems of the international monetary system.

Rising pressures[modifier | modifier le wikicode]

The Mundell triangle is the idea that an economy cannot simultaneously achieve the following three objectives:

- a fixed exchange rate regime;

- an autonomous monetary policy;

- perfect freedom of capital movement.

If we try to reconcile these three objects, we arrive at a monetary crisis, but if we abandon one of these objects, the other two are feasible. In the Breton Woods agreements, there is a fixed exchange rate regime that has an autonomous policy for member countries, but removes financial liberalization at the international level. In the gold standard system, this same logic was respected from 1870 to 1914, but in a different way, with fixed exchange rates and free movement of capital, but the countries' autonomous monetary policy was abolished. During the 1920s, there was a lack of respect for this principle with a fixed exchange rate regime, free capital flows and monetary policies that led to a major crisis.

The system works perfectly for a short period of time. For some time, countries with large current account deficits continue to mobilize the option of exchange controls in order to restore the balance of the external balance imposing controls even on currency convertibility for current transactions. France and Germany are not able to restore currency convertibility even on current transactions because their trade deficits are too large. They hesitate to restore convertibility on current transactions and eliminate convertibility on capital transactions. The Breton Woods system was not respected until 1958. The Breton Woods system worked perfectly between 1958 and 1973.

The difficulty of these countries in trying to restore currency convertibility is linked to a general idea described as a problem of shortage or scarcity of the dollar. The "dollar gap" is the lack of dollars from which some countries suffered after the Second World War, particularly for Europe. The products supplied by the United States are imported with limited capacity to pay for these imports because the European economies are in a chaotic situation. These countries are not able to produce enough to export and bring in U.S. currency to pay for imports from the United States. With such a deficit, it is very difficult to restore currency convertibility, so they impose controls even on current transactions. Consequently, there is a high risk of currency convertibility being suspended from the dollar, complicating trade in goods and services. The Americans are very unhappy about this situation, because the United States is waiting to benefit from the post-war boom. The Americans believe that restoring the convertibility of European currencies is essential, especially for the British.

The British are under enormous pressure because this country had suffered less destruction from the war than other European economies. For this argument, it would be easier to restore the convertibility of the book. However, the British are concerned about the convertibility of their currency because they have built up debts to finance the war. There are huge claims, much larger than Britain's official reserves and the problem is that these claims lead to a loss of confidence in the pound and a liquidation of these claims to convert them into dollars. The consequence would be a fall in the value of the GBP. Despite the British position, the Americans insist on the convertibility of the British pound. The Americans have an important argument since the British need the American loans in order to rebuild their economy in 1946, the Americans grant a loan of 4 billion dollars to the British in exchange for which the Americans must restore the convertibility of their currency. The book became convertible in June 1947. The reserves fled the country and the American loan was exhausted in four weeks. The crisis ended with the suspension of the convertibility of the pound on 20 August 1947.

The only advantage of this crisis is that it brings the Americans back to global problems and the shortage of the dollar. This event frightened the Americans of a possible destabilization of European economies and worried about the spread of communism. They designed the Marshall Plan to rebuild European economies and Congress has not yet approved it. The sterling-book crisis is helping Congress ratify the Marshall Plan. Marshall aid was voted in 1948. It is the Europeans who share it on the basis of consensus forecasts based on their dollar deficit. It is to address this shortage that Marshall aid is being used. Everyone hopes that the $13 billion in Marshall aid will be enough to solve the dollar problem in Europe.

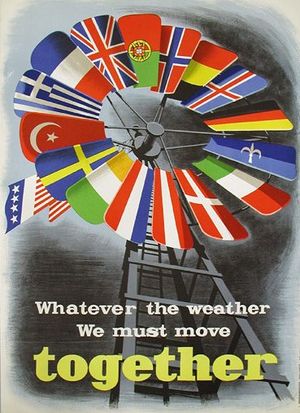

Another crisis occurred in 1948 and 1949 leading to a deflation of European currencies in 1949 which highlighted that the shortage of the dollar and the destabilization of international trade that it generates. We see efforts on the part of Europeans to create mechanisms to solve the problem of the dollar's shortage with the European Payments Union mechanism, which creates the possibility of convertibility between European currencies, but which keeps restrictions on the convertibility of current transactions between third countries. The solution lies in the economic development that we see in these European economies. International trade between Europe and the United States is beginning to be rebalanced following the restoration of European countries to export again. It is the reconstruction of European economies that solves the dollar problem. Once the dollar shortage problem is solved, we go from a dollar shortage to a dollar surplus.

Vulnerability of the Bretton Woods system[modifier | modifier le wikicode]

The challenges of the dollar shortage for the international system gave way to a new problem towards the end of the 1950s with a reversal of the problem with the emergence of a dollar surplus in the world economy linked to a Japanese and American export surplus. If there is an endogenous vulnerability of the Bretton Woods system, it is linked to the problem of the dollar surplus. With the current account problem like the Federal Republic of Germany and Japan, there is a deterioration in the 1960s trade balance of the United States. The country is starting to spend more on imports and earn a little less from exports. We see that the United States is spending more and more abroad to support its military activities and foreign aid. If we look at the balance of capital, American companies are resuming and increasing their investments in Europe. There is more and more money coming out of the United States. The US external balance in deficit leads to redistribution to other countries that are starting to earn more dollars than they spend.

An imbalance in the balance of payments is intriguing because a balance of payments is always balanced from an accounting perspective. Before 1973, it is very common to speak in terms of balance in terms of accounting, but of certain types of balance that reflect a change in balance, notably a change in a country's official reserves. The United States uses its balance of payments by letting out gold and creating official obligations to other countries - the balance of payments situation reflects a growing external weakness in the United States. For Germany, the opposite is true. Its external balance is growing stronger, Germany is able to increase its official reserves. There was a weakness that increased on the external balance of the United States throughout the 1960s.

This shows a first vulnerability of the Bretton Woods system that is surprising. There is a persistent problem with a balance of payments imbalance, whereas the Bretton Woods system was designed to avoid such a problem because it speaks of an adjustable fixed exchange rate. In the system, normally, we have a way of solving this problem, yet it is not well enough solved. How can this paradox be explained? It is possible to add value in a fundamental imbalance condition. This became an increasingly important problem during the 1960s. An admission of fundamental imbalance is embarrassing. This is a particularly embarrassing problem for large countries such as Great Britain, for example, which is reluctant to observe a fundamental imbalance. We see a decision to devalue the sterling in 1967, but this decision should have been made three years earlier. The difficulty that the Bretton Woods rules create for a country in fundamental imbalance makes it difficult not to attract the attention of speculators and cause the currency concerned to fall. These rules are too cumbersome, countries avoid getting involved in such a process because they are afraid of being subject to attack by international speculators.

The system is also dependent on a single currency which is the dollar that can be an advantage from the perspective of the United States because the United States may run a balance of payments deficit because central banks elsewhere wish to acquire dollars. The dollar is the basis of the system and most countries in the world hold dollars in their official reserves allowing the United States to increase their supply of money and their economy because the United States knows that other countries will hold those dollars as a reserve. De Gaulle will start talking about an exorbitant privilege of the United States.

We see a dimension of the official gold reserves of the United States. The United States increases receivables denominated in dollars in order to pay in dollars. It is possible to criticise the United States for its lack of discipline creating a problem for the international monetary system. If the United States decides to rebalance the external balance and reduce dollar spending, it will be a total disaster.

We're talking about Triffin's dilemma. If we look in detail at the Bretton Woods system, the systems make it necessary to have a balance of payments deficit to feed a growing economy. The world economy needs the balance of payments more because it is expanding. The solution is to increase the number of dollars circulating in the global economy. The United States is serving the international monetary system by creating more liquidity for the system. However, there is a paradox, because such an increase in the stock of dollars contributes to a gradual weakening of foreign economic agents' confidence in the reference currency.

With the increase in the number of dollars circulating in the world economy, the world gold stock is not rising much and not enough to maintain a stable ratio between gold and the dollar. At the end of the period, we are only talking about 5% of the gold stock. It is the system that gives this result because it is possible to solve the problem by asking the United States to limit the creation of dollars, but this creates a lack of liquidity at the global level. With the Bretton Woods system, we created a system too dependent on a single currency, the dollar.

There is a one-time response to the challenges of the deficit. One of the specific solutions is the creation of the gold pool. An international agreement proposed by the United States was implemented in 1961 by Switzerland and members of the European community leading to a fall in the relative price of the dollar creating an incentive to demand gold against the dollars from the U.S. Treasury. With the gold pool, member countries undertake to limit the sale of their own gold stocks. Switzerland, for example, is acting against these own interests, but there is a commitment on the part of these members to try everything to save the system. In their actions we see the vulnerability of the dollar dependency system. Efforts to control the international gold market ended in failure. In the second half of the 1960s, it became increasingly difficult to save the gold pool system. Efforts are being made to address structural weaknesses in the system. The gold pool does not respond to structural vulnerabilities. There is a willingness on the part of international actors to address structural weaknesses. In the 1960s, the goal was to reduce dependence on the Bretton Woods system and the dollar. It is not clear that there is enough gold in the world to support the global economy. We see a return of ideas that are not very far from Keynes' ideas with the creation of the bancor. Robert Triffin notes that the only solution for the Bretton Woods system is to create an artificial unit based on the value of several currencies and not on a single national currency. This was something rejected at the beginning of the system as Keynes' idea.

In the mid-1960s, we saw proposals going in the same direction. In 1964, we see that the French took up an idea first developed by the British to use Special Drawing Rights[SDRs] to solve the problem of dollar spending in the international system. At first the Americans were against wanting to keep the key role of the dollar, but the United States changed position because of growing fears for the convertibility of the dollar into gold. The system will explode if nothing changes these structural weaknesses.

In 1969, the Special Drawing Right was implemented and new international assets were created under the auspices of the IMF of a structural and inter-state nature. SDRs are reserve assets created by the IMF and allocated to member countries. The value of SDRs is assessed on the basis of a basket of international currencies and their use is limited to transactions and official transactions between member countries and with the IMF. It is an artificial and separate currency. For these reasons, there is little success with the SDR, which represents only a small part of the official reserves even before the collapse of the Bretton Woods system. There are endogenous weaknesses in the system that contribute to the eventual collapse of the Bretton Woods system.

An international market began to develop a lot during this period and especially during the 1960s. During the 1940s and 1950s, there was a desire to control international capital flows. If these member countries accept these instructions, they will propose an action regulation for these flows. We see a significant and everywhere imposed capital control limiting the possibilities for the development of the international financial market. We are beginning to see that the effectiveness of this type of control eroded in the post-war period and especially in the 1960s. First, there is the restoration of convertibility on operations which is not restored until 1958 for the major Bretton Woods countries. Once convertibility is restored, this creates a problem. It is possible to pretend to need to convert currency for legitimate reasons, but to do it differently. There is a possibility to bypass certain rules of the system once convertibility on current operations is restored.

Financial operators are finding new ways to circumvent controls by moving to the eurodollar markets. The eurodollar market represents a testing ground for the financial world. The Eurodollar creates opportunities for private and public actors to trade that were not possible in the 1950s. Eurodollars are dollars held outside the United States, but not only in Europe. Their origin dates back to the 1950s when dollar deposits began to accumulate in London. The first deposit is made in London and Paris by a Russian bank. It is not by chance that we talk about a Russian bank because the Soviet Union and the eastern countries prefer to hold their dollars outside the United States because they are afraid that their dollars will be frozen in the United States. Above all, American investments seek to escape American regulation and in particular the regulation that limits interest rates on bank deposits in the United States. Banks in Europe and London allow the possibility of investing its dollars abroad, but this is treated differently from deposits held in free-sterling which creates offshore poles. The British government does not decide to regulate the eurodollar market. The fact that these deposits are in dollars makes it possible to differentiate financial systems. This allows you to control your own financial market while allowing you to profit from the eurodollar market. Banks that hold dollar deposits are beginning to see that there are opportunities to lend them. With these dollars, they can issue dollar denominations.

Euromarkets allow investors to escape the yield limits set by the US government and also make government control over capital movements less and less effective. Nixon calls for patriotism not to appeal to the Eurodollar market. Faced with the growing pressure on the dollar during the 1960s and the rise of the Eurodollar market, the United States had to cope with capital flight. Increasingly important controls will be imposed, but these controls cannot work in a world where there is the possibility of the Eurodollar market. These controls have their limits in supporting the dollar and the Bretton Woods system. In 1970, the Federal Reserve lowered the discount rate in the United States to facilitate Nixon's reflection in 1972. At the same time, the Germans are trying to control their inflation rate which is getting higher and higher by increasing their discount rate. The result is first a huge flow of dollars that moves from the United States to other markets to seek higher interest rates and at the same time, the Germans borrow from London to borrow at lower rates. Pressure is offered to maintain sufficient parity. On August 15, 1971, the United States suspended the convertibility of the dollar.