« International triumph of the gold standard: 1871 - 1914 » : différence entre les versions

Aucun résumé des modifications |

Aucun résumé des modifications |

||

| (8 versions intermédiaires par le même utilisateur non affichées) | |||

| Ligne 1 : | Ligne 1 : | ||

{{Infobox Lecture | |||

|image= McKinley Prosperity.jpg | |||

|image_caption= William McKinley ran for president on the basis of the gold standard. | |||

| cours = [[International Economic History]] | |||

| faculté = | |||

| département = | |||

| professeurs = [[Mary O'Sullivan]]<ref>https://www.unige.ch/sciences-societe/dehes/membres/mary-osullivan/</ref><ref>https://www.researchgate.net/profile/Mary_Osullivan14</ref><ref>http://www.levyinstitute.org/scholars/mary-osullivan</ref> | |||

| enregistrement = | |||

| lectures = | |||

*[[Introductory aspects of the International Economic History Course]] | |||

*[[Introduction to the International Economic History Course]] | |||

*[[Between Free Trade and Protectionism: 1846 - 1914]] | |||

*[[International triumph of the gold standard: 1871 - 1914]] | |||

*[[International Finance and Investment: 1860 - 1914]] | |||

*[[New Challenges in International Trade: 1914 - 1929]] | |||

*[[New monetary and financial order: 1914 - 1929]] | |||

*[[Dark history for the world economy: 1930 - 1945]] | |||

*[[Crises and regulations: 1930 - 1945]] | |||

*[[Divided trade policies: 1946 - 1973]] | |||

*[[Bretton Woods System: 1944 - 1973]] | |||

*[[Money, Finance and the World Economy: 1974 - 2000]] | |||

*[[Trade and the World Economy: 1974 - 2000]] | |||

}} | |||

We are going to talk about the international monetary system. This is a subject that is both difficult and important, it is a somewhat obscure subject that remains the case for the monetary aspects of our economies. Increasingly, monetary economics is taught on the basis of economic models can be adapted to the current situation, but these models are not adapted for the most part to the past. The past can still inspire the present. We hear more and more about the systems of the past and more precisely about the gold standard system as a guarantee of the money system. | We are going to talk about the international monetary system. This is a subject that is both difficult and important, it is a somewhat obscure subject that remains the case for the monetary aspects of our economies. Increasingly, monetary economics is taught on the basis of economic models can be adapted to the current situation, but these models are not adapted for the most part to the past. The past can still inspire the present. We hear more and more about the systems of the past and more precisely about the gold standard system as a guarantee of the money system. | ||

| Ligne 8 : | Ligne 30 : | ||

For an increasing number of countries, they are making decisions on the basis of gold as the domestic standard and gold was increasingly functioning as an international standard and therefore the international standard functions as a fixed exchange rate. When a country decides to fix its currency on gold, it fixes it in relation to other countries. If all countries decide to fix their currency on gold, they also fix it against the currency of another country. We are not only talking about an international system based on gold, but it also works as a fixed exchange rate. | For an increasing number of countries, they are making decisions on the basis of gold as the domestic standard and gold was increasingly functioning as an international standard and therefore the international standard functions as a fixed exchange rate. When a country decides to fix its currency on gold, it fixes it in relation to other countries. If all countries decide to fix their currency on gold, they also fix it against the currency of another country. We are not only talking about an international system based on gold, but it also works as a fixed exchange rate. | ||

{{Translations | |||

| fr = Triomphe international de l'étalon-or : 1871 – 1914 | |||

| es = Triunfo internacional del patrón oro: 1871 - 1914 | |||

| it = Trionfo internazionale dello sistema aureo: 1871 - 1914 | |||

}} | |||

= The international triumph of the gold standard = | = The international triumph of the gold standard = | ||

Everything begins with the United Kingdom which makes the first important step towards the gold standard and more precisely England taking this way in a largely accidental way. In 1665, Isaac Newton was rewarded for an important scientific discovery. At the time, England's system was bimetallic, combining two gold and silver standards by establishing a parity between the prices of the two metals. By fixing the parity of the two metals, the exchange rate between gold and silver, Newton makes a mistake. It undervalues silver and overvalues gold. Therefore, there is an important incentive to buy gold and export the silver to sell it more expensive elsewhere. This trend continued until all the country's silver coins were exported and England was therefore only on the gold standard from 1717. However, the monetary system was not recognized as such at the time | Everything begins with the United Kingdom which makes the first important step towards the gold standard and more precisely England taking this way in a largely accidental way. In 1665, Isaac Newton was rewarded for an important scientific discovery. At the time, England's system was bimetallic, combining two gold and silver standards by establishing a parity between the prices of the two metals. By fixing the parity of the two metals, the exchange rate between gold and silver, Newton makes a mistake. It undervalues silver and overvalues gold. Therefore, there is an important incentive to buy gold and export the silver to sell it more expensive elsewhere. This trend continued until all the country's silver coins were exported and England was therefore only on the gold standard from 1717. However, the monetary system was not recognized as such at the time; formally bimetallism remained in place until the Napoleonic wars. During the Napoleonic Wars, the Bank of England suspended the convertibility of its money and after the Napoleonic Wars in 1819, the UK government formally adopted the gold standard. | ||

The gold standard in the strict sense respects certain conditions: | The gold standard in the strict sense respects certain conditions: | ||

| Ligne 18 : | Ligne 46 : | ||

*gold can be freely exported and imported. | *gold can be freely exported and imported. | ||

If we think about these characteristics, we can understand | If we think about these characteristics, we can understand the great merit given to the gold standard at the time and its ability to control inflation. It is difficult to have inflation caused by a change in government policy. In other words, it is difficult to create money, because if too much money is created, gold is lost and confidence in the ability to ensure currency convertibility is lost. Proponents of the gold standard sell the system's ability to promote economic change without government or central bank intervention. | ||

In the hypothetical situation where the workers demand an increase in their salary granted by the industrialists, if this increase in salary also increases the production costs of this country, | In the hypothetical situation where the workers demand an increase in their salary granted by the industrialists, if this increase in salary also increases the production costs of this country, consequently there is a decrease in the competitiveness of this country, exports become too expensive. Expectations are for a drop in exports in such a situation. If there is a fall in exports, it implies an imbalance in that country's trade balance. The implication is that if one has to pay for imports, or more precisely the deficit that exists between net import and export, one has to spend a certain part of the gold reserves implying the decrease of gold reserves, on a standard system this obliges to decrease the quantity of currency in circulation in the country. If we reduce the currency, we deflate the economy and therefore demand falls. If there is a decrease in demand, it puts downward pressure on the country. This is a situation where the gold standard system restores the initial balance. We respond to an imbalance with a system that can be quite brutal with a fall in prices and wages to restore balance to the economy. Such a system requires a very strong flexibility of all prices and wages pulling prices down when the country suffers an economic crisis. Opponents of the gold standard insist on the brutality of this system widening a gap with the partisans. | ||

So far, only the United Kingdom has such a system. Following the adoption of such a system, one does not immediately see a rush towards the gold standard by other countries. Portugal will adopt the gold standard only in 1854. Generally speaking, the gold standard remains a minority system. | So far, only the United Kingdom has such a system. Following the adoption of such a system, one does not immediately see a rush towards the gold standard by other countries. Portugal will adopt the gold standard only in 1854. Generally speaking, the gold standard remains a minority system. | ||

| Ligne 29 : | Ligne 57 : | ||

In Europe, a large majority of countries switch to the gold standard as the monetary system. We see almost the same trajectory outside Europe. The United States is recovering from the Civil War, its system was based on greenbacks that are unconvertible. In 1873 the American government made the decision not to resume free minting money. The United States decides to make these notes convertible into gold and not silver. From then on, this country began to function de facto with gold as its monetary base. The fact that we see the U.S. move to the gold standard does not mean that it is not contested. To have a definitive position of the United States with respect to the gold standard it is necessary to wait 1900 which is the moment when it is legally adopted by the Congress. Even in this country where there is a fairly long period of debate, in 1900 there is no doubt that the United States operates with a gold standard. In 1890, India, which had been working for a very long time with the silver standard, fixed the rupee on the British pound, Russia too, but also the Latin American countries. China and only a few Central American countries remain to maintain the monetary standard. We can really talk about an international monetary system based on gold. The trend of this international gold-based system faces obstacles. | In Europe, a large majority of countries switch to the gold standard as the monetary system. We see almost the same trajectory outside Europe. The United States is recovering from the Civil War, its system was based on greenbacks that are unconvertible. In 1873 the American government made the decision not to resume free minting money. The United States decides to make these notes convertible into gold and not silver. From then on, this country began to function de facto with gold as its monetary base. The fact that we see the U.S. move to the gold standard does not mean that it is not contested. To have a definitive position of the United States with respect to the gold standard it is necessary to wait 1900 which is the moment when it is legally adopted by the Congress. Even in this country where there is a fairly long period of debate, in 1900 there is no doubt that the United States operates with a gold standard. In 1890, India, which had been working for a very long time with the silver standard, fixed the rupee on the British pound, Russia too, but also the Latin American countries. China and only a few Central American countries remain to maintain the monetary standard. We can really talk about an international monetary system based on gold. The trend of this international gold-based system faces obstacles. | ||

{{Translations | |||

| fr = | |||

| es = | |||

}} | |||

= How do we explain the adoption of the gold standard? = | = How do we explain the adoption of the gold standard? = | ||

| Ligne 36 : | Ligne 69 : | ||

* economic policy. | * economic policy. | ||

== | == Inelectability == | ||

=== | === Increase in silver supply === | ||

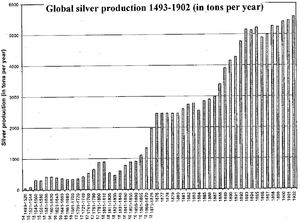

Two arguments are proposed with first the argument based on the change in the supply of precious metals and in particular the supply of silver. Experts believe that the gold standard rush can be explained by the technical weakness of the precursors of the gold standard and more precisely of bimetallism. There are problems within this system that make it impossible for this system to survive and it is inevitable that we have to change this system for something else. Bimetallism does not include significant problems as long as the relationship between the value of gold and silver remains stable. In the middle of the 19th century there appeared an important change compared to the supply of silver, there is an increase in the supply of silver following the discovery of new deposits of silver as in Nevada and elsewhere, moreover, there is a more efficient process of extraction of silver. Some experts claim that these events overload the amount of money in circulation. | |||

[[Image:Global siver production 1493 - 1902 (in tons per year).png|thumb|300px| ]] | [[Image:Global siver production 1493 - 1902 (in tons per year).png|thumb|300px| ]] | ||

What is the implication for the international monetary system? This causes the market price to fall, reducing opportunities for countries whose system is based on bimetallism. Certainly, bimetallism faces an important test in its management of silver supply disruptions, but there are changes in gold production that are putting pressure on the bimetallic system. | |||

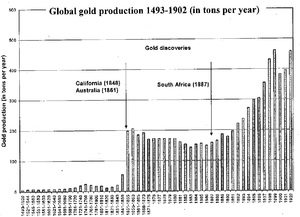

[[Image:Global gold production 1493 - 1902 (in tons per year)2.png|thumb|300px| ]] | [[Image:Global gold production 1493 - 1902 (in tons per year)2.png|thumb|300px| ]] | ||

Concerning the production of gold, there are important discoveries notably in the United States in the middle of the XIXth century. These changes would cause gold prices to fall. | |||

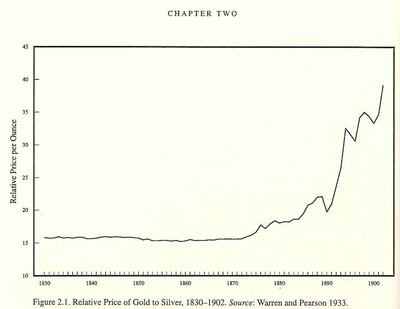

[[Image:Relative price of Gold to Silver, 1830 - 1902.png|thumb|center|400px| ]] | [[Image:Relative price of Gold to Silver, 1830 - 1902.png|thumb|center|400px| ]] | ||

It is not clear that an argument based on changing the supply of money holds water. Moreover, if we look at the measures of international stability before 1870, we see something impressive, even extraordinary. Despite all the changes, before 1870, there was extraordinary stability. There's no sign of instability. That is, the players, central banks and private actors manage to stabilize the exchange rate between the two precious metals. It is only after Germany's decision that we see a significant change in the value of money. | |||

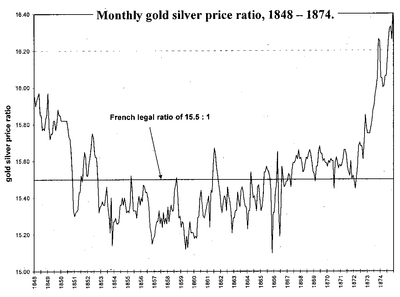

The monetary pressures exerted by changes in the supply of silver and gold were remarkably well managed by a heterogeneous monetary system before 1870. It is a heterogeneous and flexible system. Countries that practiced bimetallism, such as France before 1870, served as a shock absorber for the exchange rate, which risked shifting the relationship between gold and silver, because it was capable of absorbing large quantities of silver and gold. The circulation composition of these countries is modified according to changes in the supply of silver and gold. Despite monetary heterogeneity before 1870, the international monetary system was a fixed exchange rate system. The relationship between the two metals is stable so it's fixed. If we change scale, there is more stability. | |||

[[Image:Monthly gold silver price ratio, 1848 - 1874.png|thumb|center|400px| ]] | [[Image:Monthly gold silver price ratio, 1848 - 1874.png|thumb|center|400px| ]] | ||

We see that there is instability to manage, but most specialists note that this instability is not sufficient to call into question the functioning of the international system before 1870. We cannot see on the basis of such a graph that there is a problem with money. It is only following the German decision that we see a fall in the price of money on the international markets. | |||

This first argument does not really hold water, one cannot say that these changes are not really important. We will see that finally, the decision to base a standard on a precious metal is a risk of a change in supply. | |||

=== | === Steam engine === | ||

This argument leads to a certain inevitability in the transition to the gold standard. The invention of the steam engine is closely linked to the process of internationalization. Gold is too expensive to be used for small transactions. Another metal of lesser value was needed for these transactions, i.e. money at the time. The problem is counterfeiting, because anyone can easily make a silver coin not far from a silver coin made by the Mint in England. On the other hand, once it is capable of using steam presses, it is possible to produce high precision parts by stamping parts officially. This change makes it possible to replace the small silver and worthless coins allowing to abandon the silver to pass to the gold standard. Once again, ineluctability plays a role. However, there is a timing problem. France adopted the press relatively early, but adopted the gold standard late. | |||

== | == Special Circumstances == | ||

This argument contrasts with the inevitability. Germany is the first largest country after the United Kingdom. | |||

{{citation bloc|Germany's conversion to gold "was facilitated after the country's victory over France in 1871, which led to a substantial indemnity payment in gold. The resulting increase in the government's gold reserves allowed it to go onto gold with little difficulty between 1871 and 1873.|Frieden, 1993, p. 145}} | {{citation bloc|Germany's conversion to gold "was facilitated after the country's victory over France in 1871, which led to a substantial indemnity payment in gold. The resulting increase in the government's gold reserves allowed it to go onto gold with little difficulty between 1871 and 1873.|Frieden, 1993, p. 145}} | ||

The idea is that there are special circumstances at the end of the War of 1870. The Frankfurt Peace Treaty of 1871 obliges France to pay compensation of 5 billion francs to Germany. Germany takes advantage of this income to accumulate gold and mint coins. However, France pays only a minority of the allowances. | |||

== | == Internal elements == | ||

Perhaps some aspects of economic policy need to be looked at in order to understand the incentives for these countries to make a transition to the gold standard. It can be seen that the choices depend on domestic elements and international factors. For interior elements, there are internal possibilities compared to monetary systems. Within countries, there are often very discussed and debated discussions between different national actors, as they have different economic interests in relation to different monetary systems. | |||

[[File:greenbacks.jpg|thumb|200px|<center>Image of one dollar "Greenback",<br> first issued in 1862</center>]] | [[File:greenbacks.jpg|thumb|200px|<center>Image of one dollar "Greenback",<br> first issued in 1862</center>]] | ||

It is in the United States that we see the fiercest battle around the adoption of the gold standard. There was the decision of the United States in 1873 not to resume free minting silver and then there was the decision to convert greenbacks into gold and the de facto beginning of a gold standard system in the United States. | |||

The suspension of the minting of money became very controversial especially for the interests of money miners. In the United States, we see an increase in the power of the western states because they are silver producers. They are not at all happy with this decision because they are trying to get rid of their stocks of money by selling them to the American treasury. All of a sudden they are losing access to that market because the decisions made by the U.S. government in the 1870s are making it impossible to absorb the growing stock of money. This situation is described by money miners as a crime. This decision gave birth to the famous Silver lobby which is a pressure group that brings together powerful mining interests opposed to the demonetization of money for obvious interests. | |||

These mining interests find allies among farmers who also oppose the gold standard because of its deflationary effects. As early as the late 1890s, we see that the price level in the United States has been rising for twenty years. Farmers' representatives note that there is no coincidence that global economic production is growing much faster than the global gold stock in the global economy. There is talk of a shortage of gold because of the need of the world economy and therefore an unnecessary fall in demand and prices of goods and services. So, they see that this fall and deflation are created by monetary policy and artificially as a result of the decision to base the currency on an insufficient stock of gold to support global economic activity and growth. Farmers are the ones who notice this, because there is a situation where deflation weighs very heavily on farmers implying a decrease in the prices of their products and deflation is particularly serious on the markets of agricultural products, moreover, these farmers are more often indebted. Having a decrease in product prices does not imply a decrease in interest. There is a painful situation where incomes tend to decrease, but the level of interest remains at the same level. This is not a decision they have to accept, because there is a solution and that is why they are in favour of increasing prices to increase their income and reduce their debt burden. They propose that the government issue more money by being a gold standard whose stock is reduced, but also on silver. They agree with the Silver lobby, but for different reasons. In 1878 the Bland Allison Act was passed and in 1890 the Sherman Act. | |||

We also see that other indebted people in the United States at the time had the same interest in fighting deflation by creating either a silver standard system or a bimetallic system. They are advocates of change. | |||

Opponents were very powerful at the time in the United States. Silver lobby supporters oppose creditor interests as well as owners who support strong currency. One can imagine the same speech for monetary debates these days. International trade and financial flows reached historic levels unprecedented at the time, and industrialists in the east had an interest in strengthening the reputation of the United States and the security of the American currency. Republicans and Democrats support the gold standard, but the free money movement against the gold standard is becoming increasingly important. | |||

There is some success in this movement, but perhaps the most important moment for this debate is the political campaign against the gold standard that culminated in the 1896 presidential election. The populist party was founded in 1891 to fight the fall in prices, making the silver standard system an element of its campaign. Democrats must answer for the claims of mining interests proposing a candidate against the gold standard and for "free silver". This candidate is Bryan who wins the support of the Democrats, but also the populists. In the Speech of the Golden Cross, the crowd becomes frenetic. Bryan loses the presidential election in favor of McKinley by a narrow margin, the margin of 600,000 lanes is very small. There is then a clear decision by the United States to base its currency on gold becoming the official standard of the United States. | |||

=== | === Interest === | ||

The US case study helps to understand what explains or blocks the transition. In the American case, we see that the battle between silver and gold is a battle between the different economic interests between creditors and debtors. Overall until the 20th century, the United States was an indebted country that attracted a lot of capital to finance its government debt and the construction of its railways. As the country becomes richer, the balance shifts in favour of creditors and therefore in favour of the hard currency. A dynamic is taking hold, the United States is becoming an increasingly wealthy country with increasing savings, the interests of creditors are becoming increasingly important explaining the transition to the gold standard because creditors prevail over debtors. | |||

In the case of Great Britain, we see that the adoption of the gold standard is controversial. For example, after the Napoleonic wars, there was the same kind of battle, yet national interests and creditors were much more powerful in Great Britain than in the United States because we were talking about the richest country in the world at the time. The fact that creditors are able to prevail over creditors is much less important than for the United States. | |||

=== | === Political institutions === | ||

Political institutions help explain the transition. | |||

{{citation bloc| | {{citation bloc|In the nineteenth century, the characteristic pressure of the twentieth century for governments to subordinate monetary stability to other objectives was still ignored. The credibility of the political determination to maintain convertibility was reinforced by the fact that workers, who suffered most from the hardships of the times, were in a very poor position to make their voices heard. In many countries, the right to vote was still censal (in practice, women were almost everywhere deprived of the right to vote). Moreover, the Labour parties which were likely to defend the interests of the workers were still in an embryonic state. For all these reasons, the fact that the central bank maintained convertibility as a priority objective was not disputed.|Eichengreen}} | ||

There are political foundations of the important gold standard to understand. It is a socially constructed institution whose viability depends on the system of which it functions. Some interests are not very well represented at the political level. Events allow the creation of a binding system, but we cannot have the same political institutions. In the 1920s, it became increasingly difficult for central bankers to suppress demand to suppress inflation. Central bankers will win, but it becomes much more difficult to insist on the constraints imposed by a system like the gold standard. | |||

=== | === Ideas === | ||

Historians speak of a widespread conception at the time of a close relationship between the gold standard and Britain's financial and economic dominance. | |||

{{citation bloc|The tendency of opinion in Europe had been for 20 years in favor of the monometallic system. From the example of England it was seen that the English by the mono-metallic system of a gold standard enjoyed great advantages, and the Continental countries, especially Prussia, seeing this, decided to go into the mono-metallic system… | {{citation bloc|The tendency of opinion in Europe had been for 20 years in favor of the monometallic system. From the example of England it was seen that the English by the mono-metallic system of a gold standard enjoyed great advantages, and the Continental countries, especially Prussia, seeing this, decided to go into the mono-metallic system… | ||

| Ligne 108 : | Ligne 141 : | ||

{{citation bloc|It is the greatest delusion in the world to attribute the commercial preponderance and prosperity of England to our having a gold standard. Our gold standard is not the cause, but the consequence of our commercial prosperity.|Benjamin Disraeli, 1873.}} | {{citation bloc|It is the greatest delusion in the world to attribute the commercial preponderance and prosperity of England to our having a gold standard. Our gold standard is not the cause, but the consequence of our commercial prosperity.|Benjamin Disraeli, 1873.}} | ||

Countries that adopt the gold standard are prosperous, it is a direct link between gold standard and prosperity, but it is disillusionment. There is no evidence that the gold standard created prosperity, but what is important is that if people believe in it, it helps determine their actions. | |||

= | = International Elements = | ||

== | == Idea == | ||

For Bismarck, Britain's wealth base is the gold standard. There is a process of imitation, countries are able to imitate other countries either to learn from their political experience. | |||

== | == Hegemony == | ||

It is the power structure between countries and especially the existence of a commercial centre for Britain dominating the international begins. Britain will play a role as a financial centre. Experts believe that this is London's role as a financial centre for the whole world explaining why some countries see an international system based on the gold standard. | |||

== | == Network externalities == | ||

There are network externalities explaining the infatuation of the international system based on the gold standard. The idea is that there is a process of imitation, but the basis of this process of imitation is an economic basis. This means that there are issues of international trade transaction costs. The diffusion of the gold standard is explained by the ability of the international system to reduce the transaction cost of international trade. Authors like Green point to the incentive that some countries will have to adopt an international monetary system between trading partners. In Europe, we see that one of the most important arguments is this argument in order to reduce the costs of trade between countries. | |||

Britain's example is not enough to push all the countries in the world to adopt the gold standard. It was especially in 1872 when Germany adopted the gold standard reinforcing the incentive. The experts who put forward this argument do not explain why Germany makes this decision, but once Germany follows Britain, then two of the three largest world powers share the international monetary system and at that time there is an incentive for other countries to follow them in order to reduce transaction costs. This is a chain reaction with Germany's decision. If we look at the following countries, they are among the most important partners of Germany and Great Britain. | |||

= | = How does the gold standard work? = | ||

[[Fichier:Painting of David Hume.jpg|vignette|David Hume.]] | [[Fichier:Painting of David Hume.jpg|vignette|David Hume.]] | ||

From a theoretical perspective, the operation of the international monetary system based on the gold standard is very simple. There are several formalizations of this system, but the most famous is developed by David Hume known as the flow-price mechanism. | |||

Hume | Hume describes a simplified world where only gold coins circulate in the economy and the role of banks and central banks is negligible. Hume removes the complications of the economy in order to focus on a simplified world in which there is only gold that circulates showing very easy dynamics. Hume notes that each time a commodity is exported, the exporter receives payment in the form of gold. Every time an importer buys a merchant abroad, he must pay in gold. If a country has an external deficit and more precisely a deficit on its trade balance, i.e. imports outweigh exports, this implies a gold outflow. If there is no more gold as silver in the economy, it means that there is a decrease in the quantity of money circulating in the country, and, if there is a decrease in the money available then there is also a fall in demand implying a fall in prices. In countries in deficit, prices are likely to fall. In the country in excess, there is a gold flow that arrives, the quantity of currency increases, demand and also prices increase. There are effects for both countries. | ||

Gold flows produce a relative price change between these two countries, which is why we speak of a flow-price model. The functioning of this flow-price mechanism leads to a restoration of the balance of trade of these two countries. If there is an increase in prices in surplus countries, in deficit countries the price of imported goods is higher than before. For the consumer, as a domestic resident, this means reducing the quantities purchased abroad, and for the exporting country, exports will decrease. For the country in deficit, imports start to fall, and exports will increase leading to a recovery of the trade balance. The flow - price mechanism is automatic, the flows and their consequences on prices do the work themselves. | |||

It is unrealistic because it is too simplified. For greater relevance, economists add complications to make the model closer to reality. Models add the role of central banks. Even when central banks are included in the gold standard theories, they are supposed to strengthen adjustment mechanisms and not thwart them. When a country starts to run a trade deficit, the central bank can intervene to accelerate the adjustment mechanism by reducing the money supply in order to put pressure on prices in order to improve the competitiveness of domestic products by eliminating the external deficit without resorting to a gold outflow. The central bank, in such a theory, accepts the rules of the game coming from the operation described in Hume's model. In this expanded model, the role of central banks is to anticipate adjustment mechanisms and restore trade balance mechanisms more quickly. There are rules of the game inherent in the gold standard system and the central bank accepts these rules of the game. Even when we have central banks, the economists who build this model do not induce an autonomous monetary policy. It is this characteristic that attracts supporters to gold because a system based on gold sets limits for those who want to boost the economy reducing state interventions. | |||

{{citation bloc| | {{citation bloc|There was therefore an automatic mechanism by which the volume of purchasing power in that country was continuously adjusted to world prices. Domestic prices were automatically adjusted to avoid excessive imports. The creation of bank credit enjoyed, without danger, a freedom which excluded any state interference, which would not have been possible with a less rigid monetary system.|Cunliffe Report, The Interim Report of the Committee on Currency and the Foreign Exchanges, 1918, p. 6}} | ||

1918 | 1918 was a time in Britain when the elites sought to re-establish the gold standard. It is also a sign that it is perhaps an effort to restore glory this system not describing the functioning of this system before the First World War. If we look at the reality of how the gold standard worked before the First World War, there is a gap between theory and reality. | ||

One can go further, the gold standard process is an automatic process and an intellectual design rather than a historical reality. There are several reasons for the gap between theory and reality. Among the most important is that the major industrial countries do not follow the rules of the game dictated by the theories of the gold standard. In a study by Arthur Bloomfield, it is shown that in most cases the rules of the game are not followed by central banks. If the rules of the game were followed, it would mean that periods of credit restrictions would have to be accompanied by periods of gold and currency loss. Bloomfield finds that international and domestic liquidity movements are reversed in 60% of observed cases. Most central banks tend to neutralize or offset gold movements, thus neutralizing the consequences of an external imbalance for the domestic economy, protecting the domestic economy, not responding to signals from the international economy. | |||

France is perhaps the best example. The Banque de France is accumulating large reserves to create a barrier between its domestic economy and the world economy in order to maintain a labour margin. We see that other countries are also willing to take steps to maintain some autonomy. If we go beyond monetary policies, we see that the trade policies of the time are still justified by this trend. The idea is to establish a labour margin to escape the consequences of an international dynamic. Banks focus on the importance of the domestic economy. A significant number of industrial countries use this policy to cushion the effects of international dynamics. | |||

Yet such behaviour is not observed in all countries of the world. For peripheral countries, it is not possible to accumulate enough gold stocks to have this labour margin, monetary autonomy is completely fictitious, their gold stocks are too small to guarantee autonomy. The other exception is Britain because it is a very important tendency to prevent the rules of the game. If we look at England's central bank, we see that it follows a monetary policy that respects the rules of the game, reinforcing the automatic adjustment effects of the gold standard. We see how easy it was for these countries to adapt to the requirements of the international system at the time. | |||

A first explanation is based on the consequence of a rise in the interest rate of the Bank of England. In order to reduce supply, the Bank of England is able to raise the interest rate to make money more expensive. But, once the Bank of England has made such a decision to raise the interest rate following a loss of gold, we see that there is a tendency for this decision to restore the external balance very quickly without it being necessary to wait for the adjustment foreseen by the classical theories and in particular that of Humes. Financial investor respondents with confidence in Britain being willing to invest more. They do not have to wait to see the consequences of this adjustment mechanism. We see that international investors think that it is not necessary to have this adjustment mechanism because Great Britain is not suffering a loss of gold. | |||

[[Image:Trade, 1879 - 1939- from globalisation to fragmentation.png|thumb|400px|center]] | [[Image:Trade, 1879 - 1939- from globalisation to fragmentation.png|thumb|400px|center]] | ||

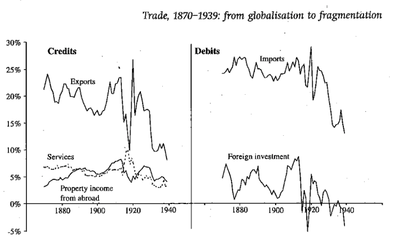

It is possible to have a deficit on the trade balance. When we look at Britain's balance of payments, we see a large deficit on the balance. With such a deficit, we expect a golden exit and deflationary consequences. However, other aspects play an important role in this adjustment. Something else is putting pressure on the balance of payments. It is the fact that there is very significant foreign investment from the British. | |||

The question is how is it possible for Britain to have a trade deficit, and an outflow of gold through investment abroad? Flows are coming into Britain and in particular, the stock of foreign investment is returning returns to Britain that we see in terms of accumulated dividends. We also see that there are exports of services, particularly finance. | |||

If we try to understand Britain's situation solely on the basis of commodities, we see that we are losing very important elements creating a currency deficit that essentially captures Britain's situation during this period because there are other flows that make it possible to support the balance of goods without having a crisis and deflationary consequences. It is an economy that has the luxury of having other inflows of capital. This means that not everything is determined by a deficit on the commodity balance. The situation is not completely unique, but it is rare. Britain is the world's largest international investor and also the most successful country in terms of exporting its services. It is the fact that London is the financial centre of the world that makes these financial services exports. It is not surprising that Britain follows the rules of the game because the rules do not weigh as heavily on Britain as on any other country. | |||

= | = What are the effects of this international monetary system based on the gold standard? = | ||

{{citation bloc| | {{citation bloc|The gold standard system implied an almost perfect monetary stability that was not unrelated to the rapid growth of both foreign trade and international investment. And that is why this 19th century is usually referred to as a century of monetary stability.|Bairoch, 1997, tome 2, p. 348}} | ||

In this quotation, we find a mixture of all the advantages found in the gold standard. There is price stability, monetary stability, and financial globalization. Bairoch exaggerates a lot about price stability and currency stability. | |||

= Price stability = | |||

For proponents of the gold standard, the advantage is the price stability it promises. Between 1880 and 1914, when the world's largest countries committed themselves to the gold standard, the inflation rate was only 0.1% per year. However, there is one very important point to be made. Behind this average lies an initial period of massive deflation and a subsequent price increase. Opponents of the gold standard find that it is because of the gold standard that these price increases are found. It is during this period that the movements for the gold standard develop. Critics note that the amount of gold in the world is too limited to sustain the growing level to sustain global economic activity. Gold production declined during the 1870s and 1880s just as countries entering the gold standard increased. Initially, many economists rejected this analysis. Alfred Marshall already complained in 1888 that precious metals could not serve as good reserves of value. He was critical of the gold standard and any other system based on precious metals. Economists and politicians do not accept that the gold standard constitutes a deflationary means. Yet today, we see that it is quite possible that the gold standard has led to deflation. Friedman will defend the idea that international bimetallism would have shed more light on greater price stability. It is more or less accepted today that the gold standard had deflationary effects during the 1870s and 1880s. | |||

[[File:BaringBaringWall.jpg|thumb|250px|Sir Francis Baring (left), with brother John Baring and son-in-law Charles Wall, in a painting by Sir Thomas Lawrence.]] | The problem of inflation related to the gold standard disparity during the 1890s because there is the discovery of new gold deposit which increases the gold supply and this change draws our attention to the fact that the gold standard does not necessarily have deflationary consequences. It is possible to see the opposite. Ultimately, it is not really possible to see a general relationship between the gold standard and deflation, or between the gold standard and stable prices, depending on the gold stock. The problem with a gold-based monetary standard, like any monetary system based on a scarce commodity, is that the characteristics of the production of this commodity increase a strong influence on the money supply. It is there that one can find the weakness of the gold standard in the fact that the basis of the gold standard system is arbitrary depending on the gold stock that one can increase or decrease.[[File:BaringBaringWall.jpg|thumb|250px|Sir Francis Baring (left), with brother John Baring and son-in-law Charles Wall, in a painting by Sir Thomas Lawrence.]] | ||

We can see that the argument goes the other way. The fact that all countries are based on the same international system has facilitated the transmission of monetary crises. Flows transmit monetary shocks from one country to another. There were several examples of serious crises during the period from 1880 to 1914 such as the Baring Crisis in 1890. At the time, the Baring Bank was one of the largest merchant banks, and this bank found itself in a relatively distressing situation due to problems related to its investments in Argentina creating very significant challenges for Britain, but also for money spreading throughout the world such as the United States. In particular, the financial and banking systems on the periphery are vulnerable creating challenges for peripheral countries to manage currency crises. | |||

We see that the United States became a very important source of monetary and financial crisis at that time, because it was a country where there was an extraordinary development process that became the first world economy on the eve of the First World War, but it was a country that had a rudimentary system without a central bank at that time. It is a rich, but unstable economy, because there is a tendency for the U.S. economy to create shocks, create crises transmit through gold flows to the entire world. So to say that this is an almost perfect monetary period is really an exaggeration. This is a time of monetary instability. London remains very useful as a very important financial centre. | |||

= Annexes = | = Annexes = | ||

Version actuelle datée du 5 novembre 2021 à 01:04

William McKinley ran for president on the basis of the gold standard.

| Professeur(s) | Mary O'Sullivan[1][2][3] |

|---|---|

| Cours | International Economic History |

Lectures

- Introductory aspects of the International Economic History Course

- Introduction to the International Economic History Course

- Between Free Trade and Protectionism: 1846 - 1914

- International triumph of the gold standard: 1871 - 1914

- International Finance and Investment: 1860 - 1914

- New Challenges in International Trade: 1914 - 1929

- New monetary and financial order: 1914 - 1929

- Dark history for the world economy: 1930 - 1945

- Crises and regulations: 1930 - 1945

- Divided trade policies: 1946 - 1973

- Bretton Woods System: 1944 - 1973

- Money, Finance and the World Economy: 1974 - 2000

- Trade and the World Economy: 1974 - 2000

We are going to talk about the international monetary system. This is a subject that is both difficult and important, it is a somewhat obscure subject that remains the case for the monetary aspects of our economies. Increasingly, monetary economics is taught on the basis of economic models can be adapted to the current situation, but these models are not adapted for the most part to the past. The past can still inspire the present. We hear more and more about the systems of the past and more precisely about the gold standard system as a guarantee of the money system.

To talk about monetary policy, we must start by talking about the currency that works as an exchange instrument. Without money, you have to barter, exchange one product for another. There are normally three functions of money: an instrument of exchange[1] for carrying out transactions within an economy or through international trade; an instrument of account[2]; and a reserve instrument[3] as a precautionary measure for later purchases. These functions are important at the household level, but also at the country or state level.

Some currencies can serve as a monetary standard, but the role of precious metals as a basis for exchange dates back to antiquity. The value of money is defined by a certain weight of precious metals. A wide variety of metals form the monetary base of countries such as gold, silver or copper. These metals form the basis of internal regulations as well as international regulations. From 1870 on, something important changed at the international level. There is a rush towards a new homogeneous international system through a gold rush. That is, the most important countries in the world link their reserves to gold; they decide to make the quantity of money in net circulation and thus the market economic activity depend on the gold reserve they hold in their official reserves. That is why we have the international system called the international gold standard.

For an increasing number of countries, they are making decisions on the basis of gold as the domestic standard and gold was increasingly functioning as an international standard and therefore the international standard functions as a fixed exchange rate. When a country decides to fix its currency on gold, it fixes it in relation to other countries. If all countries decide to fix their currency on gold, they also fix it against the currency of another country. We are not only talking about an international system based on gold, but it also works as a fixed exchange rate.

The international triumph of the gold standard[modifier | modifier le wikicode]

Everything begins with the United Kingdom which makes the first important step towards the gold standard and more precisely England taking this way in a largely accidental way. In 1665, Isaac Newton was rewarded for an important scientific discovery. At the time, England's system was bimetallic, combining two gold and silver standards by establishing a parity between the prices of the two metals. By fixing the parity of the two metals, the exchange rate between gold and silver, Newton makes a mistake. It undervalues silver and overvalues gold. Therefore, there is an important incentive to buy gold and export the silver to sell it more expensive elsewhere. This trend continued until all the country's silver coins were exported and England was therefore only on the gold standard from 1717. However, the monetary system was not recognized as such at the time; formally bimetallism remained in place until the Napoleonic wars. During the Napoleonic Wars, the Bank of England suspended the convertibility of its money and after the Napoleonic Wars in 1819, the UK government formally adopted the gold standard.

The gold standard in the strict sense respects certain conditions:

- the national currency unit is defined by a quantity of gold;

- the currency in circulation is proportionate to the central bank's gold reserves;

- the convertibility of this currency into gold is ensured by the bank;

- gold can be freely exported and imported.

If we think about these characteristics, we can understand the great merit given to the gold standard at the time and its ability to control inflation. It is difficult to have inflation caused by a change in government policy. In other words, it is difficult to create money, because if too much money is created, gold is lost and confidence in the ability to ensure currency convertibility is lost. Proponents of the gold standard sell the system's ability to promote economic change without government or central bank intervention.

In the hypothetical situation where the workers demand an increase in their salary granted by the industrialists, if this increase in salary also increases the production costs of this country, consequently there is a decrease in the competitiveness of this country, exports become too expensive. Expectations are for a drop in exports in such a situation. If there is a fall in exports, it implies an imbalance in that country's trade balance. The implication is that if one has to pay for imports, or more precisely the deficit that exists between net import and export, one has to spend a certain part of the gold reserves implying the decrease of gold reserves, on a standard system this obliges to decrease the quantity of currency in circulation in the country. If we reduce the currency, we deflate the economy and therefore demand falls. If there is a decrease in demand, it puts downward pressure on the country. This is a situation where the gold standard system restores the initial balance. We respond to an imbalance with a system that can be quite brutal with a fall in prices and wages to restore balance to the economy. Such a system requires a very strong flexibility of all prices and wages pulling prices down when the country suffers an economic crisis. Opponents of the gold standard insist on the brutality of this system widening a gap with the partisans.

So far, only the United Kingdom has such a system. Following the adoption of such a system, one does not immediately see a rush towards the gold standard by other countries. Portugal will adopt the gold standard only in 1854. Generally speaking, the gold standard remains a minority system.

What system is found in other countries before the gold standard? The system found elsewhere is the system abandoned by the British. During the 19th century, the monetary system of many countries was the bimetallic standard also called a bimetallic system like France and the United States. Another form is another monometallism which is silver monometallism. The German Confederation, the Austro-Hungarian Empire, many countries of the Middle East adopt this system. It is thus possible to divide the monetary system into three: gold; silver; and bimetallic.

Before 1870, the international monetary system was a heterogeneous complement. From 1872 onwards, and particularly following Germany's decision to move to the gold standard, there was a radical change in the international monetary system. It was the change in the Franco-Prussian war that forced France, Italy, Russia and the Austro-Hungarian Empire to suspend their monetary system. England is an island and it is difficult to predict the post-war system. It was Germany that tipped the balance with its passage to the gold standard in 1872. The period from 1872 to 1880 there was a rapid change with Denmark and Sweden joining Germany in 1873, then France, Italy and Greece moving to the gold standard system in 1874. At the end of the 19th century, Spain was the only country left to work with inconvertible paper.

In Europe, a large majority of countries switch to the gold standard as the monetary system. We see almost the same trajectory outside Europe. The United States is recovering from the Civil War, its system was based on greenbacks that are unconvertible. In 1873 the American government made the decision not to resume free minting money. The United States decides to make these notes convertible into gold and not silver. From then on, this country began to function de facto with gold as its monetary base. The fact that we see the U.S. move to the gold standard does not mean that it is not contested. To have a definitive position of the United States with respect to the gold standard it is necessary to wait 1900 which is the moment when it is legally adopted by the Congress. Even in this country where there is a fairly long period of debate, in 1900 there is no doubt that the United States operates with a gold standard. In 1890, India, which had been working for a very long time with the silver standard, fixed the rupee on the British pound, Russia too, but also the Latin American countries. China and only a few Central American countries remain to maintain the monetary standard. We can really talk about an international monetary system based on gold. The trend of this international gold-based system faces obstacles.

How do we explain the adoption of the gold standard?[modifier | modifier le wikicode]

It is possible to propose three arguments as an explanation:

- ineluctability: technological determinism is often mentioned.

- special circumstances: the special circumstances at a particular time.

- economic policy.

Inelectability[modifier | modifier le wikicode]

Increase in silver supply[modifier | modifier le wikicode]

Two arguments are proposed with first the argument based on the change in the supply of precious metals and in particular the supply of silver. Experts believe that the gold standard rush can be explained by the technical weakness of the precursors of the gold standard and more precisely of bimetallism. There are problems within this system that make it impossible for this system to survive and it is inevitable that we have to change this system for something else. Bimetallism does not include significant problems as long as the relationship between the value of gold and silver remains stable. In the middle of the 19th century there appeared an important change compared to the supply of silver, there is an increase in the supply of silver following the discovery of new deposits of silver as in Nevada and elsewhere, moreover, there is a more efficient process of extraction of silver. Some experts claim that these events overload the amount of money in circulation.

What is the implication for the international monetary system? This causes the market price to fall, reducing opportunities for countries whose system is based on bimetallism. Certainly, bimetallism faces an important test in its management of silver supply disruptions, but there are changes in gold production that are putting pressure on the bimetallic system.

Concerning the production of gold, there are important discoveries notably in the United States in the middle of the XIXth century. These changes would cause gold prices to fall.

It is not clear that an argument based on changing the supply of money holds water. Moreover, if we look at the measures of international stability before 1870, we see something impressive, even extraordinary. Despite all the changes, before 1870, there was extraordinary stability. There's no sign of instability. That is, the players, central banks and private actors manage to stabilize the exchange rate between the two precious metals. It is only after Germany's decision that we see a significant change in the value of money.

The monetary pressures exerted by changes in the supply of silver and gold were remarkably well managed by a heterogeneous monetary system before 1870. It is a heterogeneous and flexible system. Countries that practiced bimetallism, such as France before 1870, served as a shock absorber for the exchange rate, which risked shifting the relationship between gold and silver, because it was capable of absorbing large quantities of silver and gold. The circulation composition of these countries is modified according to changes in the supply of silver and gold. Despite monetary heterogeneity before 1870, the international monetary system was a fixed exchange rate system. The relationship between the two metals is stable so it's fixed. If we change scale, there is more stability.

We see that there is instability to manage, but most specialists note that this instability is not sufficient to call into question the functioning of the international system before 1870. We cannot see on the basis of such a graph that there is a problem with money. It is only following the German decision that we see a fall in the price of money on the international markets.

This first argument does not really hold water, one cannot say that these changes are not really important. We will see that finally, the decision to base a standard on a precious metal is a risk of a change in supply.

Steam engine[modifier | modifier le wikicode]

This argument leads to a certain inevitability in the transition to the gold standard. The invention of the steam engine is closely linked to the process of internationalization. Gold is too expensive to be used for small transactions. Another metal of lesser value was needed for these transactions, i.e. money at the time. The problem is counterfeiting, because anyone can easily make a silver coin not far from a silver coin made by the Mint in England. On the other hand, once it is capable of using steam presses, it is possible to produce high precision parts by stamping parts officially. This change makes it possible to replace the small silver and worthless coins allowing to abandon the silver to pass to the gold standard. Once again, ineluctability plays a role. However, there is a timing problem. France adopted the press relatively early, but adopted the gold standard late.

Special Circumstances[modifier | modifier le wikicode]

This argument contrasts with the inevitability. Germany is the first largest country after the United Kingdom.

« Germany's conversion to gold "was facilitated after the country's victory over France in 1871, which led to a substantial indemnity payment in gold. The resulting increase in the government's gold reserves allowed it to go onto gold with little difficulty between 1871 and 1873. »

— Frieden, 1993, p. 145

The idea is that there are special circumstances at the end of the War of 1870. The Frankfurt Peace Treaty of 1871 obliges France to pay compensation of 5 billion francs to Germany. Germany takes advantage of this income to accumulate gold and mint coins. However, France pays only a minority of the allowances.

Internal elements[modifier | modifier le wikicode]

Perhaps some aspects of economic policy need to be looked at in order to understand the incentives for these countries to make a transition to the gold standard. It can be seen that the choices depend on domestic elements and international factors. For interior elements, there are internal possibilities compared to monetary systems. Within countries, there are often very discussed and debated discussions between different national actors, as they have different economic interests in relation to different monetary systems.

It is in the United States that we see the fiercest battle around the adoption of the gold standard. There was the decision of the United States in 1873 not to resume free minting silver and then there was the decision to convert greenbacks into gold and the de facto beginning of a gold standard system in the United States.

The suspension of the minting of money became very controversial especially for the interests of money miners. In the United States, we see an increase in the power of the western states because they are silver producers. They are not at all happy with this decision because they are trying to get rid of their stocks of money by selling them to the American treasury. All of a sudden they are losing access to that market because the decisions made by the U.S. government in the 1870s are making it impossible to absorb the growing stock of money. This situation is described by money miners as a crime. This decision gave birth to the famous Silver lobby which is a pressure group that brings together powerful mining interests opposed to the demonetization of money for obvious interests.

These mining interests find allies among farmers who also oppose the gold standard because of its deflationary effects. As early as the late 1890s, we see that the price level in the United States has been rising for twenty years. Farmers' representatives note that there is no coincidence that global economic production is growing much faster than the global gold stock in the global economy. There is talk of a shortage of gold because of the need of the world economy and therefore an unnecessary fall in demand and prices of goods and services. So, they see that this fall and deflation are created by monetary policy and artificially as a result of the decision to base the currency on an insufficient stock of gold to support global economic activity and growth. Farmers are the ones who notice this, because there is a situation where deflation weighs very heavily on farmers implying a decrease in the prices of their products and deflation is particularly serious on the markets of agricultural products, moreover, these farmers are more often indebted. Having a decrease in product prices does not imply a decrease in interest. There is a painful situation where incomes tend to decrease, but the level of interest remains at the same level. This is not a decision they have to accept, because there is a solution and that is why they are in favour of increasing prices to increase their income and reduce their debt burden. They propose that the government issue more money by being a gold standard whose stock is reduced, but also on silver. They agree with the Silver lobby, but for different reasons. In 1878 the Bland Allison Act was passed and in 1890 the Sherman Act.

We also see that other indebted people in the United States at the time had the same interest in fighting deflation by creating either a silver standard system or a bimetallic system. They are advocates of change.

Opponents were very powerful at the time in the United States. Silver lobby supporters oppose creditor interests as well as owners who support strong currency. One can imagine the same speech for monetary debates these days. International trade and financial flows reached historic levels unprecedented at the time, and industrialists in the east had an interest in strengthening the reputation of the United States and the security of the American currency. Republicans and Democrats support the gold standard, but the free money movement against the gold standard is becoming increasingly important.

There is some success in this movement, but perhaps the most important moment for this debate is the political campaign against the gold standard that culminated in the 1896 presidential election. The populist party was founded in 1891 to fight the fall in prices, making the silver standard system an element of its campaign. Democrats must answer for the claims of mining interests proposing a candidate against the gold standard and for "free silver". This candidate is Bryan who wins the support of the Democrats, but also the populists. In the Speech of the Golden Cross, the crowd becomes frenetic. Bryan loses the presidential election in favor of McKinley by a narrow margin, the margin of 600,000 lanes is very small. There is then a clear decision by the United States to base its currency on gold becoming the official standard of the United States.

Interest[modifier | modifier le wikicode]

The US case study helps to understand what explains or blocks the transition. In the American case, we see that the battle between silver and gold is a battle between the different economic interests between creditors and debtors. Overall until the 20th century, the United States was an indebted country that attracted a lot of capital to finance its government debt and the construction of its railways. As the country becomes richer, the balance shifts in favour of creditors and therefore in favour of the hard currency. A dynamic is taking hold, the United States is becoming an increasingly wealthy country with increasing savings, the interests of creditors are becoming increasingly important explaining the transition to the gold standard because creditors prevail over debtors.

In the case of Great Britain, we see that the adoption of the gold standard is controversial. For example, after the Napoleonic wars, there was the same kind of battle, yet national interests and creditors were much more powerful in Great Britain than in the United States because we were talking about the richest country in the world at the time. The fact that creditors are able to prevail over creditors is much less important than for the United States.

Political institutions[modifier | modifier le wikicode]

Political institutions help explain the transition.

« In the nineteenth century, the characteristic pressure of the twentieth century for governments to subordinate monetary stability to other objectives was still ignored. The credibility of the political determination to maintain convertibility was reinforced by the fact that workers, who suffered most from the hardships of the times, were in a very poor position to make their voices heard. In many countries, the right to vote was still censal (in practice, women were almost everywhere deprived of the right to vote). Moreover, the Labour parties which were likely to defend the interests of the workers were still in an embryonic state. For all these reasons, the fact that the central bank maintained convertibility as a priority objective was not disputed. »

— Eichengreen

There are political foundations of the important gold standard to understand. It is a socially constructed institution whose viability depends on the system of which it functions. Some interests are not very well represented at the political level. Events allow the creation of a binding system, but we cannot have the same political institutions. In the 1920s, it became increasingly difficult for central bankers to suppress demand to suppress inflation. Central bankers will win, but it becomes much more difficult to insist on the constraints imposed by a system like the gold standard.

Ideas[modifier | modifier le wikicode]

Historians speak of a widespread conception at the time of a close relationship between the gold standard and Britain's financial and economic dominance.

« The tendency of opinion in Europe had been for 20 years in favor of the monometallic system. From the example of England it was seen that the English by the mono-metallic system of a gold standard enjoyed great advantages, and the Continental countries, especially Prussia, seeing this, decided to go into the mono-metallic system… The prosperity of England is due largely to its monetary standard… [T]hose [nations] who adopted gold as their standard of value have … been most permanently prosperous. »

— Testimony to U.S. Monetary Commission, 1876.

« It is the greatest delusion in the world to attribute the commercial preponderance and prosperity of England to our having a gold standard. Our gold standard is not the cause, but the consequence of our commercial prosperity. »

— Benjamin Disraeli, 1873.

Countries that adopt the gold standard are prosperous, it is a direct link between gold standard and prosperity, but it is disillusionment. There is no evidence that the gold standard created prosperity, but what is important is that if people believe in it, it helps determine their actions.

International Elements[modifier | modifier le wikicode]

Idea[modifier | modifier le wikicode]

For Bismarck, Britain's wealth base is the gold standard. There is a process of imitation, countries are able to imitate other countries either to learn from their political experience.

Hegemony[modifier | modifier le wikicode]

It is the power structure between countries and especially the existence of a commercial centre for Britain dominating the international begins. Britain will play a role as a financial centre. Experts believe that this is London's role as a financial centre for the whole world explaining why some countries see an international system based on the gold standard.

Network externalities[modifier | modifier le wikicode]

There are network externalities explaining the infatuation of the international system based on the gold standard. The idea is that there is a process of imitation, but the basis of this process of imitation is an economic basis. This means that there are issues of international trade transaction costs. The diffusion of the gold standard is explained by the ability of the international system to reduce the transaction cost of international trade. Authors like Green point to the incentive that some countries will have to adopt an international monetary system between trading partners. In Europe, we see that one of the most important arguments is this argument in order to reduce the costs of trade between countries.

Britain's example is not enough to push all the countries in the world to adopt the gold standard. It was especially in 1872 when Germany adopted the gold standard reinforcing the incentive. The experts who put forward this argument do not explain why Germany makes this decision, but once Germany follows Britain, then two of the three largest world powers share the international monetary system and at that time there is an incentive for other countries to follow them in order to reduce transaction costs. This is a chain reaction with Germany's decision. If we look at the following countries, they are among the most important partners of Germany and Great Britain.

How does the gold standard work?[modifier | modifier le wikicode]

From a theoretical perspective, the operation of the international monetary system based on the gold standard is very simple. There are several formalizations of this system, but the most famous is developed by David Hume known as the flow-price mechanism.

Hume describes a simplified world where only gold coins circulate in the economy and the role of banks and central banks is negligible. Hume removes the complications of the economy in order to focus on a simplified world in which there is only gold that circulates showing very easy dynamics. Hume notes that each time a commodity is exported, the exporter receives payment in the form of gold. Every time an importer buys a merchant abroad, he must pay in gold. If a country has an external deficit and more precisely a deficit on its trade balance, i.e. imports outweigh exports, this implies a gold outflow. If there is no more gold as silver in the economy, it means that there is a decrease in the quantity of money circulating in the country, and, if there is a decrease in the money available then there is also a fall in demand implying a fall in prices. In countries in deficit, prices are likely to fall. In the country in excess, there is a gold flow that arrives, the quantity of currency increases, demand and also prices increase. There are effects for both countries.

Gold flows produce a relative price change between these two countries, which is why we speak of a flow-price model. The functioning of this flow-price mechanism leads to a restoration of the balance of trade of these two countries. If there is an increase in prices in surplus countries, in deficit countries the price of imported goods is higher than before. For the consumer, as a domestic resident, this means reducing the quantities purchased abroad, and for the exporting country, exports will decrease. For the country in deficit, imports start to fall, and exports will increase leading to a recovery of the trade balance. The flow - price mechanism is automatic, the flows and their consequences on prices do the work themselves.

It is unrealistic because it is too simplified. For greater relevance, economists add complications to make the model closer to reality. Models add the role of central banks. Even when central banks are included in the gold standard theories, they are supposed to strengthen adjustment mechanisms and not thwart them. When a country starts to run a trade deficit, the central bank can intervene to accelerate the adjustment mechanism by reducing the money supply in order to put pressure on prices in order to improve the competitiveness of domestic products by eliminating the external deficit without resorting to a gold outflow. The central bank, in such a theory, accepts the rules of the game coming from the operation described in Hume's model. In this expanded model, the role of central banks is to anticipate adjustment mechanisms and restore trade balance mechanisms more quickly. There are rules of the game inherent in the gold standard system and the central bank accepts these rules of the game. Even when we have central banks, the economists who build this model do not induce an autonomous monetary policy. It is this characteristic that attracts supporters to gold because a system based on gold sets limits for those who want to boost the economy reducing state interventions.

« There was therefore an automatic mechanism by which the volume of purchasing power in that country was continuously adjusted to world prices. Domestic prices were automatically adjusted to avoid excessive imports. The creation of bank credit enjoyed, without danger, a freedom which excluded any state interference, which would not have been possible with a less rigid monetary system. »

— Cunliffe Report, The Interim Report of the Committee on Currency and the Foreign Exchanges, 1918, p. 6

1918 was a time in Britain when the elites sought to re-establish the gold standard. It is also a sign that it is perhaps an effort to restore glory this system not describing the functioning of this system before the First World War. If we look at the reality of how the gold standard worked before the First World War, there is a gap between theory and reality.

One can go further, the gold standard process is an automatic process and an intellectual design rather than a historical reality. There are several reasons for the gap between theory and reality. Among the most important is that the major industrial countries do not follow the rules of the game dictated by the theories of the gold standard. In a study by Arthur Bloomfield, it is shown that in most cases the rules of the game are not followed by central banks. If the rules of the game were followed, it would mean that periods of credit restrictions would have to be accompanied by periods of gold and currency loss. Bloomfield finds that international and domestic liquidity movements are reversed in 60% of observed cases. Most central banks tend to neutralize or offset gold movements, thus neutralizing the consequences of an external imbalance for the domestic economy, protecting the domestic economy, not responding to signals from the international economy.

France is perhaps the best example. The Banque de France is accumulating large reserves to create a barrier between its domestic economy and the world economy in order to maintain a labour margin. We see that other countries are also willing to take steps to maintain some autonomy. If we go beyond monetary policies, we see that the trade policies of the time are still justified by this trend. The idea is to establish a labour margin to escape the consequences of an international dynamic. Banks focus on the importance of the domestic economy. A significant number of industrial countries use this policy to cushion the effects of international dynamics.

Yet such behaviour is not observed in all countries of the world. For peripheral countries, it is not possible to accumulate enough gold stocks to have this labour margin, monetary autonomy is completely fictitious, their gold stocks are too small to guarantee autonomy. The other exception is Britain because it is a very important tendency to prevent the rules of the game. If we look at England's central bank, we see that it follows a monetary policy that respects the rules of the game, reinforcing the automatic adjustment effects of the gold standard. We see how easy it was for these countries to adapt to the requirements of the international system at the time.