« Open Macroeconomics: the Exchange Rate » : différence entre les versions

(Page créée avec « {{Infobox Lecture | image = | image_caption = | cours = Introduction to Macroeconomics | faculté = | département = | professeurs = *Federica Sbergami|Sb... ») |

Aucun résumé des modifications |

||

| (18 versions intermédiaires par le même utilisateur non affichées) | |||

| Ligne 29 : | Ligne 29 : | ||

{{Translations | {{Translations | ||

| | | fr = La macroéconomie ouverte: le taux de change | ||

| es = | | es = Macroeconomía abierta: el tipo de cambio | ||

}} | }} | ||

== | == The price of international transactions == | ||

The exchange rate between two countries is the price at which trade between them takes place. | |||

There are two types of exchange rates : | |||

* | *The '''nominal exchange rate''' (Purchasing Power Parity theory and foreign exchange market → this chapter); | ||

* | *The '''real exchange rate''' (equilibrium condition in an open economy → next chapter). | ||

== | == The nominal exchange rate == | ||

The nominal exchange rate is the rate at which an individual can exchange the currency of one country for that of another (relative price of two currencies). | |||

The nominal exchange rate is measured in two ways | |||

* | *Unsure ("direct quotation") = # of units of national currency per unit of foreign currency (e.g. 1 EUR is equivalent to 1.20 CHF for a Swiss resident). | ||

* | *to the certain ("indirect quotation") = # units of foreign currency per unit of national currency (e.g. 1 CHF equals 0.83 EUR for a Swiss resident). This type of quotation is applied in London, New York and since the introduction of the single currency on all places in the Euro zone. | ||

By definition the expression "CHF/EUR" is equivalent to the quotation at the certain and is currently worth about 0.83. | |||

Obviously: exchange rate at uncertain = 1 / exchange rate at certain | |||

Currency appreciation occurs when you can buy more units of foreign currency with one unit of domestic currency (↓ from exchange rate measured to uncertain and ↑ from exchange rate to certain). Depreciation occurs when you can buy fewer units of foreign currency with one unit of national currency. | |||

For this rate, we will represent the exchange rate by the variable "e", which represents the amount of foreign currency that we get for one unit of domestic currency. If e ↑ = appreciation of the domestic currency. | |||

== | == The real exchange rate == | ||

The real exchange rate is the rate at which an individual can exchange domestic goods and services with those of another country (relative price of goods). | |||

It depends on the nominal exchange rate and the prices of goods in both countries: | |||

Real exchange rate (ε) = <math>\frac {\text{Nominal exchange rate (e)} \times \text{Prices of domestic goods (P)}} {\text{Prices of goods abroad} (P*)}</math> | |||

[[Fichier:Intro macro graphe taux de change réel 1.png|200px|vignette|droite]] | [[Fichier:Intro macro graphe taux de change réel 1.png|200px|vignette|droite]] | ||

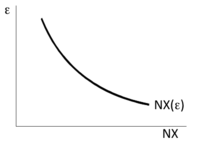

The real exchange rate is a crucial factor in determining a country's exports and imports. | |||

A real depreciation of the currency (↓ of the real exchange rate) means that the domestic country's goods have become cheaper → consumers (domestic and foreign) demand more domestic goods and less foreign goods → the country's EXPs ↑ and IMPs ↓ and consequently net exports (NX) ↑. | |||

== | == PPP Determination of the Nominal Exchange Rate == | ||

The Purchasing Power Parity (PPP) theory is the simplest and generally accepted explanation for nominal exchange rate fluctuations in the long run. According to PPP, one unit of a currency buys the same amount of goods in all countries. | |||

Hypothesis: ''Law of One Price'' = arbitrage forces equalize the price of the same good sold on different markets. If this is true for all goods | |||

:::::<math>P^* = eP</math> | :::::<math>P^* = eP</math> | ||

''' | '''Absolute PPP''': a currency must have the same purchasing power in all countries and the exchange rate varies to ensure this. | ||

:::::<math>e = \frac {P^*}{P}</math>. | :::::<math>e = \frac {P^*}{P}</math>. | ||

''' | '''relative PPP''' (less restrictive than absolute PPP): the exchange rate between the currencies of two countries reflects the difference in the general price level of these two countries. | ||

::::: | :::::percentage change in e = percentage change in <math>P^*</math> - variation % de <math>P</math> = <math>(\pi^* - \pi )</math> | ||

== | == Inflation differentials and the exchange rate == | ||

If the central bank increases the supply of money, domestic money loses value in real terms (inflation) and in terms of the number of units of foreign currency it can buy (continuous depreciation). | |||

[[Fichier:Intromacro différentiels d’inflation et le taux de change 1.png|400px|vignette|centré|Source: Mankiw 2003]] | [[Fichier:Intromacro différentiels d’inflation et le taux de change 1.png|400px|vignette|centré|Source: Mankiw 2003]] | ||

== | == The exchange rate in times of hyperinflation (Germany) == | ||

[[Fichier:Taux de change en période d’hyperinflation (Allemagne) 1.png|400px|center|vignette]] | [[Fichier:Taux de change en période d’hyperinflation (Allemagne) 1.png|400px|center|vignette]] | ||

== | == Criticisms of the PPP == | ||

# | #Not all goods are traded → non-exchangeable goods (they represent a significant part of GDP) → the law of one price for these goods is not verified; | ||

# | #Tradable goods are not necessarily perfect substitutes (national preference and non-homogeneous goods) → different spending structures and no trade-offs; | ||

#Free trade barriers (trade barriers, transport costs...) → no arbitrage. | |||

== The Big Mac Index == | |||

The economist's Big Mac index, (see readings): instead of considering a basket of goods to construct P and P*, we consider the price of a single good, the McDonald's Big Mac (= basket of ingredients, the same everywhere). | |||

Theoretical exchange rate : | |||

<math>e_{th} = \frac {P_{CHF}^{BM}}{P_{USD}^{BM}}</math> | <math>e_{th} = \frac {P_{CHF}^{BM}}{P_{USD}^{BM}}</math> | ||

If <math>e_{obs} > e_{th}</math>, an appreciation of the CHF (= depreciation of the USD) is to be expected. | |||

[[Fichier:Intromacro index bigmac 1.gif|center|400px|vignette]] | [[Fichier:Intromacro index bigmac 1.gif|center|400px|vignette]] | ||

== | == The foreign exchange market == | ||

PPP provides a (long-term) reference value towards which the exchange rate is expected to move. | |||

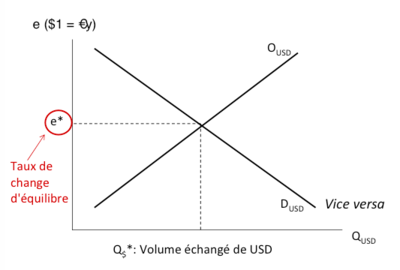

Exchange rate: the relative price of one currency to another currency. Like any other price, also the price of a currency is determined, in the short term, by the meeting of demand and supply (=> fluctuations around the long-term value determined by PPP). | |||

PPP provides a (long-term) reference value towards which the exchange rate is expected to move. | |||

Exchange rate: The relative price of one currency to another currency. Like any other price, also the price of a currency is determined, in the short term, by the meeting of demand and supply (=> fluctuations around the long-term value determined by PPP). | |||

Example: buying and selling USD against Euros (determinants of O and D): | |||

* | *Offer USD = Request Euros | ||

** | **European B&S experts | ||

** | **European asset managers | ||

**... | **... | ||

** | **Central bank interventions (USD sales → curve shift) | ||

* | *Demand USD = Offer Euros | ||

** | **B&S European Imp. | ||

**Imp. | **European Asset Imp. | ||

**... | **... | ||

** | **Central bank interventions (USD purchases → curve shift) | ||

When the USD appreciates against the Euro (it takes more Euros for $1), European products seem cheaper to Americans, who will ask for more => conversion of more $ against Euros in the foreign exchange market => increasing $ bid function. | |||

[[Fichier:Intromacro marché des changes 1.png|400px|vignette|centré]] | [[Fichier:Intromacro marché des changes 1.png|400px|vignette|centré]] | ||

SHOCKS: any change in the supply or demand for US dollars will have an impact on the balance of the foreign exchange market. | |||

If, for example, the flow of European capital to the United States were to increase because of a change in investor preferences, the demand curve would shift to the right, causing the US dollar to appreciate against the euro (which would also lead to an improvement in the European trade balance: the balance of payments is still in equilibrium). | |||

In reality the impact of shocks on the equilibrium exchange rate depends on the flexibility of the exchange rate → EXCHANGE RULES = set of rules governing the foreign exchange market. | |||

Two "extreme" exchange rate regimes (floating and fixed exchange rates) as well as a multitude of other intermediate possibilities (administered floats, fluctuation bands, etc.). | |||

== | == Flexible exchange rate regime == | ||

Under such an exchange rate regime : | |||

* | *central banks never intervene in the foreign exchange market... | ||

* | *the balance of accounts is always in equilibrium (the exchange rate adapts to any variations in the currency O and D to restore equilibrium) : | ||

** | **If deficit of the Balance → depreciation of the currency | ||

** | **If surplus in the balance → appreciation of the national currency | ||

<gallery mode="nolines" widths=200px heights=200px> | <gallery mode="nolines" widths=200px heights=200px> | ||

intromacro Régime de changes flottants 1.png| | intromacro Régime de changes flottants 1.png|Example: Increase of the European EXP of B&S (=> <math>ED_Euros</math> => appreciation of the Euro). | ||

intromacro Régime de changes flottants 2.png| | intromacro Régime de changes flottants 2.png|Example: decrease of European EXP by K (=> <math>EO_USD</math> => appreciation of the Euro). | ||

</gallery> | </gallery> | ||

== | == Fixed exchange rate regime == | ||

Under such an exchange rate regime, central banks constantly intervene in the market to ensure a certain exchange rate parity → loss of central bank autonomy: monetary policy is no longer an independent instrument of intervention for the central bank (the supply of money varies to keep the value of the national currency on the foreign exchange market constant). | |||

Examples of this are : | |||

* | *Gold standard system, 1879 - 1914: fixed gold parity; | ||

* | *Gold exchange standard system (Bretton Woods), 1946 - 1973: fixed parity in US dollars in turn fixed in gold; | ||

* | *European Monetary System, 1979 - 1999: fluctuations allowed in a tunnel around the parity; | ||

* | *In many countries, the national currency is pegged to another currency. | ||

Problem: | |||

* | *the rate set by the BC may not coincide with the equilibrium rate → interventions to maintain the desired parity. | ||

[[Fichier:Intromacro Régime de change fixe 1.png|300px|vignette| | [[Fichier:Intromacro Régime de change fixe 1.png|300px|vignette|The equilibrium rate is below the target exchange rate]] | ||

THREE OPTIONS to avoid depreciation of the Hong Kong dollar : | |||

#Interventions on the foreign exchange market: BC absorbs the HKD surplus by buying its currency in exchange for USD. Problem: BCs' currency reserves are not unlimited. | |||

#Monetary policy interventions aimed at moving the O and D curves: for example, if BC raises the domestic interest rate, the increase in incoming capital would increase the demand for HKD (moving the D function to the right). | |||

#Exchange controls. Introduction of limits on the purchase of foreign currency. | |||

NB: obviously these three measures will be applied in the opposite direction if <math>e_{target} < e^*</math>. | |||

NB | |||

== | == Fixed vs. floating changes == | ||

There are several arguments in favour of adopting a fixed exchange rate regime (no uncertainty, stability, inflation control...), but there are also costs associated with exchange rate fixing: loss of monetary policy independence, distortions due to exchange rate controls. | |||

This dilemma is summarised in a principle known in the literature as the '''Mundell's Trilemma''' or the ''Impossible Trinity''. | |||

A country cannot simultaneously have a fixed exchange rate (and thus ensure stability in international interactions), ensure full capital mobility (and thus promote financial market integration and efficiency) and benefit from an autonomous monetary policy (and thus manage a stabilization economic policy instrument). | |||

= | = Summary = | ||

* | * The exchange rate between two countries is the price at which they trade with each other... | ||

* | * Currency appreciation is when you can buy more units of foreign currency with one unit of domestic currency... | ||

* | * A country's net exports depend on the real exchange rate: a depreciation makes a country's domestic goods cheaper and consequently net exports increase. | ||

* | * The nominal exchange rate reflects the differential between inflation rates (PPP). | ||

* | * PPP is based on fairly restrictive assumptions (all tradable goods, same expenditure structure, trade-offs). | ||

* | * The parity between two currencies is the equilibrium price on the foreign exchange market... | ||

* | * There are two exchange rate regimes: fixed (central bank intervention to maintain the exchange rate) and floating (no central bank intervention). | ||

= Annexes = | = Annexes = | ||

On the BigMac Index: | |||

*McCurrencies, The Economist, 24.04.2003 | *McCurrencies, The Economist, 24.04.2003 | ||

*Bunfight, The Economist, 02.02.2013 | *Bunfight, The Economist, 02.02.2013 | ||

Version actuelle datée du 4 avril 2020 à 12:02

| Professeur(s) | |

|---|---|

| Cours | Introduction to Macroeconomics |

Lectures

- Introductory aspects of macroeconomics

- Gross Domestic Product (GDP)

- Consumer Price Index (CPI)

- Production and economic growth

- Unemployment

- Financial Market

- The monetary system

- Monetary growth and inflation

- Open Macroeconomics: Basic Concepts

- Open Macroeconomics: the Exchange Rate

- Equilibrium in an open economy

- The Keynesian approach and the IS-LM model

- Aggregate demand and supply

- The impact of monetary and fiscal policies

- Trade-off between inflation and unemployment

- Response to the 2008 Financial Crisis and International Cooperation

The price of international transactions[modifier | modifier le wikicode]

The exchange rate between two countries is the price at which trade between them takes place.

There are two types of exchange rates :

- The nominal exchange rate (Purchasing Power Parity theory and foreign exchange market → this chapter);

- The real exchange rate (equilibrium condition in an open economy → next chapter).

The nominal exchange rate[modifier | modifier le wikicode]

The nominal exchange rate is the rate at which an individual can exchange the currency of one country for that of another (relative price of two currencies).

The nominal exchange rate is measured in two ways

- Unsure ("direct quotation") = # of units of national currency per unit of foreign currency (e.g. 1 EUR is equivalent to 1.20 CHF for a Swiss resident).

- to the certain ("indirect quotation") = # units of foreign currency per unit of national currency (e.g. 1 CHF equals 0.83 EUR for a Swiss resident). This type of quotation is applied in London, New York and since the introduction of the single currency on all places in the Euro zone.

By definition the expression "CHF/EUR" is equivalent to the quotation at the certain and is currently worth about 0.83.

Obviously: exchange rate at uncertain = 1 / exchange rate at certain

Currency appreciation occurs when you can buy more units of foreign currency with one unit of domestic currency (↓ from exchange rate measured to uncertain and ↑ from exchange rate to certain). Depreciation occurs when you can buy fewer units of foreign currency with one unit of national currency.

For this rate, we will represent the exchange rate by the variable "e", which represents the amount of foreign currency that we get for one unit of domestic currency. If e ↑ = appreciation of the domestic currency.

The real exchange rate[modifier | modifier le wikicode]

The real exchange rate is the rate at which an individual can exchange domestic goods and services with those of another country (relative price of goods).

It depends on the nominal exchange rate and the prices of goods in both countries:

Real exchange rate (ε) =

The real exchange rate is a crucial factor in determining a country's exports and imports.

A real depreciation of the currency (↓ of the real exchange rate) means that the domestic country's goods have become cheaper → consumers (domestic and foreign) demand more domestic goods and less foreign goods → the country's EXPs ↑ and IMPs ↓ and consequently net exports (NX) ↑.

PPP Determination of the Nominal Exchange Rate[modifier | modifier le wikicode]

The Purchasing Power Parity (PPP) theory is the simplest and generally accepted explanation for nominal exchange rate fluctuations in the long run. According to PPP, one unit of a currency buys the same amount of goods in all countries.

Hypothesis: Law of One Price = arbitrage forces equalize the price of the same good sold on different markets. If this is true for all goods

Absolute PPP: a currency must have the same purchasing power in all countries and the exchange rate varies to ensure this.

- .

relative PPP (less restrictive than absolute PPP): the exchange rate between the currencies of two countries reflects the difference in the general price level of these two countries.

- percentage change in e = percentage change in - variation % de =

Inflation differentials and the exchange rate[modifier | modifier le wikicode]

If the central bank increases the supply of money, domestic money loses value in real terms (inflation) and in terms of the number of units of foreign currency it can buy (continuous depreciation).

The exchange rate in times of hyperinflation (Germany)[modifier | modifier le wikicode]

Criticisms of the PPP[modifier | modifier le wikicode]

- Not all goods are traded → non-exchangeable goods (they represent a significant part of GDP) → the law of one price for these goods is not verified;

- Tradable goods are not necessarily perfect substitutes (national preference and non-homogeneous goods) → different spending structures and no trade-offs;

- Free trade barriers (trade barriers, transport costs...) → no arbitrage.

The Big Mac Index[modifier | modifier le wikicode]

The economist's Big Mac index, (see readings): instead of considering a basket of goods to construct P and P*, we consider the price of a single good, the McDonald's Big Mac (= basket of ingredients, the same everywhere).

Theoretical exchange rate :

If , an appreciation of the CHF (= depreciation of the USD) is to be expected.

The foreign exchange market[modifier | modifier le wikicode]

PPP provides a (long-term) reference value towards which the exchange rate is expected to move.

Exchange rate: the relative price of one currency to another currency. Like any other price, also the price of a currency is determined, in the short term, by the meeting of demand and supply (=> fluctuations around the long-term value determined by PPP).

PPP provides a (long-term) reference value towards which the exchange rate is expected to move.

Exchange rate: The relative price of one currency to another currency. Like any other price, also the price of a currency is determined, in the short term, by the meeting of demand and supply (=> fluctuations around the long-term value determined by PPP).

Example: buying and selling USD against Euros (determinants of O and D):

- Offer USD = Request Euros

- European B&S experts

- European asset managers

- ...

- Central bank interventions (USD sales → curve shift)

- Demand USD = Offer Euros

- B&S European Imp.

- European Asset Imp.

- ...

- Central bank interventions (USD purchases → curve shift)

When the USD appreciates against the Euro (it takes more Euros for $1), European products seem cheaper to Americans, who will ask for more => conversion of more $ against Euros in the foreign exchange market => increasing $ bid function.

SHOCKS: any change in the supply or demand for US dollars will have an impact on the balance of the foreign exchange market.

If, for example, the flow of European capital to the United States were to increase because of a change in investor preferences, the demand curve would shift to the right, causing the US dollar to appreciate against the euro (which would also lead to an improvement in the European trade balance: the balance of payments is still in equilibrium).

In reality the impact of shocks on the equilibrium exchange rate depends on the flexibility of the exchange rate → EXCHANGE RULES = set of rules governing the foreign exchange market.

Two "extreme" exchange rate regimes (floating and fixed exchange rates) as well as a multitude of other intermediate possibilities (administered floats, fluctuation bands, etc.).

Flexible exchange rate regime[modifier | modifier le wikicode]

Under such an exchange rate regime :

- central banks never intervene in the foreign exchange market...

- the balance of accounts is always in equilibrium (the exchange rate adapts to any variations in the currency O and D to restore equilibrium) :

- If deficit of the Balance → depreciation of the currency

- If surplus in the balance → appreciation of the national currency

Fixed exchange rate regime[modifier | modifier le wikicode]

Under such an exchange rate regime, central banks constantly intervene in the market to ensure a certain exchange rate parity → loss of central bank autonomy: monetary policy is no longer an independent instrument of intervention for the central bank (the supply of money varies to keep the value of the national currency on the foreign exchange market constant).

Examples of this are :

- Gold standard system, 1879 - 1914: fixed gold parity;

- Gold exchange standard system (Bretton Woods), 1946 - 1973: fixed parity in US dollars in turn fixed in gold;

- European Monetary System, 1979 - 1999: fluctuations allowed in a tunnel around the parity;

- In many countries, the national currency is pegged to another currency.

Problem:

- the rate set by the BC may not coincide with the equilibrium rate → interventions to maintain the desired parity.

THREE OPTIONS to avoid depreciation of the Hong Kong dollar :

- Interventions on the foreign exchange market: BC absorbs the HKD surplus by buying its currency in exchange for USD. Problem: BCs' currency reserves are not unlimited.

- Monetary policy interventions aimed at moving the O and D curves: for example, if BC raises the domestic interest rate, the increase in incoming capital would increase the demand for HKD (moving the D function to the right).

- Exchange controls. Introduction of limits on the purchase of foreign currency.

NB: obviously these three measures will be applied in the opposite direction if .

Fixed vs. floating changes[modifier | modifier le wikicode]

There are several arguments in favour of adopting a fixed exchange rate regime (no uncertainty, stability, inflation control...), but there are also costs associated with exchange rate fixing: loss of monetary policy independence, distortions due to exchange rate controls.

This dilemma is summarised in a principle known in the literature as the Mundell's Trilemma or the Impossible Trinity.

A country cannot simultaneously have a fixed exchange rate (and thus ensure stability in international interactions), ensure full capital mobility (and thus promote financial market integration and efficiency) and benefit from an autonomous monetary policy (and thus manage a stabilization economic policy instrument).

Summary[modifier | modifier le wikicode]

- The exchange rate between two countries is the price at which they trade with each other...

- Currency appreciation is when you can buy more units of foreign currency with one unit of domestic currency...

- A country's net exports depend on the real exchange rate: a depreciation makes a country's domestic goods cheaper and consequently net exports increase.

- The nominal exchange rate reflects the differential between inflation rates (PPP).

- PPP is based on fairly restrictive assumptions (all tradable goods, same expenditure structure, trade-offs).

- The parity between two currencies is the equilibrium price on the foreign exchange market...

- There are two exchange rate regimes: fixed (central bank intervention to maintain the exchange rate) and floating (no central bank intervention).

Annexes[modifier | modifier le wikicode]

On the BigMac Index:

- McCurrencies, The Economist, 24.04.2003

- Bunfight, The Economist, 02.02.2013

- Pour les données les plus récentes : http://www.economist.com/content/big-mac-index

References[modifier | modifier le wikicode]

- ↑ Page personnelle de Federica Sbergami sur le site de l'Université de Genève

- ↑ Page personnelle de Federica Sbergami sur le site de l'Université de Neuchâtel

- ↑ Page personnelle de Federica Sbergami sur Research Gate

- ↑ Researchgate.net - Nicolas Maystre

- ↑ Google Scholar - Nicolas Maystre

- ↑ VOX, CEPR Policy Portal - Nicolas Maystre

- ↑ Nicolas Maystre's webpage

- ↑ Cairn.ingo - Nicolas Maystre

- ↑ Linkedin - Nicolas Maystre

- ↑ Academia.edu - Nicolas Maystre