« Financial Market » : différence entre les versions

Aucun résumé des modifications |

|||

| (16 versions intermédiaires par le même utilisateur non affichées) | |||

| Ligne 2 : | Ligne 2 : | ||

| image = | | image = | ||

| image_caption = | | image_caption = | ||

| cours = [[Introduction | | cours = [[Introduction to Macroeconomics]] | ||

| faculté = | | faculté = | ||

| département = | | département = | ||

| professeurs = | | professeurs = | ||

*[[Federica Sbergami|Sbergami, Federica]]<ref>[https://www.unige.ch/gsem/en/research/faculty/all/federica-sbergami/ Page personnelle de Federica Sbergami sur le site de l'Université de Genève]</ref><ref>[https://www.unine.ch/irene/home/equipe/federica_sbergami.html Page personnelle de Federica Sbergami sur le site de l'Université de Neuchâtel]</ref><ref>[https://www.researchgate.net/scientific-contributions/14836393_Federica_Sbergami Page personnelle de Federica Sbergami sur Research Gate]</ref> | *[[Federica Sbergami|Sbergami, Federica]]<ref>[https://www.unige.ch/gsem/en/research/faculty/all/federica-sbergami/ Page personnelle de Federica Sbergami sur le site de l'Université de Genève]</ref><ref>[https://www.unine.ch/irene/home/equipe/federica_sbergami.html Page personnelle de Federica Sbergami sur le site de l'Université de Neuchâtel]</ref><ref>[https://www.researchgate.net/scientific-contributions/14836393_Federica_Sbergami Page personnelle de Federica Sbergami sur Research Gate]</ref> | ||

*[[Nicolas Maystre]]<ref>Researchgate.net - [https://www.researchgate.net/profile/Nicolas_Maystre Nicolas Maystre]</ref><ref>Google Scholar - [https://scholar.google.com/citations?user=B73U0wsAAAAJ&hl=en Nicolas Maystre]</ref><ref>VOX, CEPR Policy Portal - [https://voxeu.org/users/nicolasmaystre0 Nicolas Maystre]</ref><ref>[http://nicolas.maystre.ch/ Nicolas Maystre's webpage]</ref><ref>Cairn. | *[[Nicolas Maystre]]<ref>Researchgate.net - [https://www.researchgate.net/profile/Nicolas_Maystre Nicolas Maystre]</ref><ref>Google Scholar - [https://scholar.google.com/citations?user=B73U0wsAAAAJ&hl=en Nicolas Maystre]</ref><ref>VOX, CEPR Policy Portal - [https://voxeu.org/users/nicolasmaystre0 Nicolas Maystre]</ref><ref>[http://nicolas.maystre.ch/ Nicolas Maystre's webpage]</ref><ref>Cairn.info - [https://www.cairn.info/publications-de-Nicolas-Maystre--104530.htm Nicolas Maystre]</ref><ref>Linkedin - [https://www.linkedin.com/in/nicolas-maystre-82660737/?originalSubdomain=ch Nicolas Maystre]</ref><ref>Academia.edu - [https://unctad.academia.edu/NicolasMaystre Nicolas Maystre]</ref> | ||

| enregistrement = | | enregistrement = | ||

| lectures = | | lectures = | ||

*[[ | *[[Introductory aspects of macroeconomics]] | ||

*[[ | *[[Gross Domestic Product (GDP)]] | ||

*[[ | *[[Consumer Price Index (CPI)]] | ||

*[[Production | *[[Production and economic growth]] | ||

*[[ | *[[Unemployment]] | ||

*[[ | *[[Financial Market]] | ||

*[[ | *[[The monetary system]] | ||

*[[ | *[[Monetary growth and inflation]] | ||

*[[ | *[[Open Macroeconomics: Basic Concepts]] | ||

*[[ | *[[Open Macroeconomics: the Exchange Rate]] | ||

*[[ | *[[Equilibrium in an open economy]] | ||

*[[ | *[[The Keynesian approach and the IS-LM model]] | ||

*[[ | *[[Aggregate demand and supply]] | ||

*[[ | *[[The impact of monetary and fiscal policies]] | ||

*[[Trade-off | *[[Trade-off between inflation and unemployment]] | ||

*[[ | *[[Response to the 2008 Financial Crisis and International Cooperation]] | ||

}} | }} | ||

| Ligne 36 : | Ligne 36 : | ||

The demand and supply of loanable funds make it possible to establish the conditions under which the economy is in equilibrium. | The demand and supply of loanable funds make it possible to establish the conditions under which the economy is in equilibrium. | ||

At the end of the chapter we will see how government policies can encourage savings and investment. | At the end of the chapter, we will see how government policies can encourage savings and investment. | ||

{{Translations | {{Translations | ||

| en = Marché financier | | en = Marché financier | ||

| es = | | es = Mercado financiero | ||

}} | }} | ||

| Ligne 97 : | Ligne 97 : | ||

[[Fichier:Intromacro obligation évolution prix 1.png|400px|vignette|centré]] | [[Fichier:Intromacro obligation évolution prix 1.png|400px|vignette|centré]] | ||

== | == Shares == | ||

A share is a partial title of ownership in a company entitling the holder to a corresponding share of the profits made in the future and in principle also to a right to vote at the shareholders' meeting. In other words, a share is a title deed issued by a corporation (e.g. a public limited company or a company limited by shares). It confers on its holder the ownership of a part of the capital, with the associated rights: to intervene in the management of the company and to receive an income called a dividend.<ref>Action (finance). (2014, septembre 19). Wikipédia, l'encyclopédie libre. Page consultée le 01:06, décembre 29, 2014 à partir de http://fr.wikipedia.org/w/index.php?title=Action_(finance)&oldid=107568289.</ref> | A share is a partial title of ownership in a company entitling the holder to a corresponding share of the profits made in the future and in principle also to a right to vote at the shareholders' meeting. In other words, a share is a title deed issued by a corporation (e.g. a public limited company or a company limited by shares). It confers on its holder the ownership of a part of the capital, with the associated rights: to intervene in the management of the company and to receive an income called a dividend.<ref>Action (finance). (2014, septembre 19). Wikipédia, l'encyclopédie libre. Page consultée le 01:06, décembre 29, 2014 à partir de http://fr.wikipedia.org/w/index.php?title=Action_(finance)&oldid=107568289.</ref> | ||

The holder of shares qualifies as a shareholder and the shareholders as a whole constitute the shareholding. | The holder of shares qualifies as a shareholder and the shareholders as a whole constitute the shareholding. | ||

| Ligne 117 : | Ligne 117 : | ||

*Price/Earning ratio (P/E) or cost/benefit: the ratio between the share price and total earnings per share (= share value). Historically a value of 15 is considered normal. If this ratio is higher, it means that the market expects an acceleration of earnings and if it is lower, it means that the market expects a decrease in future earnings. | *Price/Earning ratio (P/E) or cost/benefit: the ratio between the share price and total earnings per share (= share value). Historically a value of 15 is considered normal. If this ratio is higher, it means that the market expects an acceleration of earnings and if it is lower, it means that the market expects a decrease in future earnings. | ||

== | == Financial Intermediaries == | ||

Not all companies can issue shares or bonds. There are intermediaries that link investors and savers. These are financial intermediaries such as banks or mutual funds. | |||

'''Banks''' take deposits from savers and use them to make loans to investors, but they also pay interest to savers that is slightly lower than the interest they charge to borrowers (profit margin for the bank). | |||

'''Mutual funds''' sell units to the public and then buy a portfolio of different types of stocks and bonds. This allows individuals with limited budgets to diversify their portfolio of financial assets. | |||

There are also pension funds, insurance companies... | |||

== | == Asset prices: analysis of fundamentals == | ||

What price should a share have? | |||

First method of price evaluation: analysis of the fundamentals, i.e. the determinants (there are many!) underlying the company's future profits (type of sector, degree of competition, unionized or non-unionized workers, etc.). Under the hypothesis of efficient markets and rational agents, all publicly available information concerning the fundamentals of a firm is already incorporated in the share price (a margin between the market price and the value suggested by the analysis of the fundamentals indicates a profit opportunity that has not been exploited) => if the markets are efficient, at any time the share prices are correctly valued (no systematic over- or underestimation). | |||

Consequence: asset prices only change in response to new and unpredictable information about fundamentals => the evolution of stock prices will follow a random path (evolution over time of an unpredictable variable). | |||

== | == Irrational markets == | ||

The market efficiency hypothesis is strongly criticised by many economists: evidence of systematic market price disruption (in some cases prices fluctuate much more than would be justified by changes in fundamentals) or irrational behaviour by investors who, for example, rather than analysing fundamentals, simply look at past movements in a stock's value and expect them to continue in the future. | |||

Risk of sharp fluctuations in share prices, sometimes leading to major economic problems. Two recent examples: | |||

# | #The new technology (or Internet) bubble that burst at the end of the 1990s: share prices on the new technology market are difficult to justify → With the bursting of the bubble, shares lost 2/3 of their value → crisis 2001 → high unemployment. | ||

# | #The real estate bubble (see below), which caused the last economic crisis (NB: the same type of fears for the Geneva real estate market today). | ||

== | == USA Real Estate Bubble == | ||

Between 2000 and 2006 huge increase in house prices in the USA: in 2006 house prices in large cities more than twice as much as in 2000. | |||

According to a number of economists this price increase was excessive and was due to unrealistic expectations about future prices. According to others (including Alan Greenspan, Governor of the Federal Reserve), it was in line with the fundamentals and therefore perfectly justified. | |||

The former were right → huge bubble at the national level → property prices are falling → huge economic difficulties and crisis (we will see a little later how the property bubble spread to the economic system). | |||

[[Fichier:Intromacro bulle immobiliere usa 1.png|400px|vignette|centré]] | [[Fichier:Intromacro bulle immobiliere usa 1.png|400px|vignette|centré]] | ||

= | = Savings and investment: national balance = | ||

== | == National balance == | ||

Let us consider the case of a closed economy, an economy without any exchange with the rest of the world. The national accounts identity <math>Y \equiv C + I + G + EXP - IMP</math> (EXP and IMP, respectively, for exports and imports) then turns into the following : | |||

::<math>Y = C + I + G</math> | ::<math>Y = C + I + G</math> | ||

where <math>Y</math> represents GDP, <math>C</math> consumption, <math>I</math> investment and <math>G</math> public expenditure. (NB: the previous equation represents at the same time the equilibrium condition of the economic system and the identity of the national accounts, which is always verified ex-post). | |||

The national income accounting identity can be rewritten as: <math>Y - C - G = I</math> | |||

The term <math>Y - C - G</math> refers to production that remains after consumer and government demand has been met. This is called ''national savings'' and is indicated with the letter <math>S</math>. At equilibrium, <math>S = I</math>. | |||

In more detail, being <math>T</math> taxes, total savings is equal to the sum of private savings <math>S_p = (Y - T - C)</math>, and public savings, <math>SG = (T - G)</math>. (NB: if <math>T > G</math> → public savings; if <math>T < G</math> → public deficit) | |||

By introducing <math>T</math> in our equilibrium equation, we have <math>Y - C - T - G + T = I</math> ⇒ the macroeconomic equilibrium condition becomes : | |||

::<math>S = (Y - T - C) + (T - G) = SP + SG = I</math> | ::<math>S = (Y - T - C) + (T - G) = SP + SG = I</math> | ||

At any given moment in a closed economy, private savings finance investment and the eventual public deficit : | |||

::<math>SP = I + SG = I + (G-T)</math>. | ::<math>SP = I + SG = I + (G-T)</math>. | ||

== | == Savings and investment decisions == | ||

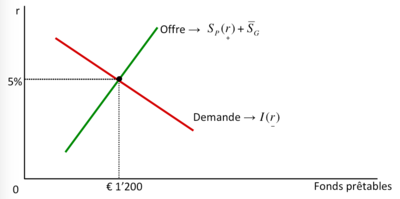

The national accounting identity shows that at any point in time savings equals investment: <math>S = I</math>. The financial market coordinates savings and investment in the market for loanable funds, the market where those who save offer loans and those who invest ask for loans. | |||

The supply of loanable funds is mainly driven by the decisions of households that decide to save part of their income and lend it on the financial market. | |||

The demand for loanable funds arises from the decisions of households and firms that decide to borrow funds to finance their investment decisions. | |||

The real interest rate (<math>r</math>) is the price of a loan: it represents what loan applicants pay and what loan providers receive for loans → decreasing demand for loanable funds and increasing supply. | |||

== | == Determining the real interest rate == | ||

The financial market functions like all other markets in the economy: the balance between demand and supply for loanable funds determines the equilibrium real interest rate. At the equilibrium interest rate, households want to save what businesses want to invest, and the supply of funds equals the demand. | |||

[[Fichier:Intromacro marché financier étermination du taux d’intérêt réel 1.png|400px|vignette|centré]] | [[Fichier:Intromacro marché financier étermination du taux d’intérêt réel 1.png|400px|vignette|centré]] | ||

The higher the remuneration on loans, the greater the incentive to save => increasing supply of funds. | |||

The more expensive loans are, the less investment is financed => decreasing demand for funds. | |||

== | == Government Policies Influencing S and I == | ||

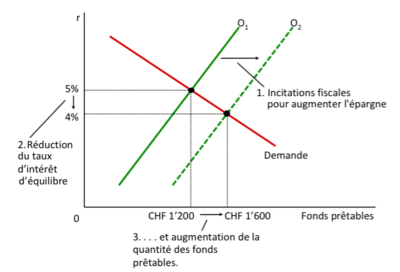

Income taxes: Lower interest-related income taxes provide an incentive for households to save more ⇒ At equal interest rates the fund supply curve shifts to the right, the equilibrium interest rate falls and the quantity of equilibrium funds (and thus investment) increases (see graph). | |||

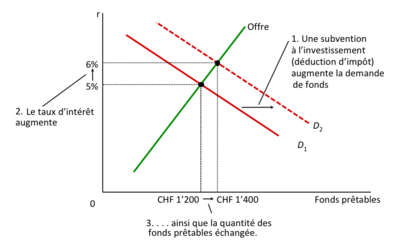

Taxes on investment: a reduction in the tax on new capital investment (e.g. in the form of a tax credit) shifts the demand curve for funds outwards ⇒ the equilibrium interest rate rises and the quantity of equilibrium funds (and thus savings) increases (see graph). | |||

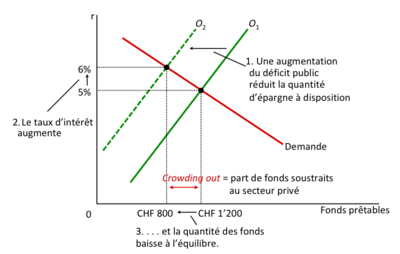

Fiscal policies: if <math>G > T</math> → deficit. The accumulation of public deficits is called public debt. When the government finances public expenditure through debt, it borrows funds to cover its deficit and reduces the loanable funds available to finance private sector investment (crowding-out or crowding out of private savings) ⇒ at parity of interest rates the funds supply curve shifts to the left, the equilibrium interest rate rises and the amount of equilibrium funds (and therefore investment) falls (see graph). | |||

== | == Savings incentive == | ||

[[Fichier:Intromacro incitation epargne marché financier 1.png|400px|vignette|centré]] | [[Fichier:Intromacro incitation epargne marché financier 1.png|400px|vignette|centré]] | ||

Problems related to savings incentives : | |||

# | #Potential equity problem: Lower taxes on savings favour wealthier individuals (who save a greater proportion of their income). For this reason, some economists suggest replacing this measure with lower income taxes. | ||

# | #Lack of responsiveness of savings decisions: savings may be insensitive to interest rate changes because the income effect may act in the opposite direction to the substitution effect (see microeconomics course). Following an increase in interest-related earnings (due to a reduction in interest-related income taxes), the substitution effect pushes households to save more and consume less, but higher interest implies a higher income for a certain level of savings, which could induce individuals to consume more and save less (income effect). From an empirical point of view, these two effects seem to offset each other (in this case, the supply curve does not shift, or shifts only slightly, to the right). | ||

== | == Investment grants == | ||

[[Fichier:Intromacro marché financier Subventions à l’investissement 1.png|400px|vignette|centré]] | [[Fichier:Intromacro marché financier Subventions à l’investissement 1.png|400px|vignette|centré]] | ||

| Ligne 215 : | Ligne 215 : | ||

== Déficit public et "crowding out" == | == Déficit public et "crowding out" == | ||

The crowding out effect is a decline in private investment and consumption caused by an increase in public spending. | |||

The crowding-out effect is generally the consequence of the expansion of public sector activities at the expense of the private sector. This term is used - often by classical economists - to describe the excesses of state interventionism that would hamper or even "crowd out" the private sector from some of its policy options. Liberal economists in particular use this argument to criticize expansionary fiscal policies.<ref>Effet d'éviction. (2014, septembre 17). Wikipédia, l'encyclopédie libre. Page consultée le 11:31, décembre 21, 2014 à partir de http://fr.wikipedia.org/w/index.php?title=Effet_d%27%C3%A9viction&oldid=107535591.</ref> | |||

[[Fichier:Intromacro marché financier Déficit public et crowding out 1.png|400px|vignette|centré]] | [[Fichier:Intromacro marché financier Déficit public et crowding out 1.png|400px|vignette|centré]] | ||

= | = Summary = | ||

The financial system consists of financial institutions such as financial markets (equity and bond markets) and financial intermediaries (banks and mutual funds). Its purpose is to allocate savings to investment. | |||

Under the assumption of market efficiency, all publicly available information about a company's fundamentals is already incorporated into the price of shares. According to a number of economists, in reality, the assumption of efficient financial markets is not verified. This is at the root of very serious economic difficulties. | |||

In a closed economy, private savings are used to finance private investment and the public deficit. | |||

The interest rate is determined by the supply and demand for loanable funds. The supply of loanable funds generally comes from households that save part of their income. | |||

The demand for loanable funds generally comes from households and businesses that want to borrow in order to invest. | |||

A government deficit reduces the private savings available to borrowers and thus reduces the supply of loanable funds. This normally leads to a higher equilibrium interest rate and less lendable funds. When the public deficit reduces private investment (crowding out) it reduces productivity and growth. | |||

= Annexes = | = Annexes = | ||

Version actuelle datée du 11 mai 2021 à 22:16

| Professeur(s) | |

|---|---|

| Cours | Introduction to Macroeconomics |

Lectures

- Introductory aspects of macroeconomics

- Gross Domestic Product (GDP)

- Consumer Price Index (CPI)

- Production and economic growth

- Unemployment

- Financial Market

- The monetary system

- Monetary growth and inflation

- Open Macroeconomics: Basic Concepts

- Open Macroeconomics: the Exchange Rate

- Equilibrium in an open economy

- The Keynesian approach and the IS-LM model

- Aggregate demand and supply

- The impact of monetary and fiscal policies

- Trade-off between inflation and unemployment

- Response to the 2008 Financial Crisis and International Cooperation

This chapter explores the importance of financial institutions (financial markets and financial intermediaries) to the economy.

The functioning of the financial system affects two major macroeconomic variables that, in turn, are important determinants of productivity :

- savings () → offers loanable funds;

- investment () → demand for loanable funds.

The demand and supply of loanable funds make it possible to establish the conditions under which the economy is in equilibrium.

At the end of the chapter, we will see how government policies can encourage savings and investment.

Financial Institutions[modifier | modifier le wikicode]

The financial institutions[modifier | modifier le wikicode]

The main role of financial institutions is to allocate capital (one of the scarce resources in the economy) from savers (supply) to investors who need it (demand) → market for loanable funds (or capital).

They are grouped into two categories:

- the financial markets:

- the bond market;

- the equity market.

- financial intermediaries :

- banks;

- Mutual funds.

Through the financial markets, savers make their capital directly available to investors.

Through financial intermediaries, savers indirectly make their capital available to investors.

Bonds[modifier | modifier le wikicode]

A bond is an acknowledgement of debt owed by a company (or government) to the holder of the bond. The company borrows directly from the public without going through the banking system. There are two essential characteristics of a bond:

- the term of the bond (expiry date);

- the signature risk (or probability of non-repayment).

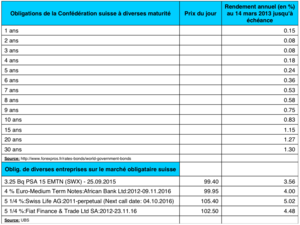

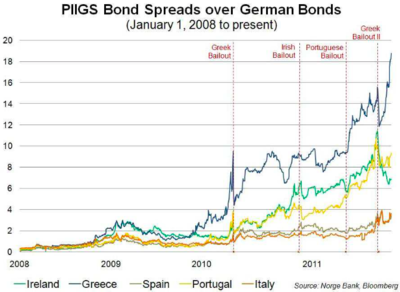

These two characteristics will determine the fixed interest (or coupon) that will be paid for this loan: "junk bonds" (very risky bonds) pay more than government bonds and a 10-year bond pays a higher interest than a 1-year bond.

The price of a bond will be determined by the market according to the term, the signature risk and the nominal market interest rate. Ceteris paribus, if the market interest rate decreases, the price of the bond increases. There is an inverse relationship between market interest and price, the market rate being the yield on new issue bonds.

Financial rating scale according to major rating agencies[modifier | modifier le wikicode]

Junk bond" (or "high-yield debt"), also called "junk bond" in French, is the colloquial name for high-risk bonds in the United States, bonds that are classified as "speculative" by the rating agencies, i.e. those with a financial rating below investment grade.

The existence of a separate but active market for these bonds stems from two particularities of the US financial system :

- the use of direct capital market fundraising has been common among large US SMEs since the late 1970s, much more so than in Europe, where the financing of this type of business is still mainly carried out by banks;

- At the same time, many institutional investors are prohibited by internal or external regulations from holding assets that are not investment grade.

For issuers, this type of financing is cheaper than bank loans.

Junk bonds ?[modifier | modifier le wikicode]

The evolution of the price[modifier | modifier le wikicode]

This graph shows the evolution of the market price of Greek bonds with a July 2019 maturity giving a nominal interest rate of 6% between March 2009 and March 2010. The evolution of the spread in relation to German bonds can be seen online.

[modifier | modifier le wikicode]

A share is a partial title of ownership in a company entitling the holder to a corresponding share of the profits made in the future and in principle also to a right to vote at the shareholders' meeting. In other words, a share is a title deed issued by a corporation (e.g. a public limited company or a company limited by shares). It confers on its holder the ownership of a part of the capital, with the associated rights: to intervene in the management of the company and to receive an income called a dividend.[11]

The holder of shares qualifies as a shareholder and the shareholders as a whole constitute the shareholding.

If Nestlé has issued a total of 1 million shares, each share corresponds to 1 millionth of its future profits.

The share price is determined on the stock market (LSE, NYSE...).

Generally, a share implies more risk than a bond, and therefore a higher average return.

Price of the day and minimum and maximum of the day and/or over the year

Newspaper information :

- Volume: the amount of shares that were traded in the previous session.

- Price change at the last session

- Dividend ratio: the amount of earnings distributed to shareholders as a percentage of the share value (= return on equity).

- Price/Earning ratio (P/E) or cost/benefit: the ratio between the share price and total earnings per share (= share value). Historically a value of 15 is considered normal. If this ratio is higher, it means that the market expects an acceleration of earnings and if it is lower, it means that the market expects a decrease in future earnings.

Financial Intermediaries[modifier | modifier le wikicode]

Not all companies can issue shares or bonds. There are intermediaries that link investors and savers. These are financial intermediaries such as banks or mutual funds.

Banks take deposits from savers and use them to make loans to investors, but they also pay interest to savers that is slightly lower than the interest they charge to borrowers (profit margin for the bank).

Mutual funds sell units to the public and then buy a portfolio of different types of stocks and bonds. This allows individuals with limited budgets to diversify their portfolio of financial assets.

There are also pension funds, insurance companies...

Asset prices: analysis of fundamentals[modifier | modifier le wikicode]

What price should a share have?

First method of price evaluation: analysis of the fundamentals, i.e. the determinants (there are many!) underlying the company's future profits (type of sector, degree of competition, unionized or non-unionized workers, etc.). Under the hypothesis of efficient markets and rational agents, all publicly available information concerning the fundamentals of a firm is already incorporated in the share price (a margin between the market price and the value suggested by the analysis of the fundamentals indicates a profit opportunity that has not been exploited) => if the markets are efficient, at any time the share prices are correctly valued (no systematic over- or underestimation).

Consequence: asset prices only change in response to new and unpredictable information about fundamentals => the evolution of stock prices will follow a random path (evolution over time of an unpredictable variable).

Irrational markets[modifier | modifier le wikicode]

The market efficiency hypothesis is strongly criticised by many economists: evidence of systematic market price disruption (in some cases prices fluctuate much more than would be justified by changes in fundamentals) or irrational behaviour by investors who, for example, rather than analysing fundamentals, simply look at past movements in a stock's value and expect them to continue in the future.

Risk of sharp fluctuations in share prices, sometimes leading to major economic problems. Two recent examples:

- The new technology (or Internet) bubble that burst at the end of the 1990s: share prices on the new technology market are difficult to justify → With the bursting of the bubble, shares lost 2/3 of their value → crisis 2001 → high unemployment.

- The real estate bubble (see below), which caused the last economic crisis (NB: the same type of fears for the Geneva real estate market today).

USA Real Estate Bubble[modifier | modifier le wikicode]

Between 2000 and 2006 huge increase in house prices in the USA: in 2006 house prices in large cities more than twice as much as in 2000.

According to a number of economists this price increase was excessive and was due to unrealistic expectations about future prices. According to others (including Alan Greenspan, Governor of the Federal Reserve), it was in line with the fundamentals and therefore perfectly justified.

The former were right → huge bubble at the national level → property prices are falling → huge economic difficulties and crisis (we will see a little later how the property bubble spread to the economic system).

Savings and investment: national balance[modifier | modifier le wikicode]

National balance[modifier | modifier le wikicode]

Let us consider the case of a closed economy, an economy without any exchange with the rest of the world. The national accounts identity (EXP and IMP, respectively, for exports and imports) then turns into the following :

where represents GDP, consumption, investment and public expenditure. (NB: the previous equation represents at the same time the equilibrium condition of the economic system and the identity of the national accounts, which is always verified ex-post).

The national income accounting identity can be rewritten as:

The term refers to production that remains after consumer and government demand has been met. This is called national savings and is indicated with the letter . At equilibrium, .

In more detail, being taxes, total savings is equal to the sum of private savings , and public savings, . (NB: if → public savings; if → public deficit)

By introducing in our equilibrium equation, we have ⇒ the macroeconomic equilibrium condition becomes :

At any given moment in a closed economy, private savings finance investment and the eventual public deficit :

- .

Savings and investment decisions[modifier | modifier le wikicode]

The national accounting identity shows that at any point in time savings equals investment: . The financial market coordinates savings and investment in the market for loanable funds, the market where those who save offer loans and those who invest ask for loans.

The supply of loanable funds is mainly driven by the decisions of households that decide to save part of their income and lend it on the financial market.

The demand for loanable funds arises from the decisions of households and firms that decide to borrow funds to finance their investment decisions.

The real interest rate () is the price of a loan: it represents what loan applicants pay and what loan providers receive for loans → decreasing demand for loanable funds and increasing supply.

Determining the real interest rate[modifier | modifier le wikicode]

The financial market functions like all other markets in the economy: the balance between demand and supply for loanable funds determines the equilibrium real interest rate. At the equilibrium interest rate, households want to save what businesses want to invest, and the supply of funds equals the demand.

The higher the remuneration on loans, the greater the incentive to save => increasing supply of funds.

The more expensive loans are, the less investment is financed => decreasing demand for funds.

Government Policies Influencing S and I[modifier | modifier le wikicode]

Income taxes: Lower interest-related income taxes provide an incentive for households to save more ⇒ At equal interest rates the fund supply curve shifts to the right, the equilibrium interest rate falls and the quantity of equilibrium funds (and thus investment) increases (see graph).

Taxes on investment: a reduction in the tax on new capital investment (e.g. in the form of a tax credit) shifts the demand curve for funds outwards ⇒ the equilibrium interest rate rises and the quantity of equilibrium funds (and thus savings) increases (see graph).

Fiscal policies: if → deficit. The accumulation of public deficits is called public debt. When the government finances public expenditure through debt, it borrows funds to cover its deficit and reduces the loanable funds available to finance private sector investment (crowding-out or crowding out of private savings) ⇒ at parity of interest rates the funds supply curve shifts to the left, the equilibrium interest rate rises and the amount of equilibrium funds (and therefore investment) falls (see graph).

Savings incentive[modifier | modifier le wikicode]

Problems related to savings incentives :

- Potential equity problem: Lower taxes on savings favour wealthier individuals (who save a greater proportion of their income). For this reason, some economists suggest replacing this measure with lower income taxes.

- Lack of responsiveness of savings decisions: savings may be insensitive to interest rate changes because the income effect may act in the opposite direction to the substitution effect (see microeconomics course). Following an increase in interest-related earnings (due to a reduction in interest-related income taxes), the substitution effect pushes households to save more and consume less, but higher interest implies a higher income for a certain level of savings, which could induce individuals to consume more and save less (income effect). From an empirical point of view, these two effects seem to offset each other (in this case, the supply curve does not shift, or shifts only slightly, to the right).

Investment grants[modifier | modifier le wikicode]

Déficit public et "crowding out"[modifier | modifier le wikicode]

The crowding out effect is a decline in private investment and consumption caused by an increase in public spending.

The crowding-out effect is generally the consequence of the expansion of public sector activities at the expense of the private sector. This term is used - often by classical economists - to describe the excesses of state interventionism that would hamper or even "crowd out" the private sector from some of its policy options. Liberal economists in particular use this argument to criticize expansionary fiscal policies.[12]

Summary[modifier | modifier le wikicode]

The financial system consists of financial institutions such as financial markets (equity and bond markets) and financial intermediaries (banks and mutual funds). Its purpose is to allocate savings to investment.

Under the assumption of market efficiency, all publicly available information about a company's fundamentals is already incorporated into the price of shares. According to a number of economists, in reality, the assumption of efficient financial markets is not verified. This is at the root of very serious economic difficulties.

In a closed economy, private savings are used to finance private investment and the public deficit.

The interest rate is determined by the supply and demand for loanable funds. The supply of loanable funds generally comes from households that save part of their income.

The demand for loanable funds generally comes from households and businesses that want to borrow in order to invest.

A government deficit reduces the private savings available to borrowers and thus reduces the supply of loanable funds. This normally leads to a higher equilibrium interest rate and less lendable funds. When the public deficit reduces private investment (crowding out) it reduces productivity and growth.

Annexes[modifier | modifier le wikicode]

- Efficiency and beyond, The Economist, 16.07.2009

- In defence of the dismal science, The Economist, 06.08.2009 (la réponse de Robert Lucas à l’article précédent)

References[modifier | modifier le wikicode]

- ↑ Page personnelle de Federica Sbergami sur le site de l'Université de Genève

- ↑ Page personnelle de Federica Sbergami sur le site de l'Université de Neuchâtel

- ↑ Page personnelle de Federica Sbergami sur Research Gate

- ↑ Researchgate.net - Nicolas Maystre

- ↑ Google Scholar - Nicolas Maystre

- ↑ VOX, CEPR Policy Portal - Nicolas Maystre

- ↑ Nicolas Maystre's webpage

- ↑ Cairn.info - Nicolas Maystre

- ↑ Linkedin - Nicolas Maystre

- ↑ Academia.edu - Nicolas Maystre

- ↑ Action (finance). (2014, septembre 19). Wikipédia, l'encyclopédie libre. Page consultée le 01:06, décembre 29, 2014 à partir de http://fr.wikipedia.org/w/index.php?title=Action_(finance)&oldid=107568289.

- ↑ Effet d'éviction. (2014, septembre 17). Wikipédia, l'encyclopédie libre. Page consultée le 11:31, décembre 21, 2014 à partir de http://fr.wikipedia.org/w/index.php?title=Effet_d%27%C3%A9viction&oldid=107535591.