« Equilibrium in an open economy » : différence entre les versions

| Ligne 112 : | Ligne 112 : | ||

Often a budget deficit is accompanied by a trade deficit (e.g. the expansionary fiscal policy of the United States in the early 1980s, which resulted in a budget deficit and a trade deficit). This is why we speak of "twin deficits". But, be careful, there is nothing automatic in all this: a variation in savings or investment decisions could compensate the ↑ (or ↓) demand for funds from the State (example: the recovery of the public deficit in the Clinton years was not accompanied by a trade surplus because, in the meantime, domestic investments have ↑ and private savings have remained constant). | Often a budget deficit is accompanied by a trade deficit (e.g. the expansionary fiscal policy of the United States in the early 1980s, which resulted in a budget deficit and a trade deficit). This is why we speak of "twin deficits". But, be careful, there is nothing automatic in all this: a variation in savings or investment decisions could compensate the ↑ (or ↓) demand for funds from the State (example: the recovery of the public deficit in the Clinton years was not accompanied by a trade surplus because, in the meantime, domestic investments have ↑ and private savings have remained constant). | ||

== | == Fiscal policy: effects on balance == | ||

Fiscal policy: an increase in public spending | |||

( | (or a tax cut) reduces national savings → shift of the supply curve to the left (1) → increase in the real interest rate (2) → crowding out of domestic investments + decrease in net investments abroad (3) → decrease in the supply of money on the foreign exchange market (4) → appreciation of the real exchange rate (5) → domestic goods become more expensive → new equilibrium corresponding to a lower quantity of net exports. | ||

[[Fichier:Intromacro Politique budgétaire effets sur l’équilibre 1.png|400px|vignette|centré]] | [[Fichier:Intromacro Politique budgétaire effets sur l’équilibre 1.png|400px|vignette|centré]] | ||

Version du 27 mars 2020 à 18:29

| Professeur(s) | |

|---|---|

| Cours | Introduction to Macroeconomics |

Lectures

- Introductory aspects of macroeconomics

- Gross Domestic Product (GDP)

- Consumer Price Index (CPI)

- Production and economic growth

- Unemployment

- Financial Market

- The monetary system

- Monetary growth and inflation

- Open Macroeconomics: Basic Concepts

- Open Macroeconomics: the Exchange Rate

- Equilibrium in an open economy

- The Keynesian approach and the IS-LM model

- Aggregate demand and supply

- The impact of monetary and fiscal policies

- Trade-off between inflation and unemployment

- Response to the 2008 Financial Crisis and International Cooperation

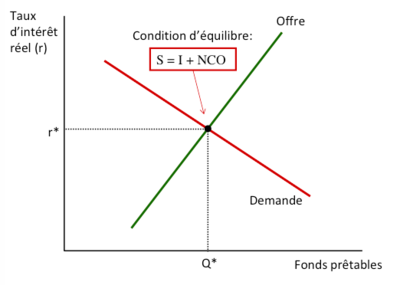

In this chapter we will characterize the macroeconomic equilibrium in an open economy = simultaneous equilibria in the market for loanable funds and in the foreign exchange market.

In an open economy, as in a closed economy, the equalisation of demand and supply of lendable funds defines the equilibrium real interest rate. The functioning of the market for loanable funds remains the same, although in an open economy economic agents demand funds either to make investments within the country or to purchase assets abroad.

Moreover, for the system to be in equilibrium, the net supply of domestic money must equal the net demand for domestic money. The equilibrium condition in the foreign exchange market will define the real equilibrium exchange rate.

NB: in the following we will once again take a long-term view and assume that output is fixed at its full employment level.

Equilibrium real exchange rate

Determination of the real exchange rate

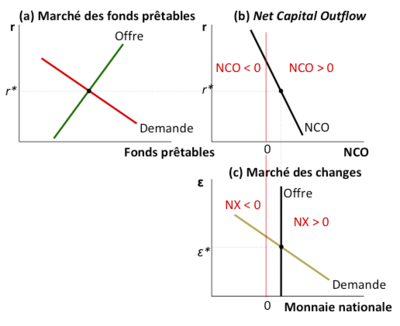

As we saw in the previous chapter, net exports are a function of the real exchange rate: the lower the real exchange rate, the cheaper domestic goods are relative to foreign goods and the higher the net exports (inverse relationship: consumers demand more domestic goods and less foreign goods) → NX(ε ).

From national accounts identities we also know that the trade balance must at all times be equal to the net capital outflow (Net Capital Outflow = NCO = - BMC) → NX(ε) = NCO.

The real exchange rate adjusts to maintain equilibrium NX(ε) = NCO.

NB: the function representing the net capital outflow is vertical because investment decisions do not depend on the real exchange rate.

Balance mechanism:

- si → oversupply of domestic currency on the foreign exchange market => real depreciation (ε↓);

- si → excess demand for domestic currency on the foreign exchange market => real appreciation (ε↑).

NB: if the vertical axis crosses the horizontal axis to the left of point Z → NCO > 0 and BC > 0; if the vertical axis crosses the horizontal axis to the right of point Z → NCO < 0 and BC < 0.

Equilibrium real interest rate

Savings and investment in the open economy

The functioning of the market for loanable funds and the determinants of the savings and investment function in a closed economy are discussed in Chapter 6.

In an open economy, the functioning of the market for loanable funds is the same. Simply, in an open economy, economic agents ask for funds either to make investments within the country or to buy assets abroad => in an open economy, national savings must cover domestic investment and the net flow of capital abroad (NB.: 'net flow' => either + or -).

Even in an open economy it is the real interest rate that balances the market for loanable funds.

NCO(r)

The net outflow of capital is a decreasing function of the real interest rate and is added to domestic investment decisions in determining the demand for loanable funds.

When the domestic interest rate is high, only highly profitable investment projects are financed (whether in the domestic country or abroad) → low demand for funds; vice versa when the cost of borrowing is low → high demand for funds (also to finance investment projects abroad).

At the same time, when the domestic interest rate is high (low), many (few) foreign investors will want to acquire domestic securities → inward capital ↑ (↓).

Equilibrium of the loanable funds market

The supply of loanable funds emanates from household savings decisions (an increasing function of the real interest rate).

The demand for loanable funds stems from domestic investment decisions and the NCO (decreasing function of the real interest rate).

Macroeconomic equilibrium in an open economy

Equilibrium in an open economy

In the market for loanable funds, the supply comes from domestic savings and the demand comes from domestic investment and net capital flows abroad.

In the foreign exchange market, supply comes from net capital flows abroad and demand comes from net exports.

Capital flow is the variable that links these two markets. For an economy as a whole to be in equilibrium, :

Simultaneous equilibrium in the loanable funds market and the foreign exchange market

Prices in the lending market (r) and the foreign exchange market (ε) adjust simultaneously to balance demand and supply in these two markets and determine national savings, domestic investment, net capital flows and net exports.

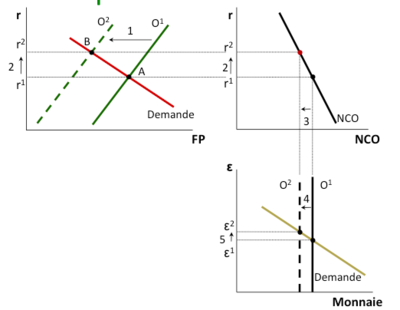

Budgetary policy

When the government finances public spending through a budget deficit, just as in a closed economy, it subtracts some of the loanable funds that would otherwise be available to finance private investment (crowding out).

In an open economy, the resulting increase in the domestic interest rate has an impact on capital flows: the NCO will fall because, on the one hand, the cost of borrowing has become more expensive and fewer investments are financed, including those made abroad (less capital outflows) and, on the other hand, foreign agents will want to buy more domestic assets (e.g. government bonds) because they pay high interest (more capital inflows) => NCO ↓. The drop in NCO has as a counterpart a reduction in the trade balance (appreciation of the real exchange rate) which could eventually become negative.

Often a budget deficit is accompanied by a trade deficit (e.g. the expansionary fiscal policy of the United States in the early 1980s, which resulted in a budget deficit and a trade deficit). This is why we speak of "twin deficits". But, be careful, there is nothing automatic in all this: a variation in savings or investment decisions could compensate the ↑ (or ↓) demand for funds from the State (example: the recovery of the public deficit in the Clinton years was not accompanied by a trade surplus because, in the meantime, domestic investments have ↑ and private savings have remained constant).

Fiscal policy: effects on balance

Fiscal policy: an increase in public spending (or a tax cut) reduces national savings → shift of the supply curve to the left (1) → increase in the real interest rate (2) → crowding out of domestic investments + decrease in net investments abroad (3) → decrease in the supply of money on the foreign exchange market (4) → appreciation of the real exchange rate (5) → domestic goods become more expensive → new equilibrium corresponding to a lower quantity of net exports.

Politique commerciale

Ensemble d’interventions du gouvernement qui influencent la quantité importée ou exportée de biens et services. Deux types:

- Tarif (ou droit de douane) = taxe sur les importations ;

- Quota d’importation = limitation sur la quantité importée.

D’un point de vue microéconomique, les effets de ces deux barrières au commerce sont équivalents en termes de variations des prix (↑), de quantités importées (↓) et de l’impact sur le surplus du consommateur (↓) et du producteur (↑). La seule différence éventuelle concerne les recettes pour le gouvernement (dans le cas d’un quota, le gouvernement s’approprie des rentes du quota seulement si les licences d’importation sont distribuées sur la base d’une vente aux enchères).

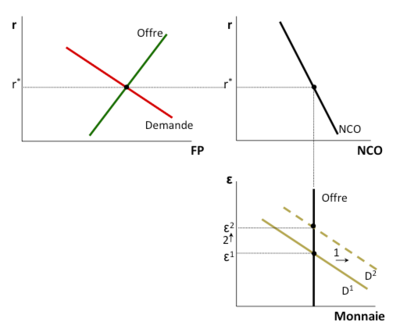

D’un point de vue macroéconomique, comme les politiques commerciales n’ont aucun impact sur l’épargne et l’investissement domestiques, elles n’ont aucune conséquence sur la balance commerciale: le taux de change réel s’ajuste pour maintenir inchangé le solde de la balance commerciale.

Politique commerciale : effets sur l’équilibre

Politique commerciale: introduction d’un quota → déplacement de la courbe NX vers la droite (1): à parité de ε () les exportations nettes sont + élevées → augmentation de la demande de monnaie et appréciation de la monnaie nationale (2) → les biens domestiques deviennent plus chers () ce qui compense l’augmentation initiale d’exportations nettes → nouvel équilibre en correspondance d’un niveau d’exportations nettes inchangé ! Pas d’influence sur la balance commerciale !

Instabilité macroéconomique

Dans des situations de grave instabilité politique et/ou économique les investisseurs peuvent être particulièrement concernés par la sécurité des leurs investissements et décider de retirer leurs capitaux des pays en situation de difficulté.

Ceci peut causer une fuite soudaine et importante de capitaux et une baisse de la demande pour les titres du pays (cf. le cas de l’Argentine au début des années 2000, du Mexique à la moitié des années 90, ou, plus récemment, de la Grèce).

Une fuite importante de capitaux fait augmenter le taux d’intérêt et déprécier la monnaie locale (sauf en cas d’union monétaire).

Instabilité macroéconomique : effets sur l’équilibre

Instabilité: une situation d’instabilité macroéconomique fait augmenter les flux sortants de capitaux (1). Ceci a deux effets: d’une part, la demande de fonds prêtables s’accroît (2) et le taux d’intérêt réel augmente (3) et, de l’autre, l’offre de monnaie sur le marché des changes augmente (4), la monnaie se déprécie (5) et la BC s’améliore.

Résumé

Les exportations nettes d’un pays dépendent du taux de change réel: une dépréciation rend les biens du pays domestique moins chers et en conséquence les exportations nettes augmentent

L’équilibre macroéconomique en économie ouverte se réalise en correspondance d’un taux de change réel tel que l’offre de monnaie nationale susceptible d’être échangée contre des devises étrangères pour être investie à l’étranger égalise la demande nette de monnaie nationale émanant d’étrangers qui souhaitent acheter des biens et services du pays domestique (NCO = NX)

Dans le marché des fonds prêtables, le taux d’intérêt réel s’ajuste pour égaliser l’offre de fonds, émanant de l’épargne, et la demande, émanant de l’investissement domestique et le flux de capitaux net vers l’étranger (S = I+NCO)

Toute politique réduisant l’épargne domestique fait baisser l’offre de fonds prêtables, augmenter le taux d’intérêt, réduire le capital net sortant, apprécier la monnaie nationale et baisser les exportations nettes

Une restriction au libre échange fait augmenter les exportations nettes, augmenter la demande pour la monnaie nationale, apprécier la monnaie et ramener la balance commerciale à son niveau initial

Une situation d’instabilité politique peut causer une sortie importante de capitaux et, par ceci, provoquer une augmentation du taux d’intérêt réel et une baisse du taux de change.

Annexes

References

- ↑ Page personnelle de Federica Sbergami sur le site de l'Université de Genève

- ↑ Page personnelle de Federica Sbergami sur le site de l'Université de Neuchâtel

- ↑ Page personnelle de Federica Sbergami sur Research Gate

- ↑ Researchgate.net - Nicolas Maystre

- ↑ Google Scholar - Nicolas Maystre

- ↑ VOX, CEPR Policy Portal - Nicolas Maystre

- ↑ Nicolas Maystre's webpage

- ↑ Cairn.ingo - Nicolas Maystre

- ↑ Linkedin - Nicolas Maystre

- ↑ Academia.edu - Nicolas Maystre