« The circuits and their geographies » : différence entre les versions

Aucun résumé des modifications |

Aucun résumé des modifications |

||

| (6 versions intermédiaires par le même utilisateur non affichées) | |||

| Ligne 1 : | Ligne 1 : | ||

{{Infobox Lecture | |||

| image = | |||

| image_caption = | |||

| faculté = | |||

| département = | |||

| professeurs = [[Jean-François Staszak|Staszak, Jean-François]]<ref>Jean-François Staszak. Wikipédia, l'encyclopédie libre. http://fr.wikipedia.org/w/index.php?title=Jean-Fran%C3%A7ois_Staszak</ref><ref>[https://www.unige.ch/sciences-societe/geo/membres/enseignants/staszakjeanfrancois/ Page personnelle de Jean-François Staszak sur le site de l'Université de Genève]</ref><ref>[[https://www.franceculture.fr/personne/jean-francois-staszak Publications de Jean-François Staszak sur le site de France Culture]]</ref><ref>[https://www.cairn.info/publications-de-Staszak-Jean-Fran%C3%A7ois--2057.htm Publications de Jean-François Staszak diffusées sur Cairn.info ]</ref><ref>[http://unige.academia.edu/JeanFran%C3%A7oisStaszak Page de Jean-François Staszak sur Academia.edu]</ref><ref>[https://www.babelio.com/auteur/Jean-Francois-Staszak/322744 Biographie de Jean-François Staszak sur Babelio.com]</ref><ref>[http://www.liberation.fr/auteur/13553-jean-francois-staszak Publication de Jean-François Staszak sur Liberation.fr]</ref> | |||

| assistants = | |||

| enregistrement = | |||

| cours = [[Economic geography]] | |||

| lectures = | |||

*[[Economic geography: approaches and challenges]] | |||

*[[The circuits and their geographies]] | |||

*[[Trade and geographical advantages]] | |||

*[[Geography of wealth and development]] | |||

*[[Geography of the Film Industry]] | |||

}} | |||

The theoretical framework of the economic circuit raises the problem of economic circuits and their geography. We will present what an economic circuit is and establish its geographical characteristics. | |||

{{Translations | {{Translations | ||

| fr = Les circuits et leurs géographies | | fr = Les circuits et leurs géographies | ||

| es = Los circuitos y sus geografías | |||

| it = I circuiti e le loro geografie | |||

}} | }} | ||

= | = Economic circuits = | ||

== | == The economy and its circuit == | ||

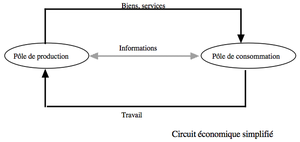

An economic circuit is composed of two elements, namely poles and flows. There are two types of poles: the consumption pole and the production pole. Between the poles, the moments, the places and the actors of production and consumption, there are exchanges that can be material or immaterial exchanges. In this interaction, there are four types of flows between the poles of consumption and production which are flows of goods and services, cash flows, labour flows and information flows. | |||

[[Fichier:Ecogeo circuit économique 1.png|vignette]] | [[Fichier:Ecogeo circuit économique 1.png|vignette]] | ||

It is important to know in the history of ideas where this concept of the economic circuit comes from? The first to think of the economic circuit was François Quesnay in 1758 who worked in the physiocrat movement. Physiocrats were thinkers in political economy who developed a reflection on the wealth of nations. The interactions between the poles and the flows refer to the idea of the human body. Society would function in the same way. It is an organicist vision as if society were a body with organs and there were exchanges. An organicist metaphor is never innocent. Beware of organicist metaphors in the social sciences. Comparing the city to a body is a vision of the city that implies policies and practices that are not insignificant. | |||

This allows us to reflect on economics, which is defined as the production, consumption and exchange of rare goods. What is important is to stress that it is not just goods that circulate, namely services, information, work and money. | |||

== | == From simple to complex circuits == | ||

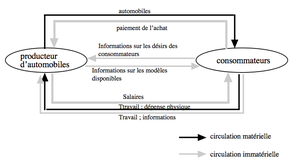

[[Fichier:Ecogeo circuit économique 2.png|vignette]] | [[Fichier:Ecogeo circuit économique 2.png|vignette]] | ||

It is possible to make the circuit more complex. In the previous case, we were in a non-monetary economy, whereas now we are integrating concepts that complicate the economy, which is becoming monetarized. Exchanges are multiplying. Sometimes there is a superposition of the poles of production and consumption. There is behind the idea of mass production and mass consumption that we find in Fordism in particular. | |||

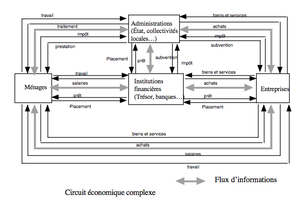

[[Fichier:Ecogeo circuit économique 3.png|left|vignette]] | [[Fichier:Ecogeo circuit économique 3.png|left|vignette]] | ||

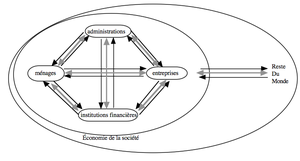

It is possible to envisage more complex economic circuits. There are no longer two poles, but there are four. Institutions play an intermediary role between these poles with an administration and private and financial institutions. We obtain matrices that become very complicated. This economic circuit will become more complex until we realize what the economy and society are. | |||

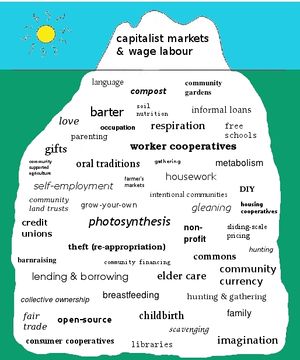

[[Fichier:paradigme iceberg.jpg|vignette]] | We must ask ourselves the question of the location of production and consumption poles, which is an important aspect of economic geography, and we must ask ourselves the question of the direction of these flows within the framework of a geography of trade. What is interesting is why these flows are taking place and what is their orientation.[[Fichier:paradigme iceberg.jpg|vignette]] | ||

The sliding through these examples is not insignificant. The iceberg paradigm is not an economic theory, but an interesting image which is the idea that in the field of economy, we only see the submerged part of the iceberg, that is to say that we only see the market economy, which passes through an economic and monetarized exchange is capitalism and labour. Most theories are theories that theorize markets and most economic indicators focus on the market and its components while this is only a very small part of the economic because there are many elements that happen outside the market economy that do not necessarily respond to the law of supply and demand. In other words, a whole series of aspects of the economy take place outside the market economy. Because of this submerged part, there is a kind of myopia that hides most of the economic field. | |||

The market is a way of regulating and organising the economy. According to the work of anthropologists, it is possible to distinguish three: | |||

* | *the market; | ||

* | *donation for donation; | ||

* | *redistribution. | ||

By taking these three types of circuit regulation, a complete view of trade and consumption and production of rare goods is obtained. It is very difficult to measure the share in the economy of each of these modes of regulation precisely because the only figures available come from the market economy, because they measure only what is visible relating to the market economy. It can be assumed that, whatever the society studied, the market economy accounts for only a minority share of economic trade, production and consumption. | |||

= | = Trade regulation = | ||

== | == Gift for gift == | ||

The system of donation for donation is first in anthropological terms, on the one hand because it is the first economic system that existed and also because it will be the founder of economics and society as such. Gift for gift is a system of exchange that is characterized by different elements: | |||

* | * the exchange is alternating, but deferred in time: the gift always calls for a donation and the counter-gift takes place after another time. | ||

* | * it is a freely consented exchange: it is what is called the alternating inequality of the market. | ||

However, it is more complicated than that. Mauss in Essay on Gift. Form and reason for the exchange in primitive societies published in 1924 speaks of the "anthropological mystery" of the gift which would be the enigma on which anthropologists are constantly stumbling. This anthropological mystery is formalized as a "free obligation". What characterizes giving against giving is that there is an obligation to give and that there is an obligation to offer. The obligation will also be in the fact that one has no right to refuse a gift that is the obligation to receive. | |||

The gift under the guise of freedom is extremely codified and standardized. The gift, because it creates obligation and because the obligation is shifted in time, it creates social bond. There is an infinite debit and credit link. From an economic point of view, that makes no sense. In giving against giving, there is something counterproductive that can be likened to an economic waste. That's why it's an anthropological mystery. Gift for gift should not be seen as an anecdotal example. There is the idea that we are all fragile beings and that help is always given. The gift we receive is something of the order of survival. Economically, if we try to evaluate it, it is enormous. According to some researchers, donation for donation would represent three quarters of GDP. | |||

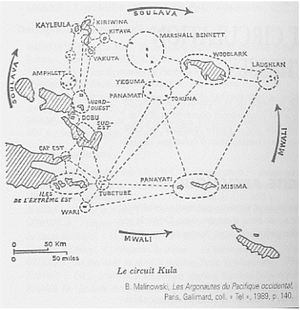

Anthropologists have analyzed the phenomenon of the potlatch which is a meeting between two tribes who will offer each other more and more precious gifts until the time when the opposing tribe can not give back. The potlatch is the continuation of war by other means. In some circumstances, gifts are burned to say the whole non-utilitarian dimension, because it is a practice that only seeks to create social bond. The antiutilitarian social science movement seeks to show that giving for giving serves to create a bond and to make society. Gift for gift is not about creating wealth, but it is about creating a social bond. There are times when we have to get out of economics in order to understand economics.[[Fichier:Phénomène de la kula.png|vignette]] | |||

Donation for donation was first observed in ethnological societies. A famous example is the example of the kula rite in Malinovsky's work. The kula is a very complex donation for donation system that takes place in western Indonesia. Ships will leave an island loaded with presents for other islands. The most precious gifts are pig gifts. A few months later, or a few years later, we will make a donation on the next island and so on. The system of donation for donation is staggered in time, but it is also indirect. There is a counter-donation, but it is not intended for the person who made the donation, but for a third person. The interest of this complex system is to conceal the reciprocity of giving and to engage not only two actors, but also a whole group of peoples in giving against giving. In our societies, there are also complicated forms of donation versus donation and their share is extremely important. | |||

To create a gift, it is often necessary to personalize relationships. Because giving creates social bonds, it is much easier to give to people you know well than to people you don't know well. Gift for gift is essential in the economy, it is a huge part of the iceberg metaphor. This is a part of the economy where there is very little theory. What we know about it is through sociologists and anthropologists who, in working on contemporary societies, show the importance of giving against giving. | |||

== Redistribution == | == Redistribution == | ||

The redistribution circuit operates in two stages. As in the system of donation for donation, there is a time lag. First, a sample is taken with a view to redistribution. What characterizes the system of redistribution is that there is a moment of levy and a moment of redistribution and unlike the market and donation for donation, this implies authority, it is not a voluntary participation of actors. It is possible to withdraw money, work or in kind. Authority can be a king, a government, a city, a religious, military or economic authority. Unlike the market system of donation for donation, an authority will decide to take and redistribute. The current economic world is governed by the principle of redistribution. Redistribution in our societies is essential. | |||

Redistribution also plays an essential role within companies. If the market economy worked well, there would be no business. The company is not regulated by the market economy, we obey orders. The company prefers to internalize rather than externalize and govern by regulation rather than by the market economy. Within each company, the economy is regulated by redistribution. An authority directs the company and decides on the flows within the company. We must understand that the field of regulation in the economy is colossal. In the company, there is authority, a levy and a redistribution. | |||

Redistribution raises the question of the justice of the levies as well as the principles of redistribution. These are political decisions. Enforcing these decisions requires authority; it is a coercive system. It is not because we do not see pure forms of redistribution that the redistribution system is not present in our societies. Authority changes in nature. Behind the regulation and the systems regulated by redistribution, there is always a font that is someone capable of enforcing redistribution. One of the questions that always arises is the question of justice. The goal of redistribution is not in itself the creation of wealth, but the regulation of the economy according to decided principles. The issue of effectiveness is not the first one. | |||

== Market == | |||

What characterizes the market economy is an immediate and balanced satisfaction, the exchange is symmetrical and instantaneous, the link is dissolved immediately as soon as the exchange is finished. The market is also a staging and all players are equal. The market gives rise to a transaction and negotiation. The agreement is absent from redistribution and gift for gift. For the market, there is an agreement where anonymity is important assuming there is no power effect. Market regulation does not necessarily imply the use of a currency. There are many other markets such as the black market, the grey market or the underground market which are prohibited or hidden markets. What we observe depends on the observation tool. The measures used to quantify the market are surface indicators that do not take into account the submerged side of the iceberg. | |||

It is interesting that the physical market has served as a metaphor for the very principle of its organization and virtual markets. The physical market has given rise to sociological and anthropological studies that analyse the behaviour of players. It also goes against the idea that the market would be like a natural way of organising the economy or like the normal way of the economy when it is not organised. | |||

Historical studies show that markets have been put in place, regulated with coercive mechanisms that had a hard time imposing themselves at the outset. This is based on a very present and urgent intervention of the public authority which fixes a precise day, timetables, an allocation of seats, with particular legislation on the fact of displaying the price of products, the fact that scales must be fair and controlled. A whole series of texts and legislations make the functioning of the market possible. The public authorities will intervene in order to impose the market system as a means of regulating the economy. Myopia suggests that the natural mode of organization would be the market economy. In reality, the oldest systems of wealth circulation and economic circuits were the system of donation versus donation and the system of regulation. The market idea existed before the market. It is because we believed in the interest of the market system that this type of structure was set up. | |||

The reason for the success of this recent institution can be explained by qualities that it possesses that donation for donation does not allow or that redistribution does not allow. Among the major points of difference, there is the fact that it does not depend on an authority, but that it depends on the agreement of the participants[1], it gives rise to a mutual and instantaneous satisfaction of the partners[2], it does not suppose and does not necessarily create a social link with the idea of anonymity of the actors[3]. The system of redistribution supposes a common identity since this system supposes that one submits oneself to a common authority which is that of the community from which one takes out an identity. In the context of giving for giving, there is no authority because the link is direct, whereas in the context of the market there is no link between the partners and the exchange is instantly settled because there is no time lag on the contrary in giving for giving where what creates the link is the debt. | |||

= Circuit scales = | |||

For a geographer, what is interesting is the spatial organization of each of these types of economic circuit regulation. Geographically, in its spatial distribution, does an economic circuit organized by donation versus donation through regulation or the market system have the same characteristics. The scale of the economic circuit is to know what is the distance between the different poles of economic circuits. | |||

== The concept of the world economy: Braudel and Wallerstein == | |||

In Civilisation matérielle, économie et capitalisme - XVe - XVIIIe siècles published in 1979, Fernand Braudel proposes the concept of world economy, which gives the following definition: "a fragment of the universe, a piece of the planet economically autonomous, capable essentially of self-sufficiency and to which its internal links and exchanges confer a certain organic unity". | |||

A world economy is a space limited by a border and economically autonomous that has very little exchange with the outside, in contrast, there is much exchange with the inside. The exchanges with this space are so strong that it gives it unity. A world economy is both a more or less closed economic system whose elements interact and a space system. | |||

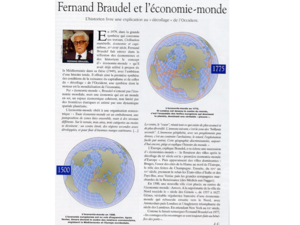

Systems are never closed on themselves. What constitutes this spatial and economic entity in system and in circuit is both the intensity of interactions within it and the rarity of interactions with the outside. A world economy is both a geographical and an economic space. In other words, a world economy is the superposition of a geographical space and an economic circuit. It is an economy and, at the same time, a world closed in on itself that partly derives its coherence from its economy.[[Fichier:Fernand braudel et économie monde 1.png|vignette]] | |||

Braudel lists some geographical features of the world economy which are spatial features: | |||

* "occupies a given geographical space"; | |||

* "always accepts a pole, a center; | |||

* "It is "divided into successive zones". | |||

The terms "poles" or "centre" do not necessarily have a geometric definition. When we speak of "centre" or "periphery" it is more in terms of geography than geometry. The reason why Braudel conceived the concept of world economy was to reflect what was happening in Europe and the Mediterranean. | |||

Until the beginning of the 16th century, trade was essentially inter-European. From 1500, with the great explorations, little by little flows will be formed. In the 18th century, the world economy changed in configuration and scale. Europe was a world economy in 1500 whereas, in 1775, it was included in a world economy that did not affect all parts of the planet, but was marked by multiple exchanges between numerous coastal trading posts. | |||

Actually, these cards are fake. There are reasons why they are not admissible. | |||

In The Modern World-System, vol. I: Capitalist Agriculture and the Origins of the European World-Economy in the Sixteenth Century published in 1974, Wallerstein proposes the concept of world system. This concept goes further than Braudel's saying that there are two types of "world system", namely a world empire [1] and a world economy [2]. | |||

What Braudel calls a "world economy" is not only geographical and economic entities, but also political entities. Wallerstein speaks of a "world empire" when these geographical and economic circuits that is the "world economy" correspond to a political entity. The borders of the "world economy" correspond to those of an empire. The international division of labour takes place within the same political, economic and geographical system. Wallerstein will reserve the term "world economy" in the case where international division is between states. The geographical entity does not correspond to one political entity, but to several political entities. In other words, a world empire is a country and a world economy is several countries. | |||

[[Fichier:Carrefours du commerce au moyen age 1.png|vignette|gauche]] | Braudel's concept is interesting because it compares spatial and economic organization, Wallerstein adds political organization. The economic circuit is economy, the world economy is economy more geography, the world empire would be economy, space and politics.[[Fichier:Carrefours du commerce au moyen age 1.png|vignette|gauche]] | ||

This map is the map of the crossroads of trade in the Middle Ages before the opening of the Atlantic. Everything is centred both on the North Sea and the Baltic Sea, on the axis of the Meuse and the Rhine, the proto-industrial cities of Italy and the flows that link the western production and consumption basins with those of the East. | |||

[[Fichier:Circuit économique 4.png|vignette]] | [[Fichier:Circuit économique 4.png|vignette]] | ||

There are flows, poles, cities and very few exchanges with the outside world. In terms of trade intensity in Europe, trade with Asia is insignificant and negligible. Nevertheless, the economic and coherent circuit forming an organization in a situation of interdependence making it possible to determine. This is the classic view of the geography of the period. Europe would correspond to the world economy having a functional and economic existence. However, this is not the case. | |||

Sahlins | == The gradient of exchange: Sahlins and Chaunu == | ||

In 1976 Sahlins published his work Stone Age, Age of Abundance, whose purpose is not to talk about economic geography and trade. The idea is that scientific and technological progress, agriculture, the market and industrialisation have saved us from a risky and miserable existence, freeing us from the strong constraints of comfort, freedom and leisure. Sahlins was interested in "tribes and savages" observing societies that knew neither industry, agriculture, nor livestock. These are hunter-gatherer savings. These are people who work an average of between one and two hours a day. The time to survive is measured and low. The rest of the time is dedicated to other practices. The Stone Age is the Age of plenty. What was considered progress can be seen as a moron. To meet our needs, we have to work between eight and ten hours a day. | |||

[[Fichier:Gradient échange 1.png|vignette]] | There has been a reversal of outlook. The reason why we agreed to work so hard and because we were created a new need. Sahlins was interested not only in production, but also in exchanges. To exchange, there is a specialization from tasks with women who will pick berries and men will hunt animals, but according to strict criteria. There is the hypothesis that specialization is not aimed at maximizing production, but at making exchange compulsory, because one is forced to exchange.[[Fichier:Gradient échange 1.png|vignette]] | ||

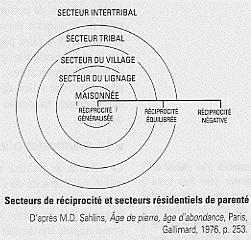

Sahlins | Sahlins wonders how economic exchanges take place. It will distinguish three successive circles: | ||

*''' | *'''circle of the household''': it is the circle of the people of the family which is close. The exchange is made according to the system of gift for gift without obligation, in other words, the free obligation to give, receive and return. This characterizes exchanges between symbolic and spatially close individuals. This regulatory system does not presuppose authority, but proximity and dependence because exchanges are daily and permanent. There is a symbolic proximity. | ||

*''' | *'''village circle''': within the tribe, the rule is redistribution. | ||

*''' | *'''intertribal circle''': exchanges with neighbouring tribes do not go well because the relations are mainly warlike. There are times when there are ritualized exchanges through barter. It is the system of immediate satisfaction of both parties on the basis of negotiation without the creation of social ties and without the need for social ties. The gift is a generalized reciprocity, but delayed in time, the redistribution is a balanced reciprocity whereas the reciprocity for the market is immediate, but can be negative. There's a degradation. According to Sahlins, the farther the partner is symbolically and geographically, the more a degraded mode of trade regulation is used. There is a noble mode of regulating trade, which is gift for gift, which presupposes and creates social ties; there is a somewhat degraded mode, which is redistribution, and an even more degraded mode within the framework of the market. The market is reserved for foreigners, for those with whom we do not want or we cannot talk. This is the way economic actors experience trade. Exchanges are linked to otherness. | ||

[[Fichier:Gradient échange 2.png|vignette]] | [[Fichier:Gradient échange 2.png|vignette]] | ||

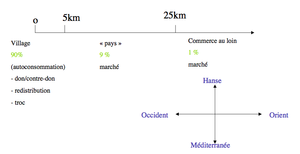

Chaunu | Chaunu was working on the nature of exchanges in the Middle Ages. 90% of economic exchanges did not travel more than 5 kilometres. There is a strong self-consumption. Each household is self-consuming, which means that there is a specialization within each household that operates on donation for donation. In the villages, there are exchanges between neighbours with specialisation and a division of labour. Part of the trade is regulated by the redistribution circuit, barter will also play a role. | ||

[[Fichier:Carrefours du commerce au moyen age 1.png|vignette|gauche]] | The further away from the village there is a lot of redistribution and a little barter. It is estimated that at the time, 90% of exchanges took place within a radius of 5 kilometres. It is possible to need products that do not come from local production either because you cannot or because you do not know. The solution is either to resort to peddlers who bring what is necessary, or it is possible to move towards a village or a city more anchored in the monetary economy with real merchants. This requires a journey of 25 kilometres. In Latin, this is called a "pagus" in which markets regularly take place. 9% of exchanges are made within a radius of 25 kilometers to buy and sell. 1% of the trade is with the rest of the world concerning rare and expensive products which the peasants have little use being reserved for the bourgeoisie or the aristocracy as jewels, instruments, rarer care, rarer services.[[Fichier:Carrefours du commerce au moyen age 1.png|vignette|gauche]] | ||

This map deals with the 1% of exchanges that cross a radius of 25 kilometres. This map shows what trades between extremely localized world economies. This space is fragmented into spaces with a radius of 25 kilometres between which almost nothing circulates. We see a traffic quantitatively non-existent, but very visible which is the trade in the distance. They are expensive products, moved over great distances reserved for people of a very high social rank. It is a world of luxury trade for an aristocracy, but it is not a world economy as defined by Braudel. | |||

Many of these maps invisibilize flows that are also essential. Beware of maps that tend to draw the line between world economy and the rest of the world in the wrong place. We must keep in mind the idea of an exchange gradient which is that the further we get, the less we exchange and the more the forms of exchange are anthropologically degraded. What is visible are the rare products and the market, while what circulates inside are the channels of giving against giving and redistribution. This allows us to reflect on globalisation and the change in scale of economic circuits that globalisation would bring. With this story and this myth that our economies would have become globalized, that our economic circuits would have changed scale and that we would have gone from a local world economy to a world economy that is the world. | |||

This idea is wrong for two reasons: globalization did not take place [1] and globalization took place long ago [2]. In other words, globalization has not affected us as much as we are told and it is not as new as we are told. Globalization must be put into perspective in its unprecedented newness, but also in its measure. For some authors, the first globalization is between 30,000 and 5,000 years before Jesus Christ with the humanization of the planet. It is possible to make arrows showing how human space has spread over the planet. This globalisation has serious consequences, but is not an economic phenomenon. | |||

== | == The first globalizations: XVIIIth century - XIXth century == | ||

We must remember 1492 and the discovery of the New World which is America. Before 1492, there was the Silk Road, but the western horizon was limited because there was no access to it. Asian products could only be acquired through Turkish intermediaries. For the first time, the West is gaining access to an elsewhere which it was unaware of until now and which it had not even hypothesized. This is a fascinating moment in Western history because it is difficult to define what it would be like today. This discovery was incompatible with what was written in the Bible. A hypothesis was formulated at this time that there were two creations and two paradises. It is the first moment when the political, cultural and economic reality of the West changes horizon. | |||

[[Fichier:Commerce triangulaire 1.png|vignette]] | [[Fichier:Commerce triangulaire 1.png|vignette]] | ||

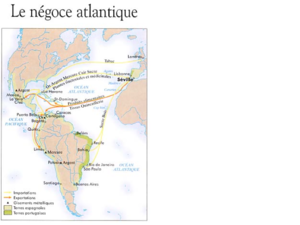

The first exchange took place in the form planned by Sahlins, which is theft, looting and violence, particularly with the massive arrival of gold and silver which will totally destabilise the European economy for the benefit of the countries of the Iberian Peninsula. Mining resources will be developed using indigenous labour. The Church will discuss in the context of the Valladolid controversy which questions the condition of the indigenous people. This will generate slave trade with Africa. The second phase is the plantation system and the massive transfer within the framework of the triangular trade of the "ebony wood" that are the black slaves. This highlights the existence of a trade of unavailability which means that if we go to look for certain resources abroad it is because we cannot produce them in Europe. | |||

In the beginning, the predation economy did not represent much for the peasant, even if it had a major impact on the European monetary system. On the other hand, products that start to transit in large quantities will have an impact for the local farmer creating a demand for exotic products that he cannot produce himself. For some, we will create a need with sugar or create an addiction as with tobacco. There is the first installation of a quantitatively significant economic circuit that is being set up on both sides of the Atlantic.[[Fichier:Négoce atlantique 1.png|vignette]] | |||

The extraction of "ebony wood" which is an economic extraction is done in violence, the plantation system is done by buying slaves, but these plantations belong for the most part to large owners and families in Europe regulated in Europe by redistribution circuits. Gradually, we move from exploitation through looting, to colonial exploitation and plantation to a more capitalist system of colonization more linked to the market, as evidenced by the existence of commercial companies characterizing the commercial capitalist system. | |||

At the beginning, the market was opposed to colonization and therefore to globalization through transatlantic trade. The first reason was for its economic inefficiency and the second ideological reason, because if you believe in the market, the use of force, of indigenous labour is counterproductive. If we believe in the market, we cannot be "for" slavery and colonization. There was a fear in the business community that the development of trade brought about by colonization would result in economic development of the colonies and thus competition from the colonies. Exploiting the colonies was possible provided they did not become competitors. A first globalization is that of gold, then of slaves and finally of tropical products which come to feed Europe. The first economic globalisation took place in the 16th century with the globalisation of colonial trade. | |||

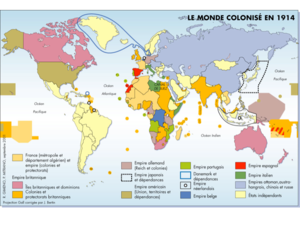

In 1914, colonization globalized the planet. All parts of the world are registered in trade circuits managed by metropolises. We fall back on Braudel's concept of the world economy with a centre that is the metropolis, a periphery that is the colony and the empire.[[Fichier:Monde colonisé en 1914 1.png|vignette|centré]] | |||

What is taking place is flows that are no longer anecdotal, but flows of massive consumer products. This globalization will last and be important until the middle of the 20th century. | |||

== The rise of international trade: 19th - 21st century == | |||

The second globalization is taking place with the establishment of international trade. Before the 19th century, international trade hardly existed due to the fact that there was much warfare, customs barriers made trade prohibitive and transport inefficient. With a series of technical inventions, procedures, new ideas that will ensure the emergence of international trade resulting in increased flows between countries. | |||

In 1801 the London Stock Exchange opened. Between 1841 and 1842, the Opium War was waged, imposing the right to sell opium on the coast and in Chinese cities. One of the first economic wars was based on the drug market. This war was a means of forcing China to open up to the outside world. At the same time in 1846 were abolished the corn laws that protected English grain farmers allowing English grain production to survive. Arrives on the British international wheat market much cheaper resulting in the disappearance of grain farming in a few years because it is not profitable. England's comparative advantage is industry. With England's opening to free trade, England's industrialization was to take place. In 1862 a Franco-English free trade treaty was signed. Between 1890 and 1914, free trade was imposed to the point that the economic opening of the countries in 1914 and today is almost the same. Between 1914 and the 1960s, borders were re-established. The 20th century is the end of international trade because of the two wars, but also because of the crisis of 1929. Between 1929 and 1933, foreign trade worldwide fell by 66%. The history of globalization is not the history of the globalization of international trade, is not the history of steady progress to the present day, but the history of a trade that internationalized rapidly and powerfully in the nineteenth century with a very brutal halt in 1914 and a stagnation of international trade at a relatively low level between 1914 and the 1960s. | |||

The 20th century will be the century of the disinternationalisation of trade with the First and Second World Wars. With the crisis of 1929, it was less the crisis than its contagion that struck minds with the fact that the crisis had begun in the United States and that it had spread in a domino effect. The solution was to close the borders with a whole series of protectionist measures. Nevertheless, the movement will resume a little before the end of the Second World War. | |||

From 1944 and 1945 onwards, international and local systems will again be put in place to remove protectionist barriers and customs barriers. The first element is a whole set of institutions and measures from the end of the war to 1947 aimed at rebuilding a ruined economic and political universe by putting in place a new order that is also an economic order with the GATT, the IBRD and the IMF. Through these international organizations, global economic governance is being established, based on the idea that increased international trade will be for the good of all. In 1957, with the Treaty of Rome, the European Economic Community was created, playing a massive role in lowering customs tariffs with the aim of creating a single European market. At the beginning, the project was to build a European economic circuit, but the reasons why we wanted to establish a single economic circuit were not primarily economic reasons. This was thought to be the best way to avoid a Third World War that would forge economic and community ties. Economics was instrumentalized for political ends whose purpose of union was for diplomatic and political ends. This community has resulted in an increase in international trade at the regional European level. Decolonization was the third major factor in the development of the international trade market. Once the former colonies escape the power and authority of the metropolis, they acquire economic and financial autonomy so that they can become players in the international market. Decolonization has led to the entry into the international market of countries that have been freed from the tutelage of metropolises. The fourth moment is the rise of neoliberalism in the 1980s that preceded the collapse of the Soviet bloc, the communist world and the political and economic ideals these powers represented. The end of the story is the idea that we had arrived at a moment in history when choice was no longer possible. The margin of history was the choice between the two models. At the end of the 1980s and 1990s, the idea arose that there was only one model which was the model of the market, of democracy, of the imperative of human rights. In this model, there is economic liberalization. A lot for the United States, there is a consubstantial relationship between economic liberalism and democracy. Democracy and the market work together. The end of history and the general agreement on the market, human rights and democracy are reflected in a very strong internationalisation of the economy. | |||

The technological revolution around transport plays a role in the expansion of economic circuits. Transport costs have rarely been a definitive obstacle to international trade, but rather protectionist measures. The 1990s with the emergence of the internal bubble resulted in a near cancellation of the cost of distance crossing for certain products and a unification of the market. In 1992, NAFTA was created, creating a single market for the United States, Canada and Mexico. The idea that borders have become porous creates a region where borders no longer stand in the way of international trade. If economic borders disappear within Europe or the United States, it is to better establish them elsewhere. Basically, the European Union has only pushed back borders. In a sense, regionalism is the opposite of free trade since we are barricading ourselves under economic borders that are displaced and changed in scale. We are not in a globalised world, but in an intermediate stage between local markets and a very single market. In 1994 the WTO was founded and in 2000 China's accession to the WTO, which is both a country marked by the communist dirigist economy and double-digit growth for decades. | |||

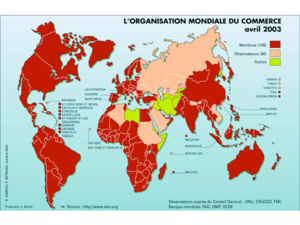

[[Fichier:OMC avril 2003 1.png|vignette|gauche]] | [[Fichier:OMC avril 2003 1.png|vignette|gauche]] | ||

The situation is that the whole world has joined the WTO. This means that the whole world has joined the market economy and the whole world has agreed on the idea that a single global market must eventually be created. This raises many discussions and debates. Adherence to the principle of the world economy does not prevent us from distancing ourselves from the means to achieve this. | |||

We come to the idea that if there was the establishment of free trade between 1800 and 1914, if there is a collapse of the international market between the two world wars, it resumes in the 1950s, it accelerates in the 1960s to lead to iconic maps showing a globalized world.[[Fichier:Commerce mondial de marchandise 2000.png|vignette]] | |||

When you look at this map, you get the impression that globalization is complete and that the scale of economic circuits is the same as that of the planet. This map is manipulative because there are ends that are cut like South Africa, on the other hand, the emphasis is on the north - north links between the "triad". The title is wrong. This map is about "international trade", but it does not say "world trade". We should see all the flows that take place in the world, but it only shows international flows. | |||

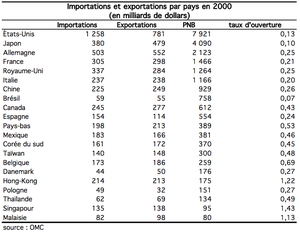

[[Fichier:Importation et exportation par pays en 2000.png|vignette|centré]] | For example, economic flows on the scale of Switzerland or France are not shown, yet they are five times more massive than international flows. The first factor that affects the quantity of international flows is the size of the countries. If a space is fragmented into small countries, there are many international flows, if a space is divided only between large blocks limits international flows. This map is biased by the political map. Basically, this map has an ideological function to put the emphasis on globalization when in fact that is not what it is about.[[Fichier:Importation et exportation par pays en 2000.png|vignette|centré]] | ||

This table is the open rate of different countries worldwide for different countries. The openness rate is calculated by adding imports plus exports divided by two times GNP. This gives the idea of the share of production exported and the share of consumption that is imported. For States, an openness rate of 13% means that on average, 13% of production and exported or 13% of consumption is imported. In other words, 87% of US production is destined for the US market and 87% of what US consumers buy is manufactured on US soil. Nine-tenths of the American economy takes place on American soil, while the United States is pushing for the opening of borders and the globalization of markets, whereas it is a very national economy. If we look at Japan, its opening rate is 0.10 which means that 10% of Japanese consumption is imported or exported. The guards showing international flows are based only on the opening rate, which is why these flows must be put into perspective. The opening rate rarely exceeds 20%. | |||

There are exceptions such as Germany, France or the United Kingdom. Within the European Union, the average is around 25%. European openness is twice as important as that of the United States and Japan. The fact that flows cross borders is linked to two factors. The first is the construction of the European Union and the fact that policies have been put in place to facilitate international trade and international economic cooperation. This means that these countries are open to the outside world, but essentially to their neighbours. The second factor is the size of Europe, because by nature small countries have a higher rate of openness than large countries. The opening rate in the Netherlands is 0.53. There's a size effect. In international competition, the only way to produce and sell and specialize. Countries will specialize in products and productions in which they hope to be competitive. The specialization of small countries means that all their production is exported and all consumption is imported. By nature, small countries have a much higher openness rate than large countries. Both for material reasons and for reasons relating to the internal market. This explains why when looking for small countries, the rate of openness is much higher. | |||

There are cases like Singapore, Malaysia and Hong Kong where the opening rate is above 1. In Hong Kong, exports and imports account for 122% of consumption or production. The explanation is that they are warehouse countries that re-export what they import, they are hubs. Imports are not linked to the domestic market but are destined for reprocessing and re-export. | |||

We must be careful with this type of table about what international flows are. How they are measured plays a large role in the conclusions drawn. What is interesting to know is the average distance travelled by a country. The increase in international trade does not really prove that the average distance travelled by products has increased, but it does prove that they cross more borders. These figures do not say much about the scale of economic circuits, but about the fact that they cross more borders. Internationalisation is very measured. For most small countries, it is below a quarter which means that in most countries are destined for and produced by the domestic market. Globalisation affects only a small part of the economy and we are still only talking about the market economy. Globalisation remains a relatively marginal phenomenon. This is not a new phenomenon either. | |||

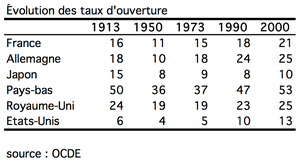

[[Fichier:Geoeco_évolution_du_taux_ouverture_par_pays.png|vignette|gauche]] | [[Fichier:Geoeco_évolution_du_taux_ouverture_par_pays.png|vignette|gauche]] | ||

Between 1913, the peak of free trade and the establishment of a world market, and 1950, opening rates collapsed. Today, if we look at the figures, several countries have just regained or have not yet regained the opening rates of 1913. For example, in 1913, Japan was 33 times internationalized than it is today. | |||

If the United States is separate, it is linked to the size of the country, but also to the fact that the American economy did not suffer in the way of the two world wars that even benefited from it. We live in a world today that is no more globalized than it was in 1914. The opening rates are percentages and this is not an absolute figure since, at the same time, world trade in "weight" has exploded. This is another quantitative reality, but if we reason in percentage, we have only caught up with the level of 1914. What is true for the goods market is also true for people. There were many more international migrations in the 19th century than today, but of course, quantitatively it is not the same thing. | |||

This is not to deny the idea that something changes at the end of the 20th century. Something changed in the 1980s and 1990s. These figures and maps are intended to suggest that globalisation is not a new phenomenon and that globalisation is an event affecting a small part of the market economy and that most market channels are local and national. We must not give in to a form of myopia that hypnotizes by the massive and recent nature of globalization, which is neither massive nor recent. | |||

= Conclusion = | = Conclusion = | ||

The market is one type of circuit and probably not the most important. Each mode of regulation, i.e. giving for giving, redistribution and the market, has different functions and scales. Each type of exchange corresponds to a spatial and symbolic proximity. Three major periods of global economic change can be distinguished with colonization, the establishment of free trade in the 19th century and the recent recovery. Globalization must be conceived as a (maximum) spatial extension of the circuit to transform the planet into a world economy. Globalization has an "old" and limited character. | |||

What are the drivers of globalization? Of course, there is a technological dimension with the transport revolution. These great logistic mutations which authorized reorganizations of the economic circuits of the changes of scales are important being related to the history of the railways, the boats, the planes and Internet. This allows globalization, but it does not require it. The reasons for international trade are ideological and political. This means that the explanation of economics is not in economics, thinking that developments find their explanation within this world. The economic is embedded in the political and in the social and these changes do not find their principle and their reason within the economy conceived as a fiction. They take place in larger and more complex logics. | |||

= Annexes = | = Annexes = | ||

= References = | = References = | ||

<references/> | <references /> | ||

[[Category:Jean-François Staszak]] | [[Category:Jean-François Staszak]] | ||

Version actuelle datée du 7 juin 2018 à 23:06

| Professeur(s) | Staszak, Jean-François[1][2][3][4][5][6][7] |

|---|---|

| Cours | Economic geography |

Lectures

The theoretical framework of the economic circuit raises the problem of economic circuits and their geography. We will present what an economic circuit is and establish its geographical characteristics.

Economic circuits[modifier | modifier le wikicode]

The economy and its circuit[modifier | modifier le wikicode]

An economic circuit is composed of two elements, namely poles and flows. There are two types of poles: the consumption pole and the production pole. Between the poles, the moments, the places and the actors of production and consumption, there are exchanges that can be material or immaterial exchanges. In this interaction, there are four types of flows between the poles of consumption and production which are flows of goods and services, cash flows, labour flows and information flows.

It is important to know in the history of ideas where this concept of the economic circuit comes from? The first to think of the economic circuit was François Quesnay in 1758 who worked in the physiocrat movement. Physiocrats were thinkers in political economy who developed a reflection on the wealth of nations. The interactions between the poles and the flows refer to the idea of the human body. Society would function in the same way. It is an organicist vision as if society were a body with organs and there were exchanges. An organicist metaphor is never innocent. Beware of organicist metaphors in the social sciences. Comparing the city to a body is a vision of the city that implies policies and practices that are not insignificant.

This allows us to reflect on economics, which is defined as the production, consumption and exchange of rare goods. What is important is to stress that it is not just goods that circulate, namely services, information, work and money.

From simple to complex circuits[modifier | modifier le wikicode]

It is possible to make the circuit more complex. In the previous case, we were in a non-monetary economy, whereas now we are integrating concepts that complicate the economy, which is becoming monetarized. Exchanges are multiplying. Sometimes there is a superposition of the poles of production and consumption. There is behind the idea of mass production and mass consumption that we find in Fordism in particular.

It is possible to envisage more complex economic circuits. There are no longer two poles, but there are four. Institutions play an intermediary role between these poles with an administration and private and financial institutions. We obtain matrices that become very complicated. This economic circuit will become more complex until we realize what the economy and society are.

We must ask ourselves the question of the location of production and consumption poles, which is an important aspect of economic geography, and we must ask ourselves the question of the direction of these flows within the framework of a geography of trade. What is interesting is why these flows are taking place and what is their orientation.

The sliding through these examples is not insignificant. The iceberg paradigm is not an economic theory, but an interesting image which is the idea that in the field of economy, we only see the submerged part of the iceberg, that is to say that we only see the market economy, which passes through an economic and monetarized exchange is capitalism and labour. Most theories are theories that theorize markets and most economic indicators focus on the market and its components while this is only a very small part of the economic because there are many elements that happen outside the market economy that do not necessarily respond to the law of supply and demand. In other words, a whole series of aspects of the economy take place outside the market economy. Because of this submerged part, there is a kind of myopia that hides most of the economic field.

The market is a way of regulating and organising the economy. According to the work of anthropologists, it is possible to distinguish three:

- the market;

- donation for donation;

- redistribution.

By taking these three types of circuit regulation, a complete view of trade and consumption and production of rare goods is obtained. It is very difficult to measure the share in the economy of each of these modes of regulation precisely because the only figures available come from the market economy, because they measure only what is visible relating to the market economy. It can be assumed that, whatever the society studied, the market economy accounts for only a minority share of economic trade, production and consumption.

Trade regulation[modifier | modifier le wikicode]

Gift for gift[modifier | modifier le wikicode]

The system of donation for donation is first in anthropological terms, on the one hand because it is the first economic system that existed and also because it will be the founder of economics and society as such. Gift for gift is a system of exchange that is characterized by different elements:

- the exchange is alternating, but deferred in time: the gift always calls for a donation and the counter-gift takes place after another time.

- it is a freely consented exchange: it is what is called the alternating inequality of the market.

However, it is more complicated than that. Mauss in Essay on Gift. Form and reason for the exchange in primitive societies published in 1924 speaks of the "anthropological mystery" of the gift which would be the enigma on which anthropologists are constantly stumbling. This anthropological mystery is formalized as a "free obligation". What characterizes giving against giving is that there is an obligation to give and that there is an obligation to offer. The obligation will also be in the fact that one has no right to refuse a gift that is the obligation to receive.

The gift under the guise of freedom is extremely codified and standardized. The gift, because it creates obligation and because the obligation is shifted in time, it creates social bond. There is an infinite debit and credit link. From an economic point of view, that makes no sense. In giving against giving, there is something counterproductive that can be likened to an economic waste. That's why it's an anthropological mystery. Gift for gift should not be seen as an anecdotal example. There is the idea that we are all fragile beings and that help is always given. The gift we receive is something of the order of survival. Economically, if we try to evaluate it, it is enormous. According to some researchers, donation for donation would represent three quarters of GDP.

Anthropologists have analyzed the phenomenon of the potlatch which is a meeting between two tribes who will offer each other more and more precious gifts until the time when the opposing tribe can not give back. The potlatch is the continuation of war by other means. In some circumstances, gifts are burned to say the whole non-utilitarian dimension, because it is a practice that only seeks to create social bond. The antiutilitarian social science movement seeks to show that giving for giving serves to create a bond and to make society. Gift for gift is not about creating wealth, but it is about creating a social bond. There are times when we have to get out of economics in order to understand economics.

Donation for donation was first observed in ethnological societies. A famous example is the example of the kula rite in Malinovsky's work. The kula is a very complex donation for donation system that takes place in western Indonesia. Ships will leave an island loaded with presents for other islands. The most precious gifts are pig gifts. A few months later, or a few years later, we will make a donation on the next island and so on. The system of donation for donation is staggered in time, but it is also indirect. There is a counter-donation, but it is not intended for the person who made the donation, but for a third person. The interest of this complex system is to conceal the reciprocity of giving and to engage not only two actors, but also a whole group of peoples in giving against giving. In our societies, there are also complicated forms of donation versus donation and their share is extremely important.

To create a gift, it is often necessary to personalize relationships. Because giving creates social bonds, it is much easier to give to people you know well than to people you don't know well. Gift for gift is essential in the economy, it is a huge part of the iceberg metaphor. This is a part of the economy where there is very little theory. What we know about it is through sociologists and anthropologists who, in working on contemporary societies, show the importance of giving against giving.

Redistribution[modifier | modifier le wikicode]

The redistribution circuit operates in two stages. As in the system of donation for donation, there is a time lag. First, a sample is taken with a view to redistribution. What characterizes the system of redistribution is that there is a moment of levy and a moment of redistribution and unlike the market and donation for donation, this implies authority, it is not a voluntary participation of actors. It is possible to withdraw money, work or in kind. Authority can be a king, a government, a city, a religious, military or economic authority. Unlike the market system of donation for donation, an authority will decide to take and redistribute. The current economic world is governed by the principle of redistribution. Redistribution in our societies is essential.

Redistribution also plays an essential role within companies. If the market economy worked well, there would be no business. The company is not regulated by the market economy, we obey orders. The company prefers to internalize rather than externalize and govern by regulation rather than by the market economy. Within each company, the economy is regulated by redistribution. An authority directs the company and decides on the flows within the company. We must understand that the field of regulation in the economy is colossal. In the company, there is authority, a levy and a redistribution.

Redistribution raises the question of the justice of the levies as well as the principles of redistribution. These are political decisions. Enforcing these decisions requires authority; it is a coercive system. It is not because we do not see pure forms of redistribution that the redistribution system is not present in our societies. Authority changes in nature. Behind the regulation and the systems regulated by redistribution, there is always a font that is someone capable of enforcing redistribution. One of the questions that always arises is the question of justice. The goal of redistribution is not in itself the creation of wealth, but the regulation of the economy according to decided principles. The issue of effectiveness is not the first one.

Market[modifier | modifier le wikicode]

What characterizes the market economy is an immediate and balanced satisfaction, the exchange is symmetrical and instantaneous, the link is dissolved immediately as soon as the exchange is finished. The market is also a staging and all players are equal. The market gives rise to a transaction and negotiation. The agreement is absent from redistribution and gift for gift. For the market, there is an agreement where anonymity is important assuming there is no power effect. Market regulation does not necessarily imply the use of a currency. There are many other markets such as the black market, the grey market or the underground market which are prohibited or hidden markets. What we observe depends on the observation tool. The measures used to quantify the market are surface indicators that do not take into account the submerged side of the iceberg.

It is interesting that the physical market has served as a metaphor for the very principle of its organization and virtual markets. The physical market has given rise to sociological and anthropological studies that analyse the behaviour of players. It also goes against the idea that the market would be like a natural way of organising the economy or like the normal way of the economy when it is not organised.

Historical studies show that markets have been put in place, regulated with coercive mechanisms that had a hard time imposing themselves at the outset. This is based on a very present and urgent intervention of the public authority which fixes a precise day, timetables, an allocation of seats, with particular legislation on the fact of displaying the price of products, the fact that scales must be fair and controlled. A whole series of texts and legislations make the functioning of the market possible. The public authorities will intervene in order to impose the market system as a means of regulating the economy. Myopia suggests that the natural mode of organization would be the market economy. In reality, the oldest systems of wealth circulation and economic circuits were the system of donation versus donation and the system of regulation. The market idea existed before the market. It is because we believed in the interest of the market system that this type of structure was set up.

The reason for the success of this recent institution can be explained by qualities that it possesses that donation for donation does not allow or that redistribution does not allow. Among the major points of difference, there is the fact that it does not depend on an authority, but that it depends on the agreement of the participants[1], it gives rise to a mutual and instantaneous satisfaction of the partners[2], it does not suppose and does not necessarily create a social link with the idea of anonymity of the actors[3]. The system of redistribution supposes a common identity since this system supposes that one submits oneself to a common authority which is that of the community from which one takes out an identity. In the context of giving for giving, there is no authority because the link is direct, whereas in the context of the market there is no link between the partners and the exchange is instantly settled because there is no time lag on the contrary in giving for giving where what creates the link is the debt.

Circuit scales[modifier | modifier le wikicode]

For a geographer, what is interesting is the spatial organization of each of these types of economic circuit regulation. Geographically, in its spatial distribution, does an economic circuit organized by donation versus donation through regulation or the market system have the same characteristics. The scale of the economic circuit is to know what is the distance between the different poles of economic circuits.

The concept of the world economy: Braudel and Wallerstein[modifier | modifier le wikicode]

In Civilisation matérielle, économie et capitalisme - XVe - XVIIIe siècles published in 1979, Fernand Braudel proposes the concept of world economy, which gives the following definition: "a fragment of the universe, a piece of the planet economically autonomous, capable essentially of self-sufficiency and to which its internal links and exchanges confer a certain organic unity".

A world economy is a space limited by a border and economically autonomous that has very little exchange with the outside, in contrast, there is much exchange with the inside. The exchanges with this space are so strong that it gives it unity. A world economy is both a more or less closed economic system whose elements interact and a space system.

Systems are never closed on themselves. What constitutes this spatial and economic entity in system and in circuit is both the intensity of interactions within it and the rarity of interactions with the outside. A world economy is both a geographical and an economic space. In other words, a world economy is the superposition of a geographical space and an economic circuit. It is an economy and, at the same time, a world closed in on itself that partly derives its coherence from its economy.

Braudel lists some geographical features of the world economy which are spatial features:

- "occupies a given geographical space";

- "always accepts a pole, a center;

- "It is "divided into successive zones".

The terms "poles" or "centre" do not necessarily have a geometric definition. When we speak of "centre" or "periphery" it is more in terms of geography than geometry. The reason why Braudel conceived the concept of world economy was to reflect what was happening in Europe and the Mediterranean.

Until the beginning of the 16th century, trade was essentially inter-European. From 1500, with the great explorations, little by little flows will be formed. In the 18th century, the world economy changed in configuration and scale. Europe was a world economy in 1500 whereas, in 1775, it was included in a world economy that did not affect all parts of the planet, but was marked by multiple exchanges between numerous coastal trading posts.

Actually, these cards are fake. There are reasons why they are not admissible.

In The Modern World-System, vol. I: Capitalist Agriculture and the Origins of the European World-Economy in the Sixteenth Century published in 1974, Wallerstein proposes the concept of world system. This concept goes further than Braudel's saying that there are two types of "world system", namely a world empire [1] and a world economy [2].

What Braudel calls a "world economy" is not only geographical and economic entities, but also political entities. Wallerstein speaks of a "world empire" when these geographical and economic circuits that is the "world economy" correspond to a political entity. The borders of the "world economy" correspond to those of an empire. The international division of labour takes place within the same political, economic and geographical system. Wallerstein will reserve the term "world economy" in the case where international division is between states. The geographical entity does not correspond to one political entity, but to several political entities. In other words, a world empire is a country and a world economy is several countries.

Braudel's concept is interesting because it compares spatial and economic organization, Wallerstein adds political organization. The economic circuit is economy, the world economy is economy more geography, the world empire would be economy, space and politics.

This map is the map of the crossroads of trade in the Middle Ages before the opening of the Atlantic. Everything is centred both on the North Sea and the Baltic Sea, on the axis of the Meuse and the Rhine, the proto-industrial cities of Italy and the flows that link the western production and consumption basins with those of the East.

There are flows, poles, cities and very few exchanges with the outside world. In terms of trade intensity in Europe, trade with Asia is insignificant and negligible. Nevertheless, the economic and coherent circuit forming an organization in a situation of interdependence making it possible to determine. This is the classic view of the geography of the period. Europe would correspond to the world economy having a functional and economic existence. However, this is not the case.

The gradient of exchange: Sahlins and Chaunu[modifier | modifier le wikicode]

In 1976 Sahlins published his work Stone Age, Age of Abundance, whose purpose is not to talk about economic geography and trade. The idea is that scientific and technological progress, agriculture, the market and industrialisation have saved us from a risky and miserable existence, freeing us from the strong constraints of comfort, freedom and leisure. Sahlins was interested in "tribes and savages" observing societies that knew neither industry, agriculture, nor livestock. These are hunter-gatherer savings. These are people who work an average of between one and two hours a day. The time to survive is measured and low. The rest of the time is dedicated to other practices. The Stone Age is the Age of plenty. What was considered progress can be seen as a moron. To meet our needs, we have to work between eight and ten hours a day.

There has been a reversal of outlook. The reason why we agreed to work so hard and because we were created a new need. Sahlins was interested not only in production, but also in exchanges. To exchange, there is a specialization from tasks with women who will pick berries and men will hunt animals, but according to strict criteria. There is the hypothesis that specialization is not aimed at maximizing production, but at making exchange compulsory, because one is forced to exchange.

Sahlins wonders how economic exchanges take place. It will distinguish three successive circles:

- circle of the household: it is the circle of the people of the family which is close. The exchange is made according to the system of gift for gift without obligation, in other words, the free obligation to give, receive and return. This characterizes exchanges between symbolic and spatially close individuals. This regulatory system does not presuppose authority, but proximity and dependence because exchanges are daily and permanent. There is a symbolic proximity.

- village circle: within the tribe, the rule is redistribution.

- intertribal circle: exchanges with neighbouring tribes do not go well because the relations are mainly warlike. There are times when there are ritualized exchanges through barter. It is the system of immediate satisfaction of both parties on the basis of negotiation without the creation of social ties and without the need for social ties. The gift is a generalized reciprocity, but delayed in time, the redistribution is a balanced reciprocity whereas the reciprocity for the market is immediate, but can be negative. There's a degradation. According to Sahlins, the farther the partner is symbolically and geographically, the more a degraded mode of trade regulation is used. There is a noble mode of regulating trade, which is gift for gift, which presupposes and creates social ties; there is a somewhat degraded mode, which is redistribution, and an even more degraded mode within the framework of the market. The market is reserved for foreigners, for those with whom we do not want or we cannot talk. This is the way economic actors experience trade. Exchanges are linked to otherness.

Chaunu was working on the nature of exchanges in the Middle Ages. 90% of economic exchanges did not travel more than 5 kilometres. There is a strong self-consumption. Each household is self-consuming, which means that there is a specialization within each household that operates on donation for donation. In the villages, there are exchanges between neighbours with specialisation and a division of labour. Part of the trade is regulated by the redistribution circuit, barter will also play a role.

The further away from the village there is a lot of redistribution and a little barter. It is estimated that at the time, 90% of exchanges took place within a radius of 5 kilometres. It is possible to need products that do not come from local production either because you cannot or because you do not know. The solution is either to resort to peddlers who bring what is necessary, or it is possible to move towards a village or a city more anchored in the monetary economy with real merchants. This requires a journey of 25 kilometres. In Latin, this is called a "pagus" in which markets regularly take place. 9% of exchanges are made within a radius of 25 kilometers to buy and sell. 1% of the trade is with the rest of the world concerning rare and expensive products which the peasants have little use being reserved for the bourgeoisie or the aristocracy as jewels, instruments, rarer care, rarer services.

This map deals with the 1% of exchanges that cross a radius of 25 kilometres. This map shows what trades between extremely localized world economies. This space is fragmented into spaces with a radius of 25 kilometres between which almost nothing circulates. We see a traffic quantitatively non-existent, but very visible which is the trade in the distance. They are expensive products, moved over great distances reserved for people of a very high social rank. It is a world of luxury trade for an aristocracy, but it is not a world economy as defined by Braudel.

Many of these maps invisibilize flows that are also essential. Beware of maps that tend to draw the line between world economy and the rest of the world in the wrong place. We must keep in mind the idea of an exchange gradient which is that the further we get, the less we exchange and the more the forms of exchange are anthropologically degraded. What is visible are the rare products and the market, while what circulates inside are the channels of giving against giving and redistribution. This allows us to reflect on globalisation and the change in scale of economic circuits that globalisation would bring. With this story and this myth that our economies would have become globalized, that our economic circuits would have changed scale and that we would have gone from a local world economy to a world economy that is the world.

This idea is wrong for two reasons: globalization did not take place [1] and globalization took place long ago [2]. In other words, globalization has not affected us as much as we are told and it is not as new as we are told. Globalization must be put into perspective in its unprecedented newness, but also in its measure. For some authors, the first globalization is between 30,000 and 5,000 years before Jesus Christ with the humanization of the planet. It is possible to make arrows showing how human space has spread over the planet. This globalisation has serious consequences, but is not an economic phenomenon.

The first globalizations: XVIIIth century - XIXth century[modifier | modifier le wikicode]

We must remember 1492 and the discovery of the New World which is America. Before 1492, there was the Silk Road, but the western horizon was limited because there was no access to it. Asian products could only be acquired through Turkish intermediaries. For the first time, the West is gaining access to an elsewhere which it was unaware of until now and which it had not even hypothesized. This is a fascinating moment in Western history because it is difficult to define what it would be like today. This discovery was incompatible with what was written in the Bible. A hypothesis was formulated at this time that there were two creations and two paradises. It is the first moment when the political, cultural and economic reality of the West changes horizon.

The first exchange took place in the form planned by Sahlins, which is theft, looting and violence, particularly with the massive arrival of gold and silver which will totally destabilise the European economy for the benefit of the countries of the Iberian Peninsula. Mining resources will be developed using indigenous labour. The Church will discuss in the context of the Valladolid controversy which questions the condition of the indigenous people. This will generate slave trade with Africa. The second phase is the plantation system and the massive transfer within the framework of the triangular trade of the "ebony wood" that are the black slaves. This highlights the existence of a trade of unavailability which means that if we go to look for certain resources abroad it is because we cannot produce them in Europe.

In the beginning, the predation economy did not represent much for the peasant, even if it had a major impact on the European monetary system. On the other hand, products that start to transit in large quantities will have an impact for the local farmer creating a demand for exotic products that he cannot produce himself. For some, we will create a need with sugar or create an addiction as with tobacco. There is the first installation of a quantitatively significant economic circuit that is being set up on both sides of the Atlantic.

The extraction of "ebony wood" which is an economic extraction is done in violence, the plantation system is done by buying slaves, but these plantations belong for the most part to large owners and families in Europe regulated in Europe by redistribution circuits. Gradually, we move from exploitation through looting, to colonial exploitation and plantation to a more capitalist system of colonization more linked to the market, as evidenced by the existence of commercial companies characterizing the commercial capitalist system.

At the beginning, the market was opposed to colonization and therefore to globalization through transatlantic trade. The first reason was for its economic inefficiency and the second ideological reason, because if you believe in the market, the use of force, of indigenous labour is counterproductive. If we believe in the market, we cannot be "for" slavery and colonization. There was a fear in the business community that the development of trade brought about by colonization would result in economic development of the colonies and thus competition from the colonies. Exploiting the colonies was possible provided they did not become competitors. A first globalization is that of gold, then of slaves and finally of tropical products which come to feed Europe. The first economic globalisation took place in the 16th century with the globalisation of colonial trade.

In 1914, colonization globalized the planet. All parts of the world are registered in trade circuits managed by metropolises. We fall back on Braudel's concept of the world economy with a centre that is the metropolis, a periphery that is the colony and the empire.

What is taking place is flows that are no longer anecdotal, but flows of massive consumer products. This globalization will last and be important until the middle of the 20th century.

The rise of international trade: 19th - 21st century[modifier | modifier le wikicode]