« Bretton Woods System: 1944 - 1973 » : différence entre les versions

(Page créée avec « Nous allons essayer de comprendre la gouvernance pour les aspects monétaires et financiers pour les économies de l’après-guerre. La planification du système financie... ») |

Aucun résumé des modifications |

||

| Ligne 1 : | Ligne 1 : | ||

We will try to understand governance for monetary and financial aspects for post-war economies. The planning of the post-war international financial and monetary system began very early. Allies wonder what form future international monetary and financial relations will take before the fall of the Nazi regime. We need to look at the context in which these discussions are taking place in relation to the legacy of the past from the 1920s and 1930s, but also from the Second World War. | |||

= | = The debate on the new order = | ||

The memories of the 1920s and 1930s are vivid. The willingness of politicians to find solutions leads to better management following a learning process that greatly helps the task of rebuilding the world economy after the war. Despite the fact that during the Second World War we saw the same financial dependence as during the First World War, the financial consequences were different. This is due to a program instituted by Roosevelt which is the Loan-Lease program which is an armament program set up by the United States to provide allies with war material. This Act authorizes the President of the United States to sell, lease, or provide by any means a defence program to any government whose defence the President considers vital to the defence of the United States. This opens the possibility for the United States to almost give equipment to allied countries changing everything to financial consequences after World War II. | |||

The main beneficiaries of the Lease-Loans were Great Britain, which benefited from 30 billion dollars, and the Soviet Union, which benefited from 11 billion dollars. The United States is counting on the return of these assets after the war.{{citation bloc| | |||

{{citation bloc| | |||

:"What do I do in such a crisis?" the president asked at a press conference. | :"What do I do in such a crisis?" the president asked at a press conference. | ||

:"I don't say... 'Neighbor, my garden hose cost me $15; you have to pay me $15 for it' … | :"I don't say... 'Neighbor, my garden hose cost me $15; you have to pay me $15 for it' … | ||

:'I don't want $15 — I want my garden hose back after the fire is over."|Presidential Press Conference, December 17, 1940}} | :'I don't want $15 — I want my garden hose back after the fire is over."|Presidential Press Conference, December 17, 1940}} | ||

The idea is to lend help to the allies to put an end to the fire according to Roosevelt's analogy. There is a different attitude in the United States towards the trade made necessary by the Second World War. In addition, Allied countries can keep these goods for a payment of only 10% of the value. There is a spirit of subsidy. The Loans-Leasing program plays a role in helping the Allies to continue the war, but also to avoid excessive debt as seen after the First World War. We see with certain bilateral agreements and especially between Great Britain and the United States in December 1945 that the United States decided to cancel almost all of the British debt. The existence of the Loan-Lease program does not mean that belligerent countries do not incur significant debts to finance the Second World War. | |||

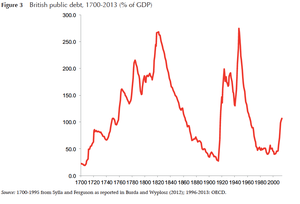

[[Image:British public desbt, 1700 - 2013 (% of GDP).png|thumb|300px| ]] | [[Image:British public desbt, 1700 - 2013 (% of GDP).png|thumb|300px| ]] | ||

We see that wars are always expensive. The Loan-Lease programme cannot help the British avoid all the financial consequences of war. The exchange rate during the Second World War was more moderate than the First World War while the Second World War was more expensive than the First World War. This burden would have been much heavier without the U.S. loan and lease policy. We see better management of the war economy by allied countries. | |||

[[Image:Eugene_White,_2001,_“Making_the_French_pay-_costs_and_consequences_of_the_Napoleonic_reparations,”_European_Review_of_Economic_History.png|thumb|300px|Source: Eugene White, 2001, “Making the French pay: costs and consequences of the Napoleonic reparations,” European Review of Economic History.]] | We must also look at the reparations imposed on defeated countries after the Second World War. At the end of 1945, there were reparations discussions even before the end of the war, trying to specify the amount of reparations imposed on Germany. But we see a significant reluctance on the part of the United States, because at the beginning it is the three great powers that are concerned, namely the United States, Great Britain and the Soviet Union. Only one country is pushing for major repairs, the Soviet Union. The Soviet Union plays the role of victim among the victorious countries suffering the most from the war in terms of human losses, but also in terms of material losses. The fact that the Soviet Union is demanding reparations is not surprising. However, the United States and Great Britain were reluctant to put a financial burden on a country that was much more devastated after the Second World War than after the First World War. There is a fear that having reparations imposed on some countries may have wider consequences than in the late 1930s. In the end, the amount imposed was not so large as after the First World War and reparations were imposed in kind. There is talk of the immediate confiscation of certain industrial assets with the sale of German industries exported to the Soviet Union. It is through the confiscation of property that already exists that we see the amount of reparations. The United States wants to limit reparations in kind by insisting that the Soviet Union take these reparations in kind from its own areas of Germany. The United States wants to limit the Soviet Union's ability to take reparations from other areas of Germany. There is a desire on the part of the major powers to control the financial implications of repairs. In the 1950s, further reparations were negotiated between the Federal Republic of Germany and other countries, but especially with Israel.[[Image:Eugene_White,_2001,_“Making_the_French_pay-_costs_and_consequences_of_the_Napoleonic_reparations,”_European_Review_of_Economic_History.png|thumb|300px|Source: Eugene White, 2001, “Making the French pay: costs and consequences of the Napoleonic reparations,” European Review of Economic History.]] | ||

The issue of reparations is not new. The estimates for Germany do not include immediate material confiscations, but are much lower than for the First World War. Following the Second World War, there was a different policy on the part of the Allied countries. Other countries are concerned, such as Italy and Japan. Most experts believe that the Allies learned of the economic consequences of the post-First World War. | |||

The complication of World War II and the fact that there was a First World War before. There is a possible interaction between the financial consequences of the First World War and the financial consequences of the Second World War. For the First World War, agreements ended financial reparations in the 1930s in the case of a moratorium initiated by Hoover in 1931 to freeze debts for one year. The Lausanne conference of 1932 put an end to the repairs. The debts contracted by Germany throughout the 1920s are contracted in order to pay for repairs with a close interaction between payment of repairs and increase in debts. The Dawes Plan and the Young Plan allowed the Germans to pay for the repairs. Other loans are contracted by firms or cities. Thus, we see a significant level of international debt for Germany. | |||

In the 1930s, the Nazis tried to repudiate debts. We see a possible repudiation of these debts by the Nazis in the 1920s. At the end of the Second World War, the question arose as to whether the Germans were responsible for paying off the pre-war debts and the new loans added for reconstruction after the Second World War. There is the question of these pre-war and post-war debts. As far as the pre-war debt is concerned, we are talking about 13.5 billion marks. As far as the debts contracted immediately after the war are concerned, the debt is 16.2 billion marks. Between the two, we are talking about nearly 30 billion marks which remain to be determined for the amount of the debts. In 1951, Eisenhower accepted the responsibility of the Federal Republic of Germany to pay these debts. The Allies occupy West Germany, and he insists on the fact that German international trade must be revived leading to an agreement in 1953 that reduces the amount of debts of the Federal Republic of Germany by 50%. We are talking about a burden for an economy in full reconstruction in 1953, but which makes it possible to launch a certain expansion. | |||

We can say that there is an important learning process among Allied countries following the experience of the First World War with a desire to limit the financial consequences after the Second World War, which does not mean that there are important problems to be solved after the Second World War in order to create a new international financial and monetary system. Allies are especially afraid of the collapse of the global trading system and the global economy. The idea is to create a global economic system that gives new impetus to international trade, but everyone quickly understands that in order to start international trade, international payment problems must first and foremost be solved. | |||

= | = Characteristics of the Bretton Woods system = | ||

The importance of the debate on the new monetary and financial order may seem strange, because we are talking about a technical and even obscure challenge, but there is a real obsession with the form of this new international monetary system after the end of the war and afterwards. It is considered the most important mechanism to revive international trade in the post-war period. The reconstruction of the new international monetary system is mainly the responsibility of the Americans and the British. On the one hand, the British are led to think about it by the Americans in the context of the principle of imperial preference. The United States claims Britain's involvement under the preferential agreements it has with its empire. Britain is very resistant because, given its large trade deficit, it is afraid of the consequences of the free trade system on its external economy. The British must find an answer other than resistance. | |||

[[Image:WhiteandKeynes.jpg|thumb|Harry Dexter White ( | [[Image:WhiteandKeynes.jpg|thumb|Harry Dexter White (left) and John Maynard Keynes in 1946. They were the two main protagonists of the conference held in Bretton Woods.]] | ||

The most important figure working on this issue in Britain is Keynes who is the adviser to the British Foreign Secretary. In order to revive the international system, we need a system without punishing countries in deficit on the trade balance. In The General Theory of Employment, Interest and Money, he criticizes the orthodox policy of deflation to rebalance the economy. He noted as early as 1936 that the State had an important role to play in rebalancing the economy. In creating an international system, it is important to support the policy it wants to see within economies in order to create the opportunity outside deflation to rebalance the balance of payments. It has two objectives, to create an international payments system and to create other opportunities for countries that are in deficit. At the same time, Americans begin to talk about the same challenge through the person through White. | |||

The initiatives of these two men advance separately, but once contact is established, it is clear that their vision of the international order of the world is different. In the possible Breton Woods agreement, we find a compromise between their two visions of the international monetary system. The two new systems reflect the different experiences of their own countries during the 1920s and 1930s. Keynes and White learn something from history, but from different things in history. For Keynes the lessons of history were rather sad, for Britain lost its place as hegemony of the world economy, the war increased its external dependence and Britain predicted a difficult post-war period following the problems it saw from the end of World War II. Britain is not an optimistic country for the post-World War II period. Moreover, following the experiment of the 1920s concerning the gold standard, the British are more and more negative compared to this experiment. During the 1920s, Britain had great difficulty keeping the pound parity against the dollar. The British have an overvalued pound, but they also consider that it was the fault of the other central banks that it was difficult to maintain parity with the dollar. They consider that the gold standard is not the best system to keep. They are concerned about the possibility of deflation-related punishment because they were punished in the 1920s. | |||

One may wonder who is responsible for balanced and unbalanced international trade. If we have one country with permanent surpluses and another with permanent deficits, who is responsible? Some accuse deficit countries of spending more than they can afford. This was the shared idea, but not by Keynes who considered that the burden was shared. The countries that are in excess, for Keynes, do not respect the rules of the world economy. They should have stimulated their domestic economies to control their surpluses. Keynes finds that countries that are often in excess exploit demand from other countries. This is a very lively debate. When we talk about Germany and Greece today or the United States and China today, we have the same debate. At the end of the Second World War, the British were in deficit and the United States in surplus. Keynes, insists that international discipline is needed to regulate the global economy. | |||

For the American economy, the consequences of the Second World War are rather happy with a strong external position and a strong external balance. It is a country which took advantage of the First World War to advance its positions and which foresaw an even more flourishing post-war period after the Second World War. Regarding the gold standard, the United States became increasingly enthusiastic about such a system, for White understood the consequences of war differently than Keynes. In Britain, politicians should have had more budgetary rigour and disciplined trade unions rather than pursued a monetary deficit policy. For White, the global economy must be based on competitiveness by taking measures that weigh on wages and prices in general. It is no coincidence that the United States and Great Britain had difficulty getting along in the interwar period. In the possible Breton Woods agreement, we find a compromise with their different visions of the international system. | |||

= | = A financial world under pressure = | ||

* The Breton Woods system has three features: | |||

* | * fixed but adjustable exchange rate; | ||

* | * currency convertibility, but capital flow controls ; | ||

* | * new organizations: IMF and World Bank. | ||

== | == Fixed but adjustable exchange rate == | ||

The monetary authorities of each country undertake to maintain their currency at a parity being obliged to maintain their currency at a value of 20% around the parity value. The parities are adjustable under certain conditions. The chosen parity can be modified by a member country to correct a fundamental imbalance in the value of payments. For a change of up to 20% of the nominal value of the currency, the country must consult the IMF without necessarily having its approval. The decision remains national. For a larger change, IMF approval by qualified majority is required. The Americans take advantage of the Breton Woods agreements to place their currency at the heart of the system by declaring their currency in relation to gold. The other countries are not able to do to them after the war, because their economies are too weak to restore a balance, that is why they declare their currency against the dollar. If we look at the Breton Woods system, the key currency is the dollar, which plays an important role as an anchor in this system. Keynes proposed a new global currency called the bancor. The Americans and White did not want the birth of the bancor because they feared a loss of discipline in the creation of this currency. It was important to keep the dollar as the key to the system that succeeded in imposing the dollar as a solution. The fact that there is a possibility of adjustment means that there is another possibility of solving the problems of imbalance than deflation. It is an international monetary system that tries to integrate the solutions to devaluation into the international system itself. | |||

== Convertibilité des monnaies, mais des contrôles sur les flux de capitaux == | == Convertibilité des monnaies, mais des contrôles sur les flux de capitaux == | ||

| Ligne 121 : | Ligne 117 : | ||

= References = | = References = | ||

<references/> | <references /> | ||

[[Category:Mary O'Sullivan]] | [[Category:Mary O'Sullivan]] | ||

Version du 5 avril 2018 à 00:03

We will try to understand governance for monetary and financial aspects for post-war economies. The planning of the post-war international financial and monetary system began very early. Allies wonder what form future international monetary and financial relations will take before the fall of the Nazi regime. We need to look at the context in which these discussions are taking place in relation to the legacy of the past from the 1920s and 1930s, but also from the Second World War.

The debate on the new order

The memories of the 1920s and 1930s are vivid. The willingness of politicians to find solutions leads to better management following a learning process that greatly helps the task of rebuilding the world economy after the war. Despite the fact that during the Second World War we saw the same financial dependence as during the First World War, the financial consequences were different. This is due to a program instituted by Roosevelt which is the Loan-Lease program which is an armament program set up by the United States to provide allies with war material. This Act authorizes the President of the United States to sell, lease, or provide by any means a defence program to any government whose defence the President considers vital to the defence of the United States. This opens the possibility for the United States to almost give equipment to allied countries changing everything to financial consequences after World War II.

The main beneficiaries of the Lease-Loans were Great Britain, which benefited from 30 billion dollars, and the Soviet Union, which benefited from 11 billion dollars. The United States is counting on the return of these assets after the war.

«

- "What do I do in such a crisis?" the president asked at a press conference.

- "I don't say... 'Neighbor, my garden hose cost me $15; you have to pay me $15 for it' …

- 'I don't want $15 — I want my garden hose back after the fire is over." »

— Presidential Press Conference, December 17, 1940

The idea is to lend help to the allies to put an end to the fire according to Roosevelt's analogy. There is a different attitude in the United States towards the trade made necessary by the Second World War. In addition, Allied countries can keep these goods for a payment of only 10% of the value. There is a spirit of subsidy. The Loans-Leasing program plays a role in helping the Allies to continue the war, but also to avoid excessive debt as seen after the First World War. We see with certain bilateral agreements and especially between Great Britain and the United States in December 1945 that the United States decided to cancel almost all of the British debt. The existence of the Loan-Lease program does not mean that belligerent countries do not incur significant debts to finance the Second World War.

We see that wars are always expensive. The Loan-Lease programme cannot help the British avoid all the financial consequences of war. The exchange rate during the Second World War was more moderate than the First World War while the Second World War was more expensive than the First World War. This burden would have been much heavier without the U.S. loan and lease policy. We see better management of the war economy by allied countries.

We must also look at the reparations imposed on defeated countries after the Second World War. At the end of 1945, there were reparations discussions even before the end of the war, trying to specify the amount of reparations imposed on Germany. But we see a significant reluctance on the part of the United States, because at the beginning it is the three great powers that are concerned, namely the United States, Great Britain and the Soviet Union. Only one country is pushing for major repairs, the Soviet Union. The Soviet Union plays the role of victim among the victorious countries suffering the most from the war in terms of human losses, but also in terms of material losses. The fact that the Soviet Union is demanding reparations is not surprising. However, the United States and Great Britain were reluctant to put a financial burden on a country that was much more devastated after the Second World War than after the First World War. There is a fear that having reparations imposed on some countries may have wider consequences than in the late 1930s. In the end, the amount imposed was not so large as after the First World War and reparations were imposed in kind. There is talk of the immediate confiscation of certain industrial assets with the sale of German industries exported to the Soviet Union. It is through the confiscation of property that already exists that we see the amount of reparations. The United States wants to limit reparations in kind by insisting that the Soviet Union take these reparations in kind from its own areas of Germany. The United States wants to limit the Soviet Union's ability to take reparations from other areas of Germany. There is a desire on the part of the major powers to control the financial implications of repairs. In the 1950s, further reparations were negotiated between the Federal Republic of Germany and other countries, but especially with Israel.

The issue of reparations is not new. The estimates for Germany do not include immediate material confiscations, but are much lower than for the First World War. Following the Second World War, there was a different policy on the part of the Allied countries. Other countries are concerned, such as Italy and Japan. Most experts believe that the Allies learned of the economic consequences of the post-First World War.

The complication of World War II and the fact that there was a First World War before. There is a possible interaction between the financial consequences of the First World War and the financial consequences of the Second World War. For the First World War, agreements ended financial reparations in the 1930s in the case of a moratorium initiated by Hoover in 1931 to freeze debts for one year. The Lausanne conference of 1932 put an end to the repairs. The debts contracted by Germany throughout the 1920s are contracted in order to pay for repairs with a close interaction between payment of repairs and increase in debts. The Dawes Plan and the Young Plan allowed the Germans to pay for the repairs. Other loans are contracted by firms or cities. Thus, we see a significant level of international debt for Germany.

In the 1930s, the Nazis tried to repudiate debts. We see a possible repudiation of these debts by the Nazis in the 1920s. At the end of the Second World War, the question arose as to whether the Germans were responsible for paying off the pre-war debts and the new loans added for reconstruction after the Second World War. There is the question of these pre-war and post-war debts. As far as the pre-war debt is concerned, we are talking about 13.5 billion marks. As far as the debts contracted immediately after the war are concerned, the debt is 16.2 billion marks. Between the two, we are talking about nearly 30 billion marks which remain to be determined for the amount of the debts. In 1951, Eisenhower accepted the responsibility of the Federal Republic of Germany to pay these debts. The Allies occupy West Germany, and he insists on the fact that German international trade must be revived leading to an agreement in 1953 that reduces the amount of debts of the Federal Republic of Germany by 50%. We are talking about a burden for an economy in full reconstruction in 1953, but which makes it possible to launch a certain expansion.

We can say that there is an important learning process among Allied countries following the experience of the First World War with a desire to limit the financial consequences after the Second World War, which does not mean that there are important problems to be solved after the Second World War in order to create a new international financial and monetary system. Allies are especially afraid of the collapse of the global trading system and the global economy. The idea is to create a global economic system that gives new impetus to international trade, but everyone quickly understands that in order to start international trade, international payment problems must first and foremost be solved.

Characteristics of the Bretton Woods system

The importance of the debate on the new monetary and financial order may seem strange, because we are talking about a technical and even obscure challenge, but there is a real obsession with the form of this new international monetary system after the end of the war and afterwards. It is considered the most important mechanism to revive international trade in the post-war period. The reconstruction of the new international monetary system is mainly the responsibility of the Americans and the British. On the one hand, the British are led to think about it by the Americans in the context of the principle of imperial preference. The United States claims Britain's involvement under the preferential agreements it has with its empire. Britain is very resistant because, given its large trade deficit, it is afraid of the consequences of the free trade system on its external economy. The British must find an answer other than resistance.

The most important figure working on this issue in Britain is Keynes who is the adviser to the British Foreign Secretary. In order to revive the international system, we need a system without punishing countries in deficit on the trade balance. In The General Theory of Employment, Interest and Money, he criticizes the orthodox policy of deflation to rebalance the economy. He noted as early as 1936 that the State had an important role to play in rebalancing the economy. In creating an international system, it is important to support the policy it wants to see within economies in order to create the opportunity outside deflation to rebalance the balance of payments. It has two objectives, to create an international payments system and to create other opportunities for countries that are in deficit. At the same time, Americans begin to talk about the same challenge through the person through White.

The initiatives of these two men advance separately, but once contact is established, it is clear that their vision of the international order of the world is different. In the possible Breton Woods agreement, we find a compromise between their two visions of the international monetary system. The two new systems reflect the different experiences of their own countries during the 1920s and 1930s. Keynes and White learn something from history, but from different things in history. For Keynes the lessons of history were rather sad, for Britain lost its place as hegemony of the world economy, the war increased its external dependence and Britain predicted a difficult post-war period following the problems it saw from the end of World War II. Britain is not an optimistic country for the post-World War II period. Moreover, following the experiment of the 1920s concerning the gold standard, the British are more and more negative compared to this experiment. During the 1920s, Britain had great difficulty keeping the pound parity against the dollar. The British have an overvalued pound, but they also consider that it was the fault of the other central banks that it was difficult to maintain parity with the dollar. They consider that the gold standard is not the best system to keep. They are concerned about the possibility of deflation-related punishment because they were punished in the 1920s.

One may wonder who is responsible for balanced and unbalanced international trade. If we have one country with permanent surpluses and another with permanent deficits, who is responsible? Some accuse deficit countries of spending more than they can afford. This was the shared idea, but not by Keynes who considered that the burden was shared. The countries that are in excess, for Keynes, do not respect the rules of the world economy. They should have stimulated their domestic economies to control their surpluses. Keynes finds that countries that are often in excess exploit demand from other countries. This is a very lively debate. When we talk about Germany and Greece today or the United States and China today, we have the same debate. At the end of the Second World War, the British were in deficit and the United States in surplus. Keynes, insists that international discipline is needed to regulate the global economy.

For the American economy, the consequences of the Second World War are rather happy with a strong external position and a strong external balance. It is a country which took advantage of the First World War to advance its positions and which foresaw an even more flourishing post-war period after the Second World War. Regarding the gold standard, the United States became increasingly enthusiastic about such a system, for White understood the consequences of war differently than Keynes. In Britain, politicians should have had more budgetary rigour and disciplined trade unions rather than pursued a monetary deficit policy. For White, the global economy must be based on competitiveness by taking measures that weigh on wages and prices in general. It is no coincidence that the United States and Great Britain had difficulty getting along in the interwar period. In the possible Breton Woods agreement, we find a compromise with their different visions of the international system.

A financial world under pressure

- The Breton Woods system has three features:

- fixed but adjustable exchange rate;

- currency convertibility, but capital flow controls ;

- new organizations: IMF and World Bank.

Fixed but adjustable exchange rate

The monetary authorities of each country undertake to maintain their currency at a parity being obliged to maintain their currency at a value of 20% around the parity value. The parities are adjustable under certain conditions. The chosen parity can be modified by a member country to correct a fundamental imbalance in the value of payments. For a change of up to 20% of the nominal value of the currency, the country must consult the IMF without necessarily having its approval. The decision remains national. For a larger change, IMF approval by qualified majority is required. The Americans take advantage of the Breton Woods agreements to place their currency at the heart of the system by declaring their currency in relation to gold. The other countries are not able to do to them after the war, because their economies are too weak to restore a balance, that is why they declare their currency against the dollar. If we look at the Breton Woods system, the key currency is the dollar, which plays an important role as an anchor in this system. Keynes proposed a new global currency called the bancor. The Americans and White did not want the birth of the bancor because they feared a loss of discipline in the creation of this currency. It was important to keep the dollar as the key to the system that succeeded in imposing the dollar as a solution. The fact that there is a possibility of adjustment means that there is another possibility of solving the problems of imbalance than deflation. It is an international monetary system that tries to integrate the solutions to devaluation into the international system itself.

Convertibilité des monnaies, mais des contrôles sur les flux de capitaux

Quand on parle de la convertibilité d’une monnaie, on parle de la possibilité d’une monnaie nationale d’être échangée contre une autre monnaie ou d’être convertie en monnaie étrangère. La convertibilité se divise entre convertibilité entre transactions courantes et la convertibilité sur les opérations en capital signifie qu’on peut échanger la monnaie nationale en monnaie étrangère pour assurer des investissements dans le pays étranger. White veut avoir une convertibilité générale insistant sur le contrôle autant des échanges que les flux internationaux. Les britanniques et Keynes insistent sur le contrôle des opérations en capital. Avec le système de Breton Woods, on a seulement le contrôle de la convertibilité sur les opérations courantes. Le principe est qu’on ne peut dépendre d’une convertibilité libre et générale pour toute transaction.

Nouvelles organisations : FMI et Banque mondiale

Il y a la création d’institutions avec le FMI et la BIRD qui devient à terme la Banque mondiale. Le FMI est particulièrement important dans le système international avec pour rôle de réguler les économies internationales dans une perspective nationale et financer la balance des paiements des pays à risque. En tant que caisse de solidarité, chaque État membre doit effectuer un dépôt dont le montant dépend du PIB prédit des pays membres et si un pays a des problèmes pour équilibrer sa balance des paiements, il peut faire appel aux aides qui sont automatiques, mais aussi conditionnelles. Keynes veut un montant élevé de cette enveloppe afin de pouvoir gérer même les déséquilibres graves. Pourtant, White et les américaines sont contre cette idée, car les États-Unis ne sont pas prêts à signer des « chèques en blanc ». Keynes perd et White gagne. Lorsqu’on regarde les caractéristiques du système de Breton Woods, on peut voir un compromis étant le reflet des négociations entre les États-Unis et les britanniques. Déjà pendant les débats autour de la forme du système monétaire international. Les États-Unis dominent les négociations de Breton Woods.

« In Washington Lord Halifax; Once whispered to Lord Keynes: "It's true they have the money bags But we have all the brains." »

— "Source: "found on a yellowing piece of paper salvaged from the first Anglo-American discussions... about postwar economic arrangements" - Gardner, 1980, p. xiii

On peut comprendre cet accord aussi comme une réponse à une logique historique que l’on trouve derrière ces caractéristiques parce qu’elles sont censées apporter des solutions aux problèmes. Le système répond aux contraintes de la déflation imposées sous l’ancien système de l’étalon-or ou le seul moyen de rééquilibrer est d’imposer une déflation. L’utilisation de la déflation est même encore plus importante après la Deuxième guerre mondiale puisque les politiques déflationnistes sont encore plus importantes sur les populations, car le pouvoir des travailleurs est encore plus important qu’avant la Deuxième guerre mondiale sous l’impulsion des partis de gauche. Cette première caractéristique répond au besoin en termes d’alternative à la déflation.

Derrière la convertibilité des monnaies et le contrôle de flux de capitaux, il y a l’idée de résoudre le problème de la convertibilité des années 1920. L’idée est de limiter le rôle de la spéculation financière et son effet sur les pays.

La création d’une nouvelle organisation internationale et surtout le FMI a pour objectif de sanctionner les gouvernements qui poursuivent des politiques qui déstabilisent l’économie internationale et d’aider les pays qui ont des déficits. L’idée est de créer un endroit et une organisation qui prend la responsabilité qui essaie de régler ces problèmes du système monétaire international.

La montée des pressions

Le triangle de Mundell est l’idée qu’une économie ne peut atteindre simultanément les trois objectifs suivants :

- un régime de change fixe ;

- une politique monétaire autonome ;

- une parfaite liberté de circulation des capitaux.

Si on essaie de concilier ces trois objets, on arrive à une crise monétaire, mais si on abandonne l’un de ces objets, les deux autres sont réalisables. Dans les accords de Breton Woods, on a un régime de change fixe qui dispose d’une politique autonome pour les pays membres, mais qui supprime la libéralisation financière au niveau international. Dans le système de l’étalon-or, cette même logique est respectée de 1870 à 1914, mais de façon différente, avec des changes fixes, une liberté de circulation des capitaux, mais on supprime la politique monétaire autonome des pays. Pendant les années 1920, on voit un manque de respect de ce principe avec un régime de change fixe, une libre circulation des capitaux et des politiques monétaires automne qui a mené à une crise importante.

Le système fonctionne parfaitement pendant une période assez courte. Pendant un certain temps, les pays qui souffrent d’un déficit important de la balance courante continuent à mobiliser l’option du contrôle des changes afin de rétablir l’équilibre de la balance externe imposant des contrôles même sur la convertibilité de la monnaie pour des opérations courantes. La France et l’Allemagne ne sont pas capables de restaurer la convertibilité de la monnaie même sur des opérations courantes parce que leurs déficits commerciaux sont trop importants. Ils hésitent à rétablir la convertibilité sur les opérations courantes et suppriment la convertibilité sur les opérations en capital. On voit un non-respect du système de Breton Woods jusqu’à 1958. Le système de Breton Woods fonctionne parfaitement entre 1958 et 1973.

La difficulté de ces pays d’essayer de rétablir la convertibilité de la monnaie est liée à une idée générale décrite comme un problème de pénurie ou de la rareté du dollar. Le « dollar gap » est le manque de dollar dont ont souffert certains pays au lendemain de la Deuxième guerre mondiale notamment pour l’Europe. Les produits fournis par les États-Unis sont importés avec une capacité limitée de payer ces importations parce que les économies européennes sont dans une situation chaotique. Ces pays ne sont pas capables de produire suffisamment pour exporter et faire entrer des devises américaines qui permettent de payer les importations des États-Unis. Avec un tel déficit, il est très difficile de restaurer la convertibilité de la monnaie, donc, ils imposent les contrôles même sur les opérations courantes. Par conséquent, il y a un fort risque de la suspension de convertibilité des monnaies d’avec le dollar compliquant les échanges de biens et de services. Les américains sont très mécontents de cette situation, car les États-Unis attendent de profiter de l’essor de l’après-guerre. Les américains pensent que la restauration de la convertibilité des monnaies européennes est essentielle visant particulièrement les britanniques.

Les britanniques sont sous pression énorme parce que ce pays avait subi moins de destructions de la guerre que d’autres économies européennes. Pour cet argument, il serait plus facile de rétablir la convertibilité du livre. Or, les britanniques s’inquiètent de la convertibilité de leur monnaie, car ils ont constitué des dettes pour financer la guerre. Il y a des créances énormes, beaucoup plus importantes que les réserves officielles de la Grande-Bretagne et le problème est que ces créances mènent à une perte de confiance en la livre et une liquidation de ces créances pour les convertir en dollar. La conséquence serait une chute de la valeur du sterling. Malgré la position des britanniques, les américains insistent sur la convertibilité de la livre sterling. Les américains ont un argument important puisque les britanniques ont besoin des prêts américains afin de reconstruire leur économie en 1946, les américains octroient un prêt de 4 milliards de dollars aux britanniques en échange de quoi les américains doivent rétablir la convertibilité de leur monnaie. Le livre devient convertible en juin 1947. Les réserves fuient le pays et le prêt des américains est épuisé en quatre semaines. La crise termine par la suspension de la convertibilité de la livre le 20 août 1947.

Le seul avantage de cette crise est qu’elle ramène les américains aux problèmes globaux et à la pénurie du dollar. Cet évènement fait peur aux américains d’une possible déstabilisation des économies européennes et s’inquiètent de la propagation du communisme. Ils ont conçu le Plan Marshall afin de reconstruire les économies européennes et le Congrès ne l’a pas encore approuvé. La crise du livre-sterling aide à la ratification du Plan Marshall par le Congrès. L’aide Marshall est votée en 1948. Ce sont les européens qui se le partagent sur la base de prévisions consensuelles sur la base de leur déficit en dollar. C’est pour répondre à cette pénurie que l’aide Marshall est utilisée. Tout le monde espère que les 13 milliards de dollars de l’aide Marshall suffiront pour résoudre le problème du dollar en Europe.

Une autre crise se produit en 1948 et 1949 conduisant à une déflation des monnaies européennes en 1949 qui met en exergue que la pénurie du dollar et la déstabilisation du commerce international qu’il engendre. On voit des efforts de la part des européens de créer des mécanismes afin de résoudre le problème de la pénurie du dollar avec le mécanisme de l’Union européenne des paiements qui créé une possibilité d’avoir une convertibilité entre monnaies européennes, mais qui garde des restrictions sur la convertibilité des opérations courantes entre pays tiers. La solution se trouve dans le développement économique que l’on voit dans ces économies européennes. Le commerce international entre l’Europe et les États-Unis commence à être rééquilibré suite à la restauration des pays européens d’exporter de nouveau. C’est la reconstruction des économies européennes qui résout le problème du dollar. Une fois le problème de la pénurie de dollars résolu, on passe d’une pénurie de dollars à un excèdent de dollar.

Vulnérabilité du système de Bretton Woods

Les défis de la pénurie de dollars pour le système international cèdent la place à un nouveau problème vers la fin des années 1950 avec un inversement du problème avec l’émergence d’un excèdent du dollar dans l’économie mondiale liée à un excèdent des exportations des japonais et des américains. S’il y a une vulnérabilité endogène du système de Bretton Woods, cela est lié au problème de l’excédent du dollar. Avec le problème de la balance courante comme la République fédérale allemande et le Japon, il y a une détérioration dans les années 1960 de la balance commerciale des États-Unis. Le pays commence à dépenser plus sur ses importations et à gagner un peu moins des exportations. On voit que les États-Unis dépensent de plus en plus à l’étranger pour soutenir ses activités militaires et son aide extérieure. Si on regarde la balance des capitaux, les entreprises américaines reprennent et augmentent leurs investissements en Europe. Il y a de plus en plus d’argent qui sort des États-Unis. La balance externe des États-Unis déficitaire conduit à une redistribution vers les autres pays qui commencent à gagner plus de dollars qu’ils n’en dépensent.

Un déséquilibre sur la balance des paiements est intrigant parce qu’une balance des paiements est toujours équilibrée dans une perspective de comptabilité. Avant 1973, il est très fréquent de parler en termes d’équilibre en termes de comptabilité, mais de certains types d’équilibre qui reflètent un changement d’équilibre notamment une variation des réserves officielles d’un pays. Les États-Unis utilisent leur balance des paiements en laissant sortir de l’or et en créant des obligations officielles envers d’autres pays la situation de la balance des paiements reflète une faiblesse externe de plus en plus importante des États-Unis. Pour l’Allemagne, on voit l’inverse. Sa balance externe est de plus en plus forte, l’Allemagne est capable de faire augmenter ses réserves officielles. Il y a une faiblesse qui augmente sur la balance externe des États-Unis au long des années 1960.

Cela montre une première vulnérabilité du système de Bretton Woods qui est surprenante. On constate un problème persistant sur un déséquilibre de la balance des paiements alors que le système de Bretton Woods fut conçu pour éviter un tel problème parce qu’on parle d’un taux de change fixe ajustable. Dans le système, normalement, on a une manière de régler ce problème pourtant ce n’est pas suffisamment bien réglé. Comment expliquer ce paradoxe ? Il est possible d’ajouter de la valeur dans une condition de déséquilibre fondamentale. Cela devient un problème de plus en plus important pendant les années 1960. Un aveu de déséquilibre fondamental est gênant. C’est un problème particulièrement gênant pour des grands pays comme la Grande-Bretagne par exemple qui hésite à constater un déséquilibre fondamental. On voit une décision de dévaluer le livre-sterling en 1967, mais cette décision aurait dû être prise trois ans plus tôt. La difficulté que les règles de Bretton Woods créent pour un pays en déséquilibre fondamental rend difficile de ne pas attitrer l’attention des spéculateurs et de provoquer la chute de la monnaie concernée. Ces règles sont trop lourdes, les pays évitent de s’impliquer dans un tel processus parce qu’ils ont peur d’être sujets à une attaque des spéculateurs internationaux.

Le système est aussi dépendant d’une seule monnaie qui est le dollar pouvant être un avantage de la perspective des États-Unis parce que les États-Unis peuvent se porter en déficit de la balance des paiements parce que les banques centrales ailleurs souhaitent acquérir des dollars. Le dollar sert comme base du système et la plupart des pays du monde détiennent des dollars dans leurs réserves officielles permettant aux États-Unis de faire augmenter leur offre de monnaie et leur économie parce que les États-Unis savent que d’autres pays vont retenir ces dollars en tant que réserve. De Gaulle va commencer à parler d’un privilège exorbitant des États-Unis.

On voit une dimension des réserves officielles en or des États-Unis. Les États-Unis augmentent les créances dénommées en dollar afin de payer en dollar. Il est possible de critiquer les États-Unis pour leur manque de discipline créant un problème pour le système monétaire international. Si les États-Unis décident de rééquilibrer la balance externe et de faire diminuer les dépenses en dollar, cela donne un désastre total.

On parle du dilemme de Triffin. Si on regarde en détail le système de Bretton Woods, les systèmes rendent nécessaire le déficit de la balance des paiements pour alimenter une économie en pleine extension. L’économie mondiale a davantage besoin de la balance des paiements puisqu’elle est en extension. La solution est l’augmentation du nombre de dollars qui circulent dans l’économie mondiale. Les États-Unis rendent service au système monétaire international en créant davantage de liquidité pour le système. Cependant, il y a un paradoxe, car une telle augmentation du stock de dollars contribue à un affaiblissement progressif de la confiance des agents économiques étrangers envers la monnaie de référence.

Avec l’augmentation du nombre de dollars qui circulent dans l’économie mondiale, le stock mondial d’or ne monte pas beaucoup et pas suffisamment afin de maintenir un ratio stable entre or et dollar. À la fin de la période, on ne parle que de 5% du stock d’or. C’est le système qui donne ce résultat parce qu’il est possible de résoudre le problème en demandant aux États-Unis en limitant la création de dollars, mais cela crée un manque de liquidité au niveau mondial. Avec le système de Bretton Woods, on a créé un système trop dépendant d’une seule monnaie qui est le dollar.

Il y a une réponse ponctuelle pour combler les défis du déficit. Une des solutions ponctuelles est la création du pool de l’or. Un accord international est proposé par les États-Unis est appliqué en 1961 par la Suisse et les membres de la communauté européenne menant à une chute du prix relatif du dollar créant une incitation à exiger de l’or contre les dollars auprès du trésor américain. Avec le pool de l’or, les pays membres s’engagent à limiter la vente de leur propre stock d’or. La Suisse par exemple agit contre ces propres intérêts, mais il y a un engagement de la part de ces membres de tout essayer afin de sauver le système. Dans leurs actions on voit la vulnérabilité du système de dépendance du dollar. Les efforts du contrôle du marché d’or international abouti à un échec. Dans la deuxième moitié des années 1960, il y a de plus en plus de difficultés à sauver le système du pool de l’or. On voit des efforts afin de résoudre des faiblesses structurelles du système. Le pool de l’or ne répond pas à des vulnérabilités structurelles. On voit une volonté des acteurs internationaux de s’attaquer aux faiblesses structurelles. Dans les années 1960, l’objectif est de réduire la dépendance du système de Bretton Woods et au dollar. Il n’est pas clair qu’il y a suffisamment de stock d’or dans le monde pour soutenir l’économie mondiale. On voit un retour des idées qui ne sont pas très loin des idées de Keynes avec la création du bancor. Robert Triffin constate que la seule solution pour le système de Bretton Woods est de créer une unité artificielle basée sur la valeur de plusieurs monnaies et non pas sur une seule monnaie nationale. Ce fut quelque chose rejeté au début du système en tant qu’idée de Keynes.

Au milieu des années 1960, on voit des propositions allant dans la même direction. En 1964, on voit que les français reprennent une idée développée d’abord par les britanniques d’utiliser des Droits de tirage spéciaux [DTS] pour résoudre le problème de la dépense au dollar du système international. Au début les américains sont contre voulant garder le rôle clef du dollar, mais les États-Unis changent de position à cause des craintes croissantes pour la convertibilité en or du dollar. Le système va exploser s’il n’y a rien qui change ces faiblesses structurelles.

En 1969, le Droit de tirages spéciaux est mis en œuvre et on voit la création de nouveaux avoirs internationaux sous les auspices du FMI de nature structurelle et interétatique. Les DTS sont des actifs de réserve créés par le FMI et alloués aux pays membres. La valeur des DTS est évaluée à partir d’un panier de monnaies internationales et leur utilisation est limitée aux transactions et aux opérations officielles entre pays membres et avec le FMI. C’est une monnaie artificielle et distincte. Pour ces raisons, on ne voit pas de grand succès du DTS qui ne représente qu’une petite partie des réserves officielles même avant l’effondrement du système de Bretton Woods. Il y a des faiblesses endogènes du système contribuant à l’effondrement éventuel du système de Bretton Woods.

Un marché international commence à se développer beaucoup pendant cette période et surtout pendant les années 1960. Pendant les années 1940 et 1950, il y a une volonté de contrôler les flux de capitaux internationaux. Si ces pays membres acceptent ces consignes, ils vont proposer un règlement d’action de ces flux. On voit un contrôle des capitaux important et imposé partout limitant les possibilités pour le développement du marché financier international. On commence à voir que l’efficacité de ce genre de contrôle s’érode dans l’après-guerre et surtout dans les années 1960. Il y a d’abord la restauration de la convertibilité sur les opérations qui n’est pas restaurée avant 1958 pour les pays principaux de Bretton Woods. Une fois la convertibilité restaurée, cela crée un problème. Il est possible de faire semblant d’avoir besoin de convertir de la monnaie pour des raisons légitimes, mais de le faire autrement. Il y a une possibilité de contourner certaines règles du système une fois la convertibilité sur les opérations courantes restaurées.

{{#ev:youtube|vNAvsrY9vR4|300|right|On 08/15/1971, under pressure from the Federal Reserve, Nixon suspended the convertibility of the US dollar into gold.}}

Financial operators are finding new ways to circumvent controls by moving to the eurodollar markets. The eurodollar market represents a testing ground for the financial world. The Eurodollar creates opportunities for private and public actors to trade that were not possible in the 1950s. Eurodollars are dollars held outside the United States, but not only in Europe. Their origin dates back to the 1950s when dollar deposits began to accumulate in London. The first deposit is made in London and Paris by a Russian bank. It is not by chance that we talk about a Russian bank because the Soviet Union and the eastern countries prefer to hold their dollars outside the United States because they are afraid that their dollars will be frozen in the United States. Above all, American investments seek to escape American regulation and in particular the regulation that limits interest rates on bank deposits in the United States. Banks in Europe and London allow the possibility of investing its dollars abroad, but this is treated differently from deposits held in free-sterling which creates offshore poles. The British government does not decide to regulate the eurodollar market. The fact that these deposits are in dollars makes it possible to differentiate financial systems. This allows you to control your own financial market while allowing you to profit from the eurodollar market. Banks that hold dollar deposits are beginning to see that there are opportunities to lend them. With these dollars, they can issue dollar denominations.

Euromarkets allow investors to escape the yield limits set by the US government and also make government control over capital movements less and less effective. Nixon calls for patriotism not to appeal to the Eurodollar market. Faced with the growing pressure on the dollar during the 1960s and the rise of the Eurodollar market, the United States had to cope with capital flight. Increasingly important controls will be imposed, but these controls cannot work in a world where there is the possibility of the Eurodollar market. These controls have their limits in supporting the dollar and the Bretton Woods system. In 1970, the Federal Reserve lowered the discount rate in the United States to facilitate Nixon's reflection in 1972. At the same time, the Germans are trying to control their inflation rate which is getting higher and higher by increasing their discount rate. The result is first a huge flow of dollars that moves from the United States to other markets to seek higher interest rates and at the same time, the Germans borrow from London to borrow at lower rates. Pressure is offered to maintain sufficient parity. On August 15, 1971, the United States suspended the convertibility of the dollar.