« New monetary and financial order: 1914 - 1929 » : différence entre les versions

| Ligne 79 : | Ligne 79 : | ||

== Financial consequences of the war == | == Financial consequences of the war == | ||

[[Image:Dettes interalliées et position extérieure nette (hors réparations) en 1919 en millions de dollars.png|thumb|300px| | [[Image:Dettes interalliées et position extérieure nette (hors réparations) en 1919 en millions de dollars.png|thumb|300px|Allied debts and net international investment position (excluding repairs) in 1919 in millions of dollars - Source: Pierre-Cyrille Hautcoeur, 2009, La crise de 2009, La Découverte.]] | ||

The United States is the largest lender internationally. We see that Great Britain also plays an important role in financing the debts of allied countries. Especially France, Russia and Italy are financed to a very important point by Great Britain. In the middle of the war, Britain's financial resources were exhausted. France is also capable of lending to Russia in particular. | |||

At the geopolitical level, the existence of these interallied loans played an important role in the development of the 1920s. Allied debts amounted to $18 million, almost the equivalent of the stock of British foreign assets on the eve of the war. If we look at the amount of the stock of foreign assets of Great Britain in 1913, we have the amount of interallied loans contracted by the allies during 4 years explaining the importance of the financial shock established to the world economy by the First World War. | |||

Borrowing between allies is done by governments and only a few privileged intermediaries are associated, such as JP Morgan in the United States. It is the bank that will serve as the gateway for Europeans to the US financial market. The commitments abroad of the European belligerents are increasing very strongly and especially those of the allied countries. At the same time, we see that the net assets on the outside decrease sharply during the war. | |||

There are sales from British assets that exist on the eve of the First World War. Britain liquidates assets to finance the war. When we talk about Great Britain, we are talking about the most important country as the world's creditor, and we are then talking about foreign claims, which are very high. British investors have put a lot of money into financing the railways in the United States and the amount invested is very high. Once Britain begins to sell its securities to pay for the products needed to import, there is a strong willingness on the part of the British government to organize a sale of securities held in the United States to have dollars available to pay for imports from the United States. The United States is frightened by the potential consequences of this sale. Even if it is considered a European war, the consequences for the United States are immediate. Given that this country is very involved in the international economic system, we see that this financial market is being closed following the sale of European securities. This is a real crisis on the American market. | |||

The UK Government is organising a major advertising campaign to convince UK investors to exchange their assets for government securities in pounds sterling. The objective is to recover dollars to pay for imports. France does much the same thing liquidating its debts in order to pay the imports necessary for the conduct of the war. It is one thing that these countries choose to sell a certain portion of these assets. There was also a loss of these assets abroad during the war. France probably loses the ¾ of its assets in Europe mainly because of the repudiation of Russian debts. The central powers will also lose assets during and especially after the war. With the Treaty of Versailles, Germany loses almost all its assets abroad. Foreign commitments increase, foreign assets fall. | |||

After the war, Europe is no longer the world's banker. In contrast, the United States, the largest former debtor until the end of the nineteenth century, became the large international creditor thereafter. There is a transition in terms of international financial hegemony. | |||

On the one hand, European allies borrow abroad, especially from the United States, to finance the war, and as a result the United States' foreign assets are increasing. This means that the United States has increasingly important interests abroad. A significant portion of the foreign assets of the European powers are European securities and these securities are sold to the Americans during the war. Thus, we see a fall in the foreign commitments of the United States. This situation creates a positive external position for the United States. | |||

For the central powers, we must go further because there are reparations at the end of the war which represent the most important financial consequences of the war. The Treaty of Versailles assigned responsibility for the war to Germany by imposing the payment of reparations. The amount to be paid is very controversial being fixed in April 1921 at 132 billion mark-or almost 3 times the GDP of Germany at the time. The question of the amount of reparations is a matter of debate among contemporaries and historians alike. | |||

At the time, the French insisted that Germany paid war damages. France is an invaded country that loses a lot of foreign assets and a country that goes into debt for a long time to pay the cost of war. It is not surprising that France is demanding the most reparation from Germany. Clemenceau presents himself in a revengeful logic in these negotiations, but expresses the dominant attitude of his fellow citizens.[[Image:Clemenceau extrait de Javel coq gaulois.jpg|thumb| ]] | |||

France's concern is to regain its economic and military balance, but also to punish Germany. The end of the war depends on the unconditional surrender of the Germans and which is an unambiguous defeat for the army, but at the same time Germany is not invaded making the acceptance of defeat more difficult. The Kaiser must not have accepted responsibility for the war. It was the new republic founded in November 1918 that had to negotiate peace and fulfil the conditions of the Treaty of Versailles. Germany emerged weakened by the conflict and in the aftermath of the war, the German economy deteriorated very rapidly. We see a sharp drop in industrial production, a rise in brutal unemployment. In 1919, the number of unemployed exceeded one million and there was a wage gap in relation to inflation, which was galloping. It is a situation that is quickly becoming revolutionary in Germany. A food shortage persisted in the post-war period. The wheat harvest in 1919 was only half that of the pre-war period. | |||

Another element is added:{{citation bloc|Under the terms of the Armistice the Allies did imply that they meant to let food into Germany… But so far, not a single ton of food had been sent into Germany. The fishing fleet had even been prevented from going out to catch a few herrings. The Allies were now on top, but the memories of starvation might one day turn against them. The Germans were being allowed to starve whilst at the same time hundreds of thousands of tons of food were lying at Rotterdam… these incidents constituted far more formidable weapons for use against the Allies than any of the armaments it was sought to limit. The Allies were sowing hatred for the future: they were piling up agony, not for the Germans, but for themselves…|David Lloyd George, Minutes of the Supreme War Council, 17th Session, 3rd Meeting, 7 March, 1919, quoted in Avner Offer, The First World War: An Agrarian Interpretation, 1991.}} | |||

The blockade continued even after the war. Lloyd George had great hesitation about the continuation of this policy. | |||

{{citation bloc|Crimes in war may not be excusable, but they are committed in the struggle for victory, when we think only of maintaining our national existence, and are in such passion as makes the conscience of people blunt. The hundreds of thousands of noncombatants who have perished since November 11, because of the blockade, were destroyed coolly and deliberately after our opponents had won a certain and assured victory. Remember that when you speak of guilt and atonement.|Speech of Count Brockdorff-Rantzau on 7 May 1919 at Versailles, quoted in Avner Offer, The First World War: An Agrarian Interpretation, 1991.}} | {{citation bloc|Crimes in war may not be excusable, but they are committed in the struggle for victory, when we think only of maintaining our national existence, and are in such passion as makes the conscience of people blunt. The hundreds of thousands of noncombatants who have perished since November 11, because of the blockade, were destroyed coolly and deliberately after our opponents had won a certain and assured victory. Remember that when you speak of guilt and atonement.|Speech of Count Brockdorff-Rantzau on 7 May 1919 at Versailles, quoted in Avner Offer, The First World War: An Agrarian Interpretation, 1991.}} | ||

We can see the importance of the blockade policy. Brockdorff-Rantzau notes that there is no real famine in Germany. The continuity of the blockade highlights the fact that the Germans are increasingly angry with the allies, that they have difficulty accepting the conditions of peace. There is a strong reluctance on the part of the Germans but there is a strong reluctance to sign the Treaty of Versailles. The consequences of peace are very controversial. This raises the question of the extent to which a policy of pressure can be put in place to encourage the signing of a peace treaty. | |||

This background to the peace negotiations with highlights two sides of the problem. We see that this debate continues and takes different forms. In economic history, we already see that in 1919, 1920 and 1921 there were debates about the reparations requested by the Germans. There are critics among British economists like John Maynard Keynes. Keynes proposes a repair of 20 billion gold marks as a repair. His proposal was rejected and criticized in his book The Economic Consequences of Peace. | |||

Americans also believe that the imposed reparations are excessive continuing to put pressure on the British, the French and Italy to pay the debts contracted during the war. The position of the United States may be considered hypocritical to some historians. A vicious circle began forcing the Allies to seek reparations. Today, the debate is divided into two camps: historians like Keynes insist on the harmful role of German reparations, and in German political life this leads to the success of the Nazi movement. Other debates consider that, given its GNP, Germany was able to pay for the required repairs. These prospects note the weaknesses of the French economy after the war to justify the vengeful attitude of the French towards the Germans. | |||

= Post-war financial and monetary challenges = | |||

There are important consequences and issues that remain very important. As far as the medium-term challenges are concerned, we must also look a little further ahead. Once the 1920s begin to unfold, what do we see in terms of the financial and monetary challenge? | |||

Fiscal imbalances last and persist after the war, the warring states are experiencing large budget deficits which are the consequence of the collapse of tax revenues due to the sharp decline in production and international trade. In addition, there is also a sharp increase in expenses and pension payments for people returning from war or for their families, reconstruction costs and debt repayment to be accounted for. With the end of the war, we cannot say that we are returning to normal with a reduction in government spending to the point of departure. The problem of budget deficits persisted after the war. One solution would be to reduce the size of the budget deficit, but this implies a reduction in state expenditure which was still very difficult in Europe at the time. | |||

Another solution must be sought to finance the budget deficit. The main opposition is taxation, but a tax increase remains very difficult given the collapse in the level of economic activity, but also the climate. There was the possibility of importing, but it is an expensive solution because there is interest to pay. In the end, this solution only declares the problem and there is finally the possibility of issuing currency. We see that there is a temptation to which most states begin to give in already during the war, but also after the war. There is the risk of high inflation, which can ruin the profitability of financial investments in the currency in question, and we see that this trend encourages capital flight. Ultimately, this causes the value of the currency concerned to collapse. The higher the inflation, the greater the risk of monetary collapse. | |||

We see the problem of a budget deficit that persists and that the same menu of options to solve this deficit. When we look at different countries, the reactions are varied. If Britain is taken, it decides to return to a balanced budget as quickly as possible at the cost of large tax increases. This country decides to discipline the economy fast. On the other hand, the country is in a situation that is not as difficult as for continental countries, but we also see a political will to face social conflicts in order to balance the budget. We also see that Britain is putting in place policies to fight inflation. There is a cost to Britain because these policies deflate the economy and are costly in terms of reducing the economy with increased unemployment, reduced investment and so on. | |||

In France, the situation is more complicated. It is difficult for France itself to start a discussion to rebalance the budget because the costs associated with the war are so great that it is difficult to imagine how it is possible for France to solve the problem of balance. Another aspect complicates the budgetary issue because it is involved in the debate on war reparations. The government does not deem it necessary to increase taxes to repay the national debt, thereby increasing the French debt. There is a reluctance on the part of politicians in France to raise taxes because they see that reparations will pay a large part of the budget deficit. In Germany, we see the same thing with a strong opposition to rising taxes to pay for repairs. There is an increase in budget deficits and an effort to monetize these deficits which leads to high inflation. | |||

In both countries, the temptation to monetize deficits is high and frustration is high. The fiscal situation of the various countries has a very strong influence on the monetary challenges of the post-war period. Restoring the gold standard after the war is the primary objective of all countries. At the time, the gold standard was seen as the only guarantee of stability. This evokes for many elite the memory of a better world. The idea of re-establishing the gold standard is the promise of greater stability. | |||

The United States is restoring free convertibility in the post-war period, but European countries face enormous challenges in re-establishing a fixed exchange rate because a return to balanced budgets is necessary for monetary stabilization. If a budget deficit is out of control, it is not possible to stabilize the currency because there is always the temptation to use the currency to finance its budget and deficit. It took until the mid 1920s to restore the gold standard and it was a new system compared to the conventional standard. There is a restoration of the international monetary system based on gold with very similar principles. Even if people think that with such a recovery they will see such stability return, we will see that it is not the same thing that will happen opening a period of strong monetary and financial instability leading to the Great Depression. | |||

In a situation of fiscal imbalance, there is always the temptation and need to print money to finance the deficit. If the budget cannot be rebalanced, there will be monetary expansion and inflation. It is only from the mid-1920s that we can speak of a new international monetary system for the world. | |||

For Germany, the first half of the 1920s was marked by the experience of hyperinflation which was linked to the weakness of the German economy and the German response to these weaknesses. Already in 1919, the Germans began to pay for repairs in cash and in kind. At the end of April 1921, the Reparations Commission informed the Germans of the amount to be paid, i.e. 132 billion gold marks, but the ability of the Germans to pay such an amount depended on the ability to export in order to earn foreign exchange. However the situation on the world markets was difficult at the time, moreover restrictions were imposed on the Germans by the allies. There are problems within Germany too, transport problems which prevent the Germans from doing what is necessary to earn enough foreign currency to pay for repairs. There is starting to be a reaction in terms of the value of the mark because international investors fear the worst not being convinced that the Germans can pay the reparations. The value of the mark falls marking a loss of confidence. The mark, which had a value of 4.2 against the dollar in 1914, was only worth 14 at the end of the war, 1 dollar was worth 500 marks in July 1922, and 70000 marks in July 1923. The dramatic fall in the value of the mark reflects the problems within the German economy and reflects the difficulty of the Germans on the international markets. | |||

The Germans stop paying for repairs because they consider that they are no longer able to pay them. The French are furious reacting aggressively with an invasion of the Ruhr to take control of the coal and iron mines to demand coal repairs. When the French arrived, there was passive resistance from the Germans, the French had to call thousands of engineers and workers to fetch coal in Germany. The French managed to find coal, but it was very expensive. The German government, which calls for passive resistance, starts printing money to compensate workers in the Ruhr to support this passive resistance. In 1922, a dollar was worth 4.2 trillion marks.[[Image:Hausse des prix de gros – indice de base 100 en 1913.png|thumb|400px|center|Wholesale price increases - base index 100 in 1913]] | |||

The wholesale price index is an indicator of inflation. There is a real currency crisis in Germany. The German government must act since there is no confidence in the German currency. The government demonetizes the mark the replacement by a new currency which is the rentemark. There is an almost total collapse of the German value. The devaluation of the value of the German currency is so serious that the German government is not able to manage the situation alone using the international to stabilize the German currency. | |||

An international commission is set up under the leadership of Dawes called the Dawes Plan trying to help the Germans stabilize their currency with a reduction in repairs and an international loan. The idea is to reduce the amount of repairs, but also to grant them an international loan to pay for the remaining repairs. International aid allows Germany to resume payment of repairs, but in a reduced way then to make its currency convertible back into gold. The experience of galloping inflation weighs very heavily until the 1930s and up to the present day. | |||

In France, the franc crisis took place. We are not talking about hyperinflation in France. There is a significant increase in prices. Crises for France took place in the 1920s. For France, monetary stabilization was a difficult test that would be completed in the mid-1920s. The French government is pursuing an economic deficit policy to finance the reconstruction of the devastated regions. It's a policy to put pressure on the Germans and pay for repairs. The French state created currency to allow the reconstruction of the country and created economic inflation. The franc becomes volatile in the face of rising prices. | |||

Another thing weighs on the value of the franc is the growing uncertainties of the payment of reparations by the Germans with the invasion of the Ruhr. Everybody's paying attention. This is increasingly seen as a failure that is causing international investors to worry more and more about the value of the franc. Looking at the budget situation, if the Germans don't pay for the repairs, they will have to devalue. The government is looking for budgetary solutions to maintain confidence in the French currency. In 1924, there was a desire to solve French budgetary problems. Yet there is a difficulty in accepting the proposed plan since it depends on an increase in taxes and no one is really convinced that it is possible to raise taxes to pay the budget deficit. This attempt failed leading to a change of government. | |||

The cartel on the left has proposals to stabilize the budget. New tax projects are proposed by the left cartel and the main measure is to tax capital. But this proposal caused a flight of capital from France to Switzerland and the Netherlands, leading to a further fall in the franc. There is more pressure on the value of the franc and we can clearly see the interaction between the fiscal crisis in France and the monetary crisis. It is not possible to solve the monetary problem without solving the budgetary problem. The government will finally demand an increase in taxes and the effort will lead to a success with a stabilization of the franc. However, it is not possible to bring the franc back to its old value, we are talking about a parity at 80% of the pre-war value. The French must accept that their economy is much weaker than it was before the First World War. Some experts believe that the government undervalued the franc to help industry and the economy grow because if the currency is undervalued, exports cost less in world markets. | |||

All the problems facing France reinforce interest in a return to the fixed exchange rate system. There is strong criticism of the floating exchange rate. The return to the fixed exchange rate is difficult to set up. A successful return to a fixed exchange rate regime is a balancing act, but also a choice of parity that is viable given the economic situation of each country. To be sustainable from a long-term economic perspective, the choice of parity must take into account purchasing power in different countries. To be sustainable, the exchange rate must equalize the price level between two countries. | |||

In Germany, hyperinflation leads to a total destruction of the value of its currency. To be aware of this economic reality, the Germans must restore the convertibility of the mark towards a much cheaper currency. If a currency is worth very little, it is difficult to buy on international markets. Saving in old marks is worth almost nothing. For the French, the situation is not as serious, but France also accepts a significant devaluation of its currency with the new franc. Some countries are in the same situation as France, such as Belgium and Italy. | |||

Great Britain is an exception. It is not prepared to accept such devaluation of its currency. There is an effort to restore the convertibility of its currency to the same parity as that of 1914. The City places great emphasis on the importance of the old parity since it considered that its reputation depended on the strength of the book. The priority is to restore the pound's parity to show international investors that they can have confidence in the British currency. To return to the previous exchange rate with the dollar, the problem is that in the meantime there are differences in inflation between the United States and the United Kingdom. A policy will be implemented to deflate the British economy. The return to the 1914 exchange rate implies an austerity policy in order to reduce both domestic price levels and wages. The convertibility of the pound is restored in 1925 to the value of 1914 after a price reduction of 1/3. This monetary success depends on economic stagnation, massive change and a real social crisis in the UK. Moreover, at the international level, the British pound remained overvalued, weighing on the country's exports during the 1920s. In monetary terms, there is success on the part of the United Kingdom. This is an objective sought by a certain part of the British is especially by financiers. | |||

= A new monetary and financial regime = | |||

With these two cases appear important difficulties in the restoration of the gold standard, but from the middle of the 1920s, there is a new international gold standard which is set up. However, it is not the same gold standard as before. If we look at the world price level in 1920 and 1922, the world price level is much higher than in 1915. The old gold standard question arises: there is always the risk that the amount of gold contained in reserve is too low to sustain the level of economic activity. | |||

At the Genoa Conference in 1922 the gold exchange standard was proposed. Central and national governments are seeking to increase the base of the international currency. Central banks develop their ability to generate money not only on gold, but also on certain currencies that are themselves convertible into gold. There is an effort to extend the possibilities in terms of the reserve that can be held. With the expansion of reserves that are usable as a monetary base, this means that the gold stock itself does not limit the money supply in the same way as before the First World War. The advantage of such a system is that it has enlarged the size of the central bank reserve, but this requires confidence in the value of money. As the 1920s unfolded, there was a decline in confidence. There are advantages to this system, but also great vulnerability. | |||

[[Image:Emissions Etrangères aux Etats-Unis, 1919-1929 en millions de dollars 1929.png|thumb|center|400px| | If we can talk about a new monetary regime in the 1920s, we can also talk about the emergence of new financial regimes. It should be noted that neutral countries such as the Netherlands and Switzerland increased their success as financial centres during the First World War. Note the importance of the rise of the United States as an international financier. This trend was already evident during the war, but following the war, this trend was reinforced by the American public's enthusiasm for foreign currencies.[[Image:Emissions Etrangères aux Etats-Unis, 1919-1929 en millions de dollars 1929.png|thumb|center|400px|Foreign issues in the United States, 1919-1929 in millions of dollars 1929.]] | ||

Capital exports to the United States are headed for Europe. The Germans attract a lot of capital from the United States. Canada and Latin America are also affected. For Latin America, there is an increase in the importance of the United States and therefore a growing dependence on the part of Latin American companies and governments. | |||

[[Image:Les destinataires des émissions étrangères aux Etats-Unis.png|thumb|300px| | [[Image:Les destinataires des émissions étrangères aux Etats-Unis.png|thumb|300px|The recipients of foreign broadcasts in the United States.]] | ||

The question that arose in the 1920s was where the Europeans were. France and Great Britain remain present, but especially Great Britain, which continues to lend money. Given the domestic problems Britain is facing, its role is diminishing. However, with the United States, competition is creating a duopoly. But in the 1920s, the United States gained a real superiority. The presence of the United States is making a difference. For the United States, this is the first time that we have seen a high level of foreign investment, creating a strong contrast with Great Britain. There are some experts who find that American investors take too much risk when they invest abroad. There is a strong criticism of the investments that the United States is making in Germany, for example. When we talk about the United States as a major investor, we are not talking about Great Britain. | |||

[[Image:Emissions Etrangères, 1920-31.png|thumb|300px|Emissions | [[Image:Emissions Etrangères, 1920-31.png|thumb|300px|Foreign Emissions, 1920 - 1931.]] | ||

Even at the peak of investments, these emissions represent a minority of investments, between 17% and 18%. For Great Britain it is 50% of the investments which are intended for the international markets. | |||

As the 1920s unfolded, this dependence became less and less important. A speculative bubble is developing and American investors have fewer and fewer solutions. They can either invest abroad or at home. As the speculative bubble develops, they are attracted by domestic investments. The British are also attracted by investment in the United States. There is beginning to be a change of direction in the destination of capital. This change in the direction of international capital flows contributes to creating a vicious circle that contributes to making the international financial system vulnerable. | |||

= Annexes = | = Annexes = | ||

Version du 4 avril 2018 à 01:41

The consequences of war include monetary and financial effects. War is expensive, creating a funding problem. Solutions to this financing problem have consequences that disrupt the global economy in the post-war period. There will be a break with the international monetary and financial system.

Financing the First World War

Costs of war

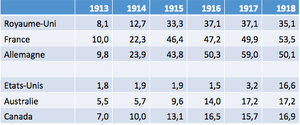

When an economist focuses on war finance, he looks at state spending. We can clearly see the scale of this war for Britain's budget. We will see the increase in the importance of government spending for Great Britain. We start from 8% of GDP to a peak of 37% of GDP in 1918. To have such an increase in a relatively short period, it weighs heavily on the economy.

This is not the only case concerned, because if we look at France, the United Kingdom and Germany, the expenditure is similar. The trends are the same for continental countries. State spending in France and Germany is even higher than in Great Britain. For the United States, spending increased from the entry of the war in 1917. However, in 1918 expenditure was far from that of Europeans. However, for an American, spending is significant, implying a greater role for the federal state in the United States than before.

Menu of different options to pay them

How can the increase in state spending be financed? If spending increases, the most logical expenditure is to increase incomes either at the state level or at the household level. When we talk about government revenues, we are talking about taxes. When we look at British spending and incomes, we see an increase in taxes from 7% of GDP to 16% of GDP, more than doubling the level of taxes.

We see that this increase is not enough to pay for war expenses. 12% of the cost of war is financed by taxes showing which remains a budget deficit to be filled.

We see the surplus and deficit in million pounds sterling and as a percentage of GDP highlighting that there is a significant financial deficit. The most important source of financing is the long-term domestic debt used as the main source of financing for the budget deficit, which remains after tax increases. There is much success on the part of the British in financing the war on the basis of taxes and on the basis of domestic debt.

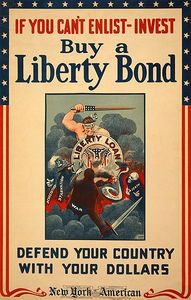

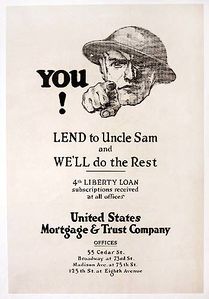

This is not surprising. London was an important place as a world financial centre. We are talking about a city that is at the centre of the financial world and that had strong financial skills. So the fact that Britain is able to finance itself on the basis of domestic debt is not surprising. There is a financial sophistication, a mobilization of capital, so it is not a problem to finance the war. It still takes a major effort on the part of the British government to stimulate investors to lend their money.

There is a call for investor patriotism. Despite London's financial sophistication, government efforts remain important to stimulate investors. Even in Britain, we see that the domestic debt is not enough to finance the war. Other options are being exploited. Great Britain was forced to go abroad, especially in the latter half of the war, to raise funds elsewhere and especially in New York. From 1915, but especially from 1917 and 1918, it was important for Britain to have financial support from the markets in New York.

The manipulation of the money supply created inflation risks, but regarding British practice, early in the war, this is a shock effect creating money to finance spending. Immediately, a discipline settles and we do not see a major recourse of the creation of the currency in Great Britain. Monetary control is being established, but it must be understood that the possibility of establishing such monetary discipline is a luxury. Britain has access to other sources of funding.

In the combination of financing options, there are different trends. Everywhere, debt is important for the financing of war. Some countries, such as Great Britain, have the luxury of a highly developed financial market that allows them to rely on domestic debt and take on long-term debt. Access to Britain's internal market allows it to go into debt internally and in the long term, and that is a luxury. You have to have some confidence as an investor to do that.

In France, there is a call for patriotism just as in the United States, and also in Germany. This is a trend that can be seen everywhere. There is also a call for taxes, but the successes are varied. For Great Britain there is a success with a doubling of taxes in relation to the size of GDP. In the United States, 25% of war efforts are financed by taxes. We see in the United States a situation not so different from that of Great Britain. In France, there is a sharp increase in taxes and there is opposition, to which is added the problem of the chaos of war which makes it difficult to collect taxes in one's country at war. For quite practical difficulties, we see that the tax covers only 15% of the cost of war. France is making greater use of debt and money creation to finance the war. In Paris, a financial market is developed allowing to get into debt inside the country.

The French sought funds first in London, but once they were exhausted, they turned to New York which became the important financial centre of the world during the war. However, raising funds in the United States is difficult because the United States remains primarily a neutral country. In October 1915, the great American banker JP Morgan tried to raise $500 million for the English and French. He finds the conditions difficult for this loan with a hesitation of part of the public to get involved in a war that is considered by most Americans as a purely imperialist and European war. There is a strong reluctance on the part of Americans to allocate their funds to Europeans. On the other hand, there is open opposition from a certain section of the German public to the idea of funding the French and English governments. We see that for this loan, in the end, the bonds are not fully subscribed and it is therefore a partial failure.

Attitudes changed with the entry of the United States into the war in April 1917. Even before that, there has been a decrease in reluctance to receive funding from Allied governments. Even before the United States entered the war, the central powers had much more difficulty borrowing from New York and abroad. It is becoming increasingly difficult for Germany to finance the war, because it is not possible for Germans to go into debt in London or Paris. Even if the United States is neutral, there is the possibility for Germany and the central powers to call on American capital, but we are only talking about 35 million dollars of loans being a rather small amount explained by reluctance of the public and investors.

We can see that for Germany, the situation and the challenge to be filled in order to finance the war mainly through long-term debt is very difficult because debt is difficult outside and inside, financial markets are not as developed as in London. When German investors agree to lend their money, it is more in the short and medium term with higher interest rates.

Like France, Germany faces great difficulties in financing the war through a tax that covers only 15% of the cost of the war. The country goes into debt to a certain extent, especially in the short term, and the country creates money because the other options are so limited for Germany.

Different approaches in different countries

The choices different countries make to finance war have different short- and long-term consequences. One cannot understand post-war instability without understanding funding during the war. One of the most important consequences of the creation of money to finance war is inflation. Some experts believe that it is because of the First World War that the world is rediscovering inflation, which has been an almost forgotten phenomenon since the end of the Napoleonic wars.

We see that for these countries, there is a challenge to be met in order to control price increases. The creation of money is not the only important element, there is also a gap between demand and supply. In times of war, there is strong demand for some countries, but supply is very limited due to reallocation of resources. The creation of money reinforces this problem. There is price control in an attempt to limit inflation. These controls are becoming important and effective, for example in Germany. What we expect is the end of the war and especially with the end of price control, we expect an explosion in prices. Once prices are released, the consequences of inflation are removed to some extent during the war. In some countries, such as France and Germany, a real problem is developing in relation to post-war inflation. In Russia, the public is losing confidence in the government refusing to accept banknotes.

The monetary and financial consequences of war

Monetary consequences

The international system based on the gold standard is its ability to control the issuance of money by stressing the importance of having a close link between the gold reserve and the money supply. To speak of the creation of money to the point that it implies a significant finalization implies that the gold standard system has been terminated. All countries effectively end the gold standard system or in practice. There is a pause concerning the international monetary system based on gold.

Exchange rates will start to change, so if there is very high inflation, it means that the value of the currency will be hurt. If we look at the situation for France or Germany, we see that there is a collapse in the value of these currencies. We are not only in a floating exchange rate regime, but there are also sudden changes in the value of money. We can then talk about certain monetary consequences of the war and in particular the immediate consequences.

There are also consequences such as the increase in the size of debts as well as debts between countries. If we look at Britain's national debt, we see a significant increase.

The national debt level for France will be a little higher than for Great Britain.

The debt burden is increasing for belligerent countries. These debts are contracted not only with domestic investors, but also with external investors involving these countries in the consequences of this trend.

Financial consequences of the war

The United States is the largest lender internationally. We see that Great Britain also plays an important role in financing the debts of allied countries. Especially France, Russia and Italy are financed to a very important point by Great Britain. In the middle of the war, Britain's financial resources were exhausted. France is also capable of lending to Russia in particular.

At the geopolitical level, the existence of these interallied loans played an important role in the development of the 1920s. Allied debts amounted to $18 million, almost the equivalent of the stock of British foreign assets on the eve of the war. If we look at the amount of the stock of foreign assets of Great Britain in 1913, we have the amount of interallied loans contracted by the allies during 4 years explaining the importance of the financial shock established to the world economy by the First World War.

Borrowing between allies is done by governments and only a few privileged intermediaries are associated, such as JP Morgan in the United States. It is the bank that will serve as the gateway for Europeans to the US financial market. The commitments abroad of the European belligerents are increasing very strongly and especially those of the allied countries. At the same time, we see that the net assets on the outside decrease sharply during the war.

There are sales from British assets that exist on the eve of the First World War. Britain liquidates assets to finance the war. When we talk about Great Britain, we are talking about the most important country as the world's creditor, and we are then talking about foreign claims, which are very high. British investors have put a lot of money into financing the railways in the United States and the amount invested is very high. Once Britain begins to sell its securities to pay for the products needed to import, there is a strong willingness on the part of the British government to organize a sale of securities held in the United States to have dollars available to pay for imports from the United States. The United States is frightened by the potential consequences of this sale. Even if it is considered a European war, the consequences for the United States are immediate. Given that this country is very involved in the international economic system, we see that this financial market is being closed following the sale of European securities. This is a real crisis on the American market.

The UK Government is organising a major advertising campaign to convince UK investors to exchange their assets for government securities in pounds sterling. The objective is to recover dollars to pay for imports. France does much the same thing liquidating its debts in order to pay the imports necessary for the conduct of the war. It is one thing that these countries choose to sell a certain portion of these assets. There was also a loss of these assets abroad during the war. France probably loses the ¾ of its assets in Europe mainly because of the repudiation of Russian debts. The central powers will also lose assets during and especially after the war. With the Treaty of Versailles, Germany loses almost all its assets abroad. Foreign commitments increase, foreign assets fall.

After the war, Europe is no longer the world's banker. In contrast, the United States, the largest former debtor until the end of the nineteenth century, became the large international creditor thereafter. There is a transition in terms of international financial hegemony.

On the one hand, European allies borrow abroad, especially from the United States, to finance the war, and as a result the United States' foreign assets are increasing. This means that the United States has increasingly important interests abroad. A significant portion of the foreign assets of the European powers are European securities and these securities are sold to the Americans during the war. Thus, we see a fall in the foreign commitments of the United States. This situation creates a positive external position for the United States.

For the central powers, we must go further because there are reparations at the end of the war which represent the most important financial consequences of the war. The Treaty of Versailles assigned responsibility for the war to Germany by imposing the payment of reparations. The amount to be paid is very controversial being fixed in April 1921 at 132 billion mark-or almost 3 times the GDP of Germany at the time. The question of the amount of reparations is a matter of debate among contemporaries and historians alike.

At the time, the French insisted that Germany paid war damages. France is an invaded country that loses a lot of foreign assets and a country that goes into debt for a long time to pay the cost of war. It is not surprising that France is demanding the most reparation from Germany. Clemenceau presents himself in a revengeful logic in these negotiations, but expresses the dominant attitude of his fellow citizens.

France's concern is to regain its economic and military balance, but also to punish Germany. The end of the war depends on the unconditional surrender of the Germans and which is an unambiguous defeat for the army, but at the same time Germany is not invaded making the acceptance of defeat more difficult. The Kaiser must not have accepted responsibility for the war. It was the new republic founded in November 1918 that had to negotiate peace and fulfil the conditions of the Treaty of Versailles. Germany emerged weakened by the conflict and in the aftermath of the war, the German economy deteriorated very rapidly. We see a sharp drop in industrial production, a rise in brutal unemployment. In 1919, the number of unemployed exceeded one million and there was a wage gap in relation to inflation, which was galloping. It is a situation that is quickly becoming revolutionary in Germany. A food shortage persisted in the post-war period. The wheat harvest in 1919 was only half that of the pre-war period.

Another element is added:

« Under the terms of the Armistice the Allies did imply that they meant to let food into Germany… But so far, not a single ton of food had been sent into Germany. The fishing fleet had even been prevented from going out to catch a few herrings. The Allies were now on top, but the memories of starvation might one day turn against them. The Germans were being allowed to starve whilst at the same time hundreds of thousands of tons of food were lying at Rotterdam… these incidents constituted far more formidable weapons for use against the Allies than any of the armaments it was sought to limit. The Allies were sowing hatred for the future: they were piling up agony, not for the Germans, but for themselves… »

— David Lloyd George, Minutes of the Supreme War Council, 17th Session, 3rd Meeting, 7 March, 1919, quoted in Avner Offer, The First World War: An Agrarian Interpretation, 1991.

The blockade continued even after the war. Lloyd George had great hesitation about the continuation of this policy.

« Crimes in war may not be excusable, but they are committed in the struggle for victory, when we think only of maintaining our national existence, and are in such passion as makes the conscience of people blunt. The hundreds of thousands of noncombatants who have perished since November 11, because of the blockade, were destroyed coolly and deliberately after our opponents had won a certain and assured victory. Remember that when you speak of guilt and atonement. »

— Speech of Count Brockdorff-Rantzau on 7 May 1919 at Versailles, quoted in Avner Offer, The First World War: An Agrarian Interpretation, 1991.

We can see the importance of the blockade policy. Brockdorff-Rantzau notes that there is no real famine in Germany. The continuity of the blockade highlights the fact that the Germans are increasingly angry with the allies, that they have difficulty accepting the conditions of peace. There is a strong reluctance on the part of the Germans but there is a strong reluctance to sign the Treaty of Versailles. The consequences of peace are very controversial. This raises the question of the extent to which a policy of pressure can be put in place to encourage the signing of a peace treaty.

This background to the peace negotiations with highlights two sides of the problem. We see that this debate continues and takes different forms. In economic history, we already see that in 1919, 1920 and 1921 there were debates about the reparations requested by the Germans. There are critics among British economists like John Maynard Keynes. Keynes proposes a repair of 20 billion gold marks as a repair. His proposal was rejected and criticized in his book The Economic Consequences of Peace.

Americans also believe that the imposed reparations are excessive continuing to put pressure on the British, the French and Italy to pay the debts contracted during the war. The position of the United States may be considered hypocritical to some historians. A vicious circle began forcing the Allies to seek reparations. Today, the debate is divided into two camps: historians like Keynes insist on the harmful role of German reparations, and in German political life this leads to the success of the Nazi movement. Other debates consider that, given its GNP, Germany was able to pay for the required repairs. These prospects note the weaknesses of the French economy after the war to justify the vengeful attitude of the French towards the Germans.

Post-war financial and monetary challenges

There are important consequences and issues that remain very important. As far as the medium-term challenges are concerned, we must also look a little further ahead. Once the 1920s begin to unfold, what do we see in terms of the financial and monetary challenge?

Fiscal imbalances last and persist after the war, the warring states are experiencing large budget deficits which are the consequence of the collapse of tax revenues due to the sharp decline in production and international trade. In addition, there is also a sharp increase in expenses and pension payments for people returning from war or for their families, reconstruction costs and debt repayment to be accounted for. With the end of the war, we cannot say that we are returning to normal with a reduction in government spending to the point of departure. The problem of budget deficits persisted after the war. One solution would be to reduce the size of the budget deficit, but this implies a reduction in state expenditure which was still very difficult in Europe at the time.

Another solution must be sought to finance the budget deficit. The main opposition is taxation, but a tax increase remains very difficult given the collapse in the level of economic activity, but also the climate. There was the possibility of importing, but it is an expensive solution because there is interest to pay. In the end, this solution only declares the problem and there is finally the possibility of issuing currency. We see that there is a temptation to which most states begin to give in already during the war, but also after the war. There is the risk of high inflation, which can ruin the profitability of financial investments in the currency in question, and we see that this trend encourages capital flight. Ultimately, this causes the value of the currency concerned to collapse. The higher the inflation, the greater the risk of monetary collapse.

We see the problem of a budget deficit that persists and that the same menu of options to solve this deficit. When we look at different countries, the reactions are varied. If Britain is taken, it decides to return to a balanced budget as quickly as possible at the cost of large tax increases. This country decides to discipline the economy fast. On the other hand, the country is in a situation that is not as difficult as for continental countries, but we also see a political will to face social conflicts in order to balance the budget. We also see that Britain is putting in place policies to fight inflation. There is a cost to Britain because these policies deflate the economy and are costly in terms of reducing the economy with increased unemployment, reduced investment and so on.

In France, the situation is more complicated. It is difficult for France itself to start a discussion to rebalance the budget because the costs associated with the war are so great that it is difficult to imagine how it is possible for France to solve the problem of balance. Another aspect complicates the budgetary issue because it is involved in the debate on war reparations. The government does not deem it necessary to increase taxes to repay the national debt, thereby increasing the French debt. There is a reluctance on the part of politicians in France to raise taxes because they see that reparations will pay a large part of the budget deficit. In Germany, we see the same thing with a strong opposition to rising taxes to pay for repairs. There is an increase in budget deficits and an effort to monetize these deficits which leads to high inflation.

In both countries, the temptation to monetize deficits is high and frustration is high. The fiscal situation of the various countries has a very strong influence on the monetary challenges of the post-war period. Restoring the gold standard after the war is the primary objective of all countries. At the time, the gold standard was seen as the only guarantee of stability. This evokes for many elite the memory of a better world. The idea of re-establishing the gold standard is the promise of greater stability.

The United States is restoring free convertibility in the post-war period, but European countries face enormous challenges in re-establishing a fixed exchange rate because a return to balanced budgets is necessary for monetary stabilization. If a budget deficit is out of control, it is not possible to stabilize the currency because there is always the temptation to use the currency to finance its budget and deficit. It took until the mid 1920s to restore the gold standard and it was a new system compared to the conventional standard. There is a restoration of the international monetary system based on gold with very similar principles. Even if people think that with such a recovery they will see such stability return, we will see that it is not the same thing that will happen opening a period of strong monetary and financial instability leading to the Great Depression.

In a situation of fiscal imbalance, there is always the temptation and need to print money to finance the deficit. If the budget cannot be rebalanced, there will be monetary expansion and inflation. It is only from the mid-1920s that we can speak of a new international monetary system for the world.

For Germany, the first half of the 1920s was marked by the experience of hyperinflation which was linked to the weakness of the German economy and the German response to these weaknesses. Already in 1919, the Germans began to pay for repairs in cash and in kind. At the end of April 1921, the Reparations Commission informed the Germans of the amount to be paid, i.e. 132 billion gold marks, but the ability of the Germans to pay such an amount depended on the ability to export in order to earn foreign exchange. However the situation on the world markets was difficult at the time, moreover restrictions were imposed on the Germans by the allies. There are problems within Germany too, transport problems which prevent the Germans from doing what is necessary to earn enough foreign currency to pay for repairs. There is starting to be a reaction in terms of the value of the mark because international investors fear the worst not being convinced that the Germans can pay the reparations. The value of the mark falls marking a loss of confidence. The mark, which had a value of 4.2 against the dollar in 1914, was only worth 14 at the end of the war, 1 dollar was worth 500 marks in July 1922, and 70000 marks in July 1923. The dramatic fall in the value of the mark reflects the problems within the German economy and reflects the difficulty of the Germans on the international markets.

The Germans stop paying for repairs because they consider that they are no longer able to pay them. The French are furious reacting aggressively with an invasion of the Ruhr to take control of the coal and iron mines to demand coal repairs. When the French arrived, there was passive resistance from the Germans, the French had to call thousands of engineers and workers to fetch coal in Germany. The French managed to find coal, but it was very expensive. The German government, which calls for passive resistance, starts printing money to compensate workers in the Ruhr to support this passive resistance. In 1922, a dollar was worth 4.2 trillion marks.

The wholesale price index is an indicator of inflation. There is a real currency crisis in Germany. The German government must act since there is no confidence in the German currency. The government demonetizes the mark the replacement by a new currency which is the rentemark. There is an almost total collapse of the German value. The devaluation of the value of the German currency is so serious that the German government is not able to manage the situation alone using the international to stabilize the German currency.

An international commission is set up under the leadership of Dawes called the Dawes Plan trying to help the Germans stabilize their currency with a reduction in repairs and an international loan. The idea is to reduce the amount of repairs, but also to grant them an international loan to pay for the remaining repairs. International aid allows Germany to resume payment of repairs, but in a reduced way then to make its currency convertible back into gold. The experience of galloping inflation weighs very heavily until the 1930s and up to the present day.

In France, the franc crisis took place. We are not talking about hyperinflation in France. There is a significant increase in prices. Crises for France took place in the 1920s. For France, monetary stabilization was a difficult test that would be completed in the mid-1920s. The French government is pursuing an economic deficit policy to finance the reconstruction of the devastated regions. It's a policy to put pressure on the Germans and pay for repairs. The French state created currency to allow the reconstruction of the country and created economic inflation. The franc becomes volatile in the face of rising prices.

Another thing weighs on the value of the franc is the growing uncertainties of the payment of reparations by the Germans with the invasion of the Ruhr. Everybody's paying attention. This is increasingly seen as a failure that is causing international investors to worry more and more about the value of the franc. Looking at the budget situation, if the Germans don't pay for the repairs, they will have to devalue. The government is looking for budgetary solutions to maintain confidence in the French currency. In 1924, there was a desire to solve French budgetary problems. Yet there is a difficulty in accepting the proposed plan since it depends on an increase in taxes and no one is really convinced that it is possible to raise taxes to pay the budget deficit. This attempt failed leading to a change of government.

The cartel on the left has proposals to stabilize the budget. New tax projects are proposed by the left cartel and the main measure is to tax capital. But this proposal caused a flight of capital from France to Switzerland and the Netherlands, leading to a further fall in the franc. There is more pressure on the value of the franc and we can clearly see the interaction between the fiscal crisis in France and the monetary crisis. It is not possible to solve the monetary problem without solving the budgetary problem. The government will finally demand an increase in taxes and the effort will lead to a success with a stabilization of the franc. However, it is not possible to bring the franc back to its old value, we are talking about a parity at 80% of the pre-war value. The French must accept that their economy is much weaker than it was before the First World War. Some experts believe that the government undervalued the franc to help industry and the economy grow because if the currency is undervalued, exports cost less in world markets.

All the problems facing France reinforce interest in a return to the fixed exchange rate system. There is strong criticism of the floating exchange rate. The return to the fixed exchange rate is difficult to set up. A successful return to a fixed exchange rate regime is a balancing act, but also a choice of parity that is viable given the economic situation of each country. To be sustainable from a long-term economic perspective, the choice of parity must take into account purchasing power in different countries. To be sustainable, the exchange rate must equalize the price level between two countries.

In Germany, hyperinflation leads to a total destruction of the value of its currency. To be aware of this economic reality, the Germans must restore the convertibility of the mark towards a much cheaper currency. If a currency is worth very little, it is difficult to buy on international markets. Saving in old marks is worth almost nothing. For the French, the situation is not as serious, but France also accepts a significant devaluation of its currency with the new franc. Some countries are in the same situation as France, such as Belgium and Italy.

Great Britain is an exception. It is not prepared to accept such devaluation of its currency. There is an effort to restore the convertibility of its currency to the same parity as that of 1914. The City places great emphasis on the importance of the old parity since it considered that its reputation depended on the strength of the book. The priority is to restore the pound's parity to show international investors that they can have confidence in the British currency. To return to the previous exchange rate with the dollar, the problem is that in the meantime there are differences in inflation between the United States and the United Kingdom. A policy will be implemented to deflate the British economy. The return to the 1914 exchange rate implies an austerity policy in order to reduce both domestic price levels and wages. The convertibility of the pound is restored in 1925 to the value of 1914 after a price reduction of 1/3. This monetary success depends on economic stagnation, massive change and a real social crisis in the UK. Moreover, at the international level, the British pound remained overvalued, weighing on the country's exports during the 1920s. In monetary terms, there is success on the part of the United Kingdom. This is an objective sought by a certain part of the British is especially by financiers.

A new monetary and financial regime

With these two cases appear important difficulties in the restoration of the gold standard, but from the middle of the 1920s, there is a new international gold standard which is set up. However, it is not the same gold standard as before. If we look at the world price level in 1920 and 1922, the world price level is much higher than in 1915. The old gold standard question arises: there is always the risk that the amount of gold contained in reserve is too low to sustain the level of economic activity.

At the Genoa Conference in 1922 the gold exchange standard was proposed. Central and national governments are seeking to increase the base of the international currency. Central banks develop their ability to generate money not only on gold, but also on certain currencies that are themselves convertible into gold. There is an effort to extend the possibilities in terms of the reserve that can be held. With the expansion of reserves that are usable as a monetary base, this means that the gold stock itself does not limit the money supply in the same way as before the First World War. The advantage of such a system is that it has enlarged the size of the central bank reserve, but this requires confidence in the value of money. As the 1920s unfolded, there was a decline in confidence. There are advantages to this system, but also great vulnerability.

If we can talk about a new monetary regime in the 1920s, we can also talk about the emergence of new financial regimes. It should be noted that neutral countries such as the Netherlands and Switzerland increased their success as financial centres during the First World War. Note the importance of the rise of the United States as an international financier. This trend was already evident during the war, but following the war, this trend was reinforced by the American public's enthusiasm for foreign currencies.

Capital exports to the United States are headed for Europe. The Germans attract a lot of capital from the United States. Canada and Latin America are also affected. For Latin America, there is an increase in the importance of the United States and therefore a growing dependence on the part of Latin American companies and governments.

The question that arose in the 1920s was where the Europeans were. France and Great Britain remain present, but especially Great Britain, which continues to lend money. Given the domestic problems Britain is facing, its role is diminishing. However, with the United States, competition is creating a duopoly. But in the 1920s, the United States gained a real superiority. The presence of the United States is making a difference. For the United States, this is the first time that we have seen a high level of foreign investment, creating a strong contrast with Great Britain. There are some experts who find that American investors take too much risk when they invest abroad. There is a strong criticism of the investments that the United States is making in Germany, for example. When we talk about the United States as a major investor, we are not talking about Great Britain.

Even at the peak of investments, these emissions represent a minority of investments, between 17% and 18%. For Great Britain it is 50% of the investments which are intended for the international markets.

As the 1920s unfolded, this dependence became less and less important. A speculative bubble is developing and American investors have fewer and fewer solutions. They can either invest abroad or at home. As the speculative bubble develops, they are attracted by domestic investments. The British are also attracted by investment in the United States. There is beginning to be a change of direction in the destination of capital. This change in the direction of international capital flows contributes to creating a vicious circle that contributes to making the international financial system vulnerable.