Dark history for the world economy: 1930 - 1945

We will seek to understand the Great Depression as a US crisis. It is necessary to understand the essential elements of the US crisis by analysing the sequence of events leading to the crisis. There are still debates about the origins of the US crisis in the late 1920s. The problem of explaining the origins of the Great Depression has not been fully resolved.

Early warning of the crisis

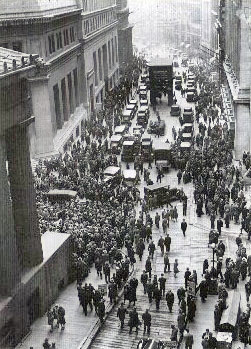

The stock market crash of 1929 was the most famous event of the Great Depression. In fact, there are disaster warnings, structural problems in the U.S. economy that are manifesting themselves. Already in the 1920s, there were structural problems.

Overproduction crisis in the United States

During the 1920s, there was a very marked increase for consumer goods. During the period 100,000 radios are sold per year to increase to 4.5 million. This is concomitant with the spread of electricity in the 1920s. The product that is the very symbol of mass consumption is the automobile. There was a sharp increase in automobile sales during the 1920s.

- Ford, 1924Her habit of measuring time in terms of dollars gives the woman in business keen insight into the true value of a Ford closed car for her personal use.The car enables her to conserve minutes, to expedite her affairs, to widen the scope of her activities. Its low first cost, long life and inexpensive operation and upkeep convince her that it is a sound investment value.And it is such a pleasant car to drive that it transforms the business call which might be an interruption into an enjoyable episode of her busy day.

There is a call for utility notably to sell cars in 1924. In 1928, the message evolved to invoke necessity. In 1930, advertising again evolved, now invoking pleasure. There is a change in advertising. There are increasing efforts on the part of automobile companies to try to sell more cars. There is an abandonment of utility as an argument to focus on pure pleasure. Efforts to sell automobiles that became increasingly aggressive in the 1920s suggested an unsustainable increase for the economy. The possibility of selling cars is supported by a change in sales practice, i.e. a strong use of consumer credit by American households.

During the 1920s, the middle class began to go into debt in order to access consumption. This trend plays an important role in boosting mass consumption. In the second half of the 1920s, the majority of automobiles were purchased on credit. Non-mortgage debt rose from 4.2% in 1919 to 20.5% in 1929. This trend makes the economy vulnerable to a change in consumption patterns on the part of consumers.

Global commodity market crisis

Throughout the 1920s, there was an increasing production of primary products and in particular agricultural products. Prices fell for most agricultural products and primary products, especially from 1925 onwards, and even before for some products. There is continued growth in production despite downward pressure on prices. The question that arises is why production increases despite the fact that prices are low? There is a particularity of agricultural markets that makes it difficult to interpret price trends in the short term. We see that the process of adjusting agricultural production to price changes is often very slow. On the other hand, when we talk about subsistence agriculture, if the prices of their product decrease, producers are often forced to continue selling and increase sales, because for some countries, it is a matter of survival.

Finally, the financial sector has an important role in lending money. In addition, there are issues on New York banks to finance farmers in the United States, but also in other countries. Mortgage debt increased from $3 million in 1910 to $9.5 million in 1925. The increase in mortgage debt reflects the use of debt to support production. Internationally, credit flows from New York to Latin America and elsewhere facilitating their integration into the global market.

For many reasons, there is an increase in agricultural production despite demand that is too low to justify it. The fall in prices makes producers and farmers very vulnerable, especially to bankruptcy with significant consequences. In the United States, agriculture still employs 25% of the working population. The effects of this vulnerability began to manifest themselves in the 1920s, especially for farmers who had a high level of debt with falling prices. Thousands of farmers in the central and midwestern United States are going bankrupt. The banks seize the land, but its value is too low to pay the loans. As a result of the fall in the prices of agricultural products, the price of agricultural land is also falling. This leads to a series of bank failures. Seizing land from bankrupt farmers does not allow banks to survive themselves. We see that the global crisis in primary markets represents a second structural problem contributing to the vulnerabilities of the US economy even before the crash of 1929.

Course of the US crisis

The decline in share price begins on October 3 and throughout the month. The Down Johns lost more than a third of its value and the fall reached 90% of its 1929 value. It's a total collapse of the stock market price. The fall in share value is linked to the scale of the crisis.

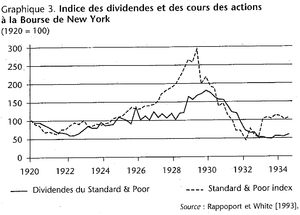

The increase in the crisis began after the crisis of 1920 and 1921. But an increase in stock prices is not in itself a bad thing. There are no scientific rules to identify if there is a bubble or not. What can be seen is that the relationship between financial measures that remain stable until 1927. We look at the indicators of actual performance and we look at the price of this asset to see if the link between the two indicators changes. Until 1927, the two curves increase together, but from 1927 a gap opens up between the dividends and the value that the market has forecast in this respect. It was in 1927 that we began to talk about a speculative bubble.

The rise in prices on the New York Stock Exchange has led to a doubling in value that has nothing to do with the trend of companies. The question is how to explain this trend. It is possible to propose two elements. Many discussions take place with the idea that the economy is based on mass consumption and the new technologies that support it. Having these new technologies makes it possible to break with past trends and move to a whole new economy. It was then possible for specialists at the time to say that this trend is not surprising because these are future returns that are not immediately reflected.

Irving Fisher, great economist said on October 16, 1929 "Stock prices have reached what looks like a permanently high plateau. I do not feel that there will soon, if ever, be a fifty or sixty point break below present levels... I expect to see the stock market a good deal higher than it is today within a few months". He notes that the price level has reached a very sustainable level since we are in a new economy. For Irving, the main reason for the crash is the credit that finances the purchase of securities.

We see that the increase in stock exchange costs is boosted by the increase in credits that support speculators on the New York Stock Exchange and in particular credits granted by brokers. During the 1920s, brokers played a different role by lending money to investors who used the money to buy securities. Brokers are obliged to borrow from banks or other brokers to lend to sp.éculateurs.

This graph is an indirect measure of the size of the credits they in turn lend to speculators. Borrowings began to increase in 1924, but very sharply in 1927 and 1928 during the so-called "speculative" period. This trend is driven by the fact that banks are increasingly attracted to brokers to whom loans are highly profitable.

Les banques sont attirées par les prêts aux courtiers parce que cela est très rentable. Des banques à New York sont de plus en plus intéressées par les prêts aux courtiers. Des banques d’ailleurs des États-Unis, mais aussi des investisseurs étrangers attirés par la possibilité de gagner beaucoup d’argent en prêtant de l’argent aux courtiers qui opèrent sur la bourse de New York. L’argent arrive même de l’étranger.

« A great river of gold began to converge on Wall Street, all of it to help Americans hold common stock on margin »

— John Kenneth Galbraith, The Great Crash 1929, 1954, p. 20

Industrial companies will also lend, but also to foreigners. However, this dynamic cries weakness and fatal vulnerability within the Bank of New York. At term, these securities must make it possible to repay debt, loan interest and brokerage fees. The bet is to sell the securities more expensive than they were bought. However, the broker asks for something in terms of guarantee and in particular the deposit of title which constitutes the "collateral margin" which represents between 25% and 30% of the loan while waiting for the final profit. This has the effect of increasing the value of prices, but this mechanism makes it more likely that prices will fall. The problem is that the value of the margin made up of securities decreases once the stock market price decreases in terms of value. Normally, brokers require additional capital from their clients to cover themselves.

Most speculators already heavily in debt are not able to provide "collateral" and there is no choice but to sell the securities to pay the debts. There is a beginning of price falls, pressure on "collateral", additional pressure on brokers, investors' inability to provide, pay debts and finance stock market price increases. Once a decline begins, we see that the structure is vulnerable to shocks leading to a collapse in stock prices.

In addition to the behaviour of private actors, specialists in the stock market crash of the 1920s noted that the Federal Reserve had its share of responsibility for the bursting of the stock market bubble in New York. The FED is under the leadership of Benjamin Strong. The FED is the central bank with a regional system where there are different banks that play a role together as a central bank. Strong is a convinced internationalist. We cannot necessarily expect such a figure at the head of the FED, because the Americans are focused on the domestic economy. Strong is very interested in the problems of the international economy. Britain restored convertibility to gold in 1925. Thereafter, the British have difficulty convincing international investors that the pound is really worth 4.86 dollars which is parity. In the absence of this confidence, gold tends to flee from London to the United States. There is instability due to a lack of confidence in the pound, highlighting the vulnerability not only of the pound but also of London's financial centre.

In 1927, Strong decided to use U.S. monetary policy to help the British. The idea is to lower the policy rate in the United States to make the United States less attractive to international investors. If it can reduce the policy rate in the US economy, it can make the US financial centre less attractive to investors and reduce pressure on the financial centre in London. Monetary policy mechanisms are not extremely important, but there is a technical mechanism.

Central banks influence monetary conditions by making money more or less abundant. In the short term, monetary policy influences interest rates on the interbank market. The central bank has the ability to influence the interest rate at which it is willing to lend money to U.S. banks. If the target rate is low, the bank is central is ready to expand its money supply, that is, the money supply is large, and when the target rate is high, there are restrictions on the amount of money that U.S. banks are willing to lend. It is by acting on the amount of money available that the United States can influence interest rates. The mechanisms vary over time. Basically, the idea is to influence the money supply in the economy in order to influence the interest rate.

We see that Great Britain is under pressure to lower the interest rate on its economy because Great Britain has a problem with an economy that is too low. These were cycles of recessions during the 1920s because she continued to insist on strong monetary policy. There is a delicate balance for Britain to strike. The fact that Strong is able to do this is a contribution for the British.

Strong lives with this double edge living in a world where there is the international economy, but also the US domestic economy. These actions have consequences for the international economy, but also for the US economy. Strong is criticized by observers who focus on the United States because although his decision to cut interest rates helps the British, specialists find that he is boosting speculation because he is boosting credit. As credit is now cheaper, it is cheaper for speculators to lend to invest in securities. There is a dual reputation for Strong, first as someone who helps the British and concerned about the international situation, and someone highly criticized for cutting interest rates at the very time when there is financial speculation. Strong is going through this dilemma. Strong quickly died in 1929.

Strong's colleagues will find that these actions have stimulated financial speculation. In 1929, the discount rate was raised to make lending to speculators more expensive. This action is holding back certain areas of the domestic economy, particularly the construction sector. As far as financial speculation is concerned, there is no immediate impact.

The rise in the interest rate does not slow speculation, but fuels speculation because it causes the return to New York of American capital so far invested abroad and attracts capital flows from international investors. The EDF's action has an international impact. The EDF faces the reality of living in a world where its actions have consequences for the international economy, but also for the domestic economy.

In 1929, the increasingly unreal conjunction entered a speculative boom. Everyone is aware that there is a speculative bubble that will burst, but nobody knows what to do to try to manage the problem. The FED wants to curb financial speculation, but hesitates to show the discount rate for fear of the reaction of international investors. The FED did not move the interest rate, but in the spring of 1929, the FED asked the banks to reduce loans to brokers. In terms of loans to brokers, by value of origin, New York banks play a considerable role as a source of loans. Other banks are not controlled, but there are also non-financial companies, international investors that are outside the control of the New York Federal Reserve. There is not much the Federal Bank can do by relying on New York banks. The frenzy of speculation is growing even more. On 6 August 1929, the FED decided to increase the discount rate.

The course of events is precipitated by international reactions. There is an inflow of capital, a worrying decline in England's gold reserves. The Bank of England is forced to raise its discount rate to try to keep its currency parity. So we see sudden withdrawals of foreign funds on the New York stock exchanges. Panic begins to develop. Almost as early, in early October, we see the beginning of the fall in New York stock market values. The drop in prices begins on October 3.

Multiple factors appear to explain first the increase in the speculative bubble and then the stock market crash. Factors interact. Even today, economists are still trying to understand the 1929 chain of events. It is an event that strikes the memories of Americans but the question is how the stock market crash causes a general crisis.

There are immediate problems with the repayment of broker loans. Mechanisms lead directly to the transmission of the stock market crash to the economic system. This creates problems for bank lenders, but also for other lenders. These problems are creating a decrease in bank lending and a decrease in the share of businesses and households that depend on these banks for borrowing. A drop in production has already begun. One can even identify a drop in production that begins before the crash and becomes even faster following the crash reflecting a combination of lending mechanism granted by banks and then a decrease for companies to invest. There is also a lack of confidence on the part of the American population. The stock market crash is a shock role. There is a fall in demand which weighs on industrial production and the production of services. If we look at the sectors most affected, it is the new industries that produce durable consumer goods that are experiencing the biggest drop. For automobiles, there is between 50% and 70% reduction. This makes the industry vulnerable, as households no longer wish to go into debt with uncertainty about the future. The fact that the economy depends on consumer credit making this sector vulnerable.

There are also major problems within the agricultural sector. Thousands of farmers go bankrupt before the stock market crash. Once again, at the same time as the stock market crash, we see that this problem is increasing with a wave of bankruptcies and the seizure of agricultural land by banks, but which do not have enough value to repay bank loans. There is a chain reaction with problems in the agricultural sector transmitted to the banking sector since banks cannot repay their own loans. For many reasons, we see a series of waves of bank suspensions in the United States.

A banking crisis is taking hold in the United States due to the stock market, the vulnerability of the agricultural sector and the vulnerability of consumption linked to credit dependence. It is a series of bank failures that turn a stock market crash into a general economic depression.

« The disappearance of banks means a decline in credit, which makes it difficult for companies to finance both their working capital and their investments, thus increasing the fall in prices[to obtain liquidity at any price], redundancies[to avoid paying wages], a fall in production and purchasing power, and thus a worsening of the crisis. »

— Pierre-Cyrille Hautcoeur, La crise de 1929, 2009, p. 44

There is no doubt that the crisis that began in 1929 did not turn into a Great Depression because of the banking crisis that began in 1930. The important question is how do we see the US crisis being transmitted internationally? It's not just a US crisis.

On voit une augmentation du chômage aux États-Unis qui est spectaculaire. Le désastre économique touche tous les aspects de la société étasunienne. Lorsqu’on lit la littérature étasunienne, le désastre économie semble n’être qu’aux États-Unis.

Premiers contrecoups internationaux

Les États-Unis sont loin d’être le seul pays touché par cette grande crise. En Allemagne, ou encore, la Grande-Bretagne atteignent des taux de chômage qui oscillent autour de 20%. Même en Australie et au Canada le taux de chômage est important.

Les contrecoups des perturbations économiques aux États-Unis sont déjà évidents en 1928 et en 1929. Les États-Unis sont devenus le premier financier du monde.

On voit une réduction des exportations de capitaux américains. Suite au boom spéculatif aux États-Unis, les opportunités afin de tirer des profits sont de plus en plus importantes aux États-Unis. Les investisseurs vont privilégier les opportunités d’investissement sur le territoire national. Avec les changements de politique de la FED et surtout les efforts de la FED de freiner le boom par le biais du taux d’escompte, les États-Unis deviennent plus intéressants pour les investisseurs étrangers, mais américains aussi. En 1928, les prêts américains à l’étranger tendent presque à zéro à cause de l’augmentation du taux d’intérêt aux États-Unis.

L’impact international de la diminution est très important parce que la réduction des exportations de capitaux pénalise les pays débiteurs afin de financer leur déficit courant. Des pays ont un déficit sur la balance des paiements courants étant particulièrement vulnérable à un changement de direction des flux de capitaux. Ce sont les pays producteurs de matières premières notamment de l’Amérique latine et de l’Australie qui dépendent de capitaux externes. Ces pays sont déjà dans des situations difficiles faisant face à un déclin du prix des matières premières. L’arrêt soudain des prêts des États-Unis rend cette situation plus difficile. L’Australie et le Canada font face à des crises de la balance des paiements dès 1929. C’est une situation critique les obligeants à déprécier leur monnaie en 1929 et 1930 en quittant l’étalon-or presque sans hésitation.

L’économie allemande a une vulnérabilité extrêmement faisant face à une balance des transactions déficitaires. Il y a des problèmes à l’intérieur dès 1927 couplés aux fardeaux de la dette de guerre faisant que la dette souffre de la pénurie de capitaux américains. La pénurie de capitaux étrangers conduit à une réduction du crédit intérieur aggravant des difficultés déjà existantes en termes d’investissements.

La banque centrale allemande cherche à attirer des capitaux et on voit que la banque centrale essaie de faire augmenter le taux d’escompte afin de soutenir la valeur du mark pesant sur l’activité économique dans l’économie intérieure. La Grande-Bretagne essaie de soutenir la livre avec pour effet des conséquences déflationnistes sur l’économie intérieure britannique. Ces trois cas sont des pays particulièrement vulnérables déjà avant octobre 1929.

Pourtant, on ne peut parler de véritable crise mondiale avant octobre 1929, car pour certain pays comme pour la France, il y a même une tendance à l’expansion avant le krach boursier et l’investissent se poursuit en France au début 1930.