The economy: a global New Deal?

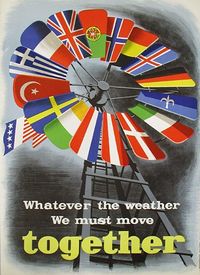

Affiche utilisée pendant la campagne présidentielle américaine de William McKinley en 1896-1897.

| Faculté | Lettres |

|---|---|

| Département | Département d’histoire générale |

| Professeur(s) | Ludovic Tournès[1][2][3] |

| Cours | The United States and the World |

Lectures

- Introduction to the course The United States and the World

- The conquest of the territory

- From Exceptionalism to American Universalism

- Foreign policy actors

- Empire of Freedom or Imperial Republic (1890 - 1939)?

- The economy: a global New Deal?

- The pursuit of a world order

- Democracy as a justification for US interventions abroad

- The Americanization of the World: Myth or Reality?

The economic issue is important. The economic dimension is an absolutely fundamental element of American foreign policy and the American mode of expansion from the end of the 19th century to the present day. The economic question is connected to the issue of foreign policy and democracy because in American foreign policy there is an intimate link between the economic dimension and in particular economic development and prosperity, the stability of society and then the political regime. Economic development leads to social stability and, finally, the development of democracy. Finally, that promoting political regimes and a mode of economic development is a recurrent feature of American foreign policy. In American messianism, there is the dimension of spreading democracy, but also in an inseparably linked way, of taking charge of social prosperity, that is to say, of taking pledge of world economic development.

The American project is based on a common thread that will be structuring in the American foreign policy which is to promote an open global market. It is a guiding idea that has been present from the end of the 19th century to the present day. Promoting the opening of the global market is an important aspect of American foreign policy.

Finally, it is necessary to question the means of carrying out this project, which can be found in the economic field even more so than in the political field, which is a synergy between public and private actors. This is done in a synergy between American entrepreneurs and the American state, which intervenes continuously and permanently. It is deceptive liberalism because since the end of the 19th century American expansionism has been supported by the state.

From the American to the world market[modifier | modifier le wikicode]

Industrial dynamism[modifier | modifier le wikicode]

The industrial power of the United States is rife with the general idea that the American Industrial Revolution, that American economic growth was extremely rapid from the end of the 19th century onwards, taking the United States from being a new country to being the world's leading economic power. This extremely rapid growth is based on a number of things that are factors:

- Natural resources will support industrialization, enrichment and American growth.

- The "internal market": the United States is a country of migration and, in a few decades, it has grown from 4 million to several hundred million people, making the American market an important market and supporting mass production that will lead to the rapid development of an important industrial power.

- "Use of technology": In the American space, the workforce is not large enough. This is why we have opted for a technological development leading to mass production with less manpower.

- Development of marketing methods: they will first develop on a US scale and then on an international scale.

- Development of a transport network: this will very quickly unify the American market. Quite quickly, through the establishment of a inland waterway transport network, but also and above all by rail, this makes it possible to unify the internal market and speed up the movement of products. From the years 1860 - 1870, a network of ports developed and rapidly internationalized.

Within the framework of industrial dynamism, the economy is relatively quickly supported and functions on an industrial scale. From the 1860s-1870s onwards, the economy was extremely concentrated with the establishment of industrial powers regrouping a number of sectors with fairly rapid monopoly and oligopoly situations. The sectors most concerned are the heavy and extractive industries such as oil, but also the processing industries such as the steel industry with industrial groups which in the 1880s were practically monopolies. The Standard Oil Company which is Rockefeller's company strangles all competitors and holds in the 1880s between 80% and 90% of the market. The context is almost similar to Carnegie's US Steel-dominated steel market. This also extends to the market that will become the services market, notably with the bank and JP Morgan. On the cultural industries side, the same type of configuration can be observed with the development and affirmation of the great American majors who will dominate the American cinema market and, from the post-war period, the world cinema market.

This economy, which is concentrated in the hands of a number of large groups, is going to make these large groups operate on a U.S. scale and without any disruption on a global scale. For these groups, the transition from the American market to the world market was quick and quite natural, since groups were in a situation from the 1890s and 1900s onwards where the American market was no longer able to absorb their production. There is a need for foreign markets to sell production. Pretty soon these companies will create subsidiaries abroad all over the world. The process of expansion of American companies and already a reality in the 1890s and from 1900 to 1914; FDI was multiplied by 4 making the process of industrialization extremely important. In the context of the time, setting up a subsidiary abroad had an important interest in circumventing the customs duty.

There is a takeover of local economies, especially in countries that are in a much less developed state than the United States, such as South America, where entire sections of the local economy are taken over by American companies. Grace and company deals primarily with the guano market in Peru and will extend its control to other sectors of the economy, which, once these sectors are controlled, will control the entire economy.

The United Fruit Company was originally a contract to create a railway line in Costa Rica. As the railway was built, the company planted banana trees along the line to feed its employees and turned it into an element of culture and commerce. Upon completion of the construction of the line, the company has a concession on the railway company, but also takes control of the farmland around and finally the ports. Costa Rica's economy falls into the hands of the United fruit. We'll give him the nickname, "octopus’.

This process began at the end of the 19th century and continued after the First World War, with an increasing number of sectors in which the United States and American companies extended their influence, such as the oil market in the Middle East. Until the early 20th century, the Middle East was a "guarded hunt" for Britain, but to a lesser extent for France. In the Sykes-Picot agreement between France and Great Britain shared the Middle East after the war except that the United States came into play with American companies and in particular Standard Oil. What was originally a Franco-English agreement becomes a Franco-Anglo-American agreement. This will lead to the creation of the Iraq Petroleum Company in Iraq and the Anglo-Persian company in Iran. The conglomerate, which was formerly Franco-British, became a 50% English, 25% French and 25% American conglomerate. The American ambition is to drive the British out of the Middle East oil mining market.

This process is also taking place in the field of communications, particularly for submarine cables, which was originally an English monopoly. From the beginning of the 20th century, American companies were going to compete and share the market with English companies, making the monopoly on submarine transmissions Anglo-American. In the transmission market, an English company named Marconi had a monopoly until a US company called Radio Corporation of America[RCA] came in to compete. In communication, there is a change of context.

In the field of cinema, the turning point of the 1910s and 1920s was fundamental. Before 1914, the dominant and French industry and after the war the dominant industry became American, displacing Pathé from the world market. The American cinema conglomerate became an oligopoly inside, but above all outside, with the creation in 1922 of the Motion Picture Producers and Distributors of America[MPPDA] with American companies competing within the American market, but outside, acting as a conglomerate and oligopoly.

Aviation is a completely new industry in the 1920s, but it is a potentially important market. France and the United States compete with each other, particularly as regards the transport of mail. The French airmail sector competes with Pan-American Airways, particularly in the South American market where the challenge is to open up mail lines.

Manifest destiny and economic conquest of the world[modifier | modifier le wikicode]

Economic expansion, economic conquest of the world, manifest destiny and American messianism go hand in hand. The mechanism and process were established in the last decade of the 19th century.

At the beginning of the twentieth century, the debate on the conquest of the American colonial empire was mixed, because it was not such a good deal from an economic point of view, but above all a conquest that cost a lot of money and was difficult. Finally, formal colonization of a territory is an expensive way to establish domination. The relationship between cost and benefit is not so obvious. There is the idea that colonization is not necessarily a good deal and that perhaps we should find another way to develop our economic power in the world.

A whole discourse developed at the end of the 19th century among industrialists, entrepreneurs, politicians, and publicists, which is the idea that there is an American market that can no longer absorb the production of companies and that it is necessary to look for foreign markets in order to absorb the surplus and to ensure the expansion of American production. Lobbyists will be set up with the National Association of Manufacturers and the American Asiatic Association, industrialists who lobby Congress for support from the U.S. Congress in their endeavours. The idea that the United States would find an original way to expand the American economy without going through formal colonization. Economic expansion becomes a modality of American expansionism, American imperialism and American moral imperialism.

In the discourse of industrialists and politicians as well as journalists, there is the idea that mass production is democratic in essence, because producing a lot with lower prices allows the greatest number of people to access material and participation in the market and a fundamental element of American democracy. The mass market at the time was still an American specificity. The development of a mass market with low prices is still largely an American specificity. There is the idea that the mass market is inherently democratic because it allows more people to consume.

From the moment that more people can access the mass market, there is the idea that well-being is more important and therefore people are less inclined to claim social stability. The mass market is the American response to class struggle. When we look at the discourse of the time, the idea of the development of the mass market makes it possible to solve the problem of Marx and Malthus in the idea of the industrialists and politicians of the time. Malthus was obsessed with scarcity of resources. As long as one has access to a mass society, the scarcity of resources is resolved. As far as Marx is concerned, access to resources answers the problem of access to wealth and thus the question of class struggle. The American economic development being based on the development of the company, it bases its idea on the development of individual value being integrated into American moral imperialism. What is important is the link between the idea of American imperialism and political development.

"The promotional State" [Emily Rosenberg][modifier | modifier le wikicode]

There is going to be a synergy between the American state and entrepreneurs what the American historian Emily Rosenberg has called "promotional State". This is the idea that expansion is achieved through strong synergy with public and private actors.

From the end of the 20th century, through lobbyists, American entrepreneurs were at the same time fierce defenders of the freedom of enterprise and did everything possible to ensure that the American state did not "put its eye" on business. At the same time, these entrepreneurs called on the American state to help them open up foreign markets and lower tariffs. A synergy developed between the two between the years 1910 and 1920, becoming more important between the two World Wars.

From the beginning of the 1890s, the U.S. government began to open up a number of markets. In 1890, the United States was a major industrial power, but not yet a major trading power. Using the McKinley Tariff Act, the U.S. is implementing a tariff policy to obtain lower tariffs from countries in exchange for lower U.S. state tariffs. The introduction of tariffs goes hand in hand with an extension of the executive branch's prerogatives. Historically, the fixing of customs tariffs and a prerogative of the Congress which, as it expands, will give up the prerogative of fixing customs tariffs to the federal administration which will make it one of the levers of its power. U.S. trade policy and parallel to the rise of the executive at the expense of Congress.

The "promotional state" is also characterized by the creation of customs unions. The American policy in the 1890s was both the promotion of Open Door Policy but they would concentrate on the customs union with a few countries to notably exclude European competitors from the market. From the time the United States conquered its first colonial empire, it would sign treaties with the United States to have privileged relations with Cuba, Puerto Rico and the Philippines in 1902. In 1911, a customs union with Canada was attempted, but this failed. Customs unions are part of the U.S. government's strategy to expand the U.S. economy.

When we look at the development history of the federal administration, we see that the federal government is increasingly dealing with the economy with the creation of organizations such as the Bureau of Foreign Trade at the State Department in 1879, which was involved before the treaties were signed, but this office means that the State Department is dealing with the economy, meaning that the economy becomes an integral part of American foreign policy. There is also the creation of the Department of Commerce and Labor in 1903 and the Office of Trade Advisors linked to the State Department in 1912.

During the war, the War Trade Board was created to organize and coordinate trade with the Allies, marking a trade prerogative of the American executive. The period from 1920 to 1929 under Republican presidency is the period when Hoover was secretary of commerce helping some companies to conquer foreign markets. There is strong U.S. state assistance to these companies that will translate into direct discussions between the U.S. government and foreign governments using the argument of Allied debt to open up foreign markets. Until the 1920s, the American state became an adjutant to American expansionism.

Birth and affirmation of economic diplomacy[modifier | modifier le wikicode]

Dollar Diplomacy[modifier | modifier le wikicode]

The Dollar diplomacy is an important chapter in American politics during the first half of the 20th century. This involves lending to a number of countries that are considered politically undeveloped and particularly unstable because they are economically undeveloped in exchange for significant control over the organisation and supervision of these national economies. American experts are seen as economists travel particularly to Central and South America to advise local governments in their economies. Dollar diplomacy is the economic side of nation-building.

The Dollar diplomacy extends from the late 1890s to the crisis of 1929, the period that saw the constitution of the American colonial empire until the Wall Street crash. With the diplomacy of the dollar, we are at the heart of the specificity of the American domination process. The diplomacy of the dollar led to the signing of agreements with the countries in question and thus to the establishment of a contract diplomacy. Countries are in trouble, the United States is offering assistance in exchange for supervision of the economy. There is a takeover of the local economy not by gunboat politics, but by contract diplomacy. However, contract diplomacy is not necessarily voluntary. This diplomacy is a way of controlling the economies of countries without controlling them from a territorial point of view. This is a special feature of the American expansion method.

The diplomacy of the dollar is linked to a global conception of American expansion because, on the one hand, there is an economic diplomacy that aims to take control, but goes hand in hand with a messianist and expansionist discourse. The agreements between the United States and the countries in question are the idea that domination is based on a contract or the appearance of consent between the dominant and the dominated. The contract as it is established between the United States and the countries in question legitimizes domination other than by the gunboat. The advantage over gunboat diplomacy is that contract diplomacy legitimizes domination. In exchange, from a control of the economy, loans are granted by American banks. We see how the idea of basing an international order not on military force, but on the contract with the international idea of basing world domination on democracy is a specificity of the American domination mode. Between the diplomacy of the dollar and the idea of a contract, is said to be the specificity of American foreign policy and American domination. As soon as this country achieves an international status that allows it to do so, the diplomacy of the dollar opens this process.

When we look at the diplomacy of the dollar, a whole series of actors are involved in the process. There is the U.S. government, but there are also the U.S. banks that provide loans, as well as the American experts who will come to different countries to take control of certain key areas such as customs. By the end of the 19th century, there had been a synergy between the American government and a number of private players, particularly banks.

The diplomacy of the dollar aims to create a whole series of structures in the countries in question which are structures that make them "Americano compatible". In addition to bringing money to the U.S., the diplomacy of the dollar is about taking control of the customs administration to take over most of the economy. It is usually indebted countries that transfer control of the U.S. customs administration back to the United States, taking part of the revenues in the process. On the other hand, a number of structures are created such as central banks, which are created with the monopoly on the issuance of currencies. The control of the customs administration is accompanied by the introduction of the Gold standard in these countries leading to it entering the American zone of influence. As we can see from the end of the 19th century onwards, dollar diplomacy aims to create a dollar zone aimed at creating a preferential market between these countries and the United States in order to compete with the sterling zone on which Britain operates. Dollar diplomacy also aims to create preferential markets, but is not accompanied by territorial domination such as European imperialism.

Dollar diplomacy occurs in countries where the United States has established its colonial empire, such as Puerto Rico, Guam and the Philippines, but this is also evident in a number of countries in Central America close to the United States. The first is the Dominican Republic or from 1904 onwards and until 1907 a fiscal protectorate was established. The process is that there are countries that are extremely indebted, particularly to the European powers. The Dominican Republic is in a state of financial highway banks turning to the United States because there is a possibility of intervention by Europeans. Finally, the setting up of this fiscal protectorate is linked to a situation of strong dependence on European countries, and then it allows the United States to bring out the countries where the dollar is established diplomacy from the influence of European powers. An agreement is signed between the Dominican Republic and the U.S. state whereby American banks grant loans in exchange for the Dominican Republic's customs control. As long as there is control by the customs department, there is an essential control of the country's economy. The experts in question are employed by the US government under Dominican contract. Moreover, loans granted to the Dominican government in exchange for supervision of the economy are granted by private banks. In some cases, private banks may refuse to lend to show that the US government does not necessarily have control over the banks. For the Dominican Republic, this works and there is a process in which the United States is the master of the economy.

In China between 1909 and 1913 and in Africa in Liberia in 1911, there is the same type of attempt. In China, the stakes are high because the Chinese market is considered important for the United States. The United States will try to establish itself in China.

Open door policy[modifier | modifier le wikicode]

The American foreign policy at the economic level at this time is expressed by the attempt to create small protected areas which are a regionalist logic and at the same time there is a broader logic of trying to completely open up international trade in order to create a large dollar zone. The politics of dollar diplomacy and open door politics go hand in hand. Two logic of economic policy can be pursued simultaneously.

With the open door policy, there is the idea of completely opening up the world market and setting up the free-trade promoted from Great Britain since the 19th century, but limited to the British Empire. The idea of the open door is liberalization on a global scale. The open-door policy is a policy that is in direct opposition to the policy of creating protected markets as put in place by the world powers. The idea is to break the logic of closing colonial markets and operate differently.

The justification for this discourse is that the logic of colonial imperialism is a logic of war, whereas the open door policy is a logic of peace through the development of trade.

The logic of the open door will materialize in 1899 and 1900 with two notes by John Hay who will send diplomatic notes to the great powers concerning the Chinese market. The Chinese market at the end of the 19th century was a dream come true for all major powers, especially the United States, given the large population in China. This market is in fact a false promise and is virtual until the 1980s. The Chinese market is in line with the American industrialists in the 1880s. A whole series of lobby groups like the American Asiatic Association is pushing the American government to open up the Chinese market to American companies. At that time, the Chinese market was divided between the European powers, but the United States was not invited. John Hay's notes will be about opening up the Chinese market. It will send Western chanceries that Chinese ports must be opened without discrimination and in particular to the American economy. The broader idea is to open up the world market. Hay's ratings concern the eventual opening of the world market. It is a position against the logic of the colonial market in the hands of a few major powers. These are notes that are welcomed in Western chanceries without an immediate effect since the United States is not able to impose the logic of the open door since the United States represents a large industrial power, but is perceived militarily as rather weak even if the United States is invited to exploit the Chinese market.

The open door policy was gradually introduced in the 1890s and 1900s. With the Wilson presidency, dollar diplomacy and open-door policy will develop, systematizing that the world must be a single, large open market with as few protective tariffs as possible. The two discourses between the creation of protected areas, on the one hand, and a completely open market are developing at the same time. The logic of systematizing the open door is present in the Fourteen Points of the January 1918 speech.[4] This is considered to be one of the fundamental issues to be put in place after the first world conflict. We see how the notion of an open door from Wilson is at the heart of U.S. foreign policy and at the heart of the relationship the United States is building with the rest of the world.

Developments between the two World Wars[modifier | modifier le wikicode]

There is a strong rupture between before 1914 and after 1914. A series of principles emerged in the 1890s and 1900s, but the United States' weight in world trade is relatively small. It is an industrial power, but not yet a commercial power. Things changed completely with the First World War. Regarding the role of the United States in the international landscape, the United States' point of view changes with a change in the fundamental balance of power, since the United States lent a lot of money to the Triple Agreement powers that ended up in 1918 with half of the world's gold stocks. After the first world conflict, the United States is now in a position of creditors vis-à-vis the European countries. After 1918, the policy of the diplomacy of the dollar will continue and develop gradually approaching the Open door policy. In the aftermath of the First World War, a whole series of themes were to continue until the Second World War and in the 1960s and 1970s with the idea of development. There is the idea of global economic development because American industries are already operating on a global scale. In the industrial sector, the transition from the American level to the global level is without solutions.

There is too much gold in the United States, which means that countries do not have enough money to buy products from the Americans. The liquidity problem means that the United States will have to lend money to the Europeans to buy their products. The lending policy will continue in Latin America, but also in European countries, although the policy of lending to European countries is not considered as a diplomacy dollar. The lending policy is accompanied by a policy of appointing financial experts and attempting reforms in a number of countries. In a way, the diplomacy of the dollar is the forerunner to the structural adjustment policy that will be implemented in the 1980s and 1990s. The logic is quite similar.

The lending policy is implemented by the banks, but the U.S. government gives its opinion and tries to coordinate the lending policy. In particular, the State Department has a policy to follow:

- loans are prohibited for weapons purchases;

- loans are forbidden in politically unstable countries;

- loans are limited to countries that do not threaten American interests.

There is a change in the diplomacy of the dollar. Peru and Colombia are concerned by this policy, China also without more success than in 1909 and 1913, but also Europe. The economic and financial reconstruction of a whole series of countries is generally not concerned by the term dollar diplomacy, but the logic is more or less the same because in some countries such as Eastern Europe, Czechoslovakia and Hungary a series of humanitarian aid are given as the first steps in loans for reconstruction. We can see how American networks are formed in these countries between the American Red Cross, the administration and private banks. This is also the case in countries whose financial situation was absolutely catastrophic in the aftermath of the First World War, particularly in Austria and Hungary, which had to completely rethink their entire banking and financial structure and were in a state of full-road banking at the beginning of the 1920s when they found themselves under infusion from the League of Nations and the United States. These cases show how private actors such as banks, Carnegie, the American State and the League of Nations are intervening, in particular through the Dawes and Young plans, in line with this logic, being elaborated by American experts whose main donors are American banks.

In Persia, a series of attempts do not go very far, but potentially, this dollar diplomacy concerns much larger geographical areas than before the First World War and particularly Europe, which before 1914 did not need the United States and which after the war finds itself in a situation of financial dependence.

The economic and financial assistance mission can be found in Peru, Colombia, Ecuador and Persia. Private banks are not at the orders of the American government and refuse to insure a certain number of loans, particularly in Peru and Persia. On the other hand, American experts, when they are engaged in tax administrations, do not necessarily succeed in imposing their point of view and in general, they promote measures that are not popular because of strong financial cuts. From the moment there is an unpopularity, there are riots against governments and, by extension, against the United States. The diplomacy of the dollar has uncertain impacts on the United States, and although it translates into American expansionism, it does not necessarily translate into a takeover of the countries concerned. The 1929 krak drastically reduces the financial resources of the American economies.

Dollar diplomacy and US economic diplomacy until the inter-war period were contradicted by the contradiction that both the United States granted a number of international loans so that countries could buy products and sell them to them, but this policy of loans before leaving with a policy of high protectionist tariffs with extremely high tariffs put in place such as the Tariff Fordney-McCumber in 1922 and the Tariff Fordney-McCumber in 1922. This contradiction was not resolved until Roosevelt's arrival in the 1930s, which led to a policy of lowering tariffs in order to turn the American economy around. It was not until 1930, with the signing of the Reciprocal Trade Agreement Act in 1934, that the United States converted to a kind of generalized free trade. The diplomacy of the dollar in the interwar period continues to develop, but within a relatively protectionist framework, but it is the crisis that causes it to break out relatively. The process of post-1945 international reorganization on a multilateral and liberal basis actually began in the aftermath of the crisis and with the start of the New Deal in 1931 and 1934.

The Second World War[modifier | modifier le wikicode]

The period from 1939 to 1971 is the continuation is the accentuation of the use of the economy as a means by the United States to mark its power. The Second World War is an important turning point because from the Second World War onwards it will accelerate considerably. The United States will have an unprecedented presence in the global economy and its reorganization, because after 1945 the international economic system is largely reconfigured to the American initiative. Not only is the United States extremely present in the global economy, but in many ways the post-1945 world economic system was conceived as an extension and projection of the American economic model. Until the late 1960s, the central place of the United States in the world economy was undisputed.

Economic warfare[modifier | modifier le wikicode]

The economic dimension of the Second World War and the Second World War is also, in a sense, first and foremost, an economic war. It is an economic war, particularly from the American point of view, since the United States even before entering the war militarily enters the war economically by producing for the European powers. There is an American economic mobilization before there is even a military mobilization. The United States' entry into economic mobilization was the last step out of the Great Depression. The various stages of the New Deal failed to get the United States out of the Great Depression.

From 1940 onwards, the United States became the arsenal of democracies producing 300,000 aircraft, 100 aircraft carriers, 2,600 cruisers, 900 oil tankers and 3,500 cargo ships. It is an American industry that is 100% mobilized for war production. The economic dimension is extremely important and all the more important since the hinge of the war is 1942 from a military point of view, but also from an economic point of view, since the moment of tipping point is the military victories, but also because the Allies and the United States produce more material than the Axis powers are capable of destroying. It's an economic machine versus an economic machine. There is also the technological dimension, since wars are always moments of great technological progress with a whole series of innovations such as radar and atomic bombs. This is a huge boost to the American economic machine.

With the Loans and Leases Act, at the very beginning of the war, most of American production was bought by the French and especially the English. Finally, the European powers spend a lot of money to buy war material. As of December 1940, England was in arrears and in bank state as a financial route bank by being able to purchase equipment in the United States. The Loans and Leases Act was passed by the United States by replacing the Cash and Carry Act with the idea that the United States would provide equipment to England on reverse that these deliveries would be paid for when England had the means to do so. It is a decisive moment in the entry of the United States into a logic of war. It is a logic of lending equipment to a country considered as an ally without knowing when the payments will come.

The war is an excellent bargain for the U.S. economy since GDP doubled between 1939 and 1945. The trade surplus is positive, and there is the debt that represents a potential trade surplus. At the end of the First World War the United States found itself with half of the international gold stock, in 1945 it was almost 2/3 of the gold stocks. In 1919 the Americans had contributed to the victory against the central empires, but the military imbalance was not flagrant when in 1945 the United States held 2/3 of the world fleet. The British navy has been completely outdone. It also accounts for half of the commercial fleet as many warships and cargo ships were produced to transport equipment, including the famous liberty ships.

The United Nations Relief and Rehabilitation Administration [UNRRA] - The Ancestor of the Marshall Plan[modifier | modifier le wikicode]

An episode is too rarely discussed, but the most important one is the UNRRA episode, which is the prototype of the United Nations, the test bed for the organization of the international system that brings together the major countries that will be part of the United Nations. Not only is it the prototype of the UN and the multilateral system, but it is also the ancestor of the Marshall Plan and the entire development aid system. UNRRA was created at the end of 1943 and ceased to operate in 1946. It groups together almost all the warring countries against the Axis, but is mainly financed and led by the United States, but the other powers are represented.

Between 1943 - 1946 and 1947, UNRRA set up a whole series of actions which would become development aid and in particular, it would combine emergency aid and reconstruction aid in the longer term. There are emergency actions such as treating the wounded and distributing equipment, there is also everything related to longer-term reconstruction such as restoring countries like France from the point of view of infrastructure, but also from the point of view of the industrial fabric, it is also necessary to put the fields back in value to feed the populations with the supply of agricultural equipment, but also transport. There is all the logistics involved. This is where the combination of "relief" and "rehabilitation" is important because the logic of UNRRA, which will then be the same logic of development aid and not to provide aid to the populations, but to provide food for themselves. The objective is to allow the economy to recover. UNRR will try much more to provide industries rather than redistribute them. The logic is to combine humanitarian aid and the economic recovery dimension in order to avoid having economies under infusion. We need to restart trade between European countries, but also between European countries and the United States. We find the logic of the United States, which aims to revive the global economic machine, particularly because the United States has an interest in it.

The Bretton Woods system: a global New Deal?[modifier | modifier le wikicode]

The Bretton Woods system is important in understanding the concept of American economic diplomacy. The Bretton Woods system is designed as a vehicle for the international diffusion of the American New Deal. This export project is taking place at the same time as the New Deal lost its share in the United States itself.

The Bretton Woods system doesn't just happen. The Bretton Woods Conference is the fruit of circumstances, but also the fruit of a longer-term process since there will be the application of a number of work projects of the American administration. The Bretton Woods system is a system based on the liberalization of world trade which is the logical outcome of the Open Door policy advocated by the United States since the end of the 18th century. It's a logic of implementation and foreign policy since the moment the United States arrived on the international stage. It's quite a "long term" aspect.

The Bretton Woods system is also designed to respond to the state of the economy as it has been since the early 1930s when the global economic system collapsed with banks' road banks and the protectionism that contributes to the contraction of trade. The economic depression was one of the breeding grounds for totalitarianism and war. In order to rebuild the international system and prevent the emergence of totalitarianism, we need to have a functioning international economic system. This is the "medium-term" dimension.

In the "short term", the Bretton Woods system is the result of the new balance of power that has been established since 1939 and 1941 with an English power that is no longer capable of managing the world economy as it has been since World War I. The Bretton Woods system has been in existence since then. Between 1939 and 1945, the economic balance of power changed completely. The two dominant characters at the Bretton Woods Conference are White and Keynes. The Americans will impose the liberalization of international trade. It is an economic conference, but it has political resonance. The dollar is becoming an international currency of reference, meaning that the dollar zone potentially extends worldwide. From the Cold War onwards, it will be excluded from the Soviet zone operating on the rouble. The pound sterling will lose its status as an international reference currency.

The IMF and IBRD are two pillars of the US project of combining the reconstruction and market economy dimensions. With the IMF, it is a matter of stabilizing exchange rates to allow trade and the World Bank must lend money to countries that are rebuilding in order to revive the economic machine. The aim is to revive local economies by providing the savings. These are two Washington-based organizations suggesting that they are in the orbit of Washington rather than the United Nations in New York. This project operates according to the logic of liberalization of international trade and which ensures colonial markets. The Bretton Woods agreements and the reorganization of the world economy are based on the idea that colonial markets are no longer set-aside markets. From the outset, Bretton Woods has been working on the idea that there should no longer be reserved areas.

The principles set out in Bretton Woods are principles of the American New Deal, which themselves are a translation of Keynesianism in the United States before Keynes' theories were formalized. The common thread of the international economic reorganization promoted at Bretton Woods and the institutions that are linked are to reorganize the world economy according to the market economy with an intervention of economic power that moderates the economy without too much intervention. It is a renewed liberalism with state intervention, but not collectivist either. It is the intervention of international management institutions of the international economy. The designers of the Bretton Woods system are all designers of the New Deal, irrigating the international trade organization project and spreading it worldwide. The logic of this project and this system is to consider that social problems can be solved not only through the redistribution of wealth, but also through production that will feed everyone and ensure an economy of abundance. The idea is that the emerging conception is an expansionist conception of the economy with the idea of producing more that will make it possible to reduce inequalities.

The reorganisation of the international economy is driven by political imperatives. With the end of the war, the revival of the world economy and international trade are fundamentally linked to American economic interests. After 1945, the American economy produced during the war that was to be converted into an economy of peace. In order to reconvert itself into an economy of peace, it must convert its war economy, but also and above all to sell the products it will manufacture. If it does not succeed in getting rid of them, it is the economic depression that is assured quickly. The United States has a vital need to revive the global economy so that countries can buy their crops. This concerns in particular Europe, which represents the main markets of the world economy. Liberalization is vital to the American economy.

Reconstruction and development[modifier | modifier le wikicode]

The Marshall Plan and European integration[modifier | modifier le wikicode]

After UNRRA, one of the fundamental aspects of the reconstruction and development effort is the Marshall Plan. It is not only a logic of national distribution to a certain number of countries, a project intimately linked to the economic recovery of Europe, but also to European integration. There is an economic aspect and a political aspect:

- The political aspect is to ensure and allow the restart of the European economic machine. In 1945 and 1947, the European economic situation was at the edge of the road bank and worse than in 1945. There are a whole series of problems linked to the conversion of the war economy into a peace economy, production problems and a lack of agricultural production. Europe was on the brink of economic asphyxiation in 1947.

- The political aspect is the Marshall Plan, which is clearly in line with the Cold War logic that began at the beginning of 1947. The political dimension is to integrate into the American orbit a maximum number of countries that allow them to rebuild themselves in the American orbit.

In both the Marshall Plan and the economic order in Bretton Woods, we see the impact of the New Deal and the designers of the New Deal. When we look at the principles of the Marshall Plan, we find the principles of the New Deal, which is a liberalism tempered by the intervention of the public authorities and a logic based on a logic of productivity. After 1945, the world economy operated on the idea of productivity and indefinite increases in production. At the time, the issue of resource distribution was completely outside the radar of political and economic leaders. The urgency of the hour is to put the economic machine and production back in place. It is also the baby-boom period with a logic of demographic expansion from 1943 and 1944 posing a number of economic problems such as population food.

Targets are set quite quickly with the idea of rebuilding the European economy. For each sector, a number of countries and at European level the idea is to set targets for increasing production in different areas. The aim of the Marshall Plan is to set objectives individually, but also collectively, for the recovery of the European economy in a planning approach. There is also the desire to try to set up as many negotiations as possible between governments, employers and trade unions with a different logic from that of the Soviet system.

Marshall's plan is not unconditional. There are clearly a number of points and ideas already present in the diplomacy of the dollar that can be found in Latin America at the end of the 19th century and the beginning of the 20th century. There is the principle that American aid is conditional on a number of things. A series of American experts come to control how American money is used and how it is used in the various sectors of this money, to see how budgets are organized.

The precondition is that the Europeans coordinate economic reconstruction in such a way that it is faster and that American aid is used to avoid duplication. Marshal aid is not given individually to each of the European countries, but is given as a block to the European countries that have to distribute it.

The other condition is that Europe must move forward in a liberalised economic area where customs barriers are being lowered more and more. American experts operate with the idea of establishing an international division of labour according to Riccardo's theory of comparative advantage. The project is set up on a European scale, but is part of a global project to liberalise world trade where each country can assert its comparative advantage in the sectors where it performs best.

This led to the creation of the OEEC in 1948. It is the organization that is created to administer the Marshall Plan. It was the first nucleus of coordination of European economic and political policy that was the American condition for applying Marshall aid. The OEEC receives a lump sum and its role is to distribute it among the beneficiaries in proportion to their needs. On the other hand, it must put in place a policy of lowering customs barriers and lowering technical barriers to trade, such as restrictions such as quotas and tariffs. The OEEC is reviewing legislation in all countries to lower tariffs. This is a logical approach before the creation of the common market for tariff reduction, which is a macroeconomic guideline for the direction of European economic policy. The Marshall Plan has an immediate emergency aid rationale and a longer-term rationale for reorganising the European economy and restoring international trade.

Productivity missions[modifier | modifier le wikicode]

Productivity missions are one of the elements of the Marshall Plan, where we find the intimate mix between the economic and political dimensions. In line with the Marshall Plan, it is a major programme designed to allow for major structural changes in the work organisation of European companies. It is an advisory programme designed to change the organisation of a large proportion of European companies, to change the way they produce. A series of American advisers come to the companies, but it is also the sending of engineers and executives from European companies to the United States. Between 1948 and 1955,25,000 engineers and executives were sent to the United States. The idea is to look at how U.S. companies operate in their industry, how the organization, production process, management, etc., works, and how they operate. The idea represented is the professionalization of the production process and in particular the professionalization of the management of the company, i.e. to consider that the management of a company is not innate to the partons, but it is a formation which is acquired.

In the United States, a large proportion of top managers are trained in universities, unlike Europeans. This aims to observe on the ground that it is the management, the organisation of personnel, the question of the circulation of information where European companies are considered as companies that operate in a very vertical way where the authority is possessed by the boss delegating it little and has the monopoly of information in the organisation of the production process. For example, up to subordinate levels of the company, employees have access to a range of statistics, while in Europe such data is restricted to the administrative team. Productivity missions are seen as a process by which European leaders will learn to produce more efficiently, more productively, more and better quality.

Within this framework, European structures were created since the watchword of the late 1940s and 1950s was productivity in order to increase production in order to revive the international economy and trade. The European Productivity Agency [AEP] was created in 1953 and developed during the 1950s, setting up methods to try to increase the productivity of European companies. In 1958 the first European Institute of Business Administration was created, called INSEAD on the American model. It is a Europe-wide school modelled on the Harvard Business School with credits from the Ford Foundation. During the first 6 and 7 years of its operation, it will be financed by large European companies on an harvardian model. This plays a role in the new working methods of European companies.

Liberalisation of international trade[modifier | modifier le wikicode]

The issue of international trade and its reorganisation, particularly on a liberal basis, is the system of organisation as envisaged in Bretton Woods. There are two directions of work in the American strategy from the beginning, and they always are. From an economic strategy point of view, the United States navigates between a regionalist strategy and a globalization strategy. These strategies may seem contradictory, but often theory is often contradicted by practice. There is an intellectual contradiction between the project of regionalism and internationalism, but this is not the case.

At the end of the 19th century, there was the strategy of building up dollar zones regionally and advocating the Open Door on a global scale. In 1944, it is the logic of globalization that prevails, but for a short time, because in Bretton Woods there is the system which considers the world as a dollar zone and the World Trade Organization project which is formalized in 1944 and 1945, but will be definitively formalized at the conference of Havana in 1948. The initial plan was to create an organization that would bring together all the countries of the world into one organization. From 1945 to 1946, the logic of the Cold War was operative and this economic reorganization was called into question. The American project soon became politically impossible with the USSR; on the other hand, the United States did not like it and would be constrained by a framework that they did not like. The multilateral dimension imagined rather ephemerally in 1944 and 1945 was set aside quite rapidly.

Even though the Havana Conference, which was held from October 1947 to March 1948, was due to give birth from the International Trade Organization, the United States signed the GATT with a number of Marshall aid recipients in October 1947. The signing of the GATT makes it possible to withdraw into countries in the American orbit and in particular in Western Europe in a more restricted regionalist approach. We can clearly see how, during the years 1944 and 1947, we are moving from a logic of globalization to a regional logic with 23 countries. The GATT was signed in 1947 to liberalize trade between signatory countries.

At the same time, the International Trade Organization was created, but the American government knew at that time that it would not ratify it. The treaty is signed, but will never be presented by Truman to Congress. Between 1944 and 1947, the process of international reorganization shifted from a global to a more regional approach. The geopolitical rupture of the Cold War plays a very important role in this change of strategy.

Theories of Modernization[modifier | modifier le wikicode]

The issue of international trade and its reorganisation, particularly on a liberal basis, is the organisational system envisaged at Bretton Woods. There have been two directions of work in the American strategy from the beginning, and they still are. From an economic strategy point of view, the United States navigates between a regionalist strategy and a globalization strategy. These strategies may seem contradictory, but theory is often contradicted by practice. There is an intellectual contradiction between the project of regionalism and internationalism, but this is not the case.

At the end of the 19th century, there was a strategy to build dollar zones at the regional level and promote the Open Door on a global scale. In 1944, it was the logic of globalization that prevailed, but for a short period of time, because in Bretton Woods there was the system that considered the world as a dollar zone and the World Trade Organization's project was formalized in 1944 and 1945, but which was finally formalized at the Havana Conference in 1948. The initial plan was to create an organization that would bring together all the countries of the world into one organization. From 1945 to 1946, the logic of the Cold War functioned and this economic reorganization was called into question. The American project quickly became politically impossible with the USSR; on the other hand, the United States did not like it and would be constrained by a framework they did not like. The multilateral dimension imagined rather ephemerally in 1944 and 1945 was set aside quite rapidly.

Even though the Havana Conference, which was held from October 1947 to March 1948, was to be the birthplace of the International Trade Organization, the United States signed the GATT with a number of Marshall aid recipients in October 1947. The signing of the GATT allows withdrawal in the countries of the American orbit and in particular in Western Europe in a more limited regionalist approach. We can clearly see how, in the years 1944 and 1947, we are moving from a logic of globalization to a regional logic with 23 countries. The GATT was signed in 1947 to liberalize trade between signatory countries.

At the same time, the International Trade Organization was created, but the U.S. government knew at the time that it would not ratify it. The treaty is signed, but will never be presented by Truman to Congress. Between 1944 and 1947, the process of international reorganization shifted from a global to a more regional approach. The geopolitical break-up of the Cold War plays a very important role in this change of strategy.

This is produced in a series of institutions that are American universities, foundations and think tanks. One of the best-known authors is Walt Whitman Rostow who published The Stages of Economic Growth in 1960. An anti-communist manifesto. What became a classic economic literature was produced in the context of the Cold War, ideological struggle and a development model for some countries. On the other hand, this book proposes an international development according to a global pattern. Rostow is not only an economist, but has important political relays who became one of the most influential economic advisers to American presidents in the 1960s and 1970s, including Johnson and Kennedy. There is a direct connection between knowledge production and implementation within the framework of a particular policy. Rostow, at the height of his influence during the 1960s, fell sharply in 1970, particularly since the United States withdrew from development assistance, but his legacy is to be found in the structural adjustment policies of the IMF and World Bank in the 1980s, which were partly based on this reading grid. Other modernization theorists include Seymour Lipset, Samuel Huntington and Talcott Parsons. They are key theories in this period, with important relays within the US government and in this way within international institutions, showing the link between the theoretical production of knowledge and its implementation in politics, but which also has broader political implications.

Development Aid[modifier | modifier le wikicode]

Development policy is only a continuation of the Marshall Plan. UNRRA is the prototype of the Marshall Plan, and the Marshall Plan is the prototype of development assistance. This is a single policy. The operating logic is identical. Development aid is no more and no less than a "Marshall Plan" for underdeveloped countries. This policy is a direct application of modernization theories that crystallized in the 1950s, but were implemented in the 1940s.

Development aid draws on a much earlier chronological perspective. If we look at development aid policy, we realize that its laboratory for implementation even before foreign countries is the southern United States, which considers it to be their "Third World". If there is a north-south divide, it is not only due to slavery, but also the economic system between agriculture and industry. An important chapter in American history is the development of the southern part of the United States from which development assistance originated in the 1920s and 1930s. In this process, the New Deal is a crucial moment. The symbol of the New Deal is the Tennessee Valley Authority[TVA] which all the development of Tennessee with the construction of large dams with electrification of the countryside in particular. The New Deal is partly a modernization and development company in the southern United States.

Johnson will say in the 1960s that if the Americans are able to understand what is happening in development in other countries, it is because they have experienced it at home. The South is a laboratory for American development policy. Finally, everything that has been implemented in developing countries since the 1950s and 1960s is done on this model. From the end of the 1940s, American development policy was launched into the Cold War and a whole series of modernisations. In other words, the internationalization of economic planning is a Cold War strategy for modernization and integration into the liberal economy.

The Point Four Program, founded in January 1949 by Truman, led to the creation of the Technical Cooperation Administration[TCA] in 1950, is the implementation of a development and technical assistance program for a series of non-European countries. Beginning in the late 1940s, the United States launched development programs in which it spent huge sums of money. Development aid has an economic component to contribute to the development of domestic markets in these countries, but also to trade with the United States. The political logic is the Cold War logic with the idea of anchoring these countries in the western orbit and removing them from Soviet influence. Between 1946 and 1960, U.S. aid amounted to $84 billion, including $43 billion for Europe, $19 billion for the Far East, $13.4 billion for the Middle East, $4.4 billion for Latin America and $882 million for Africa.

After the ATT, the second stage in development policy is the Alliance for Progress speech given by Kennedy in January 1961 and the creation of USAID, which is the extension of the ATT to other sectors, particularly in Latin America, and at the same time the rise in development aid in a number of parts of the world with privileged areas such as Latin America. It is difficult to assess the economic impact, but the political impact is relatively non-existent to the extent that one of the elements of development policy as presented in the theory of modernization is to develop the economy to develop democracy, and US policy in Latin America was not to support the development of democracy. The political and economic dimension is completely linked.

Another major area is South-East Asia with Korea and Vietnam in particular, where we can see how the United States is grappling with an initiative set up by the United Nations in 1957, the Mekong River Commission, which aims to build large infrastructures and in particular a series of dams on the Mekong to control its flow, electrify the countryside. From the late 1950s and into the 1960s, the United States will invest in the Mekong River Commission with the aim of reproducing VAT in Vietnam with the idea of contributing to economic modernization of Vietnam is to its anchoring in the Western and American camp in particular. The problem is that the increase in development aid policy comes at the same time that the United States is starting the excessive war in Vietnam. The two logics will lose and break each other, highlighting the difficulty of implementation in a country at war. Much of the development aid is used to heal the wounded and bury the dead of American bombings, but also to rebuild dams financed by development aid. The United States withdrew from the Mekong River Commission when it withdrew from Vietnam in 1975. In the 1970s, development aid will decline considerably in large part because of the extremely limited political impact.

Energy: an economic and strategic challenge[modifier | modifier le wikicode]

The case of oil shows how American foreign policy is linked to the economic dimension.

Oil in the American Economy and Society[modifier | modifier le wikicode]

Oil is a commodity that became fundamental from the 20th century onwards in the world economy, but particularly in the United States, which at the end of the 19th century was both the world's largest producer and the largest consumer. The Standard Oil company owned about 90% of the oil trade until 1910.

Oil is at the heart of the U.S. economy and American culture as part of the American way of life based on the freedom of the individual, mobility and the car that crosses the United States. It is an element of American individualistic culture. The important thing is the 1940s because from that point on, the United States no longer produces enough oil to meet its booming domestic demand.

A Strategic Issue[modifier | modifier le wikicode]

The geopolitical context of the inter-war period and the Second World War is important, becoming a strategic issue. Finally, a large part of the military operations that took place between 1941 and 1943 had the major objective of controlling oil routes. This is true for the German invasion of the USSR. Controlling oil routes such as Iraq and Iran is essential to keep the military company going. One of the reasons why Germany was suffocated at the end of the war and because Hitler failed to control oil sources. This strategic issue will continue during the Cold War. As there is an arms race logic, there is a technological dimension, but also a fuel logic.

Securing supplies[modifier | modifier le wikicode]

Securing oil supplies is an extremely important element of American economic diplomacy since the inter-war period and especially since the Second World War. During the 1920s and 1930s, the United States entered into oil negotiations in the Middle East with the entry into the capital of the Iraqi petroleum company and the Anglo-Persian company in 1928.

The United States will establish preferential partnerships with countries that seek to escape from the English, such as Saudi Arabia, with the Standard Oil Company. In 1945, an agreement was concluded between Roosevelt and Ibn Séoud to create ARAMCO to give the United States preferential access to Saudi Arabia's petroleum resources against military protection. This alliance will function almost without any problems until the end of the 1990s with the increase in attacks on the United States. This alliance continues, but is less natural than it was in the 1940s and 1960s. From the aftermath of the Second World War, there was an extremely important American grip on the supply of oil in the Middle East region, so much so that Iran tried to emancipate itself from this control with the arrival of Mossadegh, who attempted to nationalize Iranian oil in 1951, but was overthrown by a coup d'État that established the Shah. This is a context in which the United States secures its oil supply in the Middle East, highlighting the economic, geopolitical and strategic dimensions that are fundamentally linked.

The end of the Bretton Woods system[modifier | modifier le wikicode]

The United States is no longer a pole of economic stability as it was before 1945, fundamentally changing the international roles of the United States. There is no longer the overwhelming dominance of the United States over the world economy as in the post-World War II period. Moreover, with the collapse of the Soviet bloc, the competing system collapses and remains the liberal model of relative consensus. While, following the 1945s, there was a connection between American interests and the geographical areas under their influence, from the 1970s onwards, there was a growing disconnection. As a result, over the past 40 years, the United States has implemented a series of concurrent and competing strategies to return to the heart of the global economy. Sometimes they appear to be contradictory, but are implemented at the same time.

From fixed to floating exchange rates[modifier | modifier le wikicode]

The end of the Bretton Woods system means that we are moving from the fixed exchange rate system to the floating exchange rate system. The Bretton Woods system is a system that balances the world economy, but it is a precarious and fragile balance because this Bretton Woods system is based entirely on the domination and strength of the American economy and its stability, which is extremely important after the Second World War, but also on the American currency, which is a factor of international economic growth. This system depends on the balance of large loans to foreign countries between the amount of loans that are out of the United States and the amount of U.S. exports that bring in foreign currency to the United States. This "in-end" flow is balanced, but will begin to become unbalanced.

The political dimension of this system is also an economic reorganisation of the world linked to it, and in particular from 1947 onwards, which is a system designed to make the liberal ideology triumphant, but from the moment the Cold War comes into being, two models compete with each other. Central to the American strategy is the idea of defending the liberal economy against the Soviet system, which has an economic cost in military terms. Until the late 1960s, it balanced the U.S. profit. It is a system of unstable and fragile equilibrium based on the economic stability of the United States.

This imbalance began to worsen in the 1960s, which was characterized by the rise in the logic of war in Vietnam, the deepening of military engagement in Vietnam and the considerable increase in military spending. Maintaining the system is very expensive. There is a huge alliance system, which is characterized by the establishment of 2,300 bases abroad and is very expensive to maintain. As far as the Vietnam war itself is concerned, it costs $30 billion a year. There is a considerable increase in military spending that is increasingly expensive for the United States to defend the liberal economic model and liberal democracy.

American investments are growing in Europe. From the time the EEC was created, the United States created subsidiaries in Europe so as not to pay customs duties on entry into Europe. If we look at American FDI, it increased by 471% from 1958 to 1968, while at the same time in the United States, investments increased by 52%. The globalization of the U.S. company is important for foreign exchange earnings, but not much work not providing work to U.S. employees. There is an imbalance between money coming out and money coming in.

On the one hand, there are military expenditures and direct investment abroad that cause money to flow out of the United States and exports become insufficient to compensate for the outflow of money from the United States. From the 1950s onwards, and more precisely from 1959 onwards, the United States is in a balance of payments deficit and is facing European countries that have rebuilt and become competitors.

The United States will start to borrow a lot more, especially as the United States holds the dollar and borrows dollars at low rates obtaining more facilities from European banks and in particular from German banks. From the moment there is an influx of money into the U.S. through borrowing, will start working the "money board", as the U.S. will no longer have enough gold to cover foreign borrowing. At the same time, there is the cost of military engagement that leads to weakening American economic power and the stability of the Bretton Woods system that is built around the dollar. Once the dollar is no longer a credible currency, it is no longer a guarantee of stability in the international economic system. U.S. allies will fund the United States, but will no longer want to continue to do so, because from the 1960s onwards, the United States will finance its deficit through its allies. European central banks, and in particular the Bundesbank, are reluctant to lend to the United States. As the dollar is destabilized, it triggers speculative attacks that weaken the dollar. All these phenomena coalesced in the spring of 1971 with the Bundesbank, which stopped buying dollars on the market to support the dollar. The collapse of the system is partly due to the Bundesbank, which by its symbolic act shows that the system is no longer functioning.

In 1971, the U.S. trade balance was in deficit for the first time since 1893. The United States buys more than it sells, not to say that the economy is no longer credible, not as dominant as it once was. August 15,1971 is the end of the Bretton Woods system, but it is not a unilateral action by Nixon, but a reaction to the fact that European countries refuse to continue to support a de facto overvalued US currency. Suspending convertibility in gold allows the dollar to go down to boost exports. The fixed exchange rate system ceased to exist in the summer of 1971. The measure will be ratified following a conference in December 1971 leading to the Smithsonian agreements where the dollar is devalued by 10% and in 1973, the fixed exchange rate ceases to exist de jure. A system that has lasted since 1945 is quickly dismantled.

The dependency of the U.S. economy[modifier | modifier le wikicode]

The American economy, which had been driving the world economy since 1945, is becoming increasingly dependent on other countries that have recovered economically since the end of the Second World War. Europe's economic recovery took about ten years until the mid-1950s, and Europeans began to recover in the 1960s.

The U.S. economy lives on the credit of others who can no longer play a de facto pivotal role in the post-1945 world economy. The economy is all the more dependent on European economies. Until the 1930s, the U.S. economy's share of foreign trade was relatively small. From the 1960s onwards, it became increasingly important and the foreign economy became in deficit, which had a major impact on the American economy. US foreign trade represented 30% of GNP in 2000.

The issue of energy expenditure is a strategic aspect. Since World War II, energy spending in the U.S. economy has been rising steadily while the United States was almost self-sufficient before World War II. After the conflict, their dependence on external sources increases. 15% were imported in 1960,25% in 1972,50% in 1978. This plays a major role in American dependence on the rest of the world.

From the time the trade deficit first appeared in 1971, it became permanent until today, when it is growing steadily. From 1971 onwards, the economy became structurally loss-making, with an increasingly colossal sum of $100 billion in 1988, $340 billion in 1999 reaching $550 billion in 2011. This has led to an explosion in foreign borrowing, increasing the burden of debt and public debt. The more we borrow, the larger the debt becomes and today it is at a colossal level.

Since the end of 2013, the President and Congress have renegotiated the "budget wall" in order to raise the maximum debt ceiling enshrined in the Constitution. Debt began to be repurchased in the 1960s until the 1970s by Germany, followed by Japan, Saudi Arabia and China. If there is a collapse of the U.S. economy, China also collapses so that the economies are interdependent. In 1945, the United States was in a position of economic dominance with low dependency, while in the late 1960s, its economy was increasingly connected, dependent on the rest of the world, interdependent in particular with U.S. debt, which was financed by foreign countries. The context changed from the 1970s onwards, making American power very strong, but no longer resembles what it could have been in the twenty years after World War II.

The United States is still the world's largest economy. From the moment the economic system is globalized, the economic collapse of the United States would lead to the collapse of the rest of the industrial powers. Support for the U.S. economy can also be explained by this, but the situation of domination is no longer the same as it was before the 1960s. The terms of the relationship between the United States and the world changed fundamentally from 1945-1971.

The United States in the face of global multipolarization[modifier | modifier le wikicode]

The rise of Europe and Japan[modifier | modifier le wikicode]

The multipolarization of the world is first and foremost the reconstruction of a certain number of countries, in particular the countries of Western Europe and Japan. Between 1945 and 1960, the European and Japanese economies were on American perfusion, in particular being fed by the Marshall Plan credits allowing these economies to buy equipment, start selling, trade among themselves and with the United States. This reconstruction is being done extremely quickly. After a few years of rebuilding industrial potential, starting in 1954 and 1954, economic dynamism was boosted by the establishment of the European Economic Community in 1957. Growth rates are sometimes 7%, 8%, 9% or 10%. Reconstruction is rapid, and these countries became competitors of the United States fairly quickly by the early 1960s.

Oil shocks[modifier | modifier le wikicode]

Oil shocks signify the arrival on the geo-economic scene of countries that were not there before. There are far-reaching structural causes being the fact that in 1945, the United States when it introduced the "military umbrella" on Arab countries and Saudi Arabia in particular, this was based in particular on a relatively low oil price. On a regular basis, the Arab countries try to obtain an increase in oil prices and this demand is always met with a refusal by the United States. Since the Arab countries are divided, they are unable to influence the United States in this type of negotiation. Even after the creation of OPEC in the 1960s, with the ambition of joining forces to influence Western countries, OPEC countries could not reach an agreement. A whole exasperation is taking place in the face of low oil prices, which pay little. The direct cause is the 1973 Kippur War with U.S. military support to Israel resulting in retaliatory action by Arab countries and rising oil prices.

The end of the Bretton Woods system and the German example is symbolic, because it means that the United States no longer makes laws on the international economic system giving ideas and showing that it is possible to oppose the economic system of the United States. Oil-exporting countries will decide to raise oil prices. In 1973, prices are multiplied by 4 and between 1973 and 1979 prices are multiplied by 12, accentuating the American trade deficit. This shows the rebellion of a group of countries that were under the tutelage of the United States, including the Baghdad Pact.

These oil shocks come after the end of the Bretton Woods system, showing that the international economic system set up after 1945 is no longer controlled by the United States. Symbolically, the oil shock means a new stage in the loss of US control over the international economic system.

A New International Economic Order [NOEI]?[modifier | modifier le wikicode]

In the early 1970s, the new international economic order was in vogue. This is one of the signs of the multipolarization and contestation of American leadership. The centrepiece of the new international economic order and the GATT issue, which is a free trade agreement first signed between the United States and a number of European countries and a number of Third World countries. The principle of non-discrimination in trade and the principle of tariff reduction work less well for fragile economies in developing and less industrialized countries with few product lines. From the late 1960s and early 1970s, the GATT principle was increasingly challenged by Third World countries. That is when we talk about neo-colonialism with a system that replaces political domination with economic domination.